GCShutter/E+ via Getty Images

Investment Thesis

Sea Limited (NYSE:SE) is a Southeast Asia consumer business, made up of its highly profitable gaming business, plus its growing e-commerce business.

Going into Q3 results there was an 8% short against the stock. Not too high, by any stretch, but it could be said that the short position become crowded as the shorts overstayed their position.

And it made sense, the unprofitable winners from 2020-2021 have nearly all been grounded. And with many of those names going into earnings many stocks were getting hit by a further 15% to 20% on the downside.

However, Sea Limited came out with a concrete plan that flummoxed the short argument. Sea Limited has a path to profitability by the end of 2023.

This is a game-changer moment.

What’s Happening Right Now?

Investors are mostly focused on one thing only. The Fed slowing down its rate hike. Investors believe that if rate increases start to slow down, somehow, companies that are not profitable will be able to see their multiples stop compressing.

So, herein lies the question that I’m attempting to grapple with, what’s a business that can’t produce GAAP earnings worth? Put another way, is SBC a real cost? Or is the market willing to look to SBC as a necessary evil?

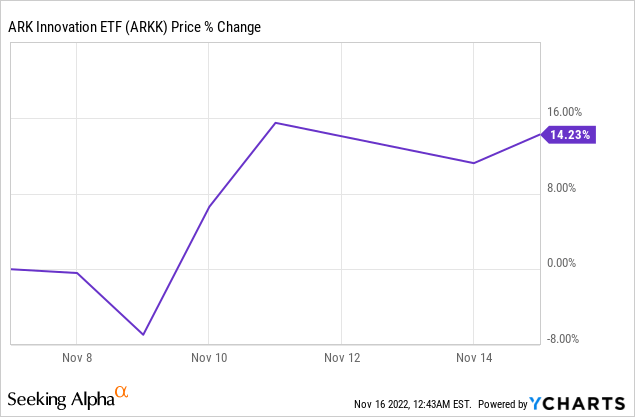

In the past week, the ARK ETF (ARKK) is up more than 14%. It’s made more than 1-years normalized return in a week. What the market is saying is that unprofitable businesses have been hit too much, and are worth more than they presently trade for.

With all this in mind, let’s turn our focus to Sea Limited.

Sea Limited’s Q3 Revenue Growth Rates Impress

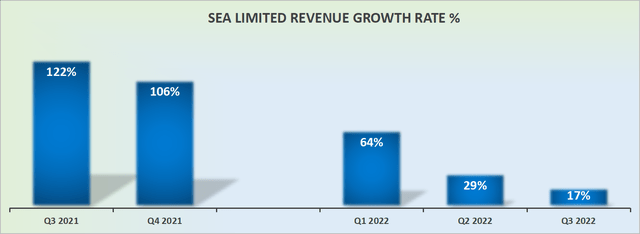

Against a very tough comparison with last year, Sea was still able to deliver some growth. What immediately becomes apparent is that if SE can deliver some growth against Q3 of last year, the next few quarters become progressively easier to compare against.

Consequently, it could be argued that the worst is over.

Within Sea’s business, what was once its crown jewel, its highly profitable gaming business, Digital Entertainment, reported a second consecutive quarter of negative y/y revenue growth rate. More specifically, Digital Entertainment saw revenues fall by 19% y/y.

Now, let’s discuss what really got bulls excited.

All Eyes on a Path to Profitability

This is what Sea’s founder and CEO Forrest Li said on the call,

I announced in mid-September that the management team will stop receiving cash compensation until we achieve self-sufficiency.

This hasn’t stopped stock-based compensation from increasing 59% y/y, growing materially faster than revenue growth rates, which grew 17% y/y, but it does mean that management is directly aligned with shareholders on seeing the path to profitability being achieved.

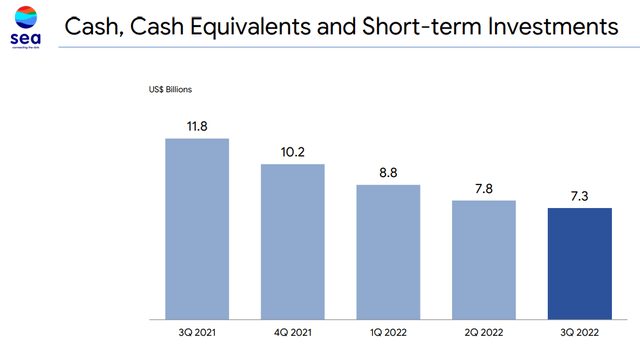

Meanwhile, keep in mind that Sea’s balance sheet is in a strong position.

Above we see that Sea holds $7.3 billion of cash. Even if we account for the $3.5 billion of convertibles, Sea’s balance clearly provides it with ample flexibility.

Nevertheless, Li’s commentary throughout the earnings call was one that reflected financial discipline going forward.

Furthermore, Li contended that Shoppe, Sea Limited’s e-commerce business would reach adjusted breakeven by the end of 2023.

SE Stock Valuation – 3x Sales

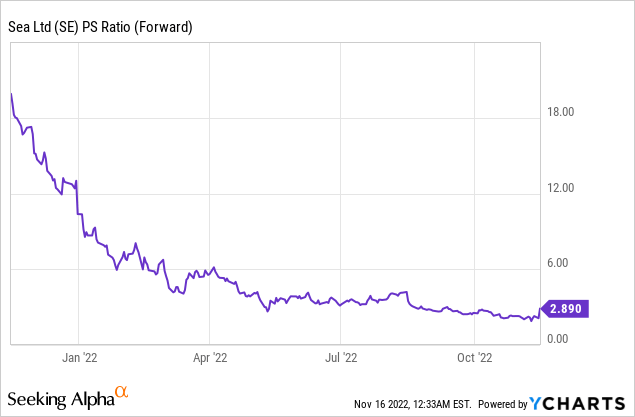

The graph that follows is a reminder of how far Sea’s multiple has come in the past year.

Even though the company continues to grow, as is abundantly clear, its multiple has become fully compressed.

If Sea was able to reach adjusted EBITDA by some point in H2 2022, what we’d have is a self-sufficient company, with multinational e-commerce exposure priced at approximately 3x next year’s revenues.

This strikes me as a positive risk-reward.

The Bottom Line

This is the one-line takeaway, Sea Limited has seen its valuation crushed to a pulp. There’s very little hope priced in.

The expanded takeaway is that Sea Limited is upfront in recognizing how much shareholders have suffered this past year and they are attempting to carve out a path to profitability in the coming twelve months.

Simply put, I don’t believe that it makes any sense to be short the stock at this point.

The time to have been short the stock was at any point much earlier in 2022. At this point, with management clearly on board with the ”message” that they must prioritize profitability, I believe that Sea’s valuation is the best it’s been for a long time.

Remember, its gaming business was never the problem. It was its e-commerce business that was struggling to be profitable. And this business is now guided to reach profitability within approximately 12 months.

I believe there’s an attractive investment opportunity here.

Be the first to comment