f11photo/iStock via Getty Images

Scottish Mortgage Investment Trust PLC (OTCPK:STMZF) has had a strong few years, but its performance over the past few months has been much less impressive. I think it could well fall further, but increasingly reckon there may be value here from a long-term perspective.

An Old Trust with Modern Ideas

Scottish Mortgage has considerable pedigree. It dates from before World War 1 and is one of the few London-listed stocks to maintain or raise its dividend for many decades. Its last dividend cut came during the Great Depression.

But despite its storied past, the trust has taken a very modern and forward-looking view in recent years. It has allocated a large part of its portfolio to high-growth tech stocks, meaning it benefitted substantially from the tech bull market we have seen over the past few years. Indeed, it did very well from being an early backer of Tesla (TSLA). It has since reduced that stake, but Tesla’s share price rise means that it remains the trust’s fourth largest holding.

Performance is Linked to Wider Market Trends

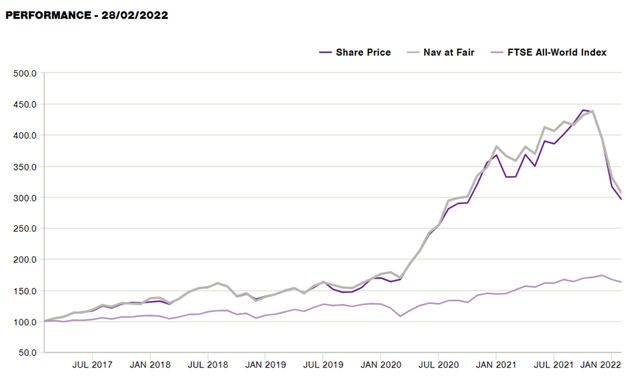

Given its heavy tech exposure and investment trust structure, it is no surprise that the company has performed well over the past few years. As the chart below shows, it was handily outperforming the FTSE 100 before the pandemic before accelerating its outperformance sharply along with the tech boom seen amidst the pandemic.

Scottish Mortgage Investment Trust

With its active management, the trust does not move simply in parallel with the market. But clearly, it is affected by wider trends in areas where it has large holdings, as we have seen with its tech shares. I expect this to continue to be the case. As tech remains a large part of the company’s holdings (and indeed it has a sizeable China tech position which I think could also turn out to be problematic for short- to medium-term valuation) then I think the trust could continue to move downwards in coming months if tech generally moves lower.

The Trust is Moving Further into Promising Areas

At the end of February, the fund’s top ten holdings accounted for almost 42% of its value.

Table compiled by author using data from company website

I think a few things are interesting about the current portfolio and what it indicates about the possible long-term direction of travel at Scottish Mortgage.

First is the growing push into biotech. The growth in the size of the Moderna stake is notable. At the end of February, the Moderna share price was less than a third of where it had been during its August high point, so at one point Moderna would have had an even bigger share of the Scottish Mortgage portfolio.

Another point of interest is that Scottish Mortgage’s tech interest is not focused on the usual consumer tech names like Apple and Meta (it holds neither). Instead it is getting into the chip space (ASML and Nvidia make this point) and also the sorts of super-apps that are increasingly dominating online behavior in Asia and which may end up doing the same in the west.

Tencent, Meituan and Alibaba are examples of this, but I would say the same for holdings such as Delivery Hero (DHERO), DoorDash (DASH), HelloFresh (OTCPK:HLFFF), JD (JD), MercadoLibre (MELI), Ocado (OTCPK:OCDGF) and Zalando (OTC:ZLDSF). Although that is a diverse list, what I think it has in common is that each name to some extent is building a proposition around digital purchase and fulfilment, in most cases trying to expand it into adjacent areas.

Rather than fretting about a regulatory crackdown on Alibaba or concerns about profitability at Ocado (as I do), Scottish Mortgage seems to be happy to buy a wide range of shares in the theme. Even if some or most of them disappoint, it may not matter in my view as getting an early sizeable position in the two or three superapps that end up at the top of the tree could be a huge prize in the coming decade.

That approach excites me because I think it reflects a smart, well-considered thesis as to where money can be made in future in the digital economy. So I expect the digital component of the trust’s portfolio to continue to do well in coming years. The recent price slide does not mark the end of this phase of the trust’s history, I think. Rather, it is a price contraction that may go further but ultimately (maybe not for many years, admittedly) I expect to be reversed due to the quality of the current tech strategy at the trust.

Valuation Looks Increasingly Attractive

Since my bearish February 2021 piece Scottish Mortgage Investment Trust: Tech Trouble Ahead, the shares have run up then down and now sit 16% below where they were at that point.

I now consider the tech valuation concern to be more accurately factored into the Scottish Mortgage share price. Further downward moves in tech stocks generally could yet hurt the trust in coming months. But in general I am now more bullish that its valuation (down 38% since November) reflects the potential of its high-quality portfolio. With a willingness to wait for what may be a long journey, I accordingly move my rating to “buy.”

Be the first to comment