Allen And Company Annual Meeting Brings Business Executives, Media Moguls, And Politicians To Sun Valley, Idaho Kevin Dietsch/Getty Images News

“I can calculate the motion of heavenly bodies, but not the madness of people.” Sir Isaac Newton

Dear Fellow Investors,

I have the privilege to write to you this annual letter for the fiscal year of 2021 (updated for Q1, 2022).

General Overview:

As usual, I wish to welcome the clients who joined our financial path this past year. Together with our new clients, we currently have over 500 partners involved in our activity. At the same time, the value of our assets under management quadrupled in the year 2021. It is my great honor and responsibility to keep providing our clients with the service you deserve.

Due to the Covid-19 virus and its different variants, 2021 was a very challenging year which brought along a significant blow to the lifestyle, employment, and different activities in our lives. Most stock markets in the world still enjoyed solid returns in 2021, alongside impressive economic growth in most of the world’s economies. Of course, this also had a positive influence on the performances of our portfolios, with returns well above the relevant benchmarks. However, during the last months of 2021, and more significantly the beginning of 2022, the stock markets began suffering from a significant downturn, mainly due the beginning of an increase in the interest rates in the U.S., inflationary pressures as well as Russia’s invasion to the Ukraine.

Despite these circumstances and other such “noises”, we continue to follow the same financial path we started off with over five years ago, of which you are well aware. Our investing journey does not include focusing on the fluctuations of individual stocks in the short term, but rather carefully selecting companies that demonstrate outstanding economic performance, and invest in their stocks (as partners) for many years. We do not engage in daily/monthly/yearly comparison of the performance of our stocks to the various benchmarks or attempt futile predictions of short-term market gyrations. Instead, we establish our investment decisions on the financial parameters of the companies we purchase (see for example my article on The Marker from September 2nd 2020: בזמן שחברות התעופה מתרסקות, חברה אחת מצליחה להמריא – רווחים במחשבה תחילה). As Warren Buffet once stated- “time in market”, rather than “market timing”, is the key to our success in the investment world!

In line with this “patient” strategy, we also stayed away from the more popular technology stocks and the array of stocks offered to the public in the past year via IPO’s and SPAC companies (see the article published by my partner, Matan Guetta on this subject- כשהמניה קופצת בימים הראשונים אחרי ההנפקה, זה יכול להיות גם סימן אזהרה). These stocks, particularly the stocks favored by Kathy Wood’s ARK funds, which had increased dramatically in 2021 (mainly due to the activity of young and mostly inexperienced investors, equipped with smartphones and the Robinhood app), demonstrated towards the end of 2021 and in the current year a severe crash which has caused her investors to lose billions of dollars. Similarly, the value of the “Reddit” stocks and popular technology stocks such as GME, TESLA, Beyond Meat, and even stocks such as the Israeli Lemonade, Monday and Wix decreased by up to 80% in the last few months. This grim and predictable development, which I anticipated in my last year’s letter to you, is the grounds for our decision to avoid recommending stocks such as these.

Another strategy we have embraced is investing in the stock markets of countries outside of the U.S.A (such as in European, Canadian, British and Japanese stocks). Seemingly, this policy is like “swimming against the current”, particularly considering that up until recently, the American NASDAQ index has gone mainly upwards in the past 5 years. But in fact, in these countries around the world we have found (and continue to find) many outstanding companies which are traded at a 50% discount and even more in comparison to their equivalents in the U.S. In this context, we trust the words of Professor Robert Shiller, winner of the 2013 Nobel Prize in Economic Sciences, who recently stated that the American stock market is approaching bubble prices, and therefore it is wise to shift funds to markets outside of the U.S.

Another important factor that influences the returns of our portfolios, which mostly consist of foreign stocks (outside of Israel), is of course the foreign currency rate. The strengthening of the Shekel (one of the strongest currencies in the world lately) compared to the rest of the world’s currencies, impaired our returns (when we recommend investing our Shekels in foreign stocks which are priced in foreign currencies and translate the performance back to Shekels, the portfolio can exhibit a loss even if these stocks increased in their value in the foreign currency). However, in our opinion, this is a non-issue for the long term. Over time what will determine our results, is primarily the economic performances of the companies we invest in all over the world, combined with the enormous power of the compound interest effect, and not the fluctuations of exchange rates in the short term.

That being said, I am happy to inform you that in the past year most of you have enjoyed significant positive returns in your portfolios (please see the annual reports that are delivered to you by mail). But while we take pleasure and satisfaction in this positive run, and as we constantly repeat, our ambitions are set for the long term. Our goal is to win a “marathon”, not a sprint!

Looking Forward:

Let us start with this current year, 2022. The year kicked off with a storm as Russia invaded the Ukraine and as of the date of this letter the war continues in the region. On top of the humanitarian disaster and global tensions inflicted by the war, stock markets around the world felt the pain. Naturally, many people ask me what to do with their portfolios during these events. My answer is not to involve emotions and to react impulsively to the markets but rather to maintain self-discipline and financial discretion.

I love this quote which Jason Zweig from the Wall Street Journal stated late last year:

“I think the best investment of 2022 is likely to be discipline”

First and foremost, we must fully understand that the attempts of interpreters and all sorts of media “specialists” to time the market and provide forecasts and predictions are no more than wild guesses. We have no control over local or global events affecting the stocks markets and our investments in the short term. The wise investor should focus, even (and maybe especially) during this time, on investing in stocks of great companies at good prices (see below), and then try to “turn off” the screen, “close” the newspaper, relax, and let our investments work for us for the long run.

Reviewing the history of the markets clearly shows that even investing in the largest and most successful companies entailed long periods of fluctuations in their stocks. For example, Apple’s stock, the largest company by market cap today, produced zero profits for its investors over the course of 20 years (from 1980 to 2000). Similarly, the stock value of Amazon decreased several times by 50-90% during various periods in the past two decades and bounced back every time. The conclusion is clear – our investing decisions should not be based on the value of a certain stock in the short term, because such value may not reflect the economic reality of the company.

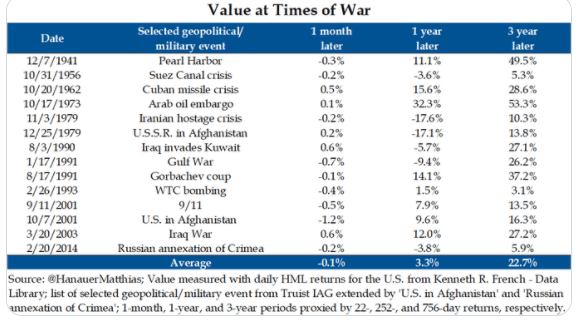

Moreover, this volatility which distinguishes the stock markets is not a reason for concern – it is actually an opportunity for hunting for new investments. The more volatile the markets are, the more opportunities we get to purchase companies for “sale”. See for example the Covid-19 crash which led in a short period of time during March 2020 to a decrease of over 30% in the price of the S&P 500 index, but since then until today the S&P 500 has more than doubled its value(!). See below a table showing the performances of the world stock markets a year and three years after pervious wars in history. It clearly shows that within three years following each tragic war, the stock market indexes increased significantly.

Kenneth R. French Library

“Gravity” and “Mass” in the Stock Market:

I am often being asked how to measure and identify a profitable investment in the stock market. The answer to this question may be very complicated and many factors play a role in determining the price of each financial asset and influence its returns over time. We discussed many of them in the articles we have published and in our letters to you in the past.

In this letter I wish to share with you some “thoughts” about two major forces which act on every financial asset, determine its price and its returns over time. I am referring to interest rates and the “economical mass” of any financial asset.

Before I go into details and in order to explain the interaction between these two financial factors, we can borrow an equation from the field of classical physics:

Weight = Mass X Gravitational Acceleration

Based on this equation (courtesy of Isaac Newton…), one can create a financial function, in which the “weight” is the value/price of the asset, the “mass” is the “economical mass” of the asset, and the “gravitational acceleration” are interest rate, and replace the equal sign in the physical equation with the proportion sign in the financial function. Meaning, if we put it in the financial function, we will get:

The value of an asset∝ the economical mass of the asset X the change in the interest rates

Let us begin this analogy with an example regarding the behavior of interest rates in the market, which will emphasize the differences in the nature of the three investments in the stock market, i.e., short-term deposits (CD’s), bonds, and different kinds of stocks. The first two are considered “safe investments”.

For example, an investor who has $100,000 that he wishes to invest. His first option, investing in a short-term bank deposit, will generate for him in today’s low interest rates an extremely low yield of 0.1% a year (that is, an economic profit of $100 a year), but without taking any risk. The second option, investing in a government bond for 10 years (granting a loan to the government), will yield in our example a low yearly interest of 1% (that is, an economic profit of $1,000 a year) with a very little risk (though slightly higher than from investing in a short-term bank deposit). A third option is investing in the stock market which he expects to generate, on average, a yield of approximately 10% a year (that is, an economic profit of $10,000 a year compounded annually) but with much more risk and high volatility. Of course, the level of risk the investor wishes to take will help him choose between the different options, but the factor which will determine the underlying attractivity of each option is the interest rates. How so?

Today, in times when the interest of the Bank of Israel on deposits and loans is close to zero (0.1%), the bank can offer its clients a low interest on the short-term deposit because the alternative interest (which is dictated by the Bank of Israel), that the client will receive elsewhere (for instance, from investing in government bonds) is also unattractive. However, in a scenario where the Bank of Israel will increase the market rates to 5% for example, the bank will probably have to try to get its clients to invest in a new short-term deposit with a higher interest for their deposits – for example, 4% a year. This will reduce the appeal and decrease the value of the old short-term deposit which is “locked” in the bank with a low interest. This change in the interest rates will similarly decrease the value of the government bonds which were previously purchased (bearing an interest of 1%) because the government will offer new bonds which generate a higher interest, that will be closer to the new interest of 5% a year offered by the Bank of Israel. And what about investing in stocks in this higher rate environment? The stock market will probably not stay indifferent to this change in the interest rate. Why should an investor invest in high-risk stocks if he is offered an investment in a short-term bank deposit or a government bond which will provide him a nice return of 4-5% a year with low risk? As such, all else being equal, an increase in interest rates will cause a drop in the prices of stocks to a level which will offer investors a satisfactory yield for their investment with a reasonable risk in relation to the other options.

I should point out that as opposed to the physical equation in which there is a direct correlation between the gravitational acceleration acting on the object and the weight of the object, in the financial function there is a reversed correlation between the interest rate and the value/price of the financial asset (short-term deposit, bond or stock). The more the interest rates increase, the more the price of most of assets will fall, and vice versa in the case of a decrease in the interest rates which will lead to an increase in the price of most financial assets.

And here we reach the additional variable in our function which is the economical mass of the financial asset. The economical mass of an asset is expressed in the professional language by the “Duration” of the proceeds expected to be received from that asset over time. In other words, the Duration is a number which represents the period of time in which the proceeds are expected to be received from investing in any security, and the amount of those proceeds. If a financial asset is predicted to generate a relatively low yield for an investor only in the far future, its Duration will be high. However, if a financial asset is predicted to generate a substantial cash flow in the near future, its Duration will be low. As expressed in our financial equation, the higher the average duration of an asset, the more a given change in the interest rates will affect its value/price (an increase in the interest rate will decrease the value/price more sharply). And vice versa, an asset with a low average Duration will be less affected by a change in the interest rate. Thus, for example, the value of a short-term bank deposit with a very low Duration will be less affected by an increase in interest rates as compared to a government bond with a higher Duration. And what about stocks? Here we must distinguish between stocks with a high Duration and those with a low Duration. A stock of a speculative company, which is currently losing money and predicted to yield profits for the investor only in the far future (high Duration asset) will probably fall considerably in response to an increase in interest rates. On the other hand, a stock of a profitable company with positive cash flow which generates profits for the investor in the present (low Duration asset) will be less sensitive to changes in the interest prices and its value/price should remain more stable.

Considering the above, it is clear how a change in interest rates may affect financial assets in the world, and why an increase in the interest rates may decrease the price of most of our investments in the short term. This interest rate exercise is not only theoretical but also very practical today. In the last decades, the interest rates in most of the western countries have been decreasing (in the 70s, you could get a 15% yearly profit on a short-term bank deposit) and that is mostly due to the efforts of the world’s central banks to spur the local economies (low interest encourages investments and financial activities). These decreases of the interest rates caused an increase in the value of almost all the financial assets. But today it seems we are heading towards the end of that era. Without delving into macro analyses and forecasts, the assumption (and the promise) of most of the governors of the central banks around the world is to raise interest rates in the near future (in order to curb inflation, among other things). In the past year, we began to see this trend in the U.S, where the inflation and the interest rate increase led to a decrease in the price of “safe” bonds by up to 30% YTD. So, as opposed to what many investors got used to, in a scenario of interest rate increase, it is possible to lose a lot of money even when investing in bonds. Additionally, and according to the above analysis, many of the “dream” stocks (companies without present profits) sharply dropped in value, based on the anticipation of the market for interest rate increases, as opposed to “stable” profitable stocks whose price fell much less.

What is the meaning of all this for us and for our investment portfolios? To start, you can understand why we avoid investing today in most short-term bank deposits and government bonds. Aside from their traditionally low yield, these assets are highly expensive these days due to the low interest of the market, and most importantly, they may sharply drop in value if the interest rates will indeed continue to increase. And what about investing in stocks in times of this anticipated interest rate increase? First, we learn from history that a moderate interest increase is not necessarily negative for the stock market (please see an article by Ben Carlson- How Do Stocks Perform When the Fed Raises Rates?), and it can even lead to economic growth and an increase in the price of certain stocks, mainly stocks of financial companies. In addition, even during a period of rising inflation and interest rates, the more we focus on our strategy to invest in great companies with present stability and profitability, the more we can succeed to pass even these challenging times.

In summary, it is important to emphasize again that what will determine our returns over time will be first and foremost be the profitability of the companies in which we invest, rather than other macro conditions, such as foreign exchange rates (see above) or the interest rate environment.

Henceforth we will set forth a specific description of our investment policy:

Our Portfolios:

Our portfolios are divided into three parts (with the exception of those of you who invested in the Tavor Fund, which is concentrated mainly in Net-Net stocks and Negative Enterprise value stocks worldwide):

- “Micro- Cap Value Stocks” rebalanced monthly.

- “Compounder” stocks.

- “Special Situations” and cash.

I should emphasize that the Individual Retirement Account (I.R.A.) option also allows us to rebalance our portfolio without incurring taxes (please see my article in The Marker, הקופה שתאפשר לציבור ליהנות מהשקעה במניות).

1. Micro-Cap Value Stocks

This investment strategy is based on one of the best strategies in the book “What Works on Wall Street” by James P. O’Shaughnessy. This strategy selects a basket of 25stocks whose market cap at the time of purchase is under 500 million dollars (stocks which are usually excluded from the major indexes in the U.S.A.). These stocks are selected only if they fulfill a number of criteria (including value, momentum and financial stability) which have been proven by empirical studies to be a source of alpha.

As we have witnessed in the first years, some of these stocks and this strategy do not outperform the market every year. Nevertheless, this instability per se (which may cause other investors to abandon the strategy at exactly the wrong time) is the key for its success over time as it involves “going against the herd”. As Prof. Joel Greenblatt, the author of the book “The Little Book that Beats the Market”, once stated:

“If I wrote a book about a strategy that worked every month, or even every year, everyone would start using it, and it would stop working.”

2. Compounders

“We do a lot of thinking and not a lot of acting. A lot of investors do a lot of acting, and not a lot of thinking.”

Lou Simpson, RIP

Compounder stocks are stocks of profitable companies which operate in various fields (including many owner-operated stocks of public insurance companies around the world), led by honest, reliable Outsider-like CEOs with a proven track record. We prefer to purchase these at a healthy discount to their economic value, so that even in the worst-case scenario our investment can still be profitable (Margin of Safety). However, once we purchase these, we plan to never sell them unless they undergo a dramatic change or a de-listing (much like the Coffee-can Portfolio).

And anyone who is interested in the origin of the idea of “Margin of Safety” (a topic defined so nicely in Seth Klarman’s famous book) is invited to review the following quote from Midrash Tanchuma (collections of Pentateuch Aggadot from the 8th Century):

“Uncelus, the son of Hadrian’s sister, seek to convert to Judaism and went to see his uncle Hadrian whom he feared/respected. He said to him: I ask to make goods.

He said to him: When I told you I was asking to make merchandise, and you told me, every prakmatia (trade) you see low and given in the land, go and engage in it, for it shall rise. I searched in all the nations and did not see a lowly nation in the land such as Israel, and as such they shall rise. “

Midrash Tanchuma, Parashat Mishpatim, Chapter 21, Mark 5

If so, the “Margin of Safety” already has a reference in our Jewish sources … It is told in this midrash about Uncelus during the Roman conquest of the Land of Israel who asked a Rabbi for advice on what to do for a living. The rabbi advised him to look for goods selling for the lowest price and buy them when they are cheap. Although the parable is joining the oppressed Israeli nation at that time, we are also adopting the economic lesson …

So how did our companies perform in 2021?

Let us start off with the Italian holding company EXOR (EXO.MI), an old family-owned company which historically has excelled in a very successful investment and acquisition policy. The market value of the company remains about 16 billion euros, despite a very challenging year with much volatility. As you recall, among the holdings of EXOR you can find Fiat-Chrysler (which merged in 2021 together with the French auto manufacturer, Peugeot into a new company- Stellantis), CNH Industrial (the manufacturer of agricultural equipment), Ferrari, Juventus Football Club, the newspaper The Economist and one of the largest insurance companies in Europe – Partner Re (Exor lately finalized an agreement with Covea to sell Partner Re for 9 billion Euro). In addition, Exor invested in 2021 550 million Euro in the leading fashion company, Christian Louboutin, and in the Israeli company, Via, another 150 million Euro. The Net Asset Value of the company, as published in its financial reports, rose 29.7% in 2021, while the stock price increased by 21%. There is no doubt that this leading company is financially solid and meets all the criteria I stand by for long-term investment (see my article about EXOR in my blog on The Marker פתיח איטלקי מוצלח לתיק ההשקעות שמתחת למזרן – רווחים במחשבה תחילה).

An additional player in our “team” is Brookfield Asset Management (BAM), a Canadian holding company which owns and manages over 680 billion dollar worth of real estate around the world. As the real estate sector is recovering globally, BAM’s market value is already close to $90 billion. In addition, the company is positioning itself in the lucrative insurance industry with a number of its subsidiaries. Brookfield’s stock rose almost 50% during 2021, well above the benchmark. Bruce Flatt, BAM’s CEO wrote in the latest letter to shareholders, that $1 was invested in BAM’s stock 30 years ago is worth today $111 (17% CAGR) in comparison with $1 invested in the S&P 5000 which would be worth today only $22 (11% CAGR)- (https://bam.brookfield.com/sites/brookfield-ir/files/2022-02/q4_2021_ltr_to_shareholders.pdf).

Another company we own is InterActiveCrop (IAC). IAC is a highly successful holding company in the technology sector, which is managed by the renowned investor, Barry Diller. The value of its stock rose in 2021 by 4%, excluding Vimeo shares received via a spin off. We plan to continue holding these shares for many years with Barry Diller at the helm, and will continue to increase our stake in the company with any sell off in the stock. During the past year the company acquired Meredith Corporation for $2.7 billion and shares of MGM worth over $1 billion.

We also increased our stake in the giant global-American asset management company, Kohlberg Kravis Roberts (KKR & Co.), which manages today over 460 billion dollars (23% CAGR growth rate in the past decade). The company’s stock rose almost 90% last year. Despite this growth and the fact that the asset management industry is one of the best and most profitable ones in the economy, we believe that the company’s stock is still trading at a discount to its true value. Many insiders in the company, as well as several successful investment managers in the world, invest alongside us in this company.

We remind you this year again that we believe that one of the most promising pathways for investing in the stock market is investing in insurance companies. A well-managed insurance company has two sources of profitability: 1. Insurance activity, and 2. Investment of its “float” (see my Bizportal article on this subject from September 2016 – מאמרי דעה של יואב זליקוביץ – Bizportal). Accordingly and after careful examination, we have increased our stake in a number of insurance companies, including Fairfax Financial Holdings (OTCPK:FRFHF), which has compounded book value at an almost 18% rate for the past 30 years, Assured Guaranty (AGO), and Markel Corporation managed by the exemplary Thomas Gayner, and the Norwegian insurance company, Protector Insurance, which is a rising star in the European insurance field. These companies continued to demonstrate excellent performances in the year of 2021.

Another stock we plan to own for many years is Texas Pacific Land Trust (TPL). TPL is a trust company which was founded in 1888, when it received through a legal settlement, a valuable piece of real estate (packed with oil fields) in the state of Texas. This is a royalty company which profits from royalties paid to it by oil drilling companies that operate in the area. The big advantage of this business model is that the company has almost no expenses, which significantly increases its profitability (the profit margins of TPL are even higher than those of Microsoft). Add to this the rights that the company possesses for many water resources discovered on its lands, and a good management team which excels in efficient capital allocation (for example, by buying back its own stocks instead of distributing large dividends) It goes without saying that the company benefits from an increase in oil prices. The company increased its earning by over 50% in the past year (30% CAGR over the last decade).

Due to the temporary crash in the global airline industry because of the COVID crisis, we also took advantage of the crisis to buy the stocks of HEICO (HEI.A/HEI), a Florida-based company which designs and manufacturers parts for the aircraft and aerospace industries. This is a company with great economic attributes and financial stability. It has proven itself to be a very skilled acquirer of companies while allowing the acquired companies to continue to grow autonomously over time under the HEICO name. The price of its stocks dropped during the crisis, but its economic value dropped more moderately (Heico maintains a positive cash flow throughout the year), and the company seems to be overcoming the crisis with much success. We bought the company’s stock when they were “on sale” during the pandemic and they are likely to yield significant profits in the long term. To learn more about this company and about my reason for investing in it, see my blog on The Marker:בזמן שחברות התעופה מתרסקות, חברה אחת מצליחה להמריא – רווחים במחשבה תחילה and הזדמנות השקעה במשבר הקורונה – דווקא בענף שחווה את המכה הקשה ביותר – רווחים במחשבה תחילה).

New “Compounder” stock:

In 2021, we also added to our portfolio the stock of Israel’s leading payment company – SHVA (Automatic Banking Services). SHVA was established in 1978 by the five largest banks in Israel. The company’s services enabled customers of all banks to withdraw money from any ATM. Subsequently, SHVA also established Israel’s clearing system for transactions made by credit cards. Today, the company manages the major credit card network in Israel as the terminals in businesses around the country are connected to its network, and the company enables the process that allows any credit card holder to withdraw cash at any ATM anywhere. Following the recommendations of the Strum Commission,, the banks were forced to sell some of their holdings in this company and they were sold to the public in an IPO in 2019. Following an in-depth examination of the issue by us (including talks with the company’s management and consultation with the renowned investor Shreekkanth Viswanathan of SVN Capital), we recommended purchasing the SHVA shares in early 2021. Despite the recent price volatility of the stock, the return on this investment in 2021 stood at almost 100%, and we intend to continue to recommend holding it for many years.

3. Special Situations and Cash

The role of this category is to serve as a “conservative” backdrop in our portfolios. Due to the low interest rates in the world today, bonds, usually the less volatile portion in investment portfolios, currently display minimal yields only. As such, we do not consider most bonds to be an attractive investment at the present time. However, in order to diversify our stock-focused portfolios, we use the cash that has accumulated in the investor’s portfolio and invest it in a more “conservative” fashion. To this end, we search the global markets for special situations such as tender offers, re-organizations, delisting, mergers and acquisitions that can provide us with opportunities to make lower risk investments with a target date of return. These investments may yield low returns over short-term periods of time but become very profitable over long-term periods.

Due to the many opportunities we find today in the first two categories detailed above, at this time we have a smaller allocation to this third category.

Net-Net Stocks

We recently added another investment strategy to our portfolios. While this strategy is similar to the investment strategies I described above, in this strategy we adhere specifically to a policy of investing in specific stocks called “net-net” stocks. This strategy was first applied by Benjamin Graham (the author of “The Intelligent Investor”), and it involves investing in stocks that trade at a price which is less than the company’s net asset value. The market cap of “Net-Net” companies’ is lower than the value of all the company’s cash and current assets after deducting all of the company’s liabilities. Companies that trade at such low prices, usually operate in “out of favor”” industries. Due to their small market value most of the shares of the companies that meet this criterion will be out of the investment radar of most investors in the world. These days we find many ”Net-Net” stocks in Asia (especially Japan), Europe and other countries. This strategy has been back-tested in many countries and has so far been proven to yield an excess return to market indices of about 10% per year on average over time (there is of course no guarantee for the future). Graham himself used this strategy and managed to yield an annual return of over 15% for his investors.

On the personal level, as your portfolio manager, I am pleased to share with you some of my activities in the year 2021:

- I continued being interviewed regularly for the successful podcast of Igor Baskin, “The Financial Egg” (להשקיע כמו באפט – עמית עשת בשיחה עם יואב זליקוביץ).

- I was ranked in the first place for 2021 in Israel on the investors list published by the investment forum, Collective 2.

- I was invited by our Legal Advisor, Oded Ofek, to give an additional lecture to graduate students at the Hebrew University in which I talked about the teachings of the great value investors.

- I was selected to teach a Value Investing Course in Israel (via Zoom), administered by Interactive Brokers Israel. A big thank you to Lior and Meirav Shemesh from Interactive Israel and their team, especially Ido Harrari and Sapir Elimelech. We just began our second placement for this course.

- I was interviewed by the renowned financial mentor, Amit Eshet (השקעות בשוק ההון – עמית עשת מארח את יואב זליקוביץ). Thanks to this interview and the exposure it gave us, many of you joined our financial journey.

- My friend and partner, Matan Guetta, published two articles this year in the prestigious local economic newspaper- “The Marker”- מתן גואטה – TheMarkerץ

- I published over the last five years 13 articles in leading financial portals in Israel and abroad, including The Marker, Bizportal, Globes, Forbes and Seeking Alpha.

- Since early 2019, I have been regularly writing an investment blog on the website of The Marker, where I have already published 15 chapters – See רווחים במחשבה תחילה – TheMarker.

- In light of the high demand for our I.R.A. services, we have continued working with Meitav Dash, a leading broker in Israel. A big thanks is due to Mr. Ilia Shirshov, who assists us and gives our clients the personal attention they deserve.

- I still enjoy the warm environment and cooperative work with the staff of Interactive Brokers. This cooperation is very beneficial for us and for our clients. Special thanks go out to David Shem Tov and his staff, especially Itzik Shemesh and Liran Younger.

In conclusion, I wish to summarize again and share with you our “Ten Commandments” which underlie and direct us in our investment activities:

- Focus on high quality micro-cap value stocks which have a well-documented track record of achieving alpha and not on high-flying popular stocks.

- Identify and analyze the best Compounders in the world and invest in them as partners for the long-term.

- Set a long-term goal of at least 5 years to achieve investment returns.

- Utilize the powerful effect of compound interest on long-term investments on behalf of our investors.

- Refrain from any speculation and short-term trading.

- Not allow “noisy” headlines and catchy newsflashes about the stock market dictate our activity in this market.

- Stay away from any investment fads, the long-term economic value of which is highly questionable.

- Carefully analyze the past and present investment strategies of the world’s best investors who are renowned for excellent financial performance.

- Continuously read and study professional/academic papers, reports and research in the area of investments/finances published around the world.

- Finally – rehash to our investors the message- “Patience is gold”.

We wish to thank again our investors for the pleasure we get from working with you and for the trust you grant us. On our part, we will continue to work on your behalf in a fair, diligent, professional and trustworthy manner, while utilizing our investing strategy outlined above.

Please allow me to inform you about an exciting personal event that occurred in 2021, namely my wedding to my sweetheart, Revital. The wedding ceremony, attended by family and close friends, took place last Hanukkah in the Holy City, Jerusalem. Our hearts are filled with joy!

Finally, I wish to thank and send my love and admiration to my father, Prof. Israel Zelikovic, who revised and edited this Annual Letter, and of course, to my loving mother, Orly Zelikovic. Both of them continue to be role models for me and for our whole family. G-d willing may they be healthy for many years!

I am hopeful that 2022 will be for all of us a year of financial growth, economic and personal prosperity, joy among our families, a year of peace and tranquility, and mostly, a year of health!

Happy Passover and Easter to all those who celebrate!

Sincerely,

Yoav Zelikovic

Attorney and Senior Equity Analyst

Be the first to comment