jetcityimage

Ulta Beauty Inc. (NASDAQ:ULTA), the leading beauty retailer in the United States, has outpaced the market this year due to its above-average revenue and earnings growth. The stock rose steadily over the last few years despite several challenges for retailers, such as supply chain bottlenecks, extremely high inflation, and stiff competition.

The question is whether Ulta Beauty’s current trading prices reflect the company’s fair value or if there is more room for upside movement. Based on our Factor-Based ranking system, the firm is considerably undervalued, given its high rank. This article will examine some quality, value, and momentum factors that prove Ulta Beauty’s future upside potential.

A Successful Strategy

Ulta Beauty’s successful business model, “All things beauty, all in one place,” offered a new shopping experience for beauty products and services with an expansive assortment of over 25,000 products across cosmetics, fragrance, skincare, and hair care. Ulta Beauty, founded in 1990, operates 1,325 retail stores in 50 states and distributes its products through its website. Over the last decade, the company has made significant progress in the beauty industry and is now the largest beauty retailer in the United States.

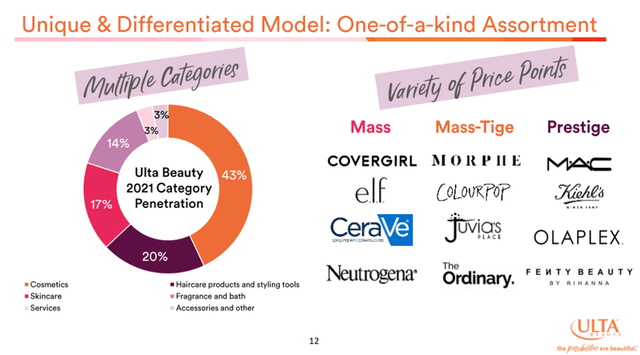

The company has one reportable segment, which includes retail stores, salon services, and e-commerce. Its portfolio can be divided into six categories: cosmetics, hair care products and styling tools, skincare, fragrance and bath, services and accessories, and others.

Ulta Beauty Investor Presentation – March 2022

Ulta Beauty is a key player in the beauty product industry and has approximately a 9% market share of the total $91 billion beauty product market in the US. Furthermore, it had less than 1% of the salon services industry, valued at approximately $49 billion.

Omni-channel growth

Like many retailers, Ulta Beauty was negatively affected by the COVID-19 social restrictions. However, it managed to transition to other digital channels, capitalizing on previous investments in omnichannel. It could stay connected to its customers while providing a personalized and convenient shopping experience. Ulta Beauty’s partnership with Target (TGT) also drove the company’s growth. This shop-in-shop strategy will keep Ulta Beauty closer to its clients and provide an opportunity to acquire new clients and increase its market share.

The loyalty program Ultamate

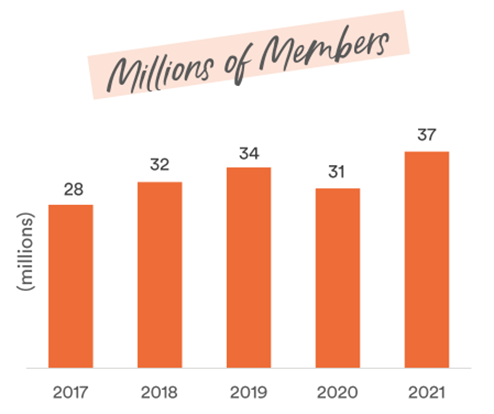

The Ultamate rewards program proved to be a key growth driver, with more than 37 million members. Ulta Beauty intends to keep innovating this program and deepening customer engagement, as member transactions account for 95% of the company’s annual sales. Data shows that loyalty members shop more frequently and spend more per visit than non-members.

Ulta Beauty Loyalty Members – March 2022

Competitive Advantage

Given the well-defined strategy and distinct business model, it’s time to examine Ulta Beauty’s market positioning to evaluate its competitive advantage. We will apply the Porter Five Forces framework to assess the industry’s attractiveness and understand the firm’s competitive position in the market.

Threat of New Entrants (Low)

Achieving a cost advantage through mass production in this industry is challenging. As a result, companies like Ulta Beauty founded several decades ago, have a significant advantage in increasing profitability by controlling costs. Furthermore, new entrants should have well-established distribution channels and strong relationships with suppliers to compete efficiently with the current market players, which require high capital requirements.

Threat of Substitutes (Medium)

Switching costs in the cosmetics and personal care industry are low, and substitutes can be homemade natural products for skin and hair care or products manufactured by competitors. However, customers in this industry are brand loyal and do not frequently switch to different brands, even if the switching costs are low. As a result, if a customer finds that a product meets her needs, she is unlikely to take the risk of looking for alternatives.

Bargaining Power of Customers (Medium)

Customers are price sensitive regarding cosmetics, skincare, and beauty products. So, whenever a recession is expected, consumers trim their spending on non-essential products, which might affect Ulta Beauty’s turnover. Additionally, the firm is susceptible to changes in the US economy as its operations and customers are only concentrated in the United States.

Bargaining Power of Suppliers (Low)

The raw materials used by Ulta Beauty are standardized, and the company creates differentiation in the final products. As such, the company incurs no switching costs if it wishes to switch suppliers, excluding the contract termination fee. Moreover, the firm made significant investments in its infrastructure to build a customer-centric distribution network, which proved efficient during the most recent supply chain crisis.

Competitive Rivalry (High)

Ulta Beauty faces intense competition from traditional department stores, drugstores, and specialty stores, as well as from other companies offering similar products, such as Sephora, Nordstrom, Sally Beauty, and others. On the other hand, the market for salon services is highly fragmented, and competitors include chain and independent salons. Market players compete with aggressive targeting and pricing strategies, which may limit growth potential. Still, the loyalty program Ultamate provides excellent data and consumer insights that allow Ulta Beauty to offer personalized services to customers across all digital and physical stores and stay ahead of competitors regarding consumer trends.

Rankings

Ulta Beauty is an appealing investment opportunity as it ranks among the first decile stocks in our multi-factor ranking system. After considerable back-testing for the results of our ranking system, we concluded that firms ranked above 90 (top decile) performed better than other companies. As such, Ulta Beauty is part of our Factor-Based US Large Cap Equity Strategy holdings. It currently has a rank of 98.5, which includes a mix of nine quality, value, and momentum factors, as shown below:

|

Ranking (%) |

Quality (45%) |

Value (20%) |

Momentum (35%) |

|

98.5 |

63.3 |

88.5 |

78.7 |

Source: Factor-Based

We first assign a weight to each factor to obtain the final rank before normalizing it to a percentile. Now, we will dig a little deeper into some of those factors to see how they contributed to this high ranking for ULTA compared to its counterparts.

Quality

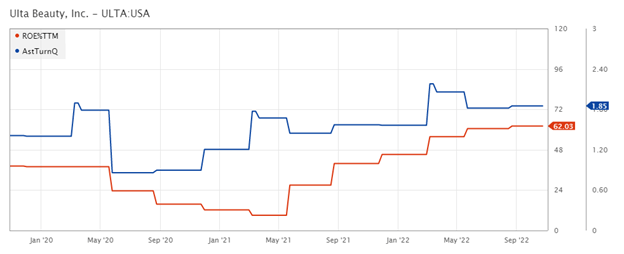

The twelve-month trailing ROE and the asset turnover ratio are among our quality factors. In a nutshell, ROE shows how much profit each dollar generates for its shareholders’ investments. Ulta Beauty has a relatively high ROE (62.03%), which is quite impressive compared to the sector median of 14.47%. Moreover, the ratio has been steadily increasing over the last six quarters.

Factset

Asset turnover is another metric to assess how efficiently a company uses its assets to generate revenue. As shown in the above chart, asset turnover dropped slightly as COVID-19 emerged, then continued its upward trend, implying that the firm’s assets are efficiently used to drive sales and growth.

Value

The EBITDA (adjusted for CapEx and R&D) to Enterprise Value is among our value factors. Ulta Beauty’s ratio has soared since 2021, implying that it increased profitability through improved efficiency.

Factset

Momentum

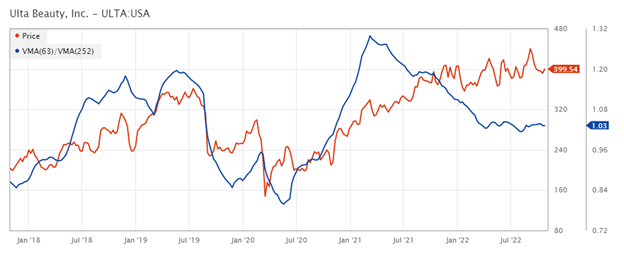

One of the momentum factors used is the price slope, which facilitates identifying medium-term upswings. Although this factor has declined since 2021, it remained above 1.0 and has not fallen to the levels seen in 2020. As a result, the negative sentiment had little impact on Ulta Beauty’s stock price, which has been consolidating above $350 for over a year. So, a new upward swing is expected once the negative sentiment fades.

Factset

Investment Risks

Despite being the leading beauty retailer in the US, Ulta Beauty is exposed to several risks. In addition to the recession risk, where demand for its products will likely be affected due to the decrease in spending on discretionary products, we note two more specific risks that might jeopardize the growth potential of the company:

- Social media as a business threat: Despite the high acquisition costs, social media is still a key marketing channel in the beauty industry. Several companies are increasing their investments and sponsoring micro-influencers, relatively unknown globally but have higher credibility and authenticity than celebrities. This principally applies to Instagram and TikTok users who are creating trends. If Ulta Beauty cannot correctly target this segment, other competitors may benefit from this trend and have the first-mover advantage in several markets.

- Changing customer preferences: Across several categories, Ulta Beauty might be negatively affected by changing consumer preferences. For instance, several studies showed that women became more comfortable going out without makeup after the pandemic. Although this does not pose a short-term productivity risk since Ulta Beauty relies heavily on customer loyalty to sell its products, it may impact customer preferences in the cosmetics industry.

Conclusion

To summarize, Ulta Beauty’s business proved less cyclical than other companies. It increased its sales and revenue while expanding its reach to ideal customers despite broader macroeconomic headwinds. The factors we use in our ranking system point to Ulta Beauty as an undervalued investment opportunity. Its future outlook is not fully reflected in the current share price, implying that it is not too late to invest in ULTA. However, before making any investment decisions, it is worth considering the risks that the firm and the industry are expected to face before making an informed investment decision. Still, Ulta Beauty is delivering excellent results and preparing for a successful year.

Be the first to comment