Scott Olson/Getty Images News

Have U.S. investors finally accepted the fact that the Federal Reserve is going to stick by its pledge to keep money tight for an extended period of time?

Quantitative tightening seems to be the name of the game, the other side of the quantitative easing that took place in the 2010s and in 2020 and 2021.

After the Wednesday press conference following this week’s meeting of the Federal Open Market Committee, the stock market has headed down.

On Wednesday afternoon, the Standard & Poor’s 500 Stock Index closed down by 25 points for the day.

On Thursday the S&P 500 drop was 99 points.

On Friday the decline was 44 points.

168 points for the last three days of the week.

The investor conclusion: the Federal Reserve was going to cause a recession, and the recession could be somewhat painful.

Here on Saturday morning, one could argue that the investor search for a “pivot” on the part of the Federal Reserve will not turn up anything hopeful.

The Federal Reserve will continue on with its quantitative tightening well into 2023.

And, as the Federal Reserve continues on with its quantitative tightening, the stock market will decline.

The Fed’s Dilemma

The Federal Reserve went through much of the 2010s, under the leadership of Ben Bernanke, stimulating a rise in the stock market, a rise that was relatively steady and quite long.

Investor expectations of continuing Fed support for the stock market grew and grew and grew.

Then the Covid-19 pandemic hit.

The Federal Reserve, under the leadership of Jerome Powell, did not want to come up short in its response to the threat and so moved to be sure that its monetary policy erred in a major way on the side of monetary ease.

The Fed succeeded.

Its quantitative easing resulted in a massive build-up of liquidity in the financial system, an explosion in debt creation, asset price inflation, and continued belief that the Federal Reserve would continue to support increasing stock prices.

The securities portfolio of the Fed rose by $4.5 trillion as a part of the program of quantitative easing to fight the Covid-19 threat.

The stock market continued to rise through 2021 and the S&P 500 Stock Index hit its last historical high on January 3, 2022.

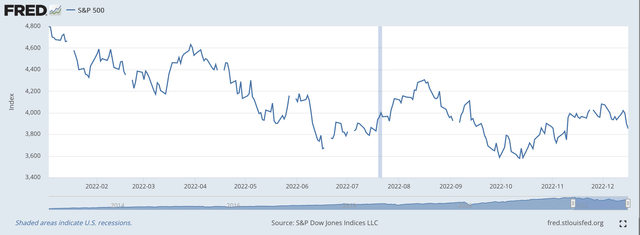

S&P 500 Stock Index (Federal Reserve)

Since the middle of March, the Federal Reserve has been dealing with the implementation of its program of monetary tightening.

As can be seen in the above chart, the S&P 500 declined from the January 3rd date, but did not really “take off” until April, after the Federal Reserve began to increase its policy rate of interest.

Quantitative Tightening

But the real program that investors need to watch is what the Fed does to its securities portfolio.

Quantitative tightening really began in the spring of 2022.

Quantitative easing is expected to continue well into 2023, and possibly into 2024.

The Fed acquired $4.5 trillion in securities in 2020 and 2021.

The question we now face is, how much of this $4.5 trillion is going to be placed back in the market?

The real question is not how high the Fed’s policy rate of interest will go.

The real question is about the amount of securities the Fed is going to remove from its balance sheet.

It was quantitative easing that supported the rise in the stock market from 2010 through 2021.

How far is quantitative tightening going to go in 2023 and possibly 2024?

The problem is that if the Federal Reserve does not stay around to clean up the mess it created, then the “clean up” will only be postponed to a later date.

But, does Chairman Powell have what it takes to return the U.S. financial system and economy to a “more normal” environment?

In my mind, there is no way that this trip can be an easy one. Chairman Powell, I think, is going to be tested to his limit.

The conclusion will always be, if the central bank does not do enough to return the financial markets back to a stable, functioning level, then the fight against inflation will not abate.

The U.S. economy is in a complicated position of disequilibrium.

The path ahead for the Federal Reserve…and the stock market…will not be an easy one.

Be the first to comment