We Are

Hercules Capital, Inc. (NYSE:HTGC) saw a strong rebound in its stock price in October, but I believe the business development company (“BDC”) is still very attractively valued. It easily earned its dividend from net investment income in the third quarter and recently increased its quarterly base dividend by one cent, to $0.36 per share.

Hercules Capital’s investment portfolio is efficiently managed, and the company has low non-accruals, indicating its strong credit quality.

The BDC has excellent positive interest sensitivity, which supported the most recent dividend increase. The 9.8% dividend remains a very appealing passive income proposition for investors.

A High Quality, Well-Managed Business Development Company With Interest Upside

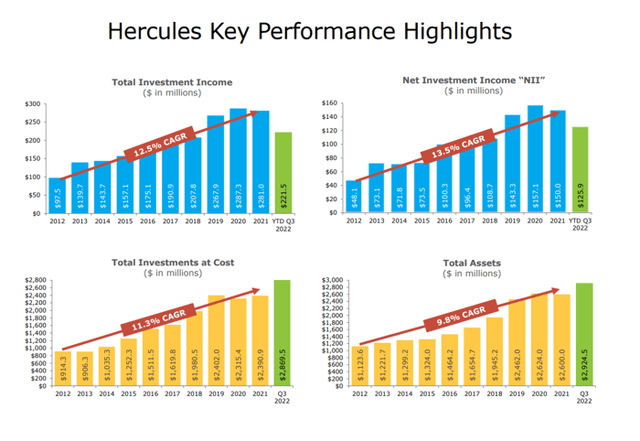

In the third quarter, Hercules Capital’s debt-heavy investment portfolio generated $50.0 million in net investment income, up 31.2% YoY. A “greater weighted average debt investment portfolio” as well as an increase in core yields benefited the business development organization.

Key Performance Highlights (Hercules Capital Inc)

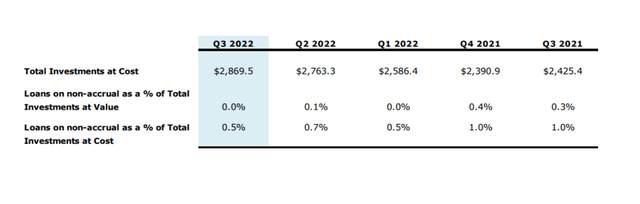

The very high portfolio quality that the business development company gives investors is a major aspect that speaks for Hercules Capital.

Hercules Capital carefully underwrites debt investments and has a track record of a few loan defaults. Hercules Capital had one non-accrual debt investment in the third quarter, compared to two in the previous quarter.

In the third quarter, the total amount of capital at risk due to non-accruals was $0.07 million, based on fair value, resulting in a non-accrual percentage of 0.0%.

Non-Accrual Debt Investments (Hercules Capital Inc)

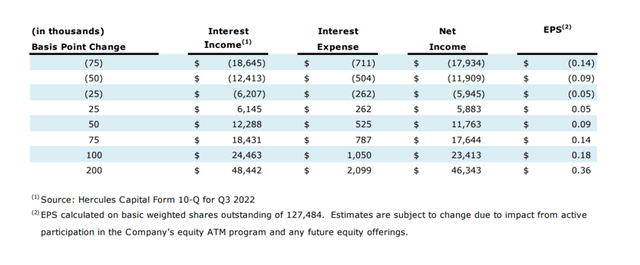

The portfolio of Hercules Capital is focused on variable rate loans. Management has allocated 95.1% of the portfolio to floating interest rates, therefore, the central bank’s aggressive interest rate cycle is a compelling cause to purchase HTGC. In fact, Hercules Capital’s recent base dividend increase of $0.01 per share was a direct outcome of the company’s high net interest income.

According to Hercules Capital’s interest rate table, a one-point increase in interest rates results in a $23.4 million gain in net income and a $0.18 increase in earnings per share.

Interest Rate Table (Hercules Capital Inc)

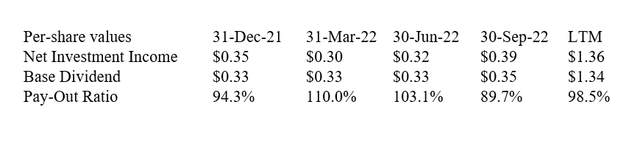

Dividend Remained Covered By Net Investment Income

In the third quarter, Hercules Capital earned $0.39 per share in net investment income while paying a $0.35 basic dividend. In order to distribute portfolio surplus profits, the BDC additionally issued a quarterly special dividend of $0.15 per share. Hercules Capital has since boosted its base dividend payment by one cent per share to $0.36 per share.

The business development firm distributed 90% of its net investment income in the third quarter and nearly 99% in the previous twelve months.

Hercules Capital’s stock currently trades at a 9.7% yield, and both the dividend and the yield appear to be quite justifiable to me.

Dividend And Net Investment Income (Author Created Table Using BDC Information)

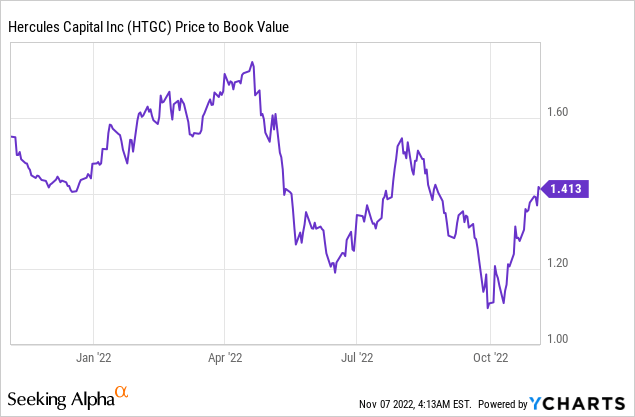

Attractive Valuation Given Strength Of The Portfolio

Hercules Capital is trading at a reasonable valuation based on its net asset value. At the end of the September quarter, the business development company’s net asset value was $10.47 per share, representing a 0.4% gain QoQ.

Because the company is presently trading at $14.32, the most recent net asset value report equates to a net asset value multiple of 1.40x.

I believe the premium multiple is perfectly justified for a higher-quality business development company with historically great credit quality and low loan defaults.

Why HTGC Might See A Lower/Higher Valuation

Hercules Capital is a well-managed BDC, but an increase in non-accruals or a decrease in net investment income could cause major problems for the company.

Hercules Capital now covers its dividend payments with net investment income, and the company’s positive interest sensitivity suggests that the pay-out ratio could improve.

On the other hand, if interest rates begin to fall and the economy enters a recession, Hercules Capital may witness a decline in portfolio metrics as well as net investment income.

My Conclusion

Hercules Capital is a high-quality business development firm with an appealing net asset value multiple. The company has a well-managed debt investment portfolio, low non-accruals, and a robust 9.8% dividend yield, which was easily covered by net investment income in the third quarter.

Hercules Capital’s dividend coverage may possibly improve as management positions the business development firm for higher interest rates.

Hercules Capital likewise increased its dividend, and I think it’s difficult to argue with the BDC’s 9.8% dividend yield.

Be the first to comment