JHVEPhoto/iStock Editorial via Getty Images

Thesis

The Bank of Nova Scotia (NYSE:NYSE:BNS) stock has been battered since its highs in March 2022, as it posted a YTD total return of -18.6%. Scotiabank stock has also underperformed over the last ten years, as it posted a total CAGR of 2.76%.

We believe the market remains uncertain whether Scotiabank’s diversified portfolio could lead to long-term earnings outperformance. Given the tremendous volatility in its adjusted EPS growth, we deduce that the market has likely de-rated BNS. As a result, the market is probably asking for a higher margin of safety, as it de-risked BNS’ valuations to reflect near-term headwinds.

Notwithstanding, Scotiabank is confident that it would be able to recover its operating leverage moving forward, as it benefits from asset repricing across its portfolio. Therefore, it should help improve the recovery of its adjusted EPS growth as it climbs out of its nadir through FY23.

Coupled with a relatively low payout ratio, we believe Scotiabank’s robust dividend yields should provide strong support for its valuation at the current levels.

We rate BNS as a Buy.

BNS’ Valuation Has Been De-risked

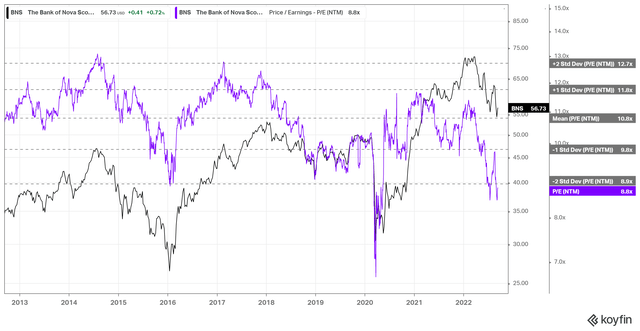

BNS NTM normalized P/E valuation trend (Koyfin)

As seen above, the market has de-rated BNS materially from its March highs, as it plummeted nearly 25% to the current levels. Consequently, BNS remains well entrenched in the two standard deviation zone below its 10Y mean. Therefore, we postulate that the market has sufficiently de-risked BNS, despite the worsening macro headwinds, amid a potential recessionary scenario.

Therefore, we believe it’s essential for investors to assess whether they think we could be plunged into a severe recession or a relatively mild version. However, management is confident that Scotiabank does not expect a recessionary outcome, as it continues to see robust strength in its loan growth, despite near-term challenges in capital markets. CEO Brian Porter accentuated:

I think there’s a real disconnect between Main Street and Wall Street or Bay Street, if you will, in terms of the direction of the economy and feeling about the economy, as I spend a lot of time as my colleagues do visiting clients across the country and throughout our different geographies and generally, the sentiment is really quite bullish. There has to be some conditions precedent in place for I don’t even like using the R word, but for a recession. And we just don’t see those. (Scotiabank 23rd Annual Financial Summit)

Therefore, we believe barring a full-blown recession which could plunge its valuations further, we are confident that BNS should find robust support at the current levels.

Scotiabank’s EPS Growth Should Recover Through FY23

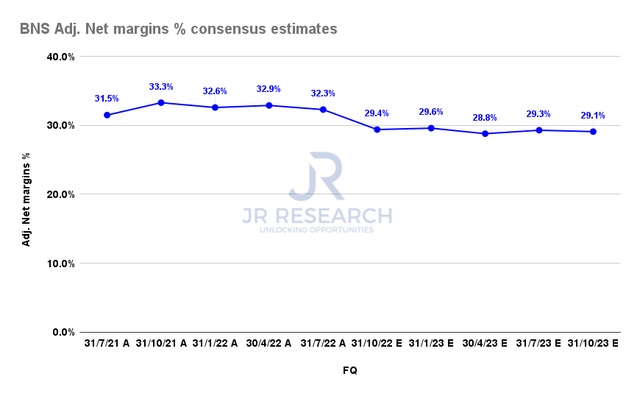

Scotiabank adjusted net margins % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) have likely factored in weaker profitability through FY23, given the macro headwinds. Therefore, we believe it’s prudent for investors to consider the impact on Scotiabank’s margins profile. However, management remains confident that it should benefit from asset repricing subsequently, lifting its margins and helping it regain operating leverage.

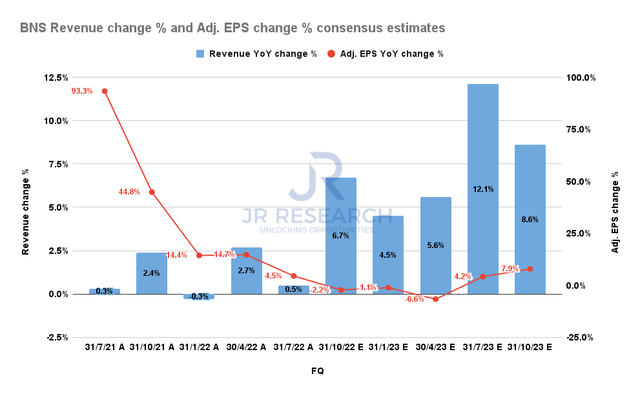

Scotiabank revenue change % and adjusted EPS change % consensus estimates (S&P Cap IQ)

Scotiabank’s profitability growth has moderated significantly from its high in FY21. Therefore, we deduce that the normalization should help Scotiabank lap easier comps in FY23, spurred by its asset repricing tailwinds and a likely recovery in capital markets growth.

Therefore, we postulate the impact seen in H2’22 is likely transitory. Notwithstanding, Scotiabank’s volatile revenue and earnings growth over time could also have affected the market’s confidence in its valuation. As a result, it could also have led to a significant de-rating in 2022, as BNS underperformed its average total return performance significantly.

Is BNS Stock A Buy, Sell, Or Hold?

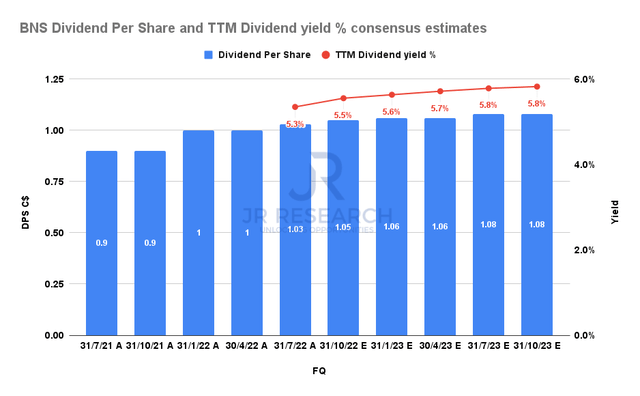

Scotiabank dividend per share and TTM dividend yield % consensus estimates (S&P Cap IQ)

Scotiabank remains a solidly profitable business, as seen in its adjusted net margins presented earlier. Coupled with a relatively low TTM payout ratio of 47.9%, it secures Scotiabank’s dividend strategy, helping to support its valuation.

As a result, we believe that its NTM dividend yield of 5.7% (vs. 10Y mean of 4.6%) should continue to attract robust buying support at the current levels.

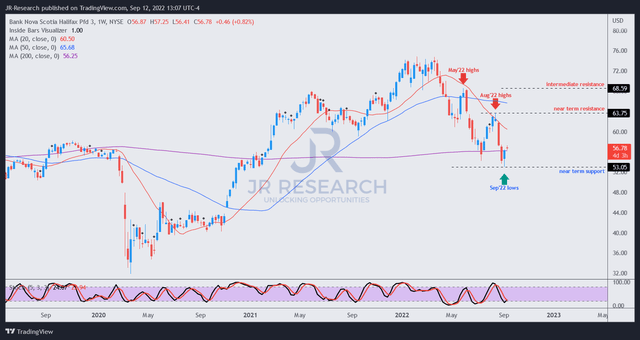

BNS price chart (weekly) (TradingView)

Furthermore, we gleaned its price action is constructive and posit that BNS likely bottomed last week. Notwithstanding, BNS needs to prove that it can retake its August highs and 20-week moving average (red line) to corroborate its path toward recovering its medium-term bullish bias.

However, we believe the reward-to-risk ratio is attractive from the price action perspective. Coupled with our valuation analysis, we are confident that investors can consider adding exposure at the current levels.

Accordingly, we rate BNS as a Buy.

Be the first to comment