Justin Sullivan

Elevator Pitch

I reiterate my Buy investment rating for AT&T Inc.’s (NYSE:NYSE:T) stock with this latest article. My earlier article for T written on July 14, 2022 highlighted that AT&T is an attractive investment candidate in recessionary economic conditions.

AT&T’s recent stock price weakness represents a buying opportunity as there is a key catalyst supporting a potential rebound, and this has prompted me to publish an update on T. Specifically, I think that AT&T’s stock can go back to $20, which isn’t unreasonable as its shares have traded at such a few months ago. The company’s share price fell recently because of concerns about its ability to deliver on its 2023 free cash flow goal. In my opinion, AT&T’s actual free cash flow for FY 2023 should be better than what investors expect, which should drive a re-rating of T’s shares to $20 or higher.

AT&T Stock Key Metrics

AT&T’s most recent quarterly metrics were pretty good.

As highlighted in the company’s Q2 2022 financial results media release, postpaid phone net additions for T’s Mobility business grew by +3% YoY from 789,000 in the second quarter of 2021 to 813,000 in the most recent quarter. AT&T’s actual Q2 2022 Mobility postpaid phone net additions came in +50% higher than the sell-side’s consensus estimate of 542,000 as per S&P Capital IQ data. It helped that the Mobility business’ postpaid phone churn rate stayed low at below 1%, or specifically 0.75% for the second quarter of the year.

Postpaid phone ARPU (Average Revenue Per User) for AT&T’s Mobility business also increased by +1.1% YoY to $54.81 in Q2 2022. The company attributed the improvement in postpaid phone ARPU to “more customers trading up to higher-priced unlimited plans and improved roaming trends”, as per T’s management comments at the Q2 2022 investor briefing.

The excellent metrics for AT&T Mobility business gave the company the confidence to revise its wireless service revenue growth guidance for full-year fiscal 2022 from +3% or higher previously to +4.5%-5% when it released its second-quarter results.

AT&T’s metrics relating to the company’s Broadband business were equally encouraging. Its Fiber net additions jumped by +28% YoY from 289,000 in Q2 2021 to 316,000 in Q2 2022, and this implied that AT&T’s Fiber penetration rate rose from 36% to 37% during the same period. Also, Fiber ARPU for T’s broadband business expanded by +5.2% YoY to $61.55 in the most recent quarter. These metrics are supportive of AT&T’s +6% FY2022 top line expansion guidance for the Broadband business.

In the next section, I explain what has contributed to the recent weakness in AT&T’s shares, even though the company’s key metrics for the recent quarter were reasonably good.

Why Has AT&T Stock Been Falling?

AT&T’s stock price has fallen by approximately -17% since the company announced its Q2 2022 financial results and updated its fiscal 2022 management guidance on July 21, 2022 before the market opened. In this same period, the S&P 500 actually rose by +3%.

In other words, T’s share price performance has been poor on both an absolute and relative basis in the past two months, and this is largely related to AT&T’s updated management guidance for the current fiscal year.

T’s Updated Full-Year FY 2022 Management Guidance

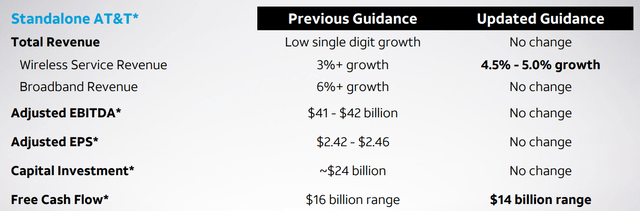

AT&T’s Q2 2022 Financial Results Presentation

As per the chart presented above, there were only two changes made to AT&T’s FY 2022 guidance when the company reported its recent quarterly results. The first change is a positive one, the upward revision in T’s wireless service revenue guidance, which I touched on in the preceding section of the article.

The second change is the one that led to AT&T’s recent share price underperformance. The company reduced its free cash flow guidance for this year from the “$16 billion range” to the “$14 billion range.”

At the company’s Q2 2022 earnings call, AT&T explained that it generated weaker-than-expected free cash flow ($1.4 billion in Q2 2022) for the recent quarter due to “the timing of higher success-based investments on the back of our robust customer growth.” T also stressed at the recent quarterly results briefing that the company is “seeing some longer collection cycles”, which was also a factor that drove the decrease in its FY 2022 free cash flow guidance.

The company’s disappointing 2022 free cash flow guidance explains why AT&T’s stock has been falling.

Can AT&T Stock Rebound To $20?

Investors are no longer convinced that AT&T can deliver on its FY 2023 target of delivering $20 billion in free cashflow, considering the modest free cash flow achieved in Q2 2022 and the reduced free cash flow guidance for fiscal 2022. All of these are reflected in Wall Street’s consensus numbers, with S&P Capital IQ’s data pointing to an expected FY 2023 free cash flow of $18.5 billion for T.

But this is exactly where the opportunity for AT&T lies. AT&T’s shares can rebound to $20+ levels where its stock was trading at for the majority of the period between mid-May and mid-July 2022, if its actual 2023 free cash flow exceeds expectations. A $20 price target for T translates into a capital appreciation potential of +17% as compared to its last traded stock price of $17.03 as of September 9, 2022, and this exceeds a 15% hurdle rate warranting a Buy call.

There are two key reasons supporting my view that AT&T can generate better-than-expected free cash flow next year, which will be a re-rating catalyst for the stock to go up to $20 or even higher.

One key reason is that there is a timing issue that affected T’s Q2 2022 free cash flow, and this should normalize in the next couple of quarters.

AT&T acknowledged at its Q2 2022 results call that it “front-end loaded our capital investment plans in order to kick-start our growth initiatives”, but it emphasized that it expects “these plans to seasonally moderate through the course of the year.” Also, as I discussed in an earlier section of the current article, AT&T’s subscriber growth was good in the second quarter of 2022. As such, it shouldn’t be a surprise that T was burdened with increased expenses (e.g. phone subsidies) that it had to incur on an upfront basis, and it is reasonable that this spike in costs will ease going forward.

Another key reason is that the longer time that AT&T is taking to collect on its bills should be a temporary problem, and this is less likely to be reflective of signs of macroeconomic weakness pressuring consumers.

At its second-quarter earnings briefing, AT&T highlighted that the company’s “postpaid base is probably skewed a little bit more to the higher socioeconomic dynamics and probably a bit more insulated.” T also referred to the longer cash collection observed as “an issue of when they pay” rather than “an issue of people not paying.”

I highlighted in my prior July 2022 article that “wireless services are largely non-discretionary” and I still stick to this view. Subscribers might delay the payment of bills by a while when their purse strings are tight, but this is unlikely to persist for a prolonged period and they are also unlikely to terminate their wireless services.

In summary, I am of the view that a rebound in AT&T’s stock price to $20 is in order with higher-than-expected free cash flow being the catalyst.

Is AT&T A Good Long-Term Stock?

T’s status as a dividend play is its key investment merit as a long-term investment candidate.

AT&T offers consensus forward FY 2023 and FY 2024 dividend yields which are both in excess of +6.5%. Also, T has a decent track record of having paid out dividends consistently for the past 37 years.

Over the long run, no investor can be assured of achieving positive capital gains in every single year going forward. Instead, dividends form a critical component of an investor’s expected total returns, and will help to mitigate losses for investors in down markets.

AT&T fits the bill of a steady dividend payor that investors can depend on for years to come in the future, and this makes it an appealing investment option for investors with longer investment time horizons.

Is T Stock A Buy, Sell, or Hold?

I rate T stock as a Buy, as its expected return based on a $20 price target exceeds the 15% required rate of return for a Bullish rating. The key catalyst for AT&T will be above-expectations free cash flow for 2023.

Be the first to comment