Ingus Kruklitis/iStock via Getty Images

Dear readers,

I wrote about Consolidated Edison (NYSE:NYSE:ED) about 19 months back in the early parts of 2021 – before Russia invaded Ukraine, before the market turned into the interest, CPI-driven mania that it’s currently in, and when my portfolio was still fairly heavily weighted towards things like pharma. That is now somewhat different.

Since then, I’ve shifted my new investments toward cash-flow safe, higher-yield businesses that in my view, will have no issues sustaining their payouts or earnings during even the harshest winter times. Utilities, being in the business of heating and lighting our homes and cities, are certainly a part of this.

With that in mind, here is my update on Consolidated Edison.

Consolidated Edison – An update

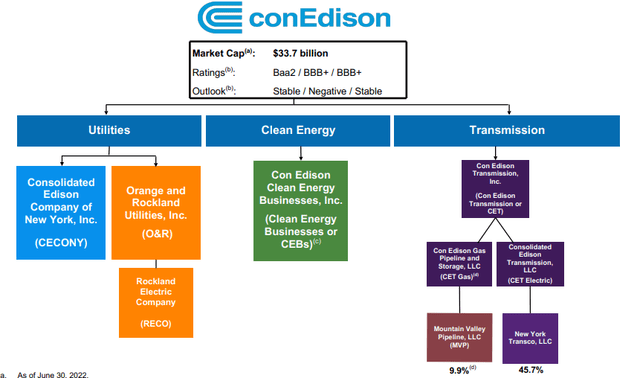

In my original article, I explained ConEd, a company with a $33.7B market capitalization that operates multiple subsidiaries in the eastern area of the US, with perhaps the crown jewel being the Consolidated Edison Company of New York, which is a regulated utility providing electricity and gas service in New York City and Westchester. It’s unique by operating the New York Steam service, probably the largest of its kind anywhere – and the company is on a tear to make sure that its operations are as future-proof as is humanly possible.

With a 200-year history, this company has seen pretty much everything you could conceive to throw at it. Currently, it provides electricity, gas, and steam services giving energy to around 10 million people. Alternatively, in different terms, essentially more than the population of all of Sweden.

More interestingly perhaps, given today’s climate, is the fact that ConEd is one of the cleanest and greenest energy providers in the US, with 71% of assets based on various forms of renewable energy.

ConEd does not own coal or nuclear assets. It’s the 2nd largest owner of solar electricity in the United States and 7th in the entire world. The company currently constructs or has in operation, renewable electric production in 20 states, and its steam network eliminates about 1M tons of Co2 per year.

Also, the company is going 100% clean by 2040 as a goal and has taken it upon itself to transform energy efficiency, as well as going with a full electric fleet going forward.

The state of New York, while a politically divisive area, has goals to go 100% carbon-free by 2040 and 70% renewable by 2030, at the latest. The energy development goals reflect these goals, and the installations for customers also reflect this increased focus on different types of energy.

That’s the base case for ConEd – both theoretically and concrete future-proof as well as with a decent current set of assets that should safeguard the company going forward.

The case of investing in this fundamentally safe BBB+ rated company is usually based on one of a few, or several arguments. It’s future-proof grid, its work with the gas system, it’s resilience thanks to New York Steam, its ESG focus and plans for reducing Co2 and/or fundamentals.

ConEd has excellent shareholder history, with 47 consecutive years of dividend increases, which beats any utility company on the S&P 500. The company’s EPS payout target is around 60-70%, and even on an NTM basis, the company meets these targets.

EPS has been clocking away on a reliable basis for 10 years, and things show very little signs of slowing down. it’s growing by that single-digit EPS on an annual basis, estimated 2.5% for 2021E.

I’m not the only person who considered this a great investment. Take a look at what happened since I wrote about the company last.

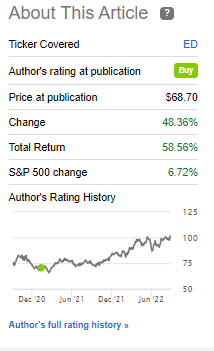

ConED Article (Seeking Alpha)

The fact is, I’m a bit late with this article. But it’s a testament to value investing. While many of the companies I currently invest in are nowhere near to normalizing or realizing their potential, I believe ED to be a good example of what happens when things turn the right way – which things have, for ED.

When I wrote my article, I remember there being plenty of fundamental bears on the company – now we’re mostly talking about the valuation of ED, which by the way I agree with, is high. More on that later.

Quarterly results were good. The company continues to invest heavily – $15.7B until 2024E through a mix of safety investments as well as green energy pushes. The company is essentially retrofitting huge swathes of its infrastructure to work for the next half-century or so – and we should want to be a part of this development.

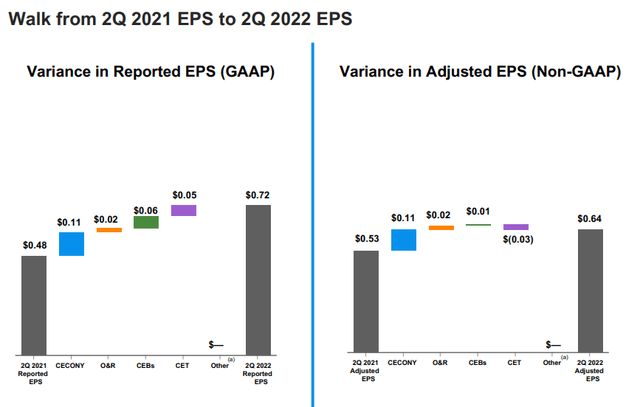

Rate cases for the company are mostly positive, allowing for an RoE of between 8.8-10, which is pretty decent. EPS is up – and pretty significantly at that.

The pandemic impact, even the disconnect stops due to nonpayment, have only marginally impacted the company’s results, and I don’t see any further headwind with regards to this in the near-term. I believe it would be fair to characterize pandemic impacts as “over” for this particular company.

While there are risks, I believe these aren’t as heavy as we could have considered them even half a year ago. They remain things to keep an eye on – but nothing that would threaten ConED as a business or as a whole.

First of all, New York City which can easily be named ConEd’s main market has experienced year-over-year population losses for three years running at this point. COVID-19 is only the latest in people essentially fleeing this geography in favor of cheaper, more flexible areas for living. For decades, New York has been able to market itself simply as New York and attract people from across the world to move there. It seems that there’s a break here now.

(Source: Consolidated Edison Article)

The ebb and flow of being a regulated utility means an essential guarantee of being provided with revenues required to cover costs, as well as a certain amount of profit. This is essentially the same all across the world, albeit at specific rates.

This is the reason I like utilities so much – especially in this environment. As long as the asset base remains safe, and as long as the demographics remain safe, there are very few things that can fundamentally derail a national or even region utility player.

Let’s look at the other part of the equation, where it currently, unfortunately, gets hairy.

Consolidated Edison Valuation

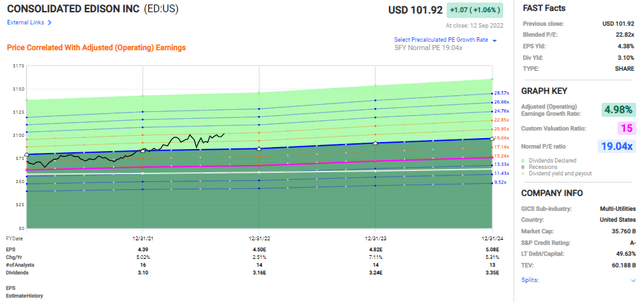

In my last article, I made a case for why it was a once-in-a-rare-time opportunity to essentially buy ED at a multiple of no higher than 16x. Today, that picture is very different.

ConEd is currently trading at close to 23x P/E. I like utilities, but a New-Yorker utility with an asset like the steam network that will need considerable retrofitting and CapEx as well as the demographics does not warrant an inch over 20x P/E.

I’ve been relatively quiet on ConEd, but when the company started to really touch that 22.8x+ P/E again, I knew I needed to act. It’s not just enough to consider, to my mind, the company a “HOLD” here. I’m actively considering the rotation of at least part of my stake in favor of cheaper-valued, higher-yielding alternatives.

ED is a great company – but every great company has a point of overvaluation. The latest year has been a reminder to those not schooled in value investing that there comes an inflection point in every company. No matter how safe you believe it to be, or that you might think that “oh, this could never fall”.

Yes, it can – everything can.

For that reason, I remind you of my original thesis target for ED. $71/share at most. The company has broken through every logical barrier in context to that here, and I give the company no more than a 20x P/E based on a normalized EPS, coming to around $88/share at most. And if the company trades at $88/share, the RoR will based on its growth rate, not be that great.

However, at current forward 19-20x P/E estimates, we have less than 3% annualized RoR. That doesn’t work for me.

At a 3.1% yield for a 23x P/E, I can easily, comparatively, get far better upside, and far better yield at the same sort of fundamentals that ED offers me (albeit not at the same portfolio safety).

Current S&P Global averages call for the company to trade between a valuation of $75 for the low, and $99 for the high, with an average of $88.60 from 15 analysts. Only 1 out of 15 analysts have a “BUY” or equivalent rating on the company.

The “sound of the music” seems clear at this point.

This company is most definitely a hold here, at double-digit overvaluation. I would go so far as to consider the company a rotation target, and in full disclosure, I might be rotating the company within the next few days.

Thesis

My thesis for Consolidated Edison Is as follows:

- Consolidated Edison is a top-quality utility with a great set of assets and a good set of fundamentals. At the right valuation, the assets here are backed by incredible safety and a good geographical population base.

- However, unless the valuation is right, you’re at risk of putting your capital to “work” at below-5% annualized RoR even with yield.

- At the current valuation, I would consider this company to be a “HOLD” and a rotation target due to overvaluation.

- I consider ED a “HOLD”. PT is $88/share.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- The company is currently cheap

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment