Alena Zharava

Main Thesis & Background

The purpose of this article is to evaluate the Schwab Large-Cap Value ETF (NYSEARCA:SCHV) as an investment option at its current market price. As the name states, this is a “value” oriented fund, as opposed to having a growth, dividend, or broad market focus, etc. The fund’s stated objective is to “track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Large-Cap Value Total Stock Market Index”.

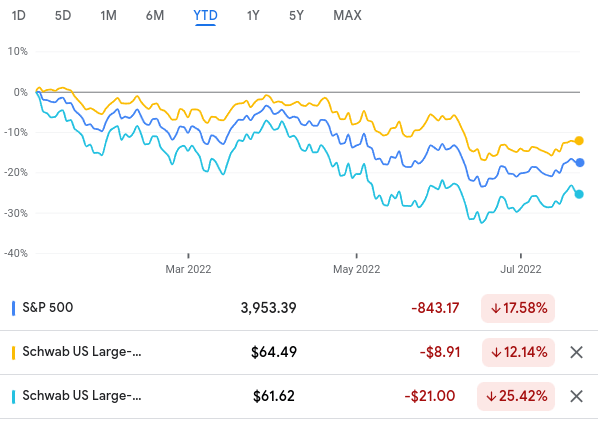

Given the turmoil we have seen in equity markets in 2022, it should not be too surprising that value as a theme is coming up more in investment conversations. This is an area that can often outperform growth or more risky objectives when investors are worried about the macro picture. The value orientation suggests less downside, since the underlying companies are trading at lower multiples. Of course, this doesn’t always translate to positive returns, the year-to-date return indicates. However, it is important to note that SCHV has indeed been a safer play in 2022, as it has outperformed the S&P 500 and its “growth” counterpart from Charles Schwab (SCHW):

YTD Performance (Google Finance)

Given this performance divergence, I thought it would be timely to write an article on SCHV and gauge if now was a good time to buy. Personally, I do see some positive attributes for the fund going forward. I like the sector breakdown, dividend growth is strong, and value could continue to outperform. However, there are some concerns I have as well. These are more related to the broader macroeconomic picture, but could impact SCHV all the same – such as inflation, war in Europe, and the potential for a recession here at home. These pros and cons balance each other out a bit, in my view, justifying a “hold” rating for now.

I Like The Financials Exposure

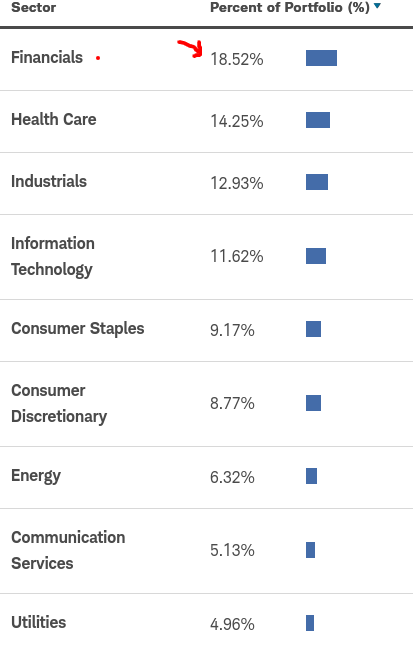

To begin, I want to highlight some of the attributes about SCHV I find attractive at this moment. The first is the sector breakdown of the fund. At time of writing, the Financials sector makes up the largest individual sector weighting, coming in just under 20% of total fund assets:

SCHV Sector Weights (Charles Schwab)

Right from the onset this tells me that if one is going to buy SCHV, they would want to have a bullish outlook on the Financial sector. Fortunately, I do.

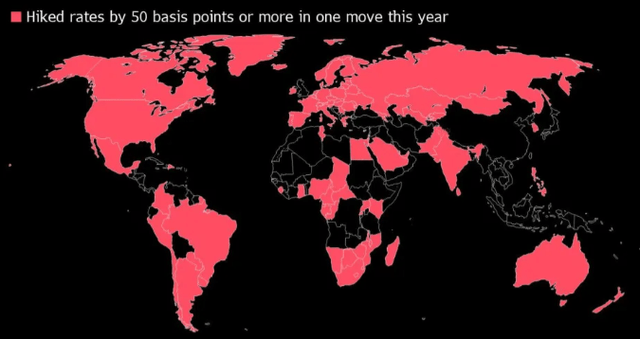

There are a number of reasons for this. The first is that interest rates have been rising, which is generally a tailwind for banks and other lenders. There are risks to this thesis of course. If rates rise too aggressively, the benefit to net interest income can be negated if lending volume dries up and/or consumers and businesses begin to default on their debt. So, a rising rate environment is good to a point, but those metrics should be monitored carefully. It is worth noting also that this environment is not just a U.S. phenomenon, but a global one. Central banks around the world have been raising their benchmark rate, as seen below:

Countries Whose Central Banks Have Raised Rates (Yahoo Finance)

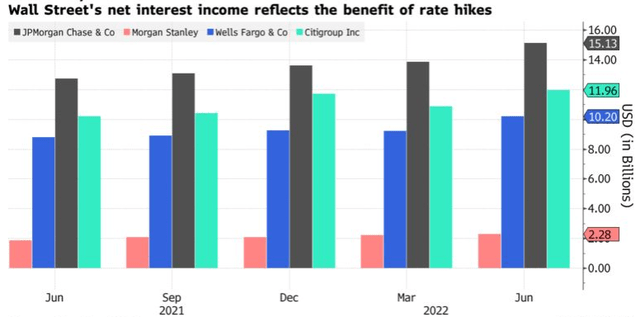

With this backdrop, it should make sense that large banks are doing well (or at least better). Fortunately, that is indeed the case. While there are concerns about a recession in the U.S., as well as in other global economies, so far lending standards and payments have held up. Large banks especially have seen a boost to their bottom-lines, with the U.S. majors benefiting from rise in Net Interest Income (NII):

Large Banks See NII Increase (Bloomberg)

This is good news and is certainly relevant to SCHV. JPMorgan (JPM), one of the biggest beneficiaries according to Q2 earnings (shown above), is actually the fourth largest individual holdings within SCHV. Wells Fargo (WFC), Morgan Stanley (MS), and Citigroup (C), all of which have seen NII improvements, are also all held by SCHV.

My takeaway here is that some of the fund’s top holdings are thriving in this big picture environment. While rising interest rates are pressuring growth names and other companies that are not profitable, the Financials sector is seeing strong results. This trickles down directly to SCHV’s performance, and helps explain why this fund is holding up better than the broader market. Given that interest rates are still set to climb in the second half of the year, I see this as support for owning this fund.

Dividend Growth Really Impresses

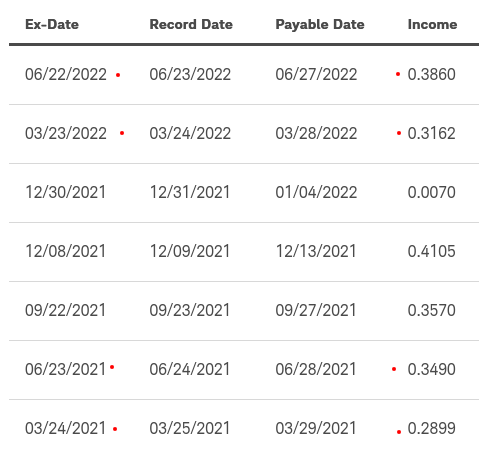

A second attribute that I view positively is the dividend story. The current yield around 2.3% does not seem wildly impressive, and that is fair. But what excites me most about this fund is not the absolute yield but the level of dividend growth. On a year-over-year basis, the distribution is up handsomely, with raises in both Q1 and Q2:

SCHV’s Distributions (Charles Schwab)

As you can see, the 2022 dividend growth rate for the first half of the year is just over 9%. This is pretty strong, especially for a fund that isn’t even dividend-oriented specifically. While inflation remains red hot, this rate beats it, so that is something to celebrate.

The conclusion I draw here is that SCHV is holding companies that are managing well in a tough environment. The fund is down less than the market and its underlying holdings are willing and able to increase their dividend payouts. As a “dividend seeker”, I like what I see.

So, What’s The Problem?

So far I have painted a positive picture of SCHV. And I stand by that call – meaning I believe holding or even buying SCHV right now makes sense. Yet, I have a hold rating on the fund, which also suggests some caution. I do not mean for this to be too contradictory. Rather, I am suggesting that investors approach positions carefully. We are in a difficult spot in global markets, with a lot of risks and a challenging outlook for corporate earnings. This tells me not to get too aggressive here with any equity position, SCHV or otherwise. I see merit to buying but not at all costs. I would be selective, wait for down days, and ladder in. This differs from a straight-up “buy” recommendation where I see immediate benefits to buying. I think investors can be patient with SCHV, and that is the course I would encourage.

This begs the obvious question – why?

To answer this, I want to emphasize that SCHV offers investors relative value. This means value compared to the large-cap stock market and corresponding growth names. This does not necessarily imply a very cheap price or overwhelming value. Is SCHV cheaper than the S&P 500 and the Schwab U.S. Large-Cap Growth ETF (SCHG)? Yes. But is the fund “cheap”? No.

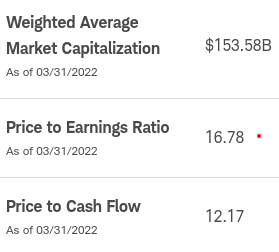

For support, let us recognize that SCHV has a P/E ratio just under 17:

SCHV Attributes (Charles Schwab)

In fairness, this figure has probably come down a bit in the short term as bank earnings have been solid and share prices have dropped. But it still doesn’t indicate a wildly cheap entry point either.

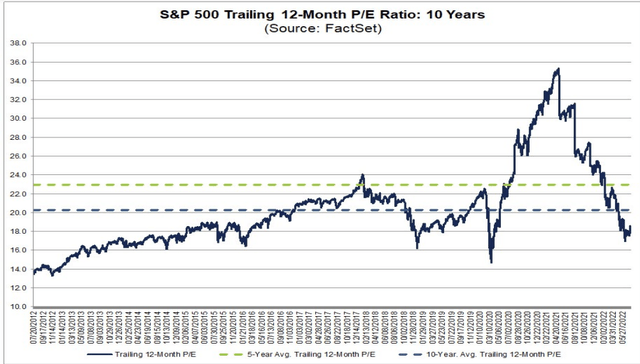

For perspective, readers should note that the broader S&P 500 has a current P/E just over 18 at time of writing. This is higher than SCHV, but not by very much, and it is below the index’s longer-term average. In a sense, this means there is value in the S&P 500 as well at these levels:

S&P 500 P/E Ratio (FactSet)

What I am getting at here is support for my more neutral tone on buying at this precise moment. SCHV has some great attributes, but I don’t want to give the impression there is unbelieve value here. Yes, it is a value fund and, yes, it is cheaper than the broader large-cap market. But it’s not cheap, and readers should evaluate carefully whether or not buying here really makes sense given all the geopolitical risks around the globe.

Health Care Sector Will Benefit From A Post-Covid World

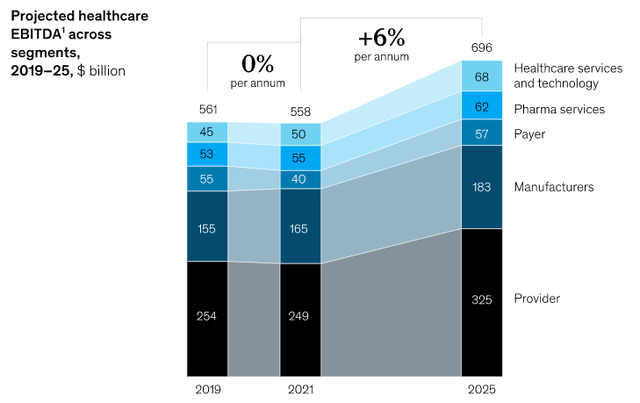

My final topic touches on the second largest sector within SCHV, which is Health Care. Similar to Financials, this is another area I am bullish on for the longer term, so I view SCHV’s heavy inclusion of these underlying companies in its portfolio as a good thing.

There are a number of reasons for this. One, we are finally getting out of pandemic mode across the country. While we are not back to “normal” yet, and Covid variants continue to plague healthcare systems and consumer sentiment, there is light at the end of the tunnel. While Covid vaccines and other treatments have been profitable for drug companies, the impact on the healthcare system has been mixed. As we return to normal, we will see patients who delayed or skipped necessary care hopefully return to the fold. This could mean an uptick in high margin physician visits, medical tests, and elective surgeries and procedures. My view is this is a net positive for the sector, and it makes sense to continue holding on to exposure here going forward.

In fact, recent studies suggest there could be a strong boost to earnings in the Health Care space across a number of different subsectors. As public and private investment increases and patients return to get the elective care they need, companies across the spectrum should see robust gains:

Projected Earnings Rise (Health Care subsectors) (McKinsey & Co.)

The conclusion I draw is that Health Care as a sector is poised to deliver strong returns over the next few years. Similar to SCHV more broadly, there is no real need to rush in all at once right now. But it is a sector that should be taken seriously by U.S. investors, especially since it is underrepresented in the S&P 500. Buying a fund like SCHV gives investors exposure to areas like Health Care that they may lack through other large-cap or broad market funds. With a benefit of diversification and long-term earnings growth potential, I see exposure as a no-brainer.

Bottom-line

SCHV has had a difficult year so far, resting in correction territory through the first seven months of the year. However, this actually compares well to the S&P 500 and the Tech-heavy Nasdaq/growth indices. By comparison, value themes are holding up better than average, and that should pique investor interest. Personally, I see it as having merit to hold this exposure, and I will look to initiate and add to a position over the next few months. However, I would caution readers that “value” does not mean “cheap”, and SCHV has plenty of downside risk if we enter a prolonged recession or geopolitical risks flare up or escalate in regions like eastern Europe or Asia-Pacific. As a result, I believe a selective approach to SCHV makes sense for now, and I would encourage readers to give this fund some careful thought at this time.

Be the first to comment