felixmizioznikov

Introduction

Swedish Match AB (OTCPK:SWMAY) (referred here as “SWMA”) released Q2 2022 results on Friday (July 22). SWMA’s share price has been flattish (up 0.1%) since, and currently stand at SEK 106.15, slightly above the SEK 106 offer from Philip Morris (PM) in May that is being recommended by SWMA’s Board.

We downgraded our rating on SWMA from Buy to Hold in May following the offer from PM, realising a gain of 42.8% (including dividends) in less than two years. Since then SWMA shares have risen 5.2%, partly attributable to reports in early July that activist investor Elliott Management was accumulating a stake to oppose the offer.

|

SWMA Share Price (Last 1 Year)  Source: Google Finance (25-Jul-22). |

Q2 2022 results again demonstrated the multi-bagger potential in a standalone Swedish Match. Its ZYN nicotine pouches continued to dominate the category in the U.S., growing volume by double-digits sequentially. Year-on-year sales growth for the group was 11% in local currencies and 23% in SEK.

We continue to believe PM’s bid materially undervalues Swedish Match, and Elliott’s rumoured involvement offers a route for shareholders to be paid more for their shares. However, Elliott’s involvement remains unconfirmed, and we believe they are more likely to be targeting a moderate sweetener from PM rather than seeking to extract the maximum value through a multi-year holding period. We see better risk/reward elsewhere and reiterate our Hold rating.

Q2 2022 Results Headlines

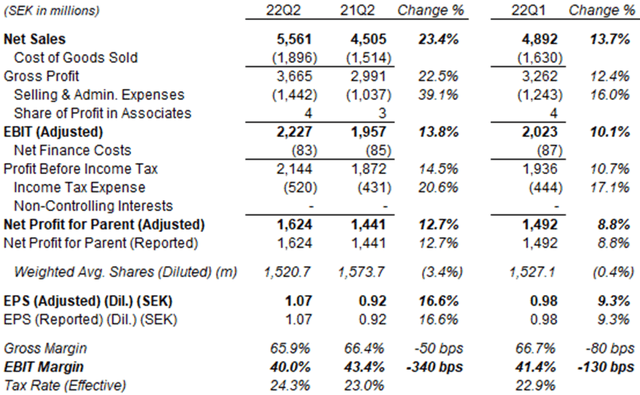

Swedish Match had a strong Q2. Year-on-year, Net Sales grew 23.4%, Adjusted EBIT grew 13.8%, and Adjusted Net Profit grew 12.7%. Adjusted EPS grew 16.6%, after buybacks reduced the share count by 3.4%:

|

SWMA P&L (Q2 2022 vs. Prior Periods)  Source: SWMA company filings. |

With 64% of year-to-date sales in the U.S., the strengthening dollar has been a tailwind for earnings. USD has risen against SEK by more than 25% since the start of 2021, including by nearly 13% in 2022 year-to-date. However, even in local currencies, year-on-year sales growth was still 11% in Q2.

Sequentially, Net Sales grew 13.7% and Adjusted EPS grew 9.3%, but the growth rate was flattered by a number of one-off items. The share count was down 0.4% from Q1, less than usual as buybacks were suspended after the PM bid.

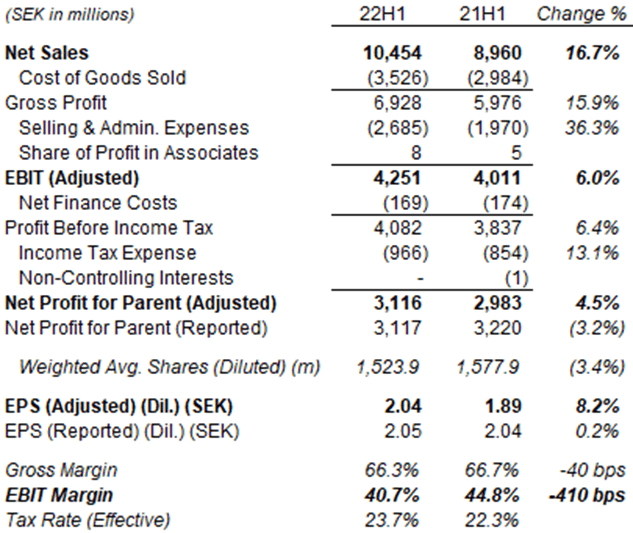

For H1 2022, Net Sales were up 16.7% and Adjusted EBIT was up 6.0% – lower than Q2 largely because of a year-on-year profit decline in U.S. Cigars, which was the result of supply chain disruptions:

|

SWMA P&L (H1 2022 vs. Prior Year)  Source: SWMA results release (Q2 2022). |

The multi-bagger potential of a standalone Swedish Match is more evident if we look at each segment separately.

U.S. Smokefree Drove Strong Q2

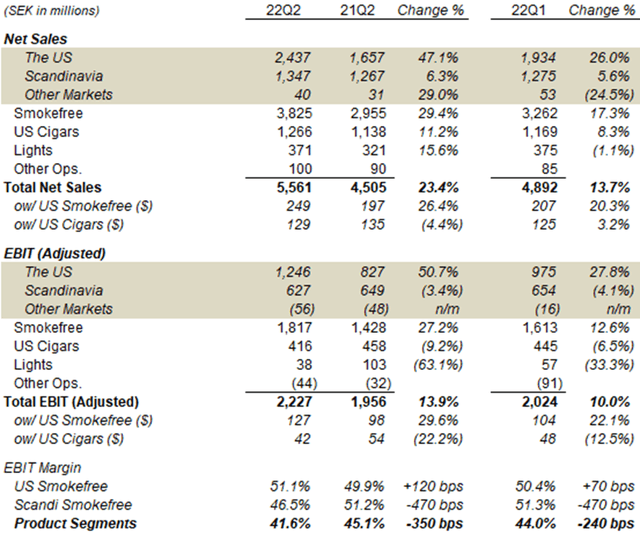

Swedish Match’s strong Q2 was driven by its U.S. Smokefree business, while Scandinavia Smokefree was in an investment phase and U.S. Cigars continued to suffer from temporary supply chain disruptions:

|

SWMA Sales and EBIT by Segment (Q2 2022 vs. Prior Periods)  Source: SWMA company filings. |

U.S. Smokefree grew Net Sales by 47.1% and Adjusted EBIT by 50.7% year-on-year in SEK, helped by currency; in USD, Net Sales was up 26.4% and EBIT was up 29.6% year-on-year. Growth was again driven by ZYN nicotine pouches, which continued to dominate the rapidly-growing category, and was helped by inventory movements.

Scandinavia Smokefree Net Sales grew 6.3% year-on-year, but Adjusted EBIT fell 3.4%. Adverse channel mix was partly to blame, with higher-priced domestic sales in Norway falling as a result of the post-COVID recoveries in the Swedish border trade and Travel Retail. Costs also rose due to higher raw materials prices, new product launches and brand building.

U.S. Cigar sales fell 4.4% year-on-year in USD, as continuing supply chain disruptions meant shipment volumes were lower year-on-year; they were up 3.2% from Q1 in USD, reflecting some improvement in production output. Lower sales, together with higher transportation and input costs, as well as highest spend in consumer loyalty programs, meant Adjusted EBIT fell 22.2% year-on-year and 12.5% sequentially in USD. (In SEK, EBIT declines were in single-digits.)

Lights Adjusted EBIT fell 63% year-on-year due to SEK 60m of prior-year one-off positives (land sales and direct tax reclaims) and SEK 15m of temporary costs this quarter. Adjusted EBIT was up on an underlying basis. However, including the effects of suspending Russian deliveries, profits are expected to fall year-on-year in H2.

ZYN Continues U.S. Market Dominance

Swedish Match’s ZYN nicotine pouches continued to dominate the category in the U.S. Actual sales figures are not disclosed, but total nicotine pouch sales were more than 30% of sales in H1 2022, up from 20% in H1 2020, which implies they have close to doubled from SEK 1.6bn to SEK 3.1bn in this period. Most of the growth has been in the U.S.

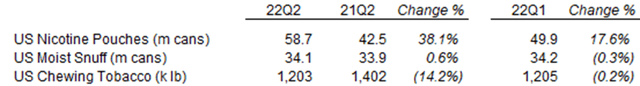

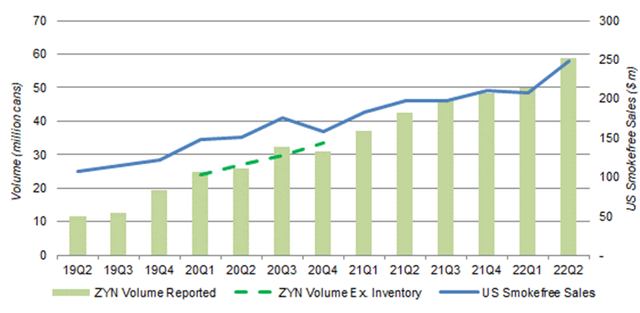

In volume terms, ZYN’s volume in Q2 was 38.1% (16.2m cans) higher year-on-year and 17.6% higher sequentially. SWMA’s moist snuff volumes only fell slightly in the same period, showing that most of ZYN’s gains have come from moist snuff volumes at SWMA’s competitors and other nicotine categories:

|

SWMA U.S. Smokefree Volumes (Q2 2022 vs. Prior Periods)  Source: SWMA company filings. |

Growth contributors continued to include both an expansion of ZYN’s distribution footprint (up 15% year-on-year to 134k stores) as well as higher velocity per store.

The growth rates in Q2 were distorted by some one-offs. Distributors adding inventory in anticipation of Q3 promotions represented an estimated 2m cans, “flavor-based shipments” were “a couple of million” cans, and the sequential growth rate was distorted by some timing effects between Q1 2022 and Q4 2021. However, management believes the 10% sequential growth shown in MSA volume data “is probably about the reflection of underlying growth”.

ZYN volume growth in the U.S. has been consistently strong since its national launch in April 2019, with a volume CAGR of nearly 15% between Q2 2019 and Q2 2022:

|

SWMA U.S. ZYN Volume (Since Q2 2019)  Source: SWMA company filings. |

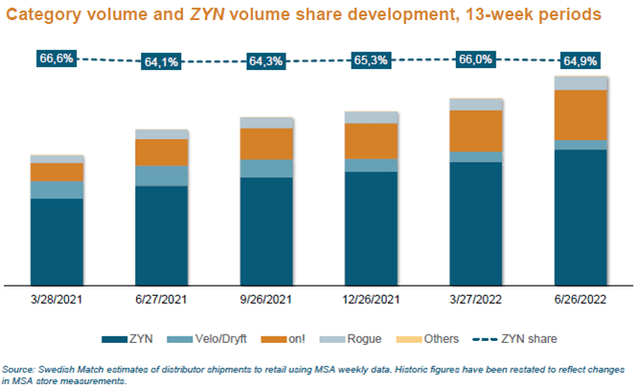

ZYN has also retained market share dominance in the U.S. nicotine pouch category, with a 64.9% volume share in Q2 2022, dipping slightly from Q2 (when SWMA ran some promotions) but up slightly year-on-year. This is far ahead of Altria’s (MO) On! and British American Tobacco’s (BTI) Velo/Dryft, despite their aggressive price cuts and promotions:

|

U.S. Nicotine Pouch Volume & Market Share (Since Q1 2021)  Source: SWMA results presentation (Q2 2022). |

SWMA stated that, based on IRI data, ZYN represented more than 75% of U.S. nicotine pouch retail sales in Q2.

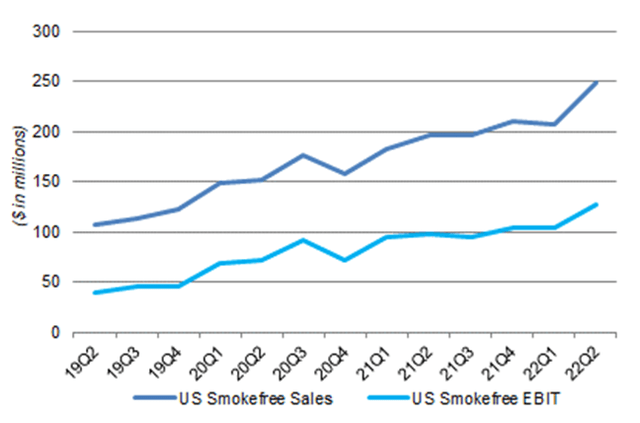

All these meant SWMA’s U.S. Smokefree EBIT has more than tripled from $40m in Q2 2019 to $127m by Q2 2022:

|

SWMA U.S. Smokefree Revenues & EBIT (in USD) (Since Q2 2019)  Source: SWMA company filings. |

We are certain ZYN can continue to grow strongly and drive group earnings within a standalone Swedish Match.

Other Businesses Also Providing Growth

Swedish Match’s other businesses remain broadly stable and continue to grow.

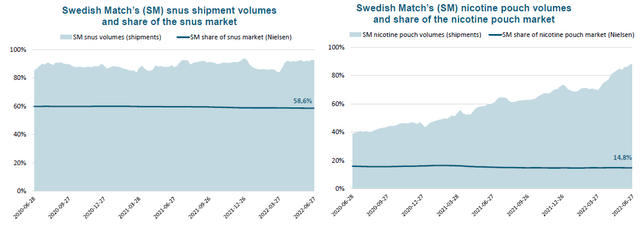

In Scandinavia Smokefree, SWMA has broadly stable volumes in snus, growing volumes in nicotine pouches, and broadly stable market shares in both. Because its share is lower in the fast-growing nicotine pouch category, its overall share in Scandinavian oral tobacco has been falling, but revenues and earnings should continue to grow over time.

|

SWMA Scandinavia Smokefree Volume & Market Share (Since June 2020)  Source: SWMA results presentation (Q2 2022). |

In U.S. Cigars, while shipments were down year-on-year due to supply chain disruptions, higher shipments from distributors to trade means that SWMA’s share in the market actually rose, and it has regained the #2 position in U.S. mass market cigars.

The approximately 3% of its cigars that were denied a Substantive Equivalence designation by the FDA in March remain in the market, and there has been no update on either SWMA’s appeal on the rest of its cigars portfolio.

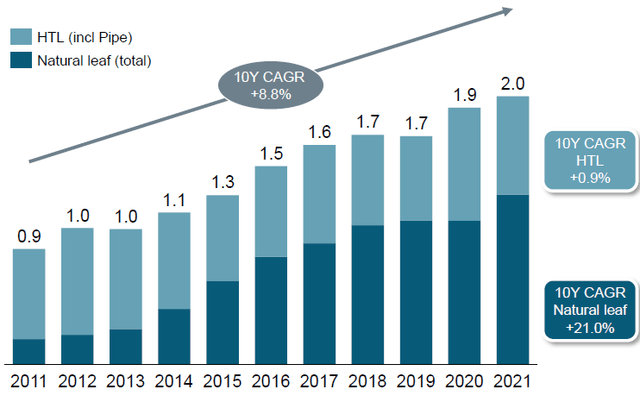

U.S. Cigars has a fast-growing market, and SWMA has grown its shipment at a CAGR of 8.8% in 2011-21:

|

SWMA U.S. Cigars Volumes (2011-21)  Source: SWMA results presentation (Q4 2021). |

U.S. Cigars does face some regulatory risks and will likely normalize down somewhat after the consumption boost during COVID-19, but should continue to generate solid earnings growth for SWMA over time.

Philip Morris Bid Process Update

Philip Morris has initiated a tender process to acquire SWMA stock for SEK 106 per share on June 29.

PM has specified a 90% acceptance level for its tender; 90% is the threshold at which Swedish law would allow PM to force any non-accepting shareholders to sell. Settlement (i.e. PM actually buying the shares tendered) can happen as soon as 90% acceptance is reached. PM can also choose to initiate the settlement at any point, but without the 90% acceptance it would be unable to squeeze out minority shareholders and formally merge SWMA into PM.

SWMA shareholders have until September 30 to accept the tender, but any acceptance can be withdrawn subsequently, provided the tender period is not over and settlement has not yet taken place.

PM will therefore know that its bid has succeeded as soon as acceptance has reached 90%. Conversely, it will know its bid will not succeed as soon as holders with more than 10% of the shares commit to not accepting it.

Reports appeared on July 7 that Elliott Management has started building a stake to opposed the bid. With more than $50bn assets under management, it certainly has the capacity to acquire 10% of SWMA (worth $1.6n at present) to block the bid. However, thus far it has not publicly declared its holding, nor has it appeared on SWMA’s major shareholders list. The Wall Street Journal reported (subscription required) on July 19 that “investors that want a higher offer already own around 5% of the share capital”, some way short of the 10% needed.

Elliott can also take SWMA private, but will likely need to partner with other firms. (It partnered with Vista to acquire Citrix (CTXS) for $16.5bn and with Brookfield to acquire Nielsen (NLSN) for $16bn this year; SWMA would be a larger deal than these). However, Elliott has more frequently acted as an activist investor, and we believe it is more likely to be targeting a moderate sweetener from PM rather than a multi-year holding period to extract the maximum value.

Until Elliott has publicly declared a position, we regard to path to higher shareholder value as uncertain.

Swedish Match Valuation

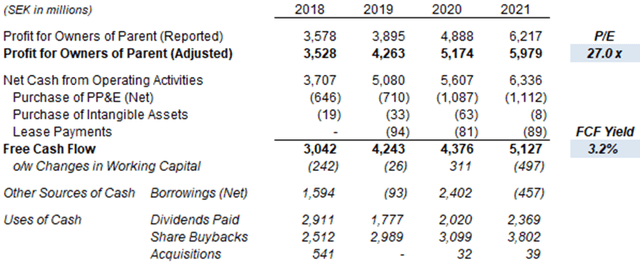

At SEK 106.15 (just above PM’s bid of SEK 106), with respect to 2021 financials, SWMA stock is trading at 27.0x P/E and a 3.2% Free Cash Flow Yield:

|

SWMA Net Income, Cashflow & Valuation (2018-21)  Source: SWMA company filings. |

The current dividend is SEK 1.86, representing a Dividend Yield of 1.8%.

We continue to believe PM’s bid materially undervalues Swedish Match.

Is Swedish Match A Buy? Conclusion

Q2 results showed Swedish Match’s standalone potential, and Elliott’s rumored stake is positive news.

However, Elliott’s involvement remains uncertain, and they are more likely to target a moderate sweetener than to help Swedish Match stay independent. SWMA stock is already trading slightly above PM’s offer, so upside may be limited from here.

At the same time, we see plenty of other attractive stocks in the market after the recent correction.

On balance, we see better risk/reward elsewhere, and reiterate our Hold rating on Swedish Match.

Be the first to comment