dem10/iStock via Getty Images

“Go to heaven for the climate and hell for the company.” – Benjamin Franklin Wade

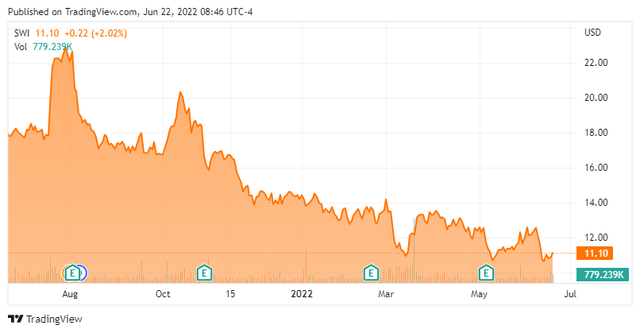

Today, we shine the spotlight on SolarWinds Corporation (NYSE:SWI) for the first time on The Busted IPO Forum. The stock has been buffeted by flat sales growth as well as overcoming a reputational breach. A full analysis follows below.

Company Overview:

SolarWinds Corporation is based out of Austin, TX. The company’s vision is to help their clients accelerate their business transformation efforts by providing simple, secure and powerful solutions designed for multi-cloud environments. The company garners revenues via licenses, maintenance and subscription sales. SolarWinds provides software that monitors computing infrastructures and is targeting being a leader in the hybrid cloud monitoring market. The company spun off its MSP business called N-able, Inc. (NABL) in the summer of 2021 to focus on its core IT management business. The stock currently trades near $11.00 a share and sports an approximate market capitalization of $1.75 billion.

First Quarter Results:

On May 5th, SolarWinds posted first quarter numbers. Non-GAAP earnings came in at 24 cents a share as sales rose just less than two percent from the same period a year ago to nearly $177 million. However, both top and bottom line numbers slightly beat expectations.

May Company Presentation

The growth engine of SolarWinds is provided via its subscription services which rose 37% from 1Q2021 to $38.7 million. Sales are shrinking from its primary revenue source (license and maintenance) which fell five percent to $138.1 million during the quarter. The company produced adjusted EBITDA in the quarter of $69 million and unlevered free cash flow $55 million.

May Company Presentation

Leadership provided the following guidance for the full fiscal 2022 year.

May Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community has gone decidedly negative on SolarWinds since its first quarter earnings report. Since then, four analyst firms including Morgan Stanley and RBC Capital have reissued Hold or Neutral ratings. Price targets proffered ranged from $13 to $15 after accommodating for downward price target revisions. JMP Securities maintained its Buy rating and $26 price target.

Approximately five percent of the outstanding shares are currently held short. There has been no insider activity in the shares in more than a year now. The company ended the first quarter with approximately $750 million in cash and marketable securities against just over $1.85 billion in long-term debt.

Verdict:

The company suffered a significant reputational setback when a major breach became known as the “SolarWinds hack“. This began in 2020 when hackers secretly broke into SolarWinds’ systems and added malicious code into the company’s software system. This code created a backdoor to customers’ information technology systems, which hackers then used to install even more malware that helped them spy on companies and organizations. This impacted hundreds of the company’s large customers, including Microsoft (MSFT) as well as numerous federal agencies.

In May, there was some speculation that M&A activity could increase in this space with SolarWinds being one possible target. The company is also nicely profitable. Other than that, there is not much to recommend SolarWinds at this time. Revenue growth is tepid, and there is quite a bit of leverage on the company’s balance sheet. The analyst community is not sanguine about the company’s current prospects, and no insiders have bought shares despite the stock’s recent decline.

May Company Presentation

Despite the notable hack, the company has managed to maintain its large customer base. However, significant sales growth probably won’t occur until the company gets a much higher percentage of overall sales from subscription services. Therefore, until sales growth returns, I have no investment recommendation around SolarWinds.

“Man is the only creature who refuses to be what he is.” – Albert Camus

Be the first to comment