Peach_iStock

In my previous Schrödinger (NASDAQ:SDGR) article, I provided some background information on the company and its growth prospects in the coming years. The company’s recent Q2 earnings report revealed significant growth and supports my views. I believe Schrodinger’s recent earnings reinforce the company’s growth prospects and should bolster investor confidence that the company will ultimately grow into its current valuation.

I intend to review the company’s Q2 earnings and will provide my thoughts on the quarter. Then, I will point out a few bullish highlights that support the growth narrative. In addition, I discuss some of SDGR’s downside risks and will classify the ticker. Finally, I discuss my plans for my SDGR position for the remainder of 2022.

Q2 Numbers

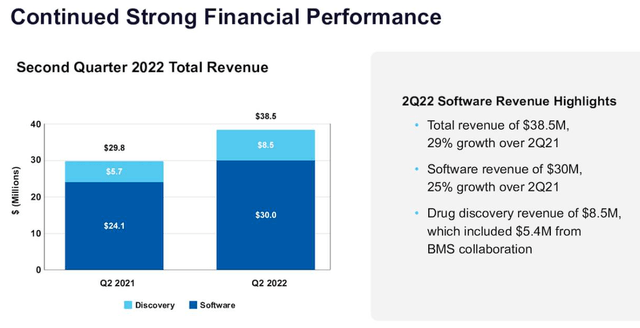

Schrödinger recently reported mixed Q2 earnings with a miss on EPS and a beat on revenue. Schrödinger was able to report another quarter of significant growth, with the company’s software revenue coming in at $30M, which is a 25% increase year-over-year. Schrödinger announced that its Drug Discovery revenue came in at $8.5M up from $5.7M in the Q2 of 2021. This growth was fueled by milestone payments from collaborative programs. The strong performance across both aspects of the company business led to total revenue of $38.5M for Q2, up 29% year-over-year. Schrödinger’s gross profit was $17.1M in Q2, up 43% over the Q2 of last year.

Schrödinger Q2 Performance (Schrödinger)

OpEx was up to $60.6M from $42.3M in Q2 of last year. The company attributes this to its “continued investment in R&D” and “infrastructure costs and the addition of staff and G&A functions.” Overall, Schrödinger recorded a net loss of $47.7M for the Q2 of 2022 compared to a loss of $35M for Q2 last year.

In terms of cash, Schrödinger finished Q2 with around $513M in cash, cash equivalents, marketable securities, and restricted cash balances. This is down from roughly $529M at the end of Q1.

My Thoughts on the Quarter

Schrödinger was able to report strong growth in its software revenue, Drug Discovery revenue, and gross profit when compared to Q2 of last year. However, the company’s OpEx outpaced the revenue growth and Schrödinger reported a larger net loss year-over-year.

Typically, I would be wary of a company that is not making any headway in the battle of “burn vs. earn”, but Schrödinger’s sources of revenue growth and OpEx demands are too complex to have a distinct viewpoint on the quarter. Indeed, I am not applauding the elevated net loss; however, I expected the amplified expenses associated with R&D. Considering the company is half technology and half biopharma, one must assume that the company will have periods of elevated expenditures to cover new R&D efforts and clinical trial costs.

Overall, I am happy with the commercial progress, and I am accepting the increased expenses in order to potentially unlock pending growth.

Growth Prospects

Schrödinger has assembled a differentiated company that allows it to “unlock pending growth” from its established business while simultaneously revolutionizing drug discovery. Schrödinger will rely upon its roughly $513M in cash to offer an adequate runway to fund its operations and wholly-owned programs for the anticipatable future. In addition, Schrödinger’s revenue growth from both its software business and drug discovery collaborations should diminish the cash burn while also outlining a path to profitability.

Schrödinger Business Updates (Schrödinger)

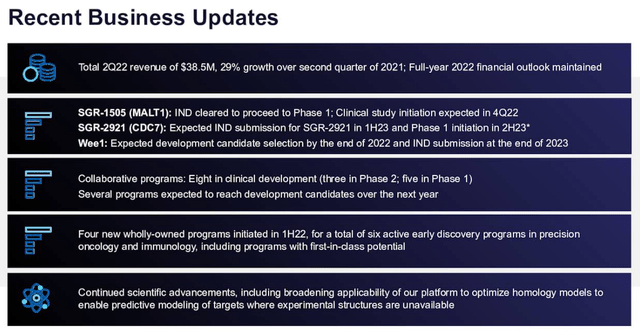

Schrödinger will employ some of its funds to invest in its platform by extending its utility with its induced fit docking methods (IFD-MD) to facilitate predictive modeling of targets where experimental assemblies have been unattainable.

Schrödinger Drug Discovery Platform Benefits (Schrödinger)

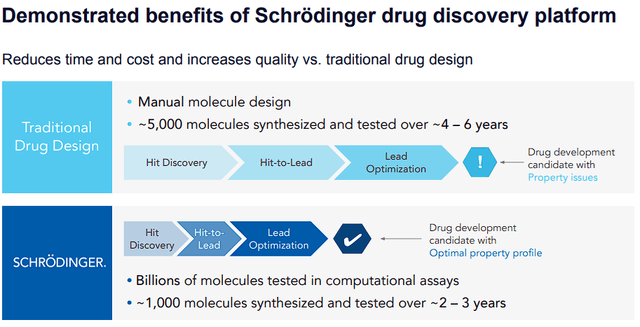

Schrödinger uses its platform and computation prowess in collaborative programs that are in the discovery, preclinical, and clinical stages of development. In fact, Schrödinger has already successfully applied IFD-MD to progress a collaborative Drug Discovery program for a target that was not structurally enabled.

The company’s collaborations have five programs that are in Phase I and three in Phase II clinical development. Moreover, Schrödinger expects several programs to enter development candidates at some point next year.

The collaborations can deliver significant revenue in the coming years as these programs hit milestones and potentially hit the market.

I believe the company’s biggest inflection will be a result of its wholly-owned pipeline assets. Schrödinger has already made progress with its first internal IND submission for MALT1 inhibitor SGR-1505 for a Phase I clinical trial in relapsed or refractory B-cell lymphoma. Schrödinger anticipates it will start SGR-1505’s Phase I trial in Q4 of this year.

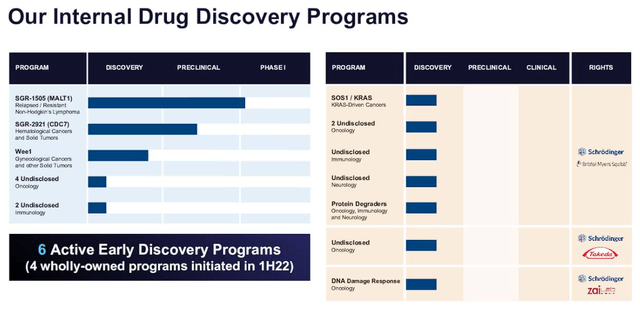

Schrödinger Internal Drug Pipeline (Schrödinger)

The company also has a Wee1 inhibitor that is projected to take aim at multiple solid tumor types with potential in lung, ovarian, and breast cancer. Schrödinger believes its computational platform has identified molecules that are “highly selective with balanced properties”, which “may help avoid some of the drug-drug interactions and off-target effects that have been observed with other Wee1 inhibitors.” Schrödinger anticipates choosing a Wee1 candidate by the end of this year and submitting for IND at the end of 2023.

The company’s CDC7 candidate, SGR-2921, has shown antitumor activity in preclinical work in combination with multiple approved agents for AML. Schrödinger anticipates submitting an IND in the first half of next year with the hopes it gets the go-ahead to initiate a Phase I study in the second half of the year.

In addition to the company’s wholly-owned assets, Schrödinger has several programs that are partnered with some of the biggest healthcare companies. Like the company’s collaboration pipeline, these partnered programs can deliver meaningful revenue in the coming years. In fact, the company’s deal with Bristol Myers Squib (BMY) is “eligible to receive up to $2.7B in milestone payments plus royalties.”

Altogether, Schrödinger’s progress across all aspects of its business has set the stage for the company to “unlock pending growth” in the coming years.

Tracking Growth

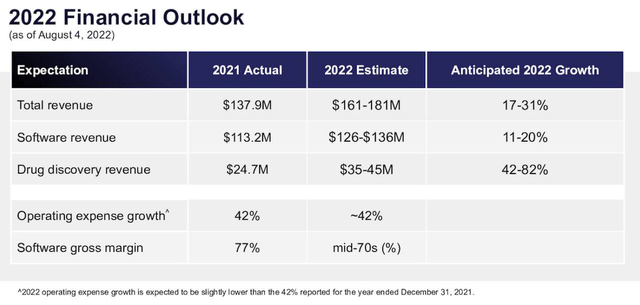

Schrödinger has a number of growth prospects that should deliver significant year-over-year growth in the coming years. In fact, the company has already reaffirmed its 2022 financial guidance, which includes its total annual revenue to be in the range of $161M to $181M, resulting in 17% to 31% growth over 2021.

Schrödinger 2022 Financial Outlook (Schrödinger )

Breaking it down, we can see that Schrödinger expects software revenue to range from $126M to $136M, up 11% to 20% year-over-year. Drug Discovery revenue is expected to be in the range of $35M to $45M, up 42% to 82% year-over-year.

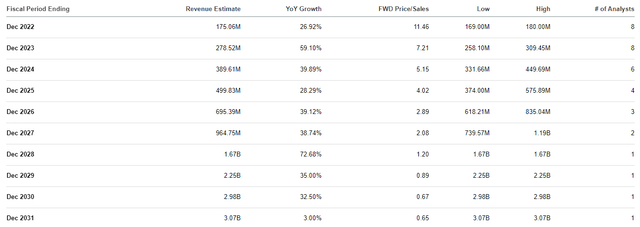

The Street projects Schrödinger to report strong double-digit growth over the remainder of the decade. In fact, the Street expects Schrödinger to go from ~$175M in 2022 to roughly $1.67B in 2028.

Schrödinger Revenue Estimates (Seeking Alpha)

Although this level of growth is not unheard of in biotech and pharma, it is surely not a common occurrence to see the Street expect a company to report 10x its revenue in 5-6 years.

Indeed, these numbers are just projections but one cannot deny that the company has a number of promising sources of revenue that could collectively fuel 10x growth in the coming years.

Downside Risks

In my previous article, I pointed out that Schrödinger has a few downside risks that investors should be aware of and those risks still exist. Primarily, the company is reporting a net loss. As I mentioned above, we have to expect the company to go through some cash as it moves pipeline programs into the clinic and expands its R&D efforts. Another element of concern is the expected volatility that occurs around data readouts and earnings. Any negative updates could have a drastic impact on the share price and might prevent a rebound until the company can address the issue.

Classifying SDGR

For me, Schrödinger has transformed the way drugs, therapeutics, and materials are being discovered. The company’s computational platform continues to generate first-in-class candidates that could transform the company’s long-term outlook. In the meantime, Schrödinger will continue to license the company’s platform to biopharma and materials companies as well as institutions, which will supply a steady source of income to offset its R&D efforts. Although downside risks still exist, I am going to remain focused on the company’s track record of achieving key objectives that have generated value and have positioned Schrödinger for long-term success.

As a result, SDGR will remain in Compounding Healthcare’s “Bio Boom” speculative portfolio. However, I am changing SDGR’s conviction level from 2 out of 5, to 3 out of 5.

My Plan For SDGR

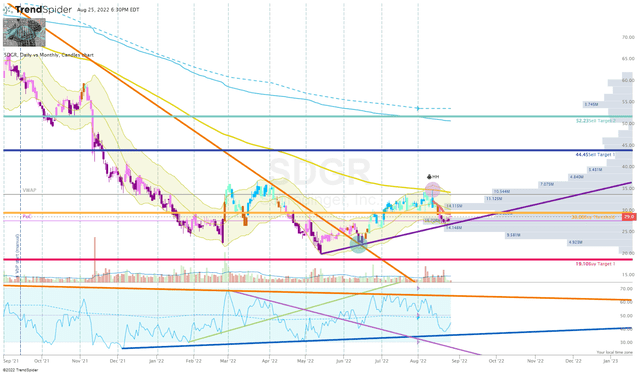

Regardless of my overwhelming bullish outlook for SDGR, I have remained disciplined with my position management and have stuck to my Buy Targets. I believe the market is going to continue to play around with SDGR thanks to it being a “Cathie Wood” stock and its premium valuation. Therefore, I am going to continue to utilize my current Buy and Sell Targets for the foreseeable future.

SDGR Daily Chart (TrendSpider)

However, I am considering adjusting my targets in Q1 of 2023 to account for the projected growth. In addition, I am planning on increasing my sizing and making SDGR a larger component in the Compounding Healthcare “Bio Boom” Portfolio.

However, I will not hesitate to book profits in order to achieve my goal of converting my SDGR position into a “house money” state.

Long-term, I am still planning on maintaining an SDGR position for at least five years in anticipation the company will continue to grow into its valuation and will be within eyesight of getting several wholly-owned assets approved.

Be the first to comment