FG Trade/E+ via Getty Images

Schnitzer Steel Industries, Inc. (NYSE: NASDAQ:SCHN) is an American steel manufacturer based in Portland, Oregon. Though the company has grown to become a multibillion-dollar manufacturing giant, it started from humble beginnings. In 1906 Russian immigrant Sam Schnitzer started the company as a one-person scrap metal recycling company. Since that time, the company has grown massively thanks to a series of acquisitions. In 2003 the company acquired Pick-N-Pull. In 2005 GreenLeaf Auto-Recyclers was acquired, along with Regional Recycling. Schnitzer Steel Industries then sold GreenLeaf Auto-Recyclers in 2009. In 2006, the company purchased Advanced Recycling. While the company has done well from a growth perspective, it has not operated without controversy. In 2007, the SEC charged then CEO Robert Phillip for violating the Foreign Corrupt Practices Act. The charge came after evidence was uncovered about illicit dealings with Chinese steel mills.

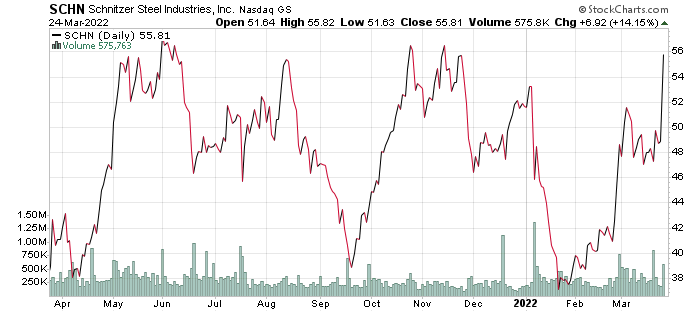

stockcharts.com

In this article, I will show that despite the current preference by consumers for imported steel, the domestic steel market is in line for a significant boost. This makes Schnitzer Steel Industries a smart investment. With the conflict in Ukraine sending oil prices soaring, the transit costs for imported steel will increase, forcing companies to charge more. As price is the main issue keeping consumers from purchasing domestically, this will level the scales. Additionally, with the passage of the $1 trillion infrastructure bill signed into law, the need for steel for building projects will see a boost. All of those factors favor growth for companies like Schnitzer Steel Industries. For these reasons, investors looking to expand their portfolio to capitalize on industrial growth should look at Schnitzer Steel Industries.

Iron and Steel Market Overview

Price increases are a significant reason why the domestic market is not growing along with demand. In 2021, US companies’ domestic steel prices reached a record high. This is due in large part to the costs associated with producing it. Because the processes are cheaper in other countries, many consumers opt to purchase or order imported steel from other countries. This creates a sort of “catch 22” in the industry. The price keeps consumers from creating demand, and the lack of demand in combination with the cost of production keeps the price high.

There is a silver lining, however, and that comes in the form of the Russian invasion of Ukraine. While war is not in any way, shape, or form something good, the rising cost of fuel does benefit the iron and steel industry. This is because it will make shipping on imports more expensive. This will level out the cost in comparison to domestic steel and could lead to an influx of sales for American-based companies. In combination with the fact that North America has increased its steel production rates and that American steel mills know they need to incentivize their customers to win them back, I see a positive spike in the near future for companies like Schnitzer Steel Industries.

Future Opportunities

One of the biggest opportunities for Schnitzer Steel Industries comes in the political realm. The passage of the Biden administration’s $1 trillion infrastructure bill bodes well for the construction and steel and iron industries in general. A large portion of that money is earmarked for road and bridge repair, much of which will require steel. With the increased shipping costs associated with the war in Ukraine, the timing of this provides optimal opportunity for US Steel companies to step up.

The Global steel market is expected to see some growth in the coming years as well, which boosts optimism in the industry. Over the next ten years, the market is expected to grow at a slow and steady CAGR of 3.9%. While this is not a substantial growth rate, one of the main drivers in the steel market is infrastructure, which means that US steel markets will likely exceed that global CAGR projection due to the Biden administration’s bill. In a market that is usually devoid of growth and optimism, there could be some sneaky short-term gain in the immediate future for domestic steel manufacturers.

Financial Overview

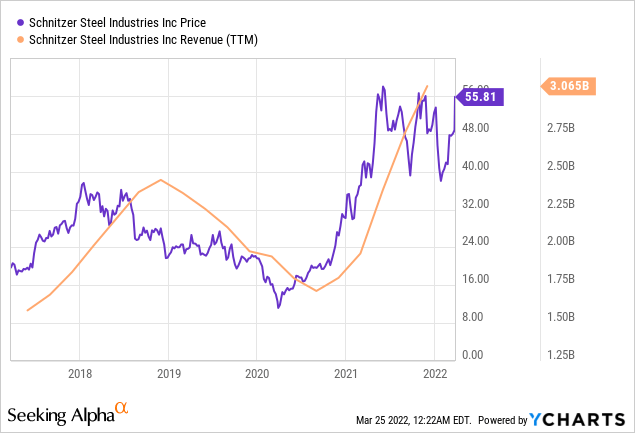

ycharts.com

Revenues have been relatively stable for Schnitzer Steel Industries over the last four years. Starting in 2018, the company posted $2.3 billion in revenue. In 2019 that number decreased slightly to $2.1 billion. The 2020 Covid-19 pandemic wreaked havoc on most US markets, and Schnitzer Steel Industries was no exception, seeing revenues drop to a four-year low of $1.7 billion. 2021 however, was a year of redemption, seeing the company post a record high in revenue, totaling $2.75 billion for the fiscal year ending on August 31st.

One downside of this trend is the cost of revenue, which has consistently risen, causing profit margins to lag behind revenues. In 2018 the company had revenue costs of $2 billion, which dropped their profits to just $354 million. 2019 saw another disappointing performance, with a COR of $1.8 billion, dropping profits to $274 million. 2020 was a complete letdown, with a COR of $1.5 billion and profits totaling a lowly $208 million. 2021 was slightly more favorable with a COR of $2.3 billion and over $450 million in profits. While the profit numbers are not as healthy as the revenues would suggest, the fact that the company has been consistently profitable is positive.

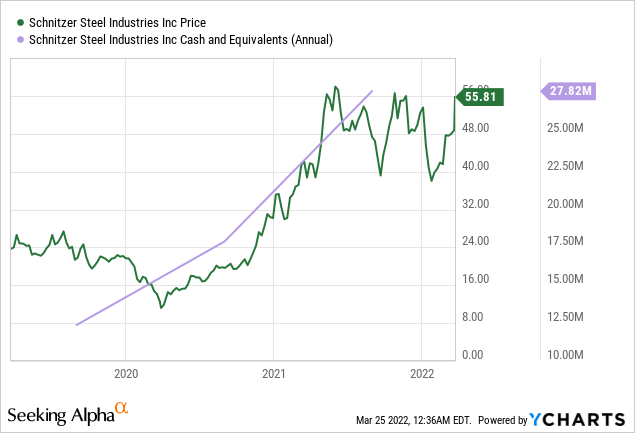

ycharts.com

The company has been able to increase cash on hand over the last four years steadily. Although this is a positive trend, the totals are not high enough to make a significant impact. In 2018 the company held $4.7 million in cash. In 2019 that number jumped to just over $12 million. Despite the pandemic in 2020, the company’s cash rose again to $17.8 million. Finally, in 2021, the company closed out the fiscal year ending on August 31st with $27.8 million. While the numbers aren’t significant as of yet, if the company is able to continue to raise its cash totals, it will provide them with a great deal of stability moving forward.

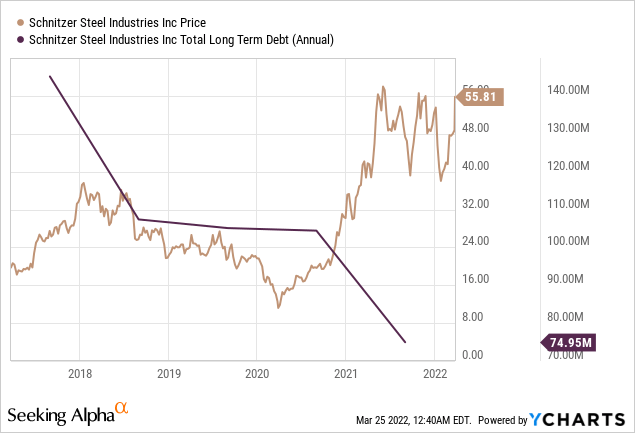

Schnitzer Steel Industries has also done a great job paying off its long-term debts. In 2018 the company held $106 million in long-term debt. By 2019 the company had already worked on paying that down, getting the number to $103 million. A pandemic hit the company in 2020, but it still managed to repay a small portion of its debts, bringing the total down to $102 million. In 2021 the company made its most extensive effort in debt repaying, dropping its long-term debt total down just $75 million.

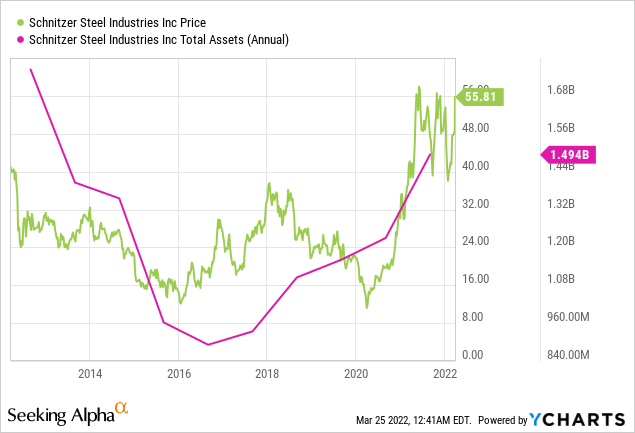

ycharts.com

One thing that has benefited the company in today’s market was its aggressive series of acquisitions in the early 2000s. Because of that, the company owns a significant amount of assets today, allowing them to expand operations and gain some extra market stability. This has helped them withstand the lack of consumers and the price spike that has led to the downfall of many domestic competitors. In 2018 the company held $1.1 billion in total assets. In 2021 that number rose to just under $1.5 billion, which is a very positive indicator for the company.

ycharts.com

Conclusion

Schnitzer Steel Industries, Inc. is one of those rare companies in a struggling market worth investment consideration. As it stands right now, the company has just posted record highs in terms of revenues and profits. It has made significant efforts to pay down its debt, holds an impressive amount of total assets, and is collecting a considerable amount of cash in hand. This gives the company a certain amount of stability and flexibility rare in their market. There is also a sneaky amount of optimism surrounding the future. The Biden administration’s infrastructure bill offers opportunity, and the rising cost of fuel attributed to the Russian invasion of Ukraine has raised the cost of imported steel. This shifted the needle of favorability back towards the domestic market. If Schnitzer Steel Industries is able to capitalize on that and incentivize their customers to come back, I think there will be a short-term gain to be had from investment. For these reasons, I believe Schnitzer Steel is a buy with a bullish future.

Be the first to comment