ThitareeSarmkasat/iStock via Getty Images

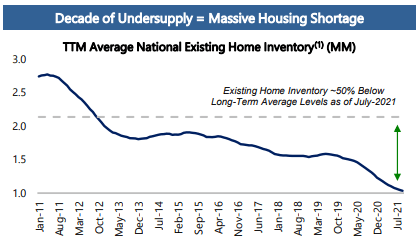

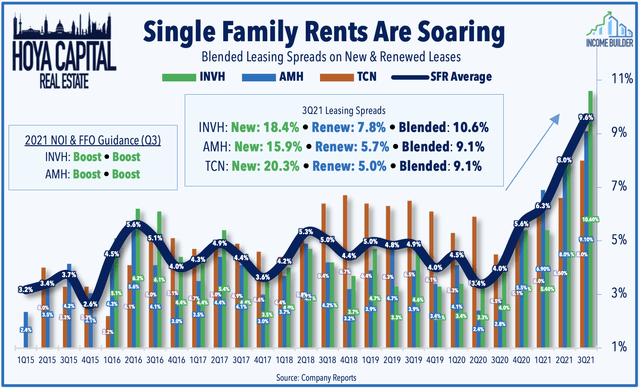

Amid the ongoing housing shortage, rents for all types of housing are skyrocketing.

American Homes 4 Rent investor presentation

Supply continues to be constrained by rising labor and materials costs, impact fees, scarcity of land, and regulatory hurdles. As a result, single-family housing prices have outstripped inflation. The housing shortage is here to stay for at least the short-to-medium term.

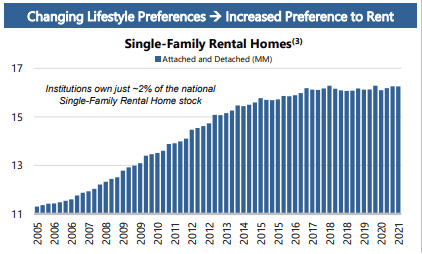

A large percentage of Millennials prefer to rent rather than own. Together, these two tailwinds are creating a major boost for SFRs (Single Family Rental REITs).

American Homes 4 Rent investor presentation

New leasing spreads for SFRs leapt by a record-high 18.2% in Q3 2021. Invitation Homes Inc. (NYSE:INVH) led the way with 18.4% increases in new lease rates, and 7.8% increases on renewals, for a blended rate of 10.6%.

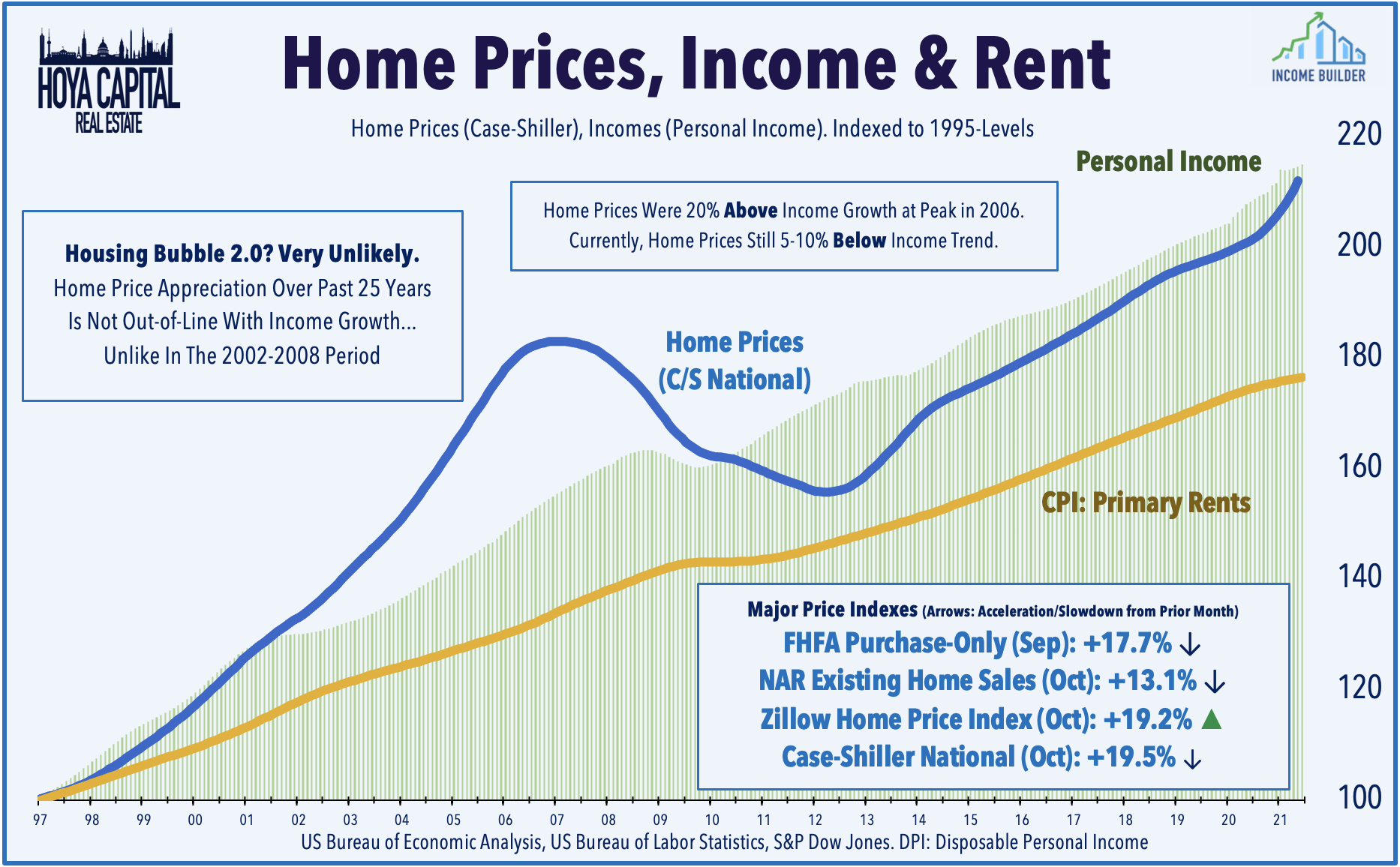

Rental rates are rising more slowly than house purchase prices, and also more slowly than personal incomes, making this a particularly good time to rent rather than buy. This holds true, despite the fact that rents are rising at the fastest pace on record, and all 60 of the largest markets saw a sequential acceleration in rents through September 2021.

Hoya Capital

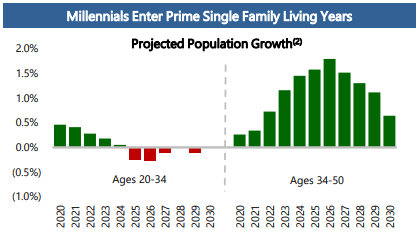

Millennials are coming of age and forming households of their own. In 2021, household formations rose at the fastest pace since the 1980s. The 34-50 age cohort (the age group most likely to move out of apartments into homes) is peaking in size over the next few years.

American Homes 4 Rent investor presentation Hoya Capital

SFR REITs have shown notable improvement in operating efficiencies over the past two years. Same-home operating expenses rose just 2.7% in the quarter compared to 7.4% revenue growth, resulting in record-high NOI growth of more than 10% in Q3.

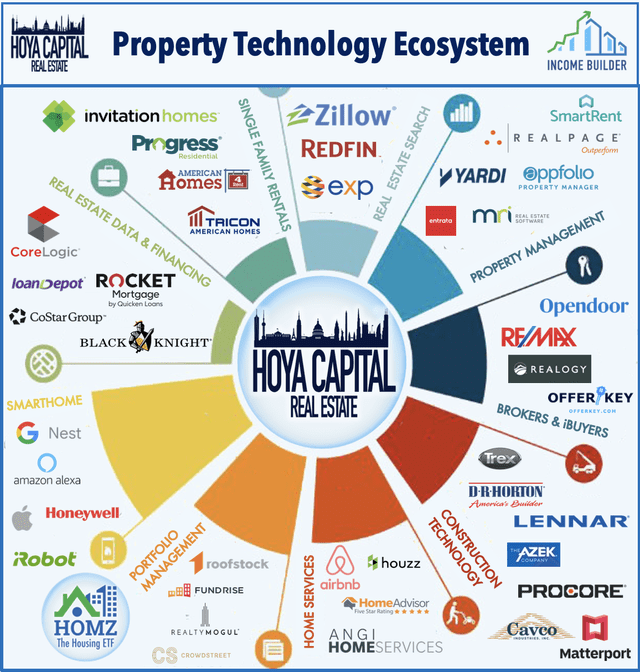

Due to stiff competition for new inventory, SFR REITs have effectively become strategic homebuilders, partnering with existing builders to develop new stock, and this cannot help but ease the supply shortage eventually. SFRs have also begun accessing the “iBuying” industry, to source acquisitions through companies such as Offerpad (OPAD) and leverage data from companies like Redfin (RDFN). They are also snapping up some of the units made available by Zillow (Z) when it closed its house-flipping operation last year.

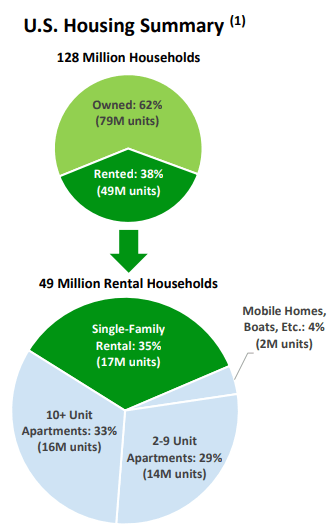

Still, all SFRs combined own less than 2% of the U.S. rental housing inventory. There are some 128 million households in the nation. Of these, 79 million are owned, and 49 million (38%) are rented. Of those, only 17 million are single-family homes, with the rest divided between apartments (30 million units) and manufactured housing, including mobile homes and boats (2 million units). The growth runway is enormous.

Invitation Homes investor presentation

For all these reasons and more, I recently named SFRs as one of 7 REIT sectors likely to outperform in 2022.

Meet the company

Formed in 2012 and headquartered in Dallas, Invitation Homes is the largest SFR, with an inventory of over 81,000 homes, far surpassing second-largest American Homes 4 Rent (AMH), which has 56,000. In each of the past 5 years, INVH has led the SFR sector in same-site NOI growth.

INVH acquires inventory in 6 different ways:

- Traditional broker/MLS listings

- County and municipal auctions

- Partnerships with builders

- iBuyers

- Aggregation of investor portfolios of 5 or more homes

- Sale-leaseback program for homeowners who want to transition to renting

Rather than compete with homebuilders to create new supply, INVH announced a partnership with PulteGroup (PHM) in July to buy 7,500 new built-to-rent homes, 1700 of which should come online in 2022.

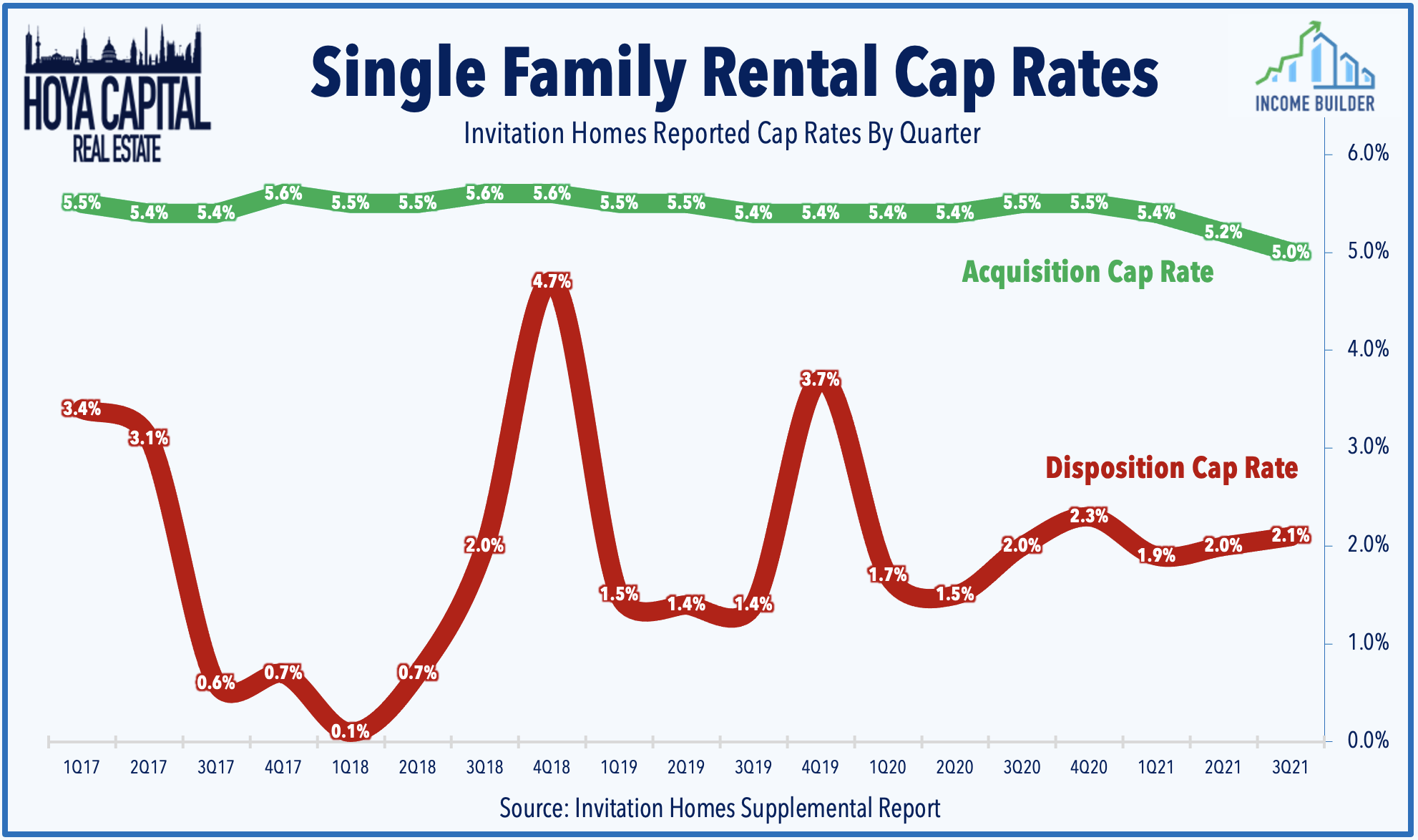

INVH typically acquires new inventory at cap rates in the mid-5s. The company acquired 4,800 homes last year (roughly double their original guidance), at an average cost of over $400,000 and an acquisition cap rate of just over 5%. These purchases were accretive to earnings, as well as to NAV (net asset value). Guidance for 2022 is for a slight increase in acquisitions, somewhere near $2 billion.

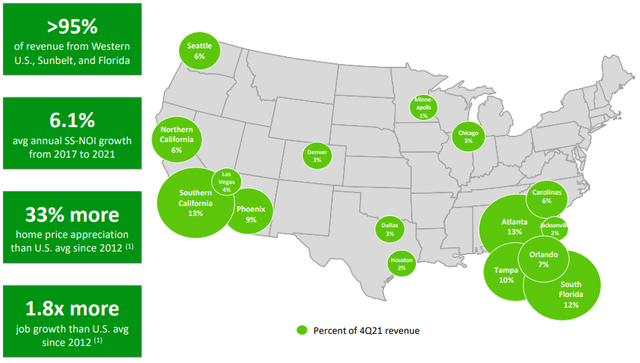

Hoya Capital

Although the channels are many, the acquisitions are highly targeted by location, focusing on in-fill areas with high barriers to home ownership in markets with outsized long-term growth drivers. Approximately 95% of INVH houses are located in the Sunbelt and the Western U.S., in markets that enjoy 33% better home price appreciation and 80% more job growth than the national average.

Invitation Homes investor presentation

These are not just houses, but “smart homes,” outfitted with video doorbells, smart locks, and smart thermostats, coordinated by a mobile maintenance app, all receiving HVAC filters automatically every 3 months. Tenants who want more smart home features can upgrade for a fee. The company also sees significant potential for growth in ancillary income from things like pet programs, pest control, landscaping, insurance, and energy optimization.

According to COO Charles Young:

About one-third of tenants chose [INVH] because they wanted a family friendly, convenience oriented, pet friendly home. Nearly half of new residents work from home at least two days a week and 75% plan to continue to work from home after their office reopens. Three- quarters of new residents feel safer living in a single family home than an apartment because of the additional space and privacy.

The company strives for density in their chosen markets. The fewest houses they have in a single city is 1,800, and the average is around 5,000. This helps drive efficiency of service and monetizable familiarity with the local markets. Staff includes 20 in-house investment professionals and 800 operations personnel, organized into 33 pods. Each house gets proactive service visits at least twice a year. Young said this on the Q4 earnings call:

We believe we offer the best level of resident service of any single family rental operator, and this is reflected in our operating results.

INVH currently enjoys slightly over 98% occupancy, and reported 16% annual growth in core FFO in 2022. On the Q4 earnings call in February, the company reported same-home NOI growth of 12.6% in Q4 and 9.4% for the full year. Average monthly rental rate grew by 7.1%.

New lease spreads came in at 17.3% for Q4, with renewal spreads at 9%, for a blended rent growth rate of 11.1%, up 50 basis points over Q3, and 630 basis points YoY (year-over-year). These outstanding spreads carried over into 2022, with new lease spreads coming in at 14.5%, renewals at 9.75%, and blended spreads at 11.0% in January and February combined.

Core FFO came in at $1.49 per share in 2021. The company is guiding for $1.62-$1.70 in 2022. At the midpoint, $1.66, that would be a healthy jump of 11.4%. This is an exact match to the Bloomberg analyst consensus forecast.

Growth metrics

Invitation Homes is a bona fide FROG (Fast Rate of Growth REIT), with the strongest track record in the SFR (Single Family Rentals) sector. In December, I named it to my watchlist of 16 REITs likely to outperform this year. The growth metrics below are stellar.

| Metric | 2018 | 2019 | 2020 | 2021 | 3-yr CAGR |

| FFO (millions) | $502 | $594 | $694 | $789 | — |

| FFO Growth % | — | 18.3 | 16.8 | 13.7 | 16.3 |

| TCFO (millions) | $561 | $662 | $697 | $908 | — |

| TCFO Growth % | — | 11.1 | 5.3 | 30.3 | 17.4 |

| Market Cap (billions) | $10.45 | $16.23 | $16.64 | $27.05 | — |

| Market Cap Growth % | — | 55.3 | 2.5 | 62.6% | 37.3 |

Source: TD Ameritrade, CompaniesMarketCap.com, and author’s calculations. (TCFO = total cash from operations)

| Metric | 2019 | 2020 | 2021 | 2022 | 3-yr CAGR |

| Share Price March 22 | $ 24.02 | $17.19 | $31.09 | $40.39 | — |

| Share Price Gain % | — | (-28.9) | 80.9 | 29.9 | 18.91 |

Source: MarketWatch and author’s calculations

Like most REITs, INVH got hammered when the pandemic arrived on American shores in 2020, but with FFO and TCFO growing rather than shrinking, share price came roaring back in 2021 and 2022. Investors who bought shares March 22, 2019 have seen 18.9% share price Gain, for a total annual return of around 21%.

Balance sheet metrics

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

| INVH | 2.12 | 23% | 6.4 | BBB- |

Source: Hoya Capital Income Builder and TD Ameritrade

Although the Debt/EBITDA is ordinary at 6.4, the company has a FROG-worthy Liquidity Ratio of 2.12, a low 23% debt ratio, and an investment-grade balance sheet. The company says it is committed to bringing Debt/EBITDA down under 6.0, and has made considerable progress, having started with a ratio of 10.7 shortly after its 2017 IPO.

INVH is sitting on $1.6 billion in liquidity, with no debts reaching final maturity until 2025. The company recently closed two public bond offerings totaling $1.65 billion, and used the proceeds to pay down higher-interest secured debt.

Dividend metrics

SFRs are notoriously low-yielding investments, but INVH makes up for that with a blistering 3-year dividend growth rate of 19.2%, resulting in an above-average Dividend Score of 3.69%. (Dividend score projects the Yield 3 years from now, assuming the dividend growth rate remains the same.)

| Company | Div. Yield | Div. Growth % | Div. Score | Payout Ratio | Div. Safety |

| INVH | 2.18 | 19.2 | 3.69 | 50% | A |

Source: Hoya Capital Income Builder, Seeking Alpha Premium, and author’s calculations

The payout ratio is an ultra-safe 50%. If anything, the dividend is too safe.

Valuation metrics

| Company | Div. Yield | Div. Growth | Div. Score | Price/FFO | Premium to NAV |

| INVH | 2.18 | 19.2 | 3.69 | 27.1 | -3.8% |

Source: Hoya Capital Income Builder and author’s calculations

At first blush, the price on INVH seems high at 27.1x FFO. However, it trades at a discount to NAV, so the price is fair for what you are getting. Whether it is worth the slight premium in multiple depends entirely on how you feel about the company’s growth proposition. With a Yield down around 2%, most of the investor’s return will be in share price appreciation, although if you hold it for 3-5 years, the dividend will probably prove to be average or better also.

What could go wrong?

With construction costs and home prices going up, along with interest rates, it may prove more and more difficult for SFRs to acquire new inventory at attractive cap rates. Pressures on working people caused by rising rents may in turn create political pressure for tenant relief, eviction moratoriums, etc. Local homeowners associations may also become more restrictive, to counteract increasing numbers of rental properties in their neighborhoods. Labor issues could also become problematic, with a staff of over 800 people.

A reader of my recent article on American Homes 4 Rent expressed a concern that the SFR business model is predatory. While I wouldn’t go that far, I am sympathetic to the concern that corporations buying up all the most attractively-located homes and jacking up the rent hurts upward mobility for young families. Upon investigation, however, there are two factors that argue against such a concern.

First, the average tenant earns about 5 times the average rent on an INVH home, so there is plenty of room for capital formation for the household. Second, investors that own 100 or more houses control only 2% of the SFR homes in the country.

In the event of a civil war, real estate of all kinds will suffer, and homes could be destroyed on a large scale. Different people have different opinions about this, and only time will tell who is right. I place the likelihood at about 50%, within the next 3-4 years. You may not see it that way, but it is still a risk a wise investor would not ignore.

Investor’s bottom line

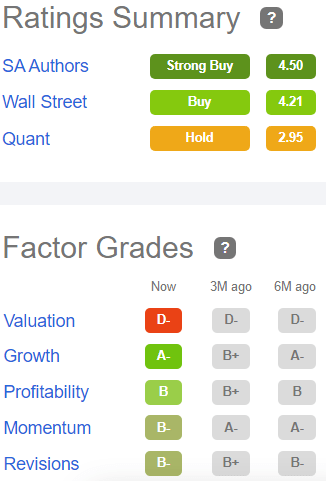

The Seeking Alpha Quant ratings rate INVH a Hold, nonplussed by its valuation metrics, but the Seeking Alpha authors and Wall Street analysts rate the company a Buy.

Seeking Alpha Premium

R. Paul Drake adds this take:

Compounded returns near 15% for more than 20 years have been achieved by only a few REIT stocks. INVH has a real potential to become one of the next group.

The Street also ranks INVH a Buy. Morgan Stanley and KeyBanc rate it Overweight. Zacks rates it a Hold.

As for me, I consider it one of the 12 best REITs you can invest in right now.

Be the first to comment