AnVr

Main Thesis & Background

The purpose of this article is to evaluate the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) as an investment option at its current market price. The fund’s stated goal is “to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Dividend 100 Index”.

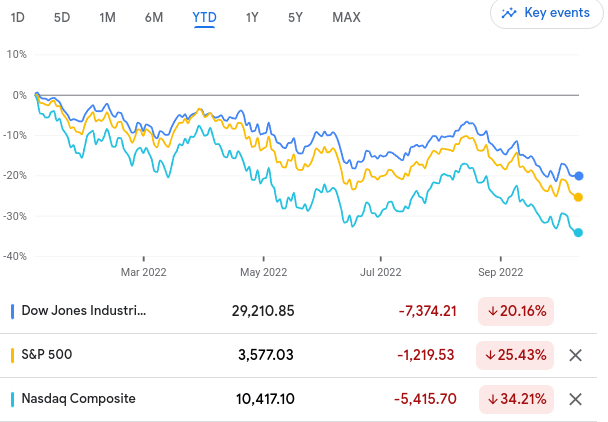

This is an ETF I have owned for a long time, and continued to recommend adding to in 2022. Unfortunately, SCHD has been caught up in the sharp equity sell-off this year, with performance consistently negative for the year:

YTD Performance (Seeking Alpha)

While there have been some moments of glory for SCHD this calendar year, the trend is clearly a negative one. This has certainly been unnerving for investors, although I should point out, this compares favorably to the larger drop for the S&P 500 – a common benchmark.

Rather than view this weakness as a reason to sell or avoid the fund, I see it as a chance to build on my long-term position. To be fair, the market sentiment is mostly negative right now, so this is not for the risk averse investor. But for those who like a bit of a contrarian play and who are able to see some of the positives in this economy, SCHD could be the right fit. I am one such person, and I will cover the reasons behind my bullish outlook below.

Why Equities Right Now?

To begin, I want to discuss why anyone might want to buy any equities right now. Clearly, this has been a difficult year and there are plenty of negative headlines to be concerned about. There is an upcoming energy crisis in the developed world this winter, the Russia-Ukraine conflict appears to be escalating, the Fed is pushing ahead with more rate hikes, and inflation is continuing to run red hot. It begs the question – why buy now?

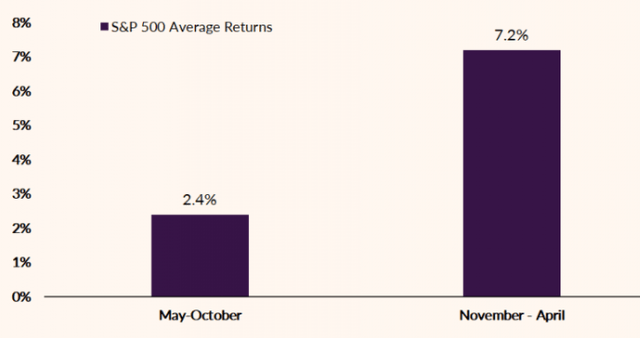

To answer this, let us consider that many of those problems have been impacting the markets quite substantially already. The S&P 500 and the NASDAQ are already deep in bear market territory, with the DOW also hitting a bear market for the calendar year. By comparison, this shows dividend funds like SCHD have been a modest hedge:

YTD Performance (Google Finance)

So how can I find anything positive in this backdrop? For one, I see massive drops in the broader equity indices as buy opportunities. Stocks do not go up or down in a straight line forever. When I see bear markets, I think buy opportunity. Two, despite all the headwinds facing us, we should remember we are entering a strong time period for stocks. Over time, the S&P 500 has averaged a 7% gain from November – April:

Historical Returns (S&P 500) (Ally Bank)

This in no way suggests the market won’t drop during this upcoming time-frame. But I take some comfort in the fact that, over time, this tends to be a cycle where stocks perform well. Given how far they have already dropped, it stands to reason we could be due for a bit of a rebound. With history supporting this potential, I think using mid or late October as a buying opportunity ahead of this cycle makes sense.

Why Choose SCHD? Income Story

Now let us dig in to why I think SCHD is a reasonable way to play a buy thesis. This is not the “S&P 500” and there are plenty of ways to play a broad equity rebound. So, why this ETF?

A primary reason has to do with the income stream. Given the dual-dynamic of a declining share price and a rising distribution rate, SCHD’s yield has pushed higher than 3.5%. That is a pretty attractive level, even with inflation where it is.

Expanding on that point, I am encouraged on the year-over-year dividend growth. Since my last review in May, SCHD has paid out a June and September distribution. Both of these payouts combine to produce a very strong dividend growth metric (annualized):

| June & September Distributions 2021 | June & September Distributions 2022 | YOY Growth |

| $1.13/share | $1.34/share | 19% |

Source: Charles Schwab

As a “dividend seeker”, this exceeds my expectations. There is not a whole lot else to say except that I view this very positively, and it supports my continued desire to build on my SCHD position.

Consumer Exposure Is A Positive In My View

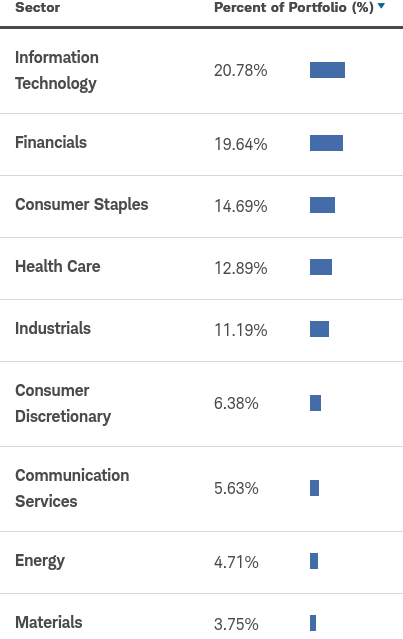

My next topic focuses on the fund’s holdings. SCHD is heavily weighted to three areas in particular – Info Tech, Financials, and Consumer sectors (both Staples and Discretionary combine to make up over one-fifth of total assets):

SCHD’s Sector Weightings (Charles Schwab)

It is no secret that Tech has been a downer this year, so it may seem odd to recommend a fund that has Tech as its top sector by weighting. However, I would note that some of the biggest decliners have been the low profit / high growth Tech themes that tend to get hammered in rising rate environments. SCHD does not hold that type of stock, given its dividend focus. This partially explains that this fund is down less than half what the Tech-heavy NASDAQ index is down in 2022.

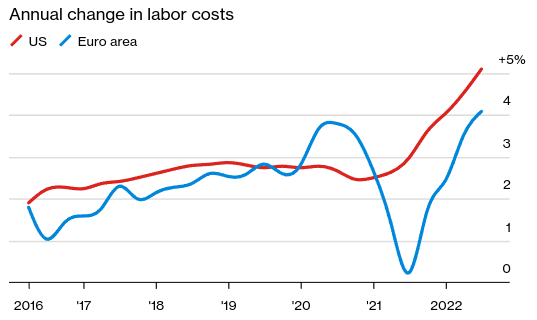

Additionally, I view the Consumer sectors as areas I want exposure to. This may sound counter-intuitive, given the declines we have seen in consumer sentiment and the increase in prices. But we have to remember that rising prices has not happened in isolation. Wages have also been rising in America (and in the Euro-zone). While perhaps not rising as fast as inflation, they have been rising enough to make a marked impact on labor costs for corporations:

Rising Labor Costs (World Bank)

While this is not necessarily a “good” thing for investors in these companies. All other things being equal, rising labor costs pressure profit margins. That is not a positive.

But for those looking at consumer-focused companies, there is an opportunity here. As wages rise, that supports consumer spending. That means that while rising wages may be a headwind for the average S&P 500 company, it could be a tailwind for companies that sell direct to U.S. consumers.

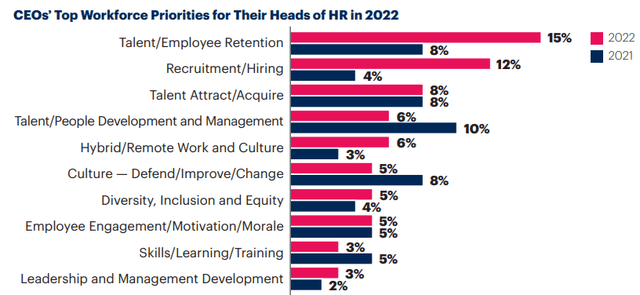

Importantly, this is a trend that should continue in to 2023. Based on a recent survey conducted by Gartner, corporate leaders see employee retention as one of their top priorities right now. This is up substantially from 2021:

Business Executives Top Concerns (Gartner)

The conclusion I draw here is that wages are likely set to keep on rising next year for American workers. This will benefit Consumer-focused companies, and SCHD by extension as well.

Tech/Growth Heavy S&P 500 Still Under Pressure By Inflation

To emphasize why I like SCHD’s holdings, I will focus on what it does not hold, which are those Tech/Growth names I alluded to above. This is critical to SCHD’s out-performance, and it is my opinion this theme will continue in Q4.

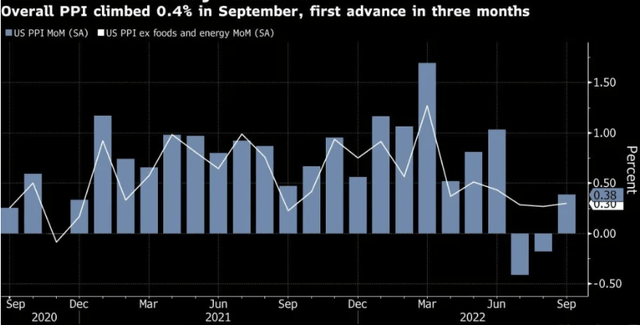

To understand why, let us be reminded that the indices that measure inflation show that we are nowhere near “out of the woods” with respect to inflation. The producer price index rose in September, indicating the Fed’s recent rate hikes have not been having the intended effects (yet):

The takeaway here is that inflationary pressures will take time to moderate. While they do, the Fed will continue on its rate-hike path. This means the outlook for Tech/Growth remains clouded, and I view SCHD’s holdings more favorably by contrast.

Remember That Dividends Are An Important Part Of Total Return

My final topic touches on the significance of dividends as a whole. This is key for why I like SCHD, as well as the other dividend ETFs and individual stocks that give me consistent income.

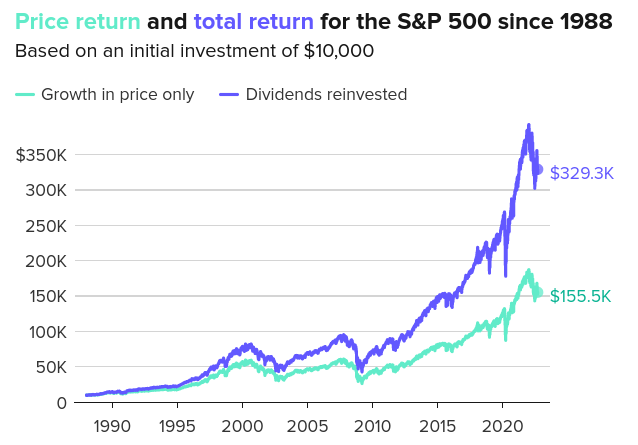

Specifically, reinvesting dividends over time helps investors in a number of ways. It can be beneficial to reinvest dividends to space out contributions to the market. It also amplifies total returns. While SCHD does not track the S&P 500, we can use it as an example of how dividends improve an investor’s long-term performance. Below is an example of the long-term return without dividends reinvested compared to the long-term return with reinvestment:

Total Return Comparison (CNBC)

This is a simple, but important, illustration of how useful dividends can be. In this vein, I remain fully committed to increasing my position in SCHD over time, including in the immediate future.

Bottom-line

SCHD has been a strong performance for me, but not in 2022! While out-performance is always helpful, it doesn’t provide too much comfort when the fund is still down in the 14-15% range once dividends are accounted for. Yet, rather than flee this option, I view it as an opportune time to add. Markets will recover eventually, and we happen to be approaching a seasonal cycle where equities tend to perform well. SCHD has the right type of Tech and Consumer exposure that I want in Q4 and early 2023, justifying building on to my position here. Therefore, I reiterate my “buy” rating on SCHD ETF, and suggest readers give this idea some consideration at this time.

Be the first to comment