DKosig/E+ via Getty Images

Investment Thesis: Should SBA Communications show growth in total assets to long-term debt, then I take the view that the company could see further upside.

In a previous article back in March, I made the argument that SBA Communications (NASDAQ:SBAC) could see upside going forward, as the continued rollout of 5G is expected to increase wireless infrastructure demand going forward.

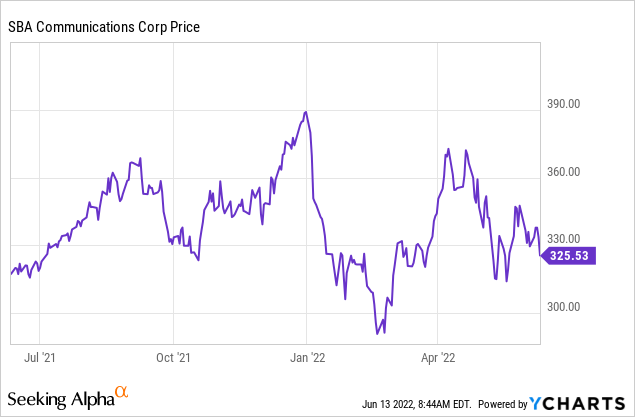

Over the past year, we have seen the stock trade in a more or less stationary manner, with some volatility:

ycharts.com

The purpose of this article is to take a more detailed look at whether SBA Communications could see upside on this basis – particularly in light of the most recent earnings results.

Customer Demand

One aspect of potential growth that I did not consider in detail in my last article was appetite from the company’s three biggest customers to further expand their wireless infrastructure, namely Verizon (VZ), AT&T (T), and T-Mobile (TMUS).

While the prevalence of 5G is growing – should major telecommunications companies see an increase in churn (or the number of customers cancelling services with the company), then this would make such companies more reluctant to further increase capital expenditure if doing so would not be expected to translate into sufficient revenue gains.

From this standpoint, I decided to compare postpaid churn rates over time for Verizon, AT&T, and T-Mobile to get a sense of whether attrition has increased or decreased.

| Postpaid Churn Rates | Verizon | AT&T | T-Mobile |

| 2017 | 1.01% | 1.17% | 1.18% |

| 2021 | 1.10% | 0.94% | 0.98% |

Source: Figures sourced from 2017 and 2021 Annual Reports for Verizon, AT&T, and T-Mobile.

We can see that churn rates for AT&T and T-Mobile have decreased from 2017 to 2021, while the churn rate has risen for Verizon.

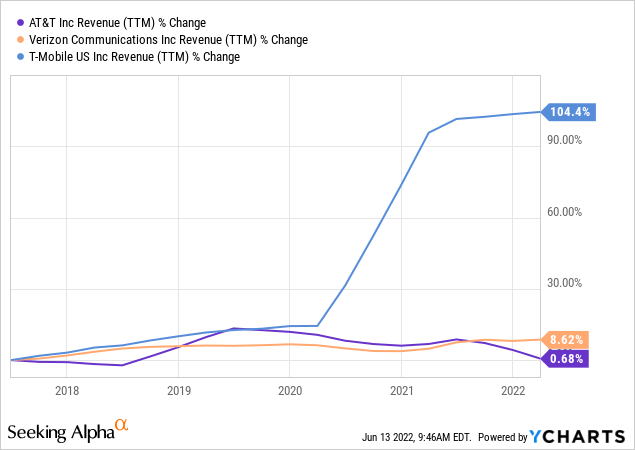

Moreover, we can see that while T-Mobile US has seen strong revenue growth over the past five years, that of AT&T and Verizon has been more modest:

ycharts.com

While this is a very brief look at the performance of these companies – growth in churn rates or lagging revenue could in turn be a concern for SBA Communications.

Given the possibility that revenue growth across the sector might continue to be modest over the next five years – then this might make telecommunications companies reluctant to further expand their wireless infrastructure – as it might be perceived that the potential revenue gain is not worth the additional expense.

Performance

When looking at balance sheet data over the longer-term, we can see that the total assets to long-term debt ratio has been declining from a high of nearly 100% in 2019 to just over 79% in 2021:

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Total assets | 7,320,205 | 7,213,707 | 9,759,941 | 9,158,018 | 9,801,699 |

| Long-term debt, net | 9,290,686 | 8,996,825 | 9,812,335 | 11,071,796 | 12,278,694 |

| Total assets to long-term debt | 78.79% | 80.18% | 99.47% | 82.71% | 79.83% |

Source: Total assets and long-term debt figures sourced from SBA Communications Annual Reports (2017 to 2021). Total assets to long-term debt ratio calculated by author.

In this regard, we can see that while the company’s total assets have been growing – this has also been accompanied by continued growth in long-term debt. In my view, should we see the total assets to long-term debt ratio start to trend lower, then this might cause some apprehension on the part of investors – as it could signify that the company is taking on too high a debt load relative to what it is able to raise in cash and assets.

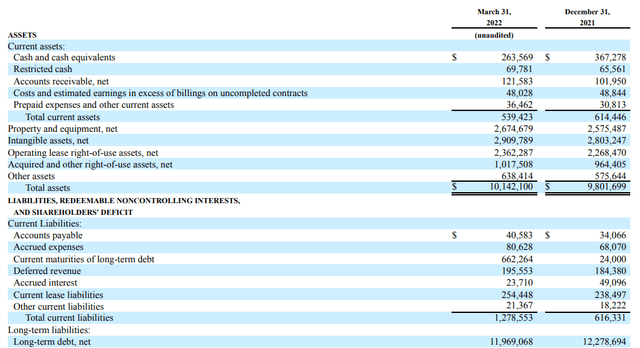

When looking at the balance sheet data for the most recent quarter, we can see that cash and cash equivalents has decreased significantly from that of the last quarter. However, total assets to long-term debt came in at just over 84% – which is higher than the figure of just under 80% reported for 2021.

SBA Communications: Form 10-Q Q1 2022

From this standpoint, the upcoming quarters will be a significant telling point as to whether the company can continue to bolster its level of total assets to long-term debt.

Looking Forward

As mentioned, the main risk to SBA Communications at this time is if the company’s largest customers decide to slow spending in telecommunications infrastructure. While the trajectory of this remains to be seen – SBA Communications could still see significant growth on the back of Verizon’s continued expansion into 5G. With the company planning to expand its 5G Ultra Wideband services across a wider range of U.S. cities this year, with both SBA Communications and Crown Castle (CCI) having been chosen by the company to speed deployment of C-band equipment for this purpose.

While competition exists between SBA Communications and alternative providers Crown Castle and American Tower (AMT) – I do not necessarily perceive that there is a big threat from these companies. As we have seen in the expansion of Verizon’s 5G services, multiple providers often complement each other in terms of scale and provide access to a wide network that could otherwise not be made available to a company by relying on one provider.

From this standpoint, SBA Communications maintains a strong position in its industry and continued 5G expansion is expected to see further demand for access to the company’s network infrastructure.

Conclusion

To conclude, SBA Communications is still showing growth with respect to continued demand for wireless infrastructure to facilitate 5G expansion.

From a financial standpoint, the total assets to long-term debt ratio is one that I believe investors will take greater note of going forward – the market is likely to want reassurance that SBA Communications can comfortably grow without having to be overly reliant on long-term debt. Should SBA Communications be able to demonstrate this, then longer-term upside is a possibility.

Be the first to comment