gorodenkoff

Investment thesis

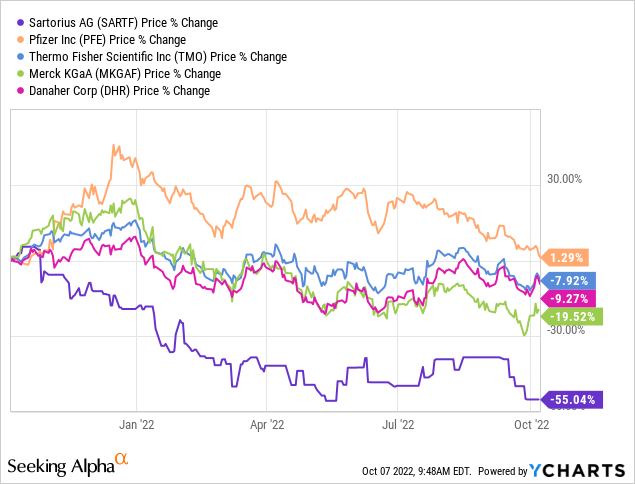

The shares in Sartorius (OTCPK:SARTF) have corrected by 55% over the last 12 months. Despite this, we rate the shares as neutral and stay on the sidelines until order visibility improves. There appears to be limited upside in the shares, given rising costs, changing customer behavior over order placement, and valuations that do not look undervalued.

Quick primer

Sartorius is a German manufacturer of laboratory equipment and consumables, catering to the biopharmaceutical, chemical, food, and beverage industries, as well as academic research. Its key growth markets are the US and Asia (chiefly Mainland China), with Europe making up 41% of total FY2021 sales. It aims to provide a platform solution to large pharmaceutical companies (customers include GSK (GSK), Pfizer (PFE), and Samsung Biologics (247940.KS)), covering both upstream (equipment for development and manufacturing of drugs) and downstream (steps taken to final filling and delivery of the product). Its product portfolio is seen to be most competitive in filtration, fluid management, and fermentation equipment, with key peers being Merck KGaA (OTCPK:MKGAF), Thermo Fisher (TMO), and Danaher (DHR).

The shareholder structure is complex, with 50% of the shares outstanding classed as ordinary shares (SARTF), and the other 50% as preference shares (OTCPK:SUVPF). The founding Franken family owns 50% of the ordinary shares outstanding.

The long-term drivers of the business are seen as 1) global aging demographics driving demand for healthcare, and 2) growing adoption for biopharmaceuticals, where drugs are produced from the biological source using biotechnology.

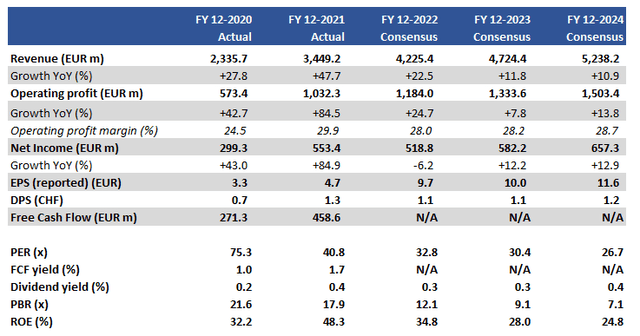

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

Over the last 12 months, the ordinary shares in Sartorius have visibly underperformed the peers as well as the pharmaceutical companies. We want to assess whether this is warranted, taking into account the current state of order growth and the medium-term outlook for the business.

Growth has proven to be unsustainable

The pandemic was an obviously powerful driver for the business, with sales growing at high double-digit growth for the last two financial years. Order intake grew an astonishing 50.5% YoY (page 39) in FY12/2021, and with COVID-related orders said to be growing only at 13% YoY, the market was led to believe that underlying demand would remain sustainably high. Management’s relatively bullish medium-term forecasts of reaching EUR5.0 billion in revenues by FY2025 implied strong order momentum, and with capex investment expected to be at 14% of sales (page 14) for the medium-term, earnings visibility was deemed to be high as spending was prioritized to drive growth. The company was happy to invest in its business, increasing headcount by approximately 3,200 people (by around 30% YoY) in FY12/2021.

Q1 FY12/2022 results unveiled a major deceleration in order intake, falling 9.8% YoY in constant currencies (reported -6.6% YoY). Although the company stressed that this was ‘as expected’ (page 2), comments about demand ‘normalizing’ and ‘changed order patterns’ (page 7) were taken as negative. This direction of change has not shifted significantly in H1 FY12/2022, with order decline at -4.8% YoY under constant currencies.

The key takeaway here is that although FY12/2022 earnings will remain relatively robust, with weakening orders there is a growing risk of significant earnings deceleration. At best, Sartorius appears to be a business experiencing normalizing demand but with some scope for growth in the medium term, supported by bolt-on acquisitions. More realistically, it appears to be a business being punished by the market for raising expectations, increasing its cost base in the face of a slowdown, and demonstrating that it is not exactly in control of its destiny despite thematic tailwinds.

The other theme that is impacting the shares is exposure to China. Whilst it was a case to price a premium on Chinese growth, nowadays reliance on the China market is seen as relatively negative, given issues over corporate governance, supply chain problems, and political risk.

A key question is when there will be a recovery in orders. In hindsight, a significant normalization of demand was to be expected post-pandemic. The challenges now are increasing macro uncertainty, rising costs, securing enough energy, and greater customer scrutiny over the timing of order placement.

Valuations

We take the view that the order outlook is not about to turn materially positive. On this basis, current consensus forecasts look too bullish, but valuation metrics do not look undervalued with the shares trading on PER FY12/2023 30.4x, with a low dividend yield of 0.3%.

Risks

Upside risk comes from a major re-acceleration in order intake, driven by renewed demand by the pharmaceutical industry. This could be driven by a new pandemic or political action over improving the readiness of future healthcare services. A bid to buy the business is possible by a competitor, but the complex shareholding structure makes this possibility less likely.

Downside risk comes from a further decline in order intake growth YoY into FY12/2023. An increasing fixed cost base with more staff could result in margin compression if sales volume does not grow as expected.

Conclusion

The shares have corrected 55% over the last 12 months, and we would like to think that most of the negatives have been priced in. During the earnings call for H1 FY12/2022, management may have been acting in a conservative manner when they mentioned it was ‘too early’ to give any guidance for FY12/2023. There are areas of strength in orders such as in China as well as the overall spending in the pharmaceutical industry. However, we believe that the business will continue to face headwinds in terms of order visibility and cost pressures, resulting in limited upside. We rate the shares as neutral.

Be the first to comment