pagadesign/E+ via Getty Images

Playtika Holding Corp. (NASDAQ:PLTK) offers games internationally, and appears to have accumulated a lot of know-how about user engagement. Management uses big data analytics to design its marketing strategies, and is investing more and more in research and development. Besides, if PLTK continues to select and successfully negotiate acquisitions, economies of scale may enhance future profitability. Under normal conditions, in my view, PLTK’s future free cash flow would justify a valuation of $18 per share. Even considering dependency on tech giants and probable unfair behavior from some gamers, I believe that PLTK’s stock price is quite undervalued.

Playtika

Playtika bills itself as one of the world’s leading developers of mobile games. The company designs games thanks to its proprietary technology platform and a lot of know-how about user engagement and monetization.

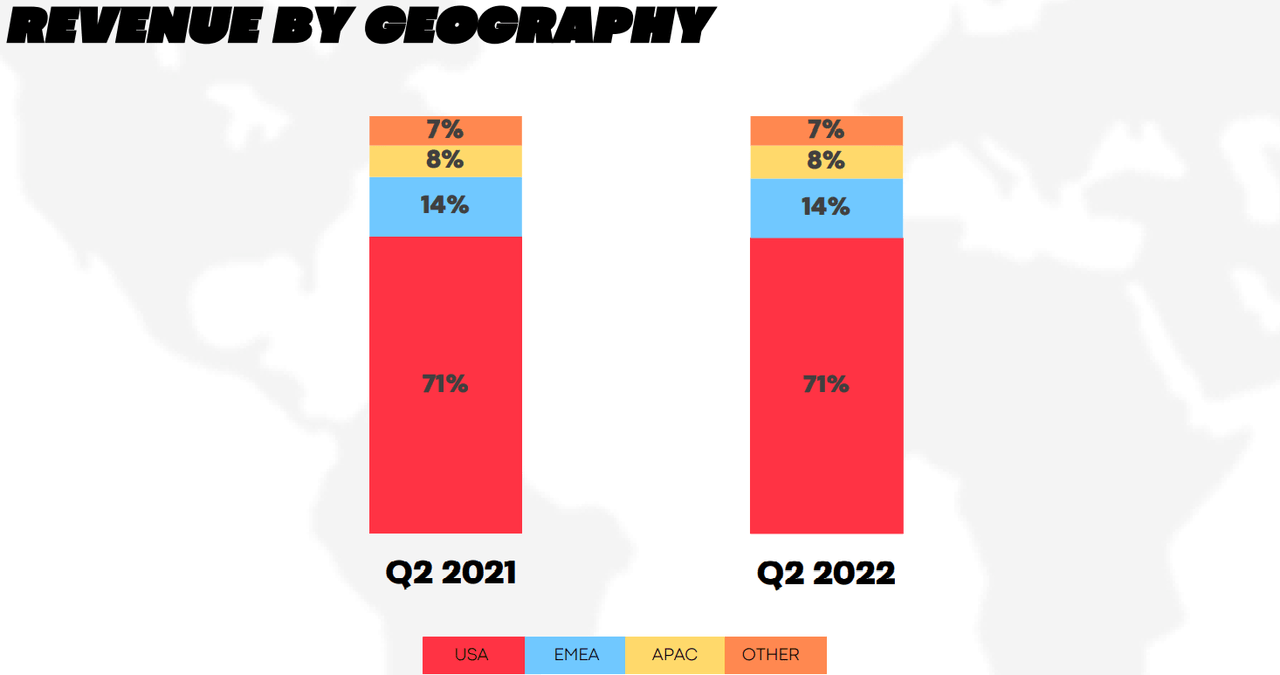

Currently with a portfolio of both acquired and developed games, I believe that there is still significant room for improvement in terms of geographic diversification. In my view, if the company successfully markets its games in Europe or Asia, as the company does in the United States, revenue growth will likely increase.

Source: Presentation

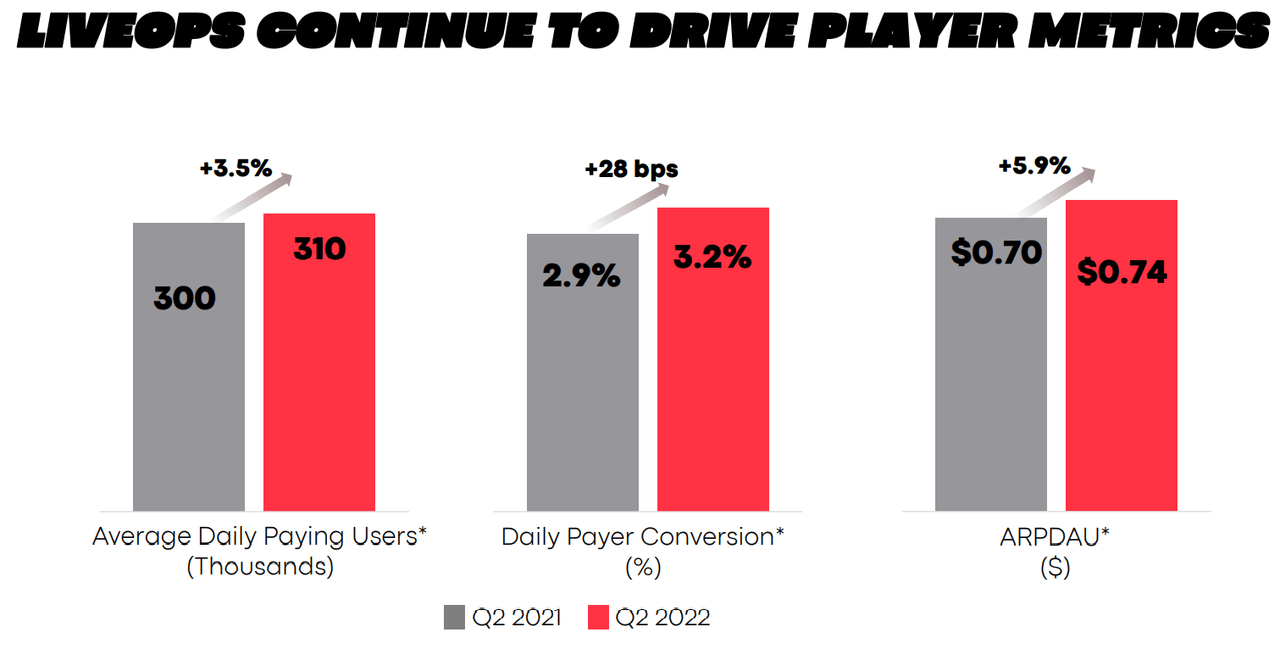

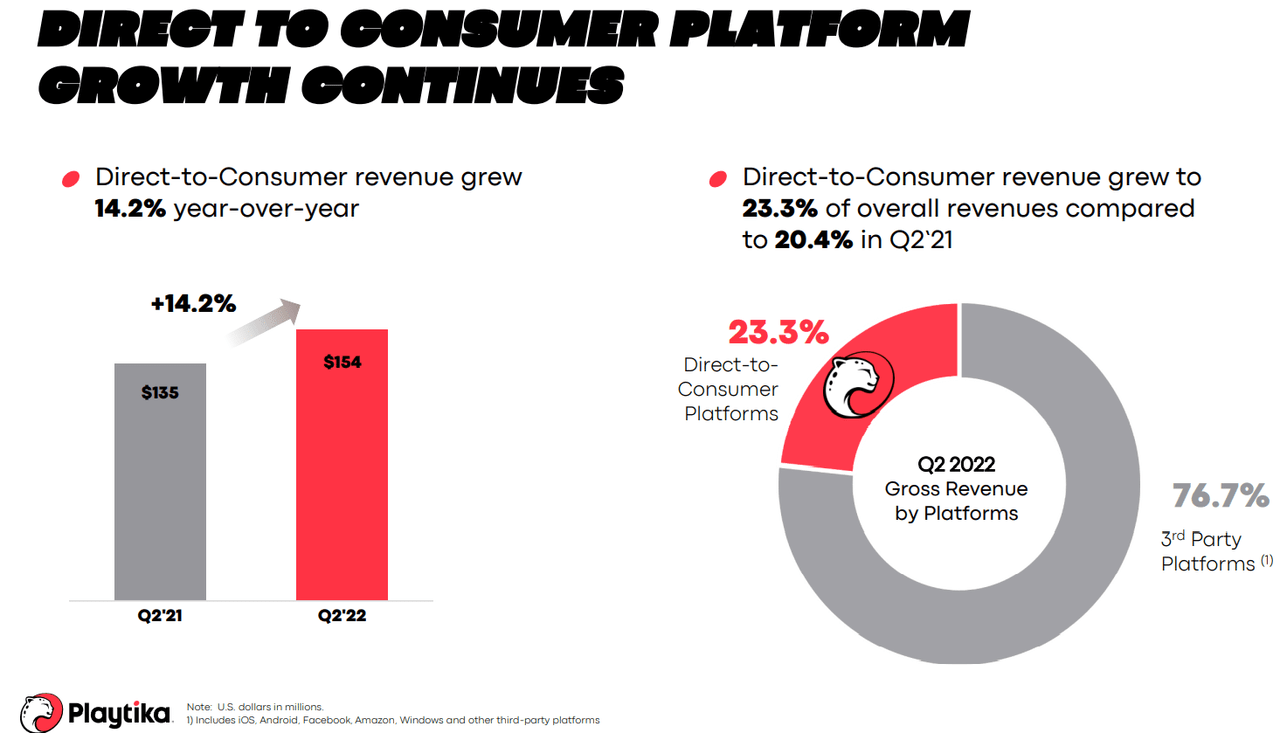

I believe that Playtika is delivering beneficial figures that I must highlight. In Q2 2022, Playtika reported an increase in the average daily paying users, more payer conversion, and more direct to consumer platform growth. In my view, the data analysis executed by Playtika appears to be paying off.

Source: Presentation Source: Presentation

Impressive Expectations From Other Investment Analysts

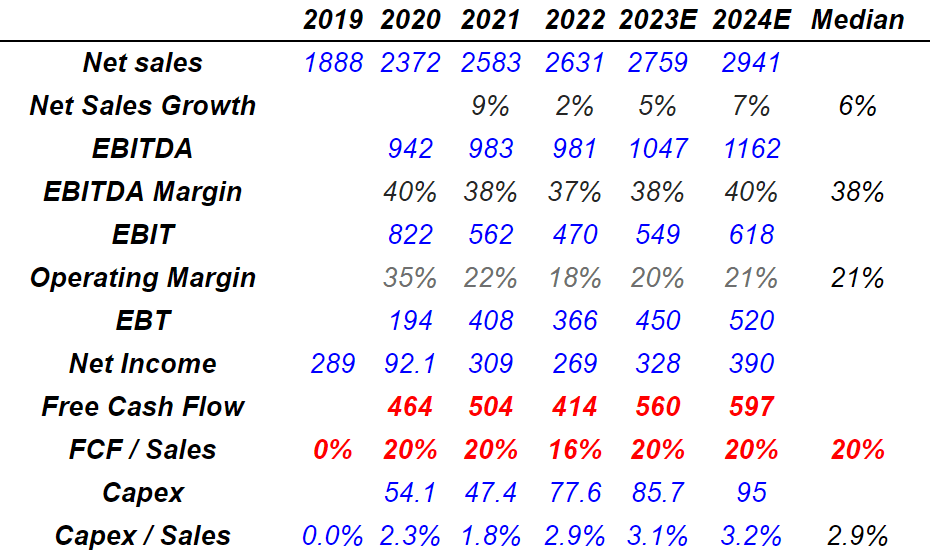

Other analysts are expecting beneficial financial figures from now until 2024. Investment analysts are expecting median sales growth close to 6%, EBITDA margin around 38%, and FCF/Sales close to 20%. I did use some of the numbers from other analysts to design my discounted cash flow model, so I believe that readers should have a look.

Author’s DCF Model

Finally, I was quite impressed by the guidance given by management. The company believes that 2022 revenue could stand at $2.6-$2.66 billion, and the adjusted EBITDA could stand at close to $900-$940 million. I also used some of the numbers from management to complete my discounted cash flow model.

Source: Presentation

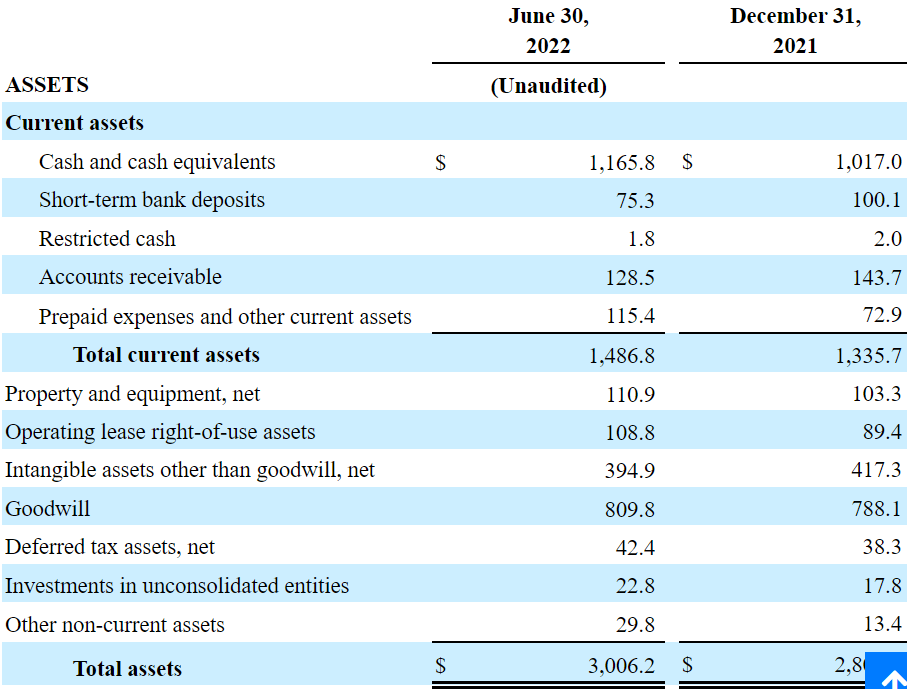

Balance Sheet: The Total Amount Of Debt Does Not Seem Worrying

As of June 30, 2022, Playtika reported $1.165 billion in cash, $3 billion in total assets, and liabilities worth $3.1 billion. I don’t like the fact that the asset/liability ratio is under one. However, if future free cash flow continues to trend higher, I wouldn’t expect investors to complain about the current state of the balance sheet.

10-Q

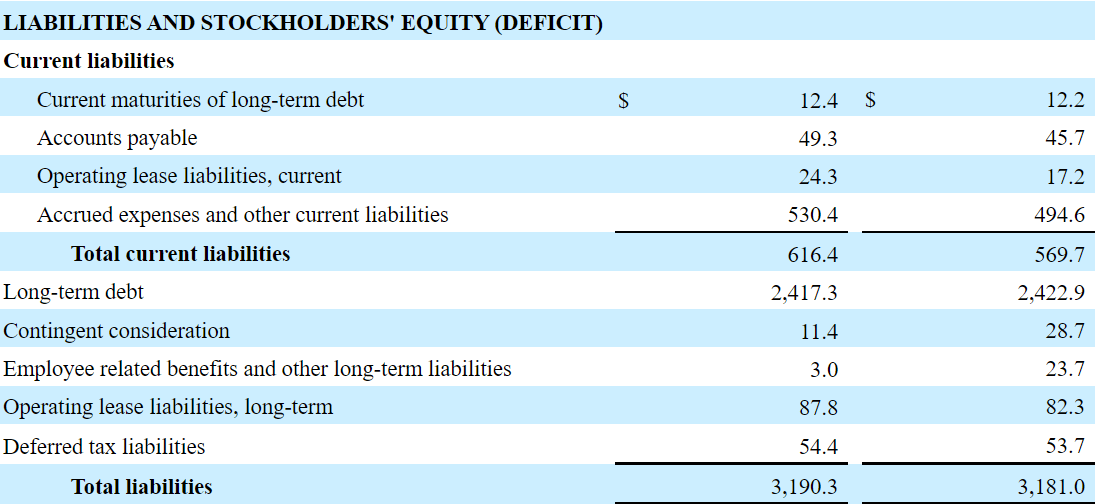

The total amount of debt stands at $2.41 billion, which is a bit lower than that in 2021. With 2025 forward EBITDA around $1.105 billion, the net debt/EBITDA does not seem that worrying.

10-Q

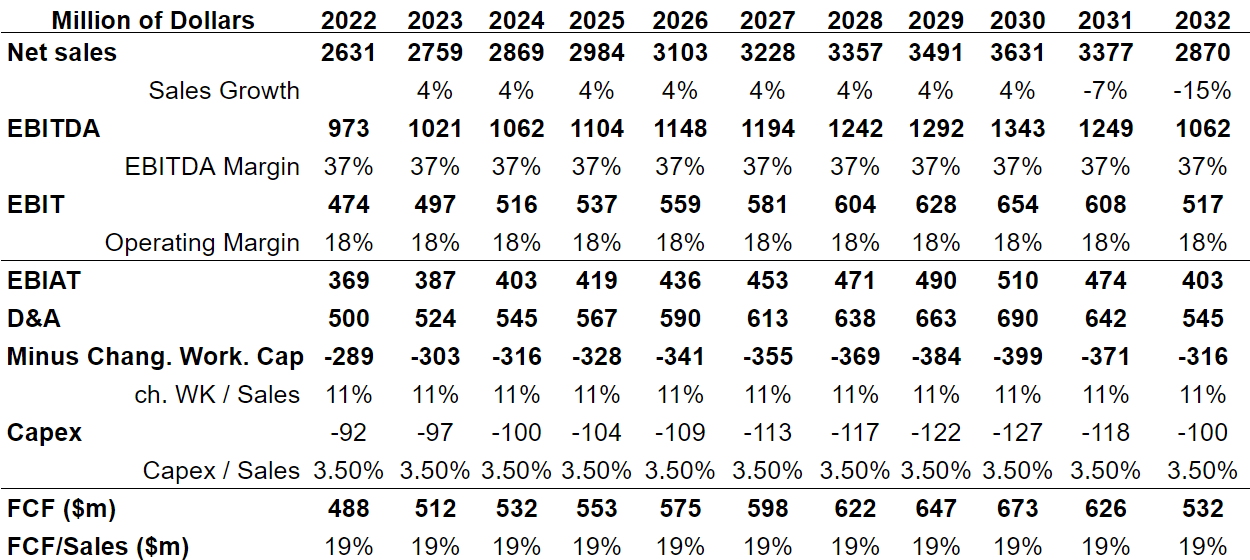

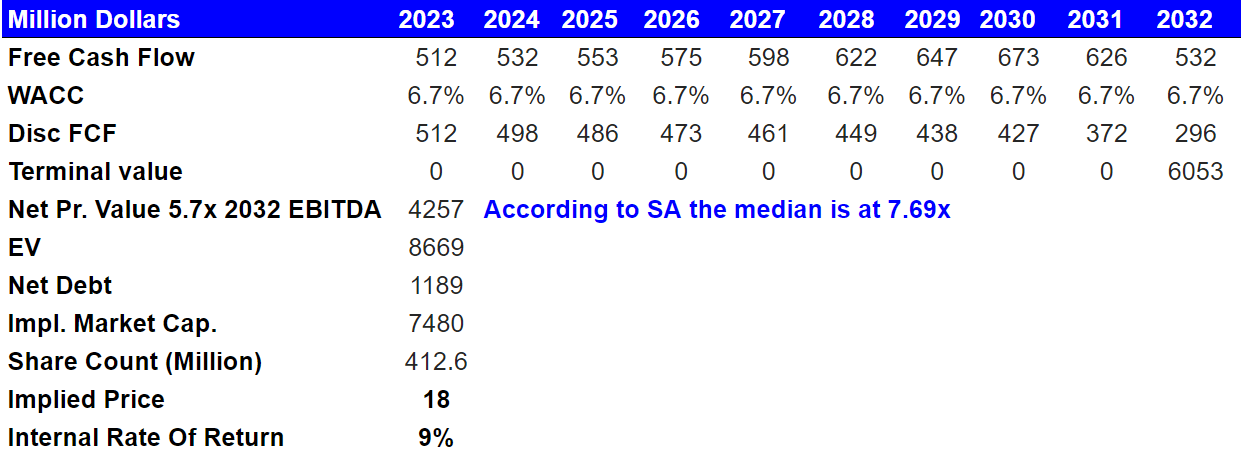

My Base Case Expectations Include Sales Growth Around 4%, 37% EBITDA Margin, And A Fair Price Of $18 Per Share

Under normal conditions, I believe that the co-founder, Robert Antokol, will be able to successfully grow the business organically. At the same time, I would be expecting beneficial acquisitions given previous successful transactions executed by Playtika. Right now, the cash in hand does not seem sufficient to make meaningful acquisitions. With that, if Playtika generates sufficient free cash flow, and reduces its total amount of debt, new acquisitions could occur.

We are led by our visionary co-founder, Robert Antokol, who has managed Playtika since inception, transforming the company from a small games business, through numerous acquisitions and steady organic growth, to become one of the largest mobile games platforms in the world. Source: 10-K

Over the past 10 years, we have successfully acquired a number of mobile games and studios, including Reworks (2021), Seriously (2019), Supertreat (2019), Wooga (2018), Jelly Button (2017), House of Fun (2014), World Series of Poker (2013) and Bingo Blitz (2012). Source: 10-K

Playtika has also a significant amount of know-how about the acquisition of new users, conversion of players, and retention of active users. Besides, if management continues to use data-based marketing strategies, and marketing expenditure does not lower, revenue growth will likely remain elevated. Management provided some information about its marketing strategies in the annual report:

We develop tailored monetization and retention strategies for different parts of our users’ lifecycles, including before they become paying users, after they become paying users, and for users who become inactive. Source: 10-K

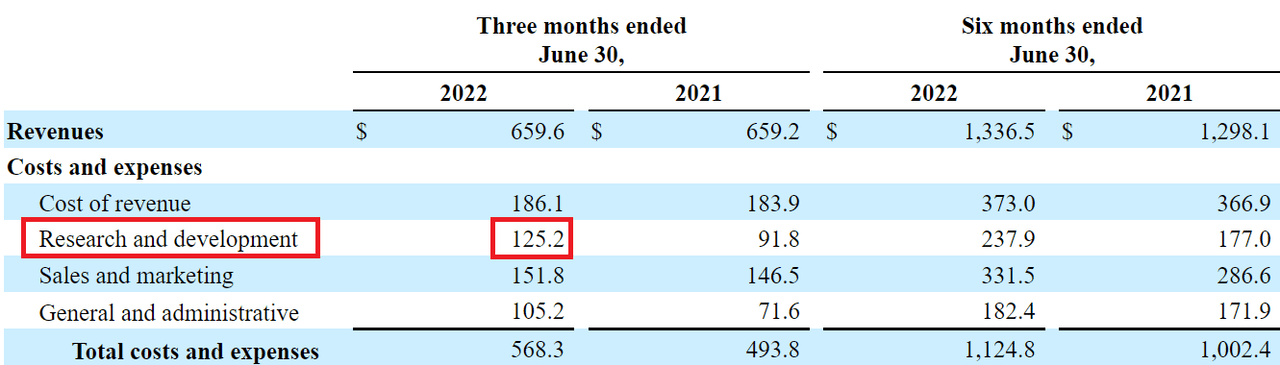

Let’s also mention that management recently increased its research and development expenses as more employees are being hired. Under normal conditions, the number of new games designed will likely increase as more engineers work for Playtika. In this regard, in the last 10-Q, there was a commentary about Playtika’s research and development:

The increase in research and development expenses was primarily due to increased headcount and employee compensation costs, and increased facilities costs associated with additional leased premises. Source: 10-K

Source: 10-K

Under very conservative but optimistic circumstances, I assumed sales growth of 4%, an EBITDA margin of 37%, and operating margin of 18%. The results include 2032 EBITDA of $1.062 billion and 2032 EBIAT of $403 million.

Now, with D&A close to $501 million and $690 million per year and capital expenditures around $101 million, the FCF/Sales margin would be 19%. We may be talking about a FCF of around $488 million and $647 million.

Author’s DCF Model

If we assume that Playtika’s WACC is close to 6.7%, like other financial advisors, and an exit multiple of 5.7x, implied enterprise value would be $8.6 billion. The equity valuation would be close to $7.4 billion, and the fair price would be $18 per share with an IRR of 9%.

Author’s DCF Model

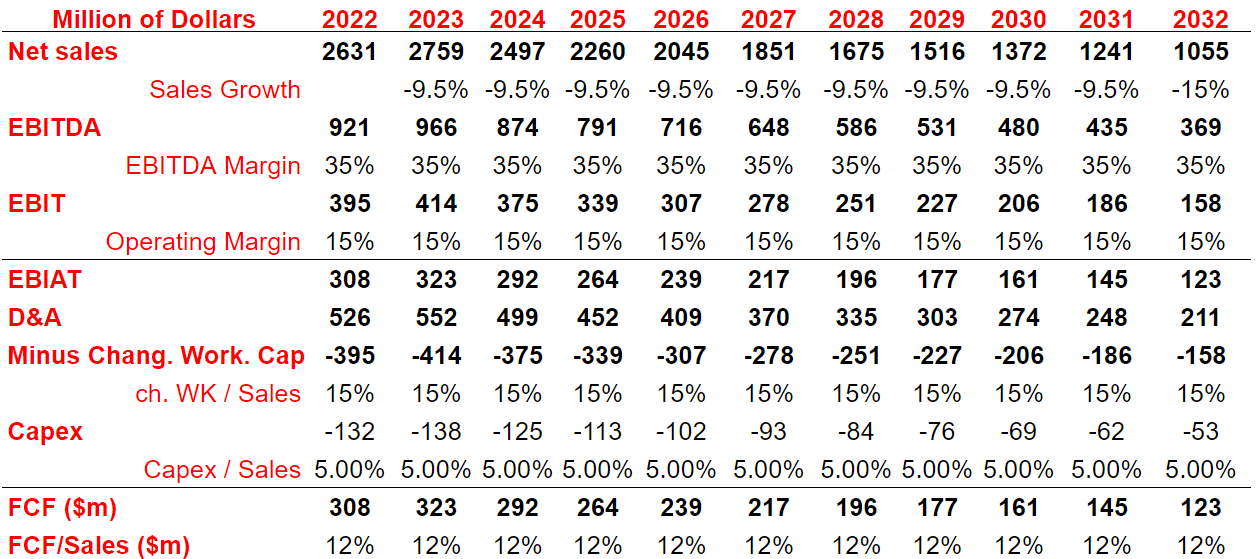

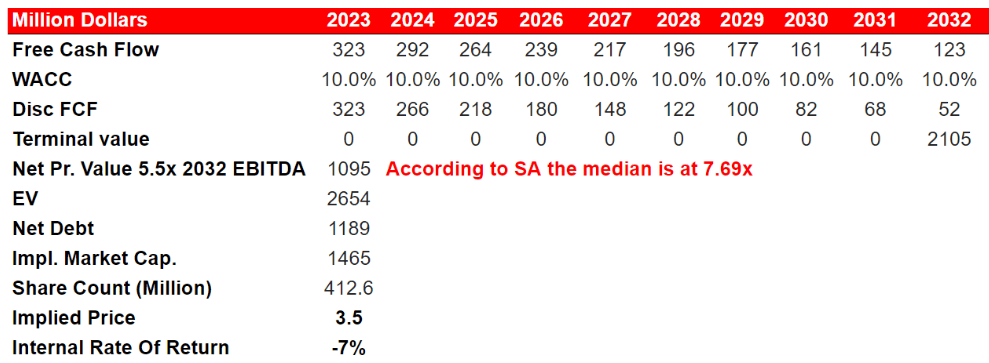

Concentration Of Clients, Scams, Cheat Guides, Failed Acquisitions, Or Lack Of Targets Could Bring The Fair Price Down To $3.5 Per Share

Playtika extensively uses services offered by large technological platforms, and most of its revenue comes from these tech giants. It means that changes in the requirements of these large conglomerates could drive Playtika’s revenue growth or profitability down:

For the year ended December 31, 2021 73.4% of our revenues were generated through the iOS App Store (AAPL), Facebook (FB), and Google (GOOG) Play Store. Source: 10-K

Playtika may also suffer from cheats and guides developed by third parties to take advantage of the company’s games. These tricks may reduce the gaming experience of other players, and may modify the economies of the company’s games. Playtika discussed extensively about tricks seen during the years. In my view, the most interesting lines about these scams are as follows:

In particular, for our games where players play against each other, such as our World Series of Poker game, there is a higher risk that these “cheats” will enable players to obtain unfair advantages over those players who play fairly, and harm the experience of those players. Additionally, these unrelated third parties may attempt to scam our players with fake offers for virtual items or other game benefits. Source: 10-K

Finally, in this case, I believe that a failure in the M&A strategy could bring down the company’s profitability, and reduce future value creation. Playtika may not pay too much for certain targets. The company may not find sufficient targets to buy, or may not obtain regulatory approvals from governmental authorities. In the worst case scenario, if journalists do note the decline in the number of acquisitions, detrimental reports could lead to declines in sales growth.

We cannot assure you that acquisition opportunities will be available on acceptable terms or at all, or that we will be able to obtain necessary financing or regulatory approvals to complete potential acquisitions. Source: 10-K

Under detrimental conditions, I included sales growth around -9.5% per year, an EBITDA margin close to 35%, and an operating margin of 15%. With a capex/sales ratio of 5% and changes in working capital/sales of 15%, FCF/sales would stand at 12%. We would be talking about 2030 FCF of $161.5 million.

Author’s DCF Model

If the company delivers -9.5% sales growth y/y, in my view, many investors would sell shares. The cost of equity could increase, which may lead to an increase in the cost of capital. With a WACC of 10% and an exit multiple of 5.5x, the enterprise value would be equal to $2.65 billion. The market capitalization would not exceed $1.465 billion, and the implied fair price would be $3.5 per share.

Author’s DCF Model

Conclusion

Already with presence outside the United States and know-how about user engagement, Playtika will likely see sales growth in the coming years. It is also quite appealing that management knows well how to negotiate the acquisition of new games and companies. More acquisitions will likely bring economies of scale and more free cash flow. Even taking into account potential risks from tech giants, unfair behavior of players, and other risks, the company looks undervalued. Keep in mind that under conservative assumptions, my discounted cash flow model resulted in a valuation of $18 per share.

Be the first to comment