ipopba/iStock via Getty Images

Dear readers/followers,

Stryker (NYSE:SYK) typically commands a fairly high sort of premium. Today is no different, and the company is by some metrics still, “expensive”. However, there is a different way of viewing Stryker, as a business worth that premium and with significant growth potential. In this article, I take that view and show you why that is, and why I recently bought a few shares in the company – the first in hopefully a larger position in the long term.

Let’s take a look here.

Stryker – What does the company do?

Stryker is a BBB+ rated MedTech/health care equipment company headquartered in Michigan. The company has a market cap of over $80B and has been in business since early WW2 when a doctor, Homer Stryker, developed a mobile hospital bed, a cast-cutting apparatus, and a walking heel (as well as other products). This began a history in MedTech, and a successful one, that’s been ongoing for decades.

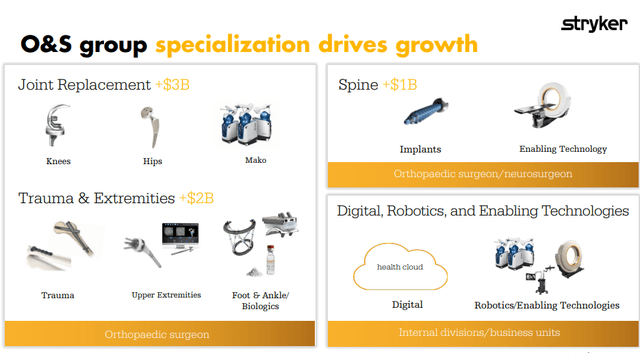

SYK IR (SYK IR)

The company IPO’ed in 1979 and now earns annual sales revenues of around $17B.

These sales primarily hail from the US/NA, with 72% of company sales in the US. The company has averaged impressive overall returns and is one of the few companies still in the green here. Organic growth usually averages 5-10% annually and aside from COVID-19, which was obviously a headwind for this company, things have been solid. Even COVID-19 saw adjusted net earnings of no more than a 10% decline YoY, and it’s already picked back up again.

SYK is an impressive company. The business has customers in 75 nations, they work with over 100,000,000 patients per year, and the company employs over 46,000 people.

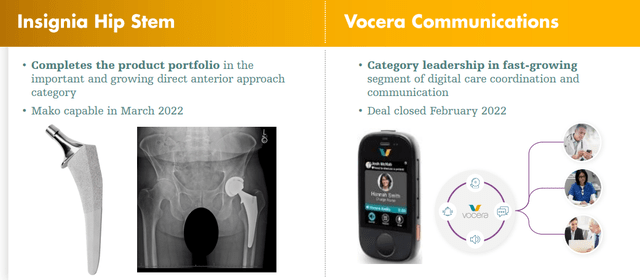

Stryker is active in two segments – MedSurg/Neurotech and Orthopaedics/Spine. These two areas come at a TAM of around $72B together, of which the company only currently has a small portion. The company’s sales come from products like joint replacements for knees, hips, and other things, interventional spine products and technologies, and trauma tech, as well as Endoscopy technologies and products, Instruments, Neurovascular, Neurocranial, and Medical care products and technologies. It goes from things as simple as a Clinician tool belt to things like smartphone apps to things like the advanced replacements you see up there.

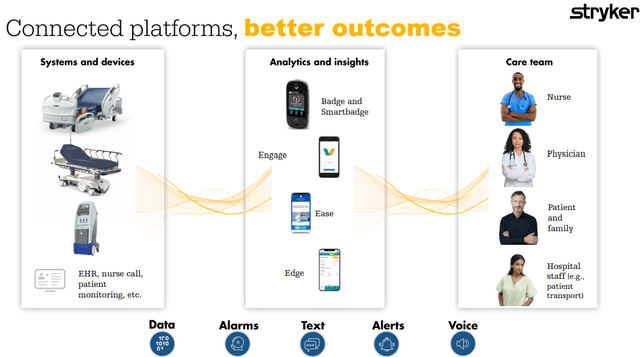

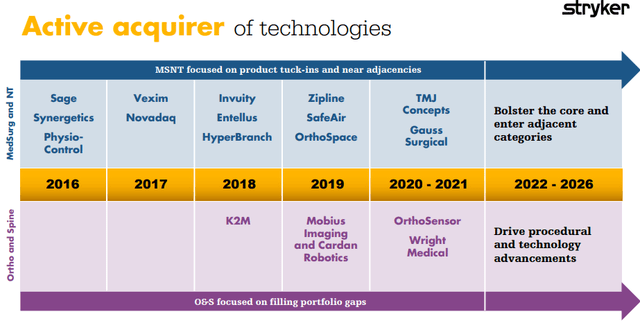

The company is also highly acquisitive – 2021 saw 3 M&As of TMJ, Gauss, and Thermedx. Much of its cash flows are spent on R&D, with a high 6.6% of sales spending on research. The company is pushing heavily for connected platforms across its portfolio.

The company has a highly motivated and talented team of managers with experience in the industry, much of it at Stryker. Perhaps most importantly though, Stryker is a category leader across all of its businesses in one category or another. It has diversified customer base with massive potential upsides, including advanced imaging, stroke care, safety, and medical robotics.

Furthermore, the aforementioned M&A approach is working very well.

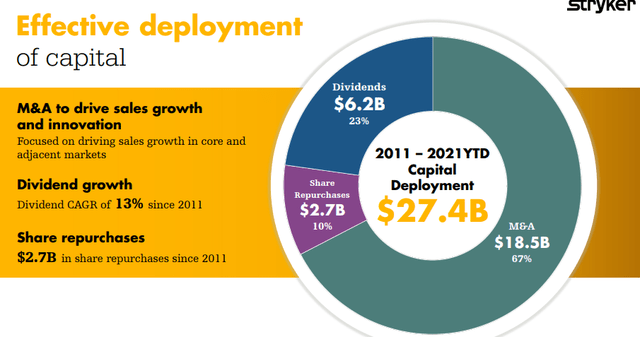

Also, the company’s growth in other non-US markets has accelerated massively since 2017, going from 1.8% in 2017, to 19.5% in 2019 and beyond. Stryker has outperformed the overall market in terms of organic growth for the past few years. You can see a capital split in terms of allocation here, which showcases the company’s M&A-heavy strategy, in order to deliver value primarily through growth, not dividends.

Future growth levers the company aims to pull come in several ways. We’ve heard most of them before, but they are still applicable to Stryker as well. These include Plant network optimization, better sourcing, global ERPs, procurement improvements and so forth. All of these are hoping to drive margins and value upward.

There are few companies that do what Stryker does – and what’s more, does what the company does as well as they do it.

While there are always leaders in specific fields, very few fields have as clear a leader as Stryker seems to be in these segments. A huge part of the future in MedTech is bound to be robotics – and the company is a robotics leader, with its Mako platform driving growth in implants and expansion both in US and in Non-US geographies. The MedSurg/Neuro-segment meanwhile is providing some extremely innovative solutions in instruments, surgical tech, and acute care – including things like extremely advanced resuscitation technologies.

Stryker is, as it has proven since its inception, a company that’s focused on innovation and making care “better”. That’s the sort of company you can almost always invest in – along with peers such as Siemens (OTCPK:SIEGY), UnitedHealth (UNH), and other businesses. They build the sort of technologies that you, frankly, want to be available to you if you’re ever in the position of requiring care.

And that is a very good position to be in, all in all – as this, provided the company is run well, is usually a very good indicator of profitability.

Recent results do showcase a few challenges – as both EPS and revenue were amiss for 2Q22. The supply chain is a big thing for the company, as is inflation. The company’s previous close-to-double-digit growth estimates might be hampered between 100-300 bps by ongoing FX and inflation issues. While this is, of course, not a good thing, I still want to emphasize that the company managed a net income increase of 11% YoY, a 5% revenue increase, and other positives – though missing analyst estimates here.

To me, this is, frankly speaking, great news.

Why is that?

Because Stryker is one of those companies I’ve always viewed peripherally. Always out of reach due to massively unappealing or forbidding valuation that would have guaranteed single-digit rates of return outside of a massive premium that I have no plans to put my faith in.

So when 2Q22 came in weak back in July, I watched. I watched and waited, patient to see what would happen.

The main case I want to put forward for Stryker is this.

Regardless of momentary issues, this is a market leader with a very appealing field that’s in healthcare, yet not related to pharma and medication. The company develops and sells tech, and they’ve been doing it for over 80 years. They do it very well, and they’re like as not to continue doing it well.

Momentary impacts in the height of a few percent in this specific market environment do not interest me. I’m interested in the long play.

And the long play for Stryker is starting to look pretty damn appealing.

Stryker’s Valuation

Again, we focus not on the recent or even the near term, but on the long term. As long as these supply chain headwinds and inflation/FX issues persist, Stryker is likely to see continued pressure here.

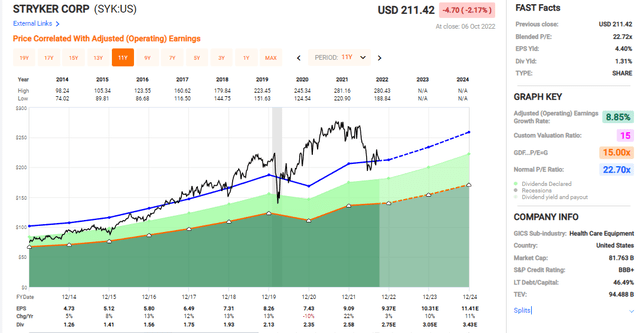

What matters to me is the fact that Stryker typically goes up to 20-30x P/E on a normalized basis, which is some of the highest premiums I’m willing to even consider being close to acceptable for a company. I wouldn’t buy it at 40x – or even close to 40x, but I would keep it at that valuation.

Now, we’re down to 20-26x, depending on where you look – and that’s starting to look interesting.

If we assume that the company is able to drive earnings as they were outside of 2016-2019, including the pandemic, then this company is likely to soar. We had a few poor years – but since 2020, the company has been stable in delivering the sort of earnings growth we’re looking for. After a crash like this in valuation…

…the company can grow appealing. Oh, others point to other risk factors, such as the company’s debt, and its rapid M&A approach which can result in volatility. Both of these are valid concerns, but I wouldn’t personally see them as particularly relevant for the long-term prospects. Stryker is, to put it bluntly, too good for that – and confidence in management pushes me forward here. The dividend is low though, among the lowest that I actively accept in my core portfolio, currently at around 1.3%, but expected to grow at an impressive rate – just like the company itself.

If we only assume a 25x P/E on a forward basis rather than a 30x, the company will still average growth on an annual basis of up to around 15-16%, or 39% until 2024. This is not a bad base thesis. If we see upwards of 27x, that goes up to around 21% annually, which goes into “great” territory.

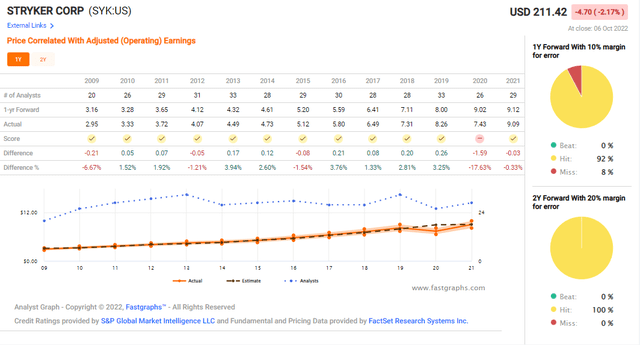

That’s a positive enough thesis for me to get on board with – especially with analyst accuracy such as this.

There is very little ambiguity to these results and this company most times. This is also reflected in how analysts view the company. Current GAAP EPS estimates are for the company to continue to rapidly improve its earnings all the way until 2026, at which point we’re expecting nearly $11 GAAP EPS. This development causes a valuation target by S&P Global of $237, from lows of $200 to highs of $290 from 21 analysts. 13 of these are at a “Buy” or equivalent here, making the company a very decent prospect at double-digit upsides, which usually do not happen outside of a recession (which of course might be what we’re moving into here).

I estimate that Stryker will continue to grow at high single-digit or low double-digit rates, which dictates that my valuation, given debt and comps, lands around $225/share. This is still a good upside, and it would guarantee you double digits if these targets, forecasts, and valuations hold.

I believe that they will.

Based on the current valuation, the forecasts, and the company’s fundamentals, I consider this one to be a “rare buy” because it usually is too expensive to consider and has too low returns given its very modest dividend.

For now, this is my thesis on Stryker.

Thesis

My thesis on Stryker is as follows:

- The company is a world-leading MedTech and equipment company, with best-in-class management, market leadership, and one of the most solid portfolios out there. Risks include aggressive growth, debt, and impacts from inflation, COVID-19, and other cyclicalities, which I do not consider relevant for the longer term.

- I believe that at anything 24x P/E or below, this company can be bought. I give the business a normalized PT of $225/share.

- That gives the company a “Buy” rating at this juncture.

Remember, I’m all about: 1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment