apomares/E+ via Getty Images

Investing for dividends can be a lot more rewarding than simply investing just for capital gains. That’s because cash dividend payments provide recurring streams that go straight to you as the investor and can never be clawed back by the company. This is in contrast to growth stocks that are fun to hold when they show unrealized capital gains, but can be downright depressing when they inevitably come back down to earth.

This brings me to Saratoga Investment (NYSE:SAR), which is a growing BDC whose share price weakness has now driven the yield to an attractively high level. This article highlights what makes SAR a decent income pick for those seeking income diversity, so let’s get started.

Why SAR?

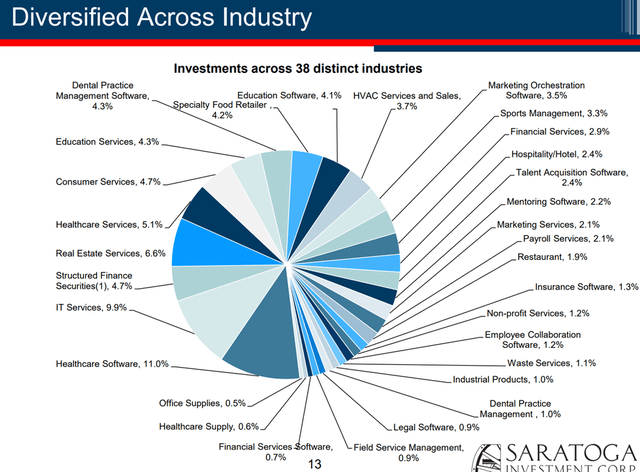

Saratoga Investment is an up and coming externally managed BDC that provides financing solutions to middle-market companies in the U.S. At present, it has an $818 million investment portfolio that’s diversified across 38 distinct industries. As shown below, SAR invests primarily in defensive industries with Education, Food, HVAC, and Healthcare Software comprising its top segments.

SAR Portfolio Mix (Investor Presentation)

The portfolio is also well-structured, comprising 77% first lien secured debt, 5.4% second lien, and with equity making up much of the remainder at 15.4% of the portfolio fair value. While equity investments tend to be riskier than debt instruments, they give more potential for capital appreciation, which result in NAV per share increases.

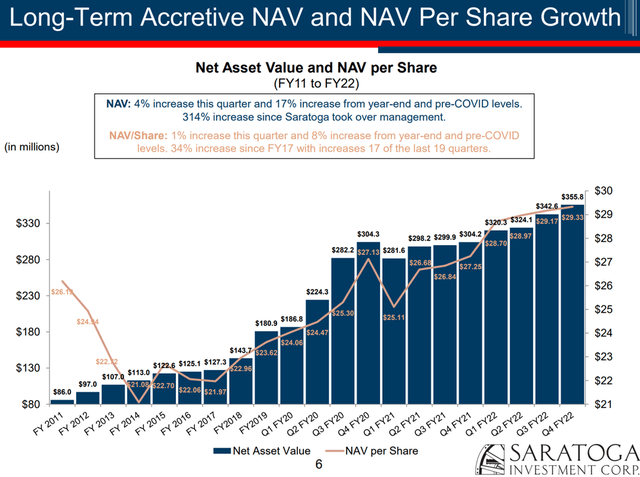

SAR has seen steady NAV/share growth since inception, and this continued in the latest quarter, Q4 FY2022 (ended February 2022), with a 4% sequential quarter-on-quarter increase and 17% increase YoY.

SAR NAV/Share Growth (Investor Presentation)

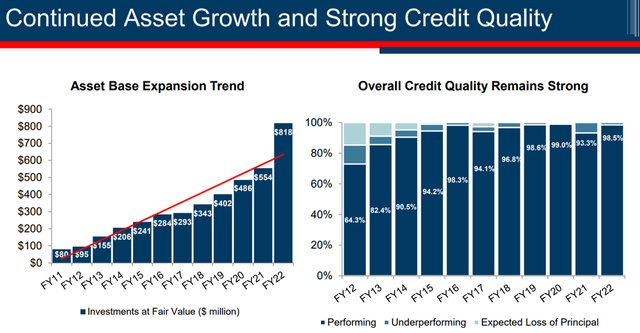

Meanwhile, SAR’s debt portfolio appears to be in healthy shape, with 98.5% of its loan investments sitting at the highest internal rating with zero non-accruals. It’s also delivering a solid return on equity, with 13.9% over the trailing twelve months. As shown below, the current management team has done a good job of reshaping the portfolio credit quality over the years.

SAR Portfolio Credit Quality (Investor Presentation)

Looking forward, SAR is well-positioned for an inflationary and rising rate environment. This is considering the fact that 97% of its debt investments are floating rate with 1.0% or higher floors. It also maintains low leverage, with an asset-to-liability coverage ratio of 209%. This translates to a debt to equity ratio of 0.91x, sitting well below the 2.0x regulatory limit.

Risks to SAR include the potential for a recession, which could result in financial hardship for portfolio companies. This is mitigated, however, by the defensive nature of the portfolio, as highlighted by management during the recent conference call:

Our underwriting bar remains high as usual, yet we continue to find opportunities to deploy capital, as we will discuss shortly. Follow-on investments in existing borrowers with a strong business model, balance sheets continued to be an important avenue of capital deployment for us, as demonstrated with 40 follow-ons this past fiscal year, 19 in the last quarter alone, including delayed draws.

A strong underwriting culture remains paramount at Saratoga. We approach each investment working directly with management and ownership to thoroughly assess the long-term strength of the company and its business model. We endeavor to peer as deeply as possible into a business in order to understand accurately its underlying strength and characteristics.

Meanwhile, the material share price drop since the start of the year from the 52-week high of $30.25 to $23.26 has driven the dividend yield up to 9.1%. The dividend also remains covered at a 94.6% payout ratio, based on FY22 (ended Feb 2022) adjusted NII per share of $2.24.

I see value in the stock at the current price-to-book value of just 0.79x, sitting well below the ~1.0x level over the past 12 months. Sell side analysts have a consensus Strong Buy rating with an average price target of $30.42, implying a potential 40% total return including dividends.

SAR Price to Book (Seeking Alpha)

Investor Takeaway

Saratoga is an enticing high yield investment option, with a diversified and defensive portfolio, strong recent credit performance, low leverage, and an attractive dividend yield. It’s well-prepared for a rising rate environment, and the recent share price weakness provides a solid margin of safety for long-term income investors.

Be the first to comment