SimonSkafar

One of the greatest things about having such a large and complex global economy is that you see demand develop in order to meet the technical challenges required for that economy to not only function but to continue to grow. There are countless companies dedicated to various offerings intended for meeting these needs. And one example of how niche these offerings can get can be seen by looking at Preformed Line Products Company (NASDAQ:PLPC). With its focus on products dedicated to support, protect, connect, terminate, and secure cables and wires, this is an incredibly focused operation. On top of that, the firm has done fairly well for itself in recent years, with top line and bottom line results steadily improving over time. And based on the data currently available, shares of the company do look to be quite affordable at this time. Given all of these factors, I do believe that it makes for a solid ‘buy’ prospect right now, with shares likely to outperform the broader market for the foreseeable future.

A niche business

As I mentioned already, Preformed Line Products Company is a truly niche player that’s dedicated to various players in the industrial markets. To best understand the company though, we should dig into the three primary product lines that the company offers. First and foremost, we have the Energy Products side of the business. Through this, the company produces products in order to support, protect, terminate, and secure both power conductor and fiber communication cables. Its offerings are also dedicated to controlling cable dynamics. Examples of products here include formed wire products. But on top of that, this unit is also responsible for other related offerings such as antenna dead ends for communications towers, mounting solutions for the solar industry, splices and connectors for vineyards and other agricultural firms, and more. The company also provides safe and reliable drone inspection services for utility assets, including transmission and distribution power lines, substations, and generation facilities. during the company’s 2021 fiscal year, this set of operations accounted for 61% of the company’s revenue.

Next in line, we have the Communications Products portion of the company. Offerings under this umbrella include protective closures that are used to protect fixed-line communication networks such as fiber optic cable or copper cable. In particular, they are dedicated to protecting these types of cable from moisture, environmental hazards, and potential contaminants. The company also supplies the communication industry with formed wire products to hold, support, protect, and terminate copper wires and cables. Plus it even sells the fiber optic cables used by the industry today. This is a growing part of the company, accounting for 30% of its revenue in 2021 compared to the 22% it accounted for only two years earlier. And finally, we have the Specialty Industries Products portion of the company. Through this, the firm offers hardware assemblies, pole line hardware, resale products, underground connectors, solar hardware systems, tree guards, and more. This is the smallest portion of the company, accounting for only 9% of sales last year.

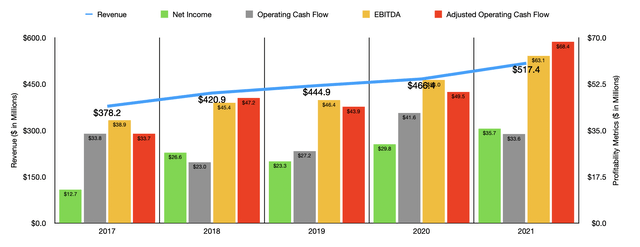

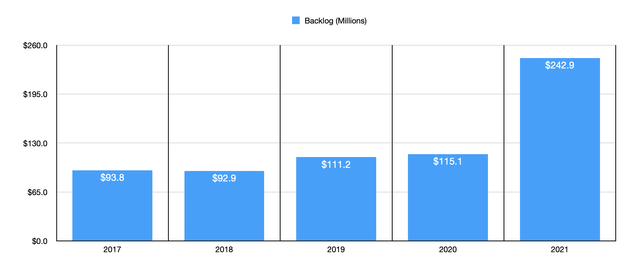

Over the past few years, management has done a really good job of growing the company steadily. Between 2017 and 2021, sales of the firm rose from $378.2 million to $517.4 million. The growth from 2020 to 2021 was a rather impressive 10.9%. Growth would have been a bit weaker, coming in at 9% year over year, had it not been for foreign currency fluctuations. Interestingly though, most of the company’s results were weaker year over year. The only real growth came from the US operations of the firm, with revenue surging 28% because of increased volume for communication and energy product sales, combined with price increases that the company implemented between June and October of last year. Internationally, sales for the company suffered because of volume decreases caused by the postponement of large-scale projects thanks to continued attention being paid to the COVID-19 pandemic threat. Even in light of this weakness, the company has benefited significantly from increased backlog. Between 2017 and 2021, backlog jumped from $93.8 million to $242.9 million. The vast majority of this rise came from the 2020 to 2021 timeframe, with backlog in 2020 coming in at only $115.1 million.

As revenue has risen, profitability for the company has also improved. But unlike revenue, the trajectory has been a bit lumpy. On the whole though, net income for the firm rose from $12.7 million in 2017 to $35.7 million last year. Operating cash flow has bounced all over the place, ranging from a low point of $23 million and a high point of $41.6 million. Last year, it came in at $33.6 million. If we adjust for changes in working capital, however, we end up with a great deal more stability. And for the past five years, the metric improved year over year, climbing from $33.7 million and 2017 to $68.4 million last year. A similar trajectory can be seen when looking at EBITDA, with the metric climbing from $38.9 million in 2017 to $63.1 million last year.

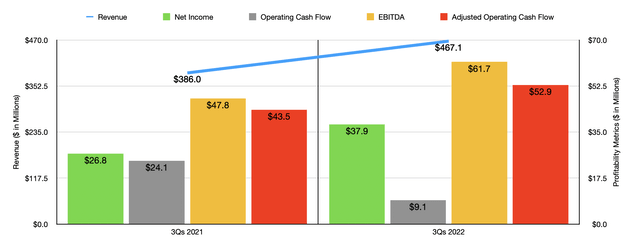

Growth for the company has continued nicely into the current fiscal year. Revenue in the first three quarters of the year came in at $467.1 million. This represents a significant improvement over the $386 million generated one year earlier. Unlike in the 2021 fiscal year relative to 2020, results so far in 2022 have been driven by strength across all of the company’s operating areas except for the Asia Pacific region. Revenue they are dropped by about 4%. Some of this sales increase was actually driven by the company’s acquisition of Maxxweld, particularly the growth experienced in the Americas. But volume increases and higher pricing were instrumental in achieving growth elsewhere.

On the bottom line, profits also fared well. The company went from generating a net profit of $26.8 million in the first three quarters of 2021 to $37.9 million the same time this year. Operating cash flow did fall, declining from $24.1 million to $9.1 million. But if we adjust for changes in working capital, it would have risen from $43.5 million to $52.9 million. In addition to this, the company also saw its EBITDA rise nicely, jumping from $47.8 million to $61.7 million at the same time of the 2022 fiscal year.

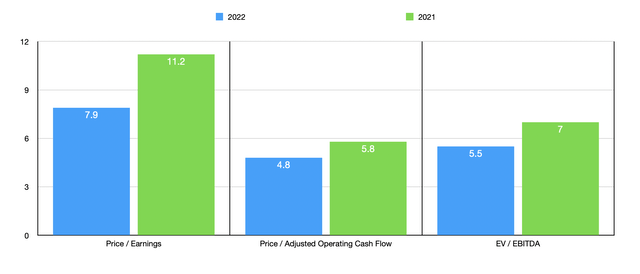

We don’t really know what to expect for 2022 as a whole. Management has not really offered any detailed guidance. But if we annualize results experienced so far, we should anticipate net income of $50.5 million, adjusted operating cash flow of $83.7 million, and EBITDA of $81.4 million. This would mean that the company is trading at a forward price-to-earnings multiple of 7.9. The forward price to adjusted operating cash flow multiple would be 4.8, while the EV to EBITDA multiple would come in at 5.5. Even if results were to weaken and revert back to what we saw in 2021, these multiples would still be low at 11.2, 5.8, and 7, respectively. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, the companies ranged from a low of 16.2 to a high of 322.3. Using the price to operating cash flow approach, the range for the four companies with positive results was between 15.8 and 668.6. And when it comes to the EV to EBITDA approach, the range was between 9.9 and 55.3. In all three scenarios, Preformed Line Products Company was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Preformed Line Products Company | 7.9 | 4.8 | 5.5 |

| Powell Industries (POWL) | 36.9 | N/A | 19.3 |

| Allied Motion Technologies (AMOT) | 33.0 | 55.6 | 14.9 |

| Thermon Group Holdings (THR) | 22.4 | 15.8 | 11.6 |

| Shoals Technologies Group (SHLS) | 322.3 | 668.6 | 55.3 |

| Acuity Brands (AYI) | 16.2 | 19.8 | 9.9 |

Takeaway

Based on all the data provided, it seems to me as though Preformed Line Products Company is a quality operator that continues to do well even in the face of a rather difficult environment. Shares of the business are trading on the cheap and it has net debt of only $46.1 million. Given all of these factors, I do believe the company offers investors attractive upside from here, even if we see financial performance worsen in the near term. Due to this, I have no problem rating it a solid ‘buy’ at this time.

Be the first to comment