Michael Vi/iStock Editorial via Getty Images

Our recent article on buying Amazon (AMZN) at a lower price by selling puts was well received by Seeking Alpha readers and enjoyed a lengthy stay on the front page as one of the trending articles. The comments stream suggested there are still a few misconceptions about selling puts. This article is aimed at clearing those misconceptions plus putting forward a trade on another tech name we are considering, Palantir Technologies (NYSE:PLTR).

Investors in Palantir have been in a world of pain. Sure, investors in general have been in pain but Palantir’s has been “off the charts” as the stock has fallen nearly 80% from its all-time high of around $35 reached in 2021. In spite of that, we don’t believe the stock has seen its worst nor has the market bottomed yet. If you are in the same camp, this sample trade shown below may be of interest to you. Once again, the intent is not to focus on this chain in particular but to educate readers on things to be aware of.

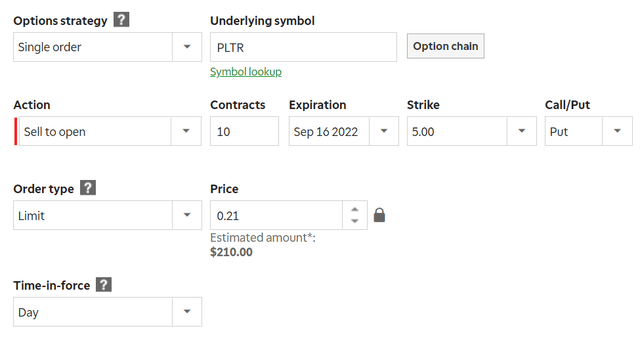

PLTR Option Chain (TD Ameritrade)

Palantir – Key data points

- Strike Price: $5

- Expiration Date: September 16th, 2022

- Number of Contracts: 10

- Premium: $0.21/share, for a total of $210.

In simple words, the put seller will be collecting $210 to buy 1,000 shares of Palantir at $5 if the stock reaches $5 or below by September 16th, 2022. Time decay is in favor of the option seller.

What’s the expected return and possible outcomes?

Return: The premium collected ($210) for setting aside $5,000 represents a return of 4.20% for about three months. Repeating this exercise 4 times a year would represent a compounded return of nearly 18% per year. By a show of hands, let’s see how many won’t take it, given how things are in the market today? Do we see two hands, or is that just one. Oh never mind, that’s someone punching the air in delight.

Outcome #1: If Palantir stays above $5 by the expiration date, we retain just the premium above. We will not be obligated to buy the shares.

Outcome #2: If Palantir goes below $5 by the expiration date, we will be forced to buy 1,000 shares at $5, irrespective of where the stock trades at that time. Keeping the premium netted in mind, the average cost in this case will be $4.79 ($5 minus $0.21).

Outcome #3: As an option seller, one can “buy to close” anytime instead of waiting till the expiration date. For example, let’s say a week after selling this put, Palantir’s stock moves up to $10 from the current price of $8. In this case, the put seller may “buy to close” the chain to lock in profits and roll the funds onto another chain (or another stock). That may be appealing to those who have the time and patience to play short-dated options many times over. But we typically let the option expire before choosing another chain (or another stock).

Also note that if you start having second thoughts and don’t want to own the stock if assigned, you may “buy to close” at a loss too, saving your $5,000 in process but perhaps losing few more dollars than the premium you received. In short, you may choose to close the chain any time before the expiration date.

Why we don’t mind owning PLTR stock at $5?

- At $5, Palantir will be trading at a forward multiple of 31. Sure, that still sounds too high and EPS estimates (and actuals) are likely to come down. But even after accounting for more downward revisions, the growth rate expected justifies a slight premium for a company still in infancy of its growth stage as a public company (less than two years) but is already showing strong fundamentals as described below.

PLTR EPS (SeekingAlpha.Com)

- At a market cap of $10B in this scenario, Palantir may even become an attractive buyout candidate for larger tech companies looking to bolster their data analytics. Google (GOOG) (GOOGL) recently announced a multi-year partnership with Palantir to help in its digital transformations. Imagine that. Google needing help with digital transformations sounds like a fish taking swim lessons at the Y! for additional practice. It also highlights Palantir’s potential as a stand-alone company as well as an attractive acquisition target under the right circumstances.

- At a market cap of $10B, Palantir’s cash on hand (and equivalent) at $2.5 Billion would represent 25% of the company’s total worth. The current market has thrown many “rare” situations at us. Palantir’s strong cash position, low debt ($267 Million), and beaten down stock qualifies as one such rare situation that investors with appetite for volatility may like.

A few misconceptions and things to be aware of

- It is not just about a lower strike price (or any other single factor) but the entire package: strike price, duration, premium and the willingness to own the underlying stock are equally important. We’d argue the last factor is the most important.

- Selling puts and writing covered calls are the safest ways to play the Options game. Sure, there are “risks” with any strategy, even with going long as the underlying stock can go to $0. But options allow both beginners and advanced investors to get a position in stocks they like without having to go all in at once.

- To reiterate, please be sure to have enough cash set aside to be able to buy the shares in case you get assigned. In this example, the amount to be set aside is $5,000 (10 contracts at 100 shares each at $5) in return for $210 immediately. Never chase higher premiums on a stock that you wouldn’t want to own at the strike price.

Conclusion

The 2022 market has proven to us in real time that while market is down, the additional income from selling puts and writing covered calls helps cushion the blow. Generally speaking, down-trending markets are more favorable for writing covered calls than for selling puts but when carefully identified, selling puts can be profitable on specific companies that you believe in. Palantir at $5 is something we believe in.

Be the first to comment