Torsten Asmus/iStock via Getty Images

Thesis

We recently wrote an article where we outlined why certain HY debentures were severely mispriced in our opinion. We were referencing short maturity BB credits in our article. At the opposite side of the spectrum an investor can find CCC and Not Rated credits which are the most susceptible to a recession. While we feel short dated, highly rated HY is mispriced, we find that more weakness is to come for the lowest rungs of junk debt with an upcoming recession that is going to weed out the weakest companies.

KKR Income Opportunities (NYSE:KIO) is a fixed income closed end fund from the KKR family. The vehicle’s objective is…

…a high level of current income with a secondary objective of capital appreciation. Under normal market conditions, the Fund will invest at least 80% of its Managed Assets in loans and fixed-income instruments. The fund seeks to leverage the KKR platform by tactically and dynamically allocating capital across companies’ capital structures where KKR Credit Advisors LLC believes its due diligence process has identified compelling investment opportunities.

With a high leverage ratio (~40% per Morningstar) and a portfolio that is tilted towards single-B, CCC and Not Rated credits (those buckets compose over 80% of the portfolio) the fund is ill set-up for a recession, even a mild one. The fund is down -27% already year to date (total return basis) and there might be more weakness to come due to fundamental concerns around some of the credits in the portfolio. While some HY CEFs have experienced price weakness due to a “mark-to-market” effect on their portfolios, in our opinion KIO is a vehicle where increased defaults in the portfolio are starting to be priced in. While it is too late at this stage to sell out of this name as a long-term investor, one should expect more weakness to come on the back of true fundamental deterioration in the underlying credits. KIO will not become an attractive opportunity until much later in this recessionary cycle.

The Fed is on an aggressive tightening path to fight inflation. Unfortunately there is little that monetary policy can do to fight a supply side issue. The Fed cannot end the war in Ukraine or open up the ports in the respective country for grains to be exported. That leaves the Federal Reserve with only one option – fight inflation by decreasing the demand side of the equation. This means that the Fed is going to aggressively raise rates until the housing market cools off and unemployment goes up. As per many leading banks, including JPMorgan, this is likely to result in a recession in 2023. Deutsche Bank is even more sanguine on the topic, predicting a major one. While there is still a probability for a soft landing, increasingly senior market participants are seeing one looming on the horizon.

CEF Metrics

This section details some CEF metrics and overall fund analytics:

Leverage Ratio: 40%

- Leverage is on the higher side

Expense Ratio: 3.12%

Manager: KKR

Yield: 10.79%

- Average for the asset class.

Discount/Z-Stat: -13.42% / -2.37

- The fund is currently trading at a discount.

- The discount is very wide.

AUM: $0.237 billion

- The fund has a low AUM for the asset class

Performance

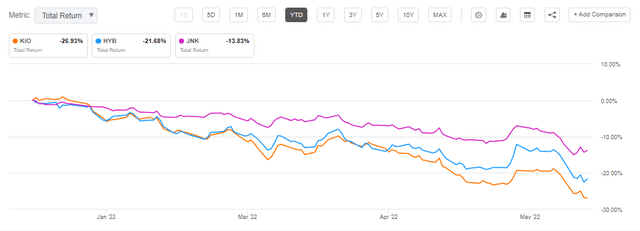

The fund is down approximately -27% year to date:

YTD Performance (Seeking Alpha)

When compared to HYB and JNK the fund exposes the weakest performance:

YTD Performance (Seeking Alpha)

Due to its composition the fund is very cyclical on a long term basis:

KIO Total Return (Seeking Alpha)

We can observe that on a 5-year time-frame the total return for KIO is now approaching 0%. Basically if an investor bought this name five years ago they would have almost nothing to show for it. Cyclical funds like KIO are to be traded, not held forever. We feel the current upcoming recession will cause the vehicle to shoot on the downside and go into negative territory for a lagging five year performance.

Holdings

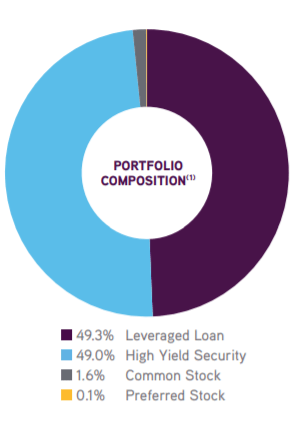

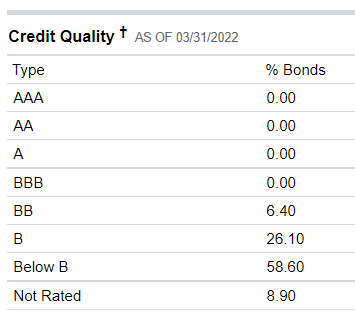

The fund has a 50/50 split between leveraged loans and high yield securities:

Holdings (Fact Sheet) The fund is overweight very low rated credits: Credit Quality (Fidelity)

This fund has a very credit risky portfolio. Being overweight CCC credits means that while the yield is higher the portfolio can experience very significant loses when the credit cycle turns from both a pure default perspective as well as from credit spread widening. This type of portfolio set-up is very aggressive, and more appropriate for a benign credit environment. With a recession looming and investors focusing on balance sheets, income statements and company’s ability to survive a revenue downturn the credits in the fund’s portfolio are not well set up. We much prefer CEFs with very robust, well rated (BB overweight) underlying instruments.

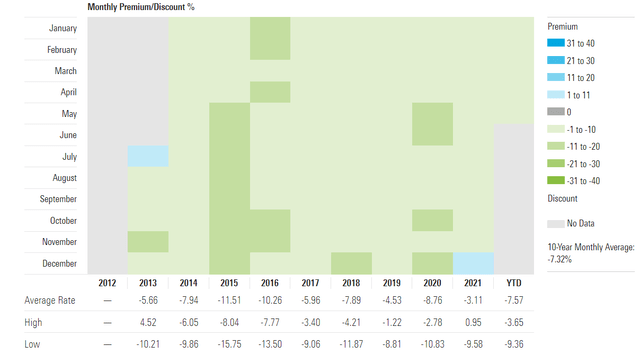

Premium/Discount to NAV

The fund is currently trading at a very wide discount to NAV:

Premium/Discount (Morningstar)

The fund is currently trading at a -13.42% discount to NAV. This level is approaching historical wides for the name as we can see from the above table. The widest discount to NAV observed was in 2015 when the fund recorded a -15.75% discount to net asset value.

We expect this state of affairs to persist, with a recessionary environment triggering a discount for illiquid assets, especially for not rated credits such as the ones present in the KIO portfolio.

Conclusion

KIO is a fixed income CEF from KKR. With an even split between high yield bonds and leveraged loans the fund has navigated well the duration carnage of 2022. The fund however runs very high credit risk, with a large concentration of CCC and Not Rated credits. Unlike some of its peers which focus on higher grade double-BB names, we fear KIO’s portfolio might experience actual defaults during the upcoming recession. We feel KIO’s aggressive credit intensive portfolio is ill set up for the upcoming recession.

Be the first to comment