Love Employee

Investment summary

There are numerous selective opportunities within the healthcare and medical technology domains for investors looking to shift up in the quality spectrum. Sangamo Therapeutics, Inc. (NASDAQ:SGMO) displays a loose affinity to these characteristics, and therefore leaves us trigger-shy and happy to sit on the sidelines. Operating metrics are unsupportive in the quality debate, despite some potential upside at the valuation front. Despite this, we are in the search for long-term cash compounders, even if there’s good chance the market will re-rate SGMO to the upside on the back of its clinical trial momentum. Alas, we rate SGMO neutral with a price target of $7.70.

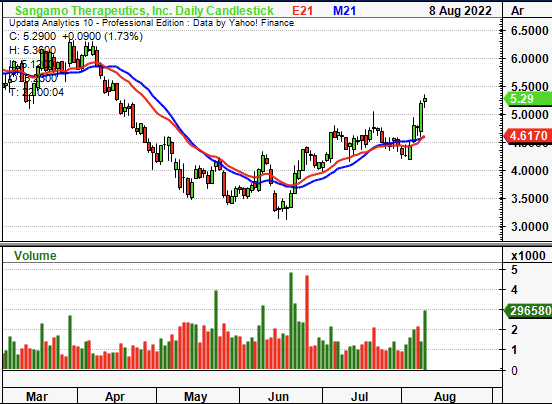

Exhibit 1. SGMO 6-month price action

Data: Updata

Q2 performance unsupportive of value thesis

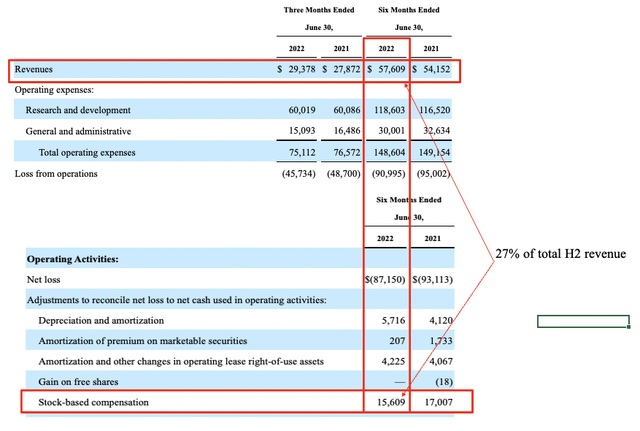

Touching on SGMO’s financials, 2nd quarter earnings were in-line with historical trends and came in ahead of consensus from top-bottom. Revenue printed at $29.4 million (“mm”), up from ~$28mm the year prior. The small upside at the top line stemmed from ~$1.3 million and $0.7 million gains on collaborations with Novartis (NVS) and Sanofi (SNY), respectively. Moving down the P&L, GAAP OPEX came into $75mm, ~190bps decrease YoY. Curiously, SGMO excludes stock-based compensation (“SBC”) its non-GAAP OPEX calculation, however this skews the data by estimation, because SBC is realistically expenditure. Hence we adjust Q2 FY22 SBC into non-GAAP OPEX. For the 6 months to June 2022 SBC totaled more than $15mm, or 27% of total revenue for H1 FY22, as seen in Exhibit 2 [taken from SGMO’s Q2 FY22 10-Q].

Exhibit 2. H1 FY22 stock-based compensation = 27% of H1 FY22 total revenue

Sure, there is the clinical trial and regulatory momentum that’s likely to have some impact on the share price. However, capital allocation is incredibly important in the current regime, not to mention measures of profitability. We can’t get there on a 27% SBC margin for the half when there’s more selective opportunities within the healthcare universe.

Data: HB Insights, SGMO 10-Q: Q2 FY2022

Meanwhile, cash burn was a $113mm loss for the quarter stemming from a net loss of $87mm, an improvement from the loss of $121mm the year prior. The smaller loss was attributed to a decrease in liabilities and other expenses. However, and again, this was offset by the $15.6mm in SBC, as seen above. For hypothetical sakes, say we reduced the SBC by the stock’s performance these past 12 months. The SGMO share price is down 47% YoY, so adjusting SBC by that amount totals $8.26mm and sees another $7.3 million added in net cash to net loss of $105 million.

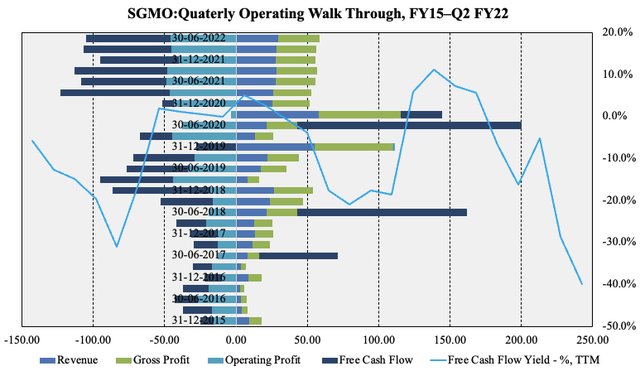

Exhibit 3. Quarterly operating metrics are unsupportive of harvesting equity premia investors are paying a premium for in FY22 [namely, profitability].

Also note the spread between top-bottom line widening, with operating losses outweighing earned income, pushing towards further capital raises

Data: HB Insights, Refinitiv Eikon

Moreover, the company’s cash-based financials could potentially turn out to be a forward looking issue for investors. SGMO left the quarter with $363 million in cash and marketable securities (highly liquid, cash-like investments), down from $464 million in Q4 FY21. SGMO also raised another $43 million throughout the last quarter.

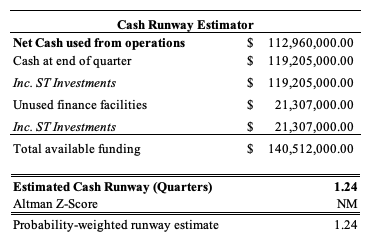

However, stripping out the $245 million marketable securities – made mostly up of 44% commercial paper and 17.5% certificates of deposit – and cash available is $119.20 at the end of Q2 FY22. As seen in Exhibit 4, there’s a risk SGMO will need to complete further (potentially dilutive) equity rounds into the future to secure additional cash. Whilst it left with ~$346mm in cash and marketable securities, this suggests runway of 3.4 quarters based on assumptions seen in Exhibit 3, whereas just cash alone, the runway is only 1.2 quarters before an additional injection of cash is needed. Moreover, with capital markets shifting and cost of capital increasing monthly, this is a risk to be factored in also.

Exhibit 4.

Data: HB Insights, SGMO SEC Filings

Full-year guidance was reiterated and SGMO forecasts non-GAAP OPEX to land between $280–$310mm. Notably, the OPEX excludes planned SBC compensation of $40mm (a non-cash expense that we feel should be expensed), and therefore could reach $350mm by estimate. The expenditure is allocated to developing its lead programs, management note.

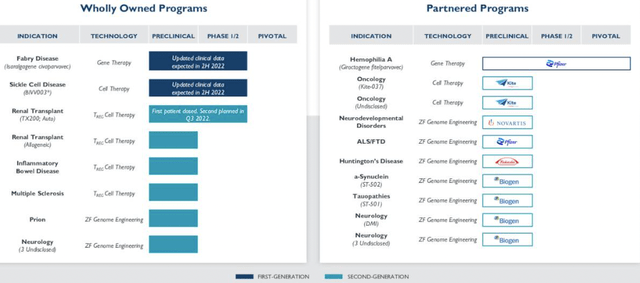

Clinical trial momentum speaks to long-term contrarians

SGMO maintained the pace of clinical and regulatory momentum last quarter was well. For instance, the Phase I/II STAAR study evaluated giroctocogene fitelparvovec for SGMO’s ST-920 gene therapy program for Fabry disease. Investors can expect further readouts from the study in H2 FY22, starting with the Society for the Study of Inborn Errors of Metabolism, SSIEM, annual symposium at end of August. Moreover, the Phase 3 study is in active planning, with the Safety Monitoring Committee endorsing the progress to escalation phase. This was determined at 5e13 vector genomes per kilogram. Sixteen sites are open and in full recruitment, including in Australia, Canada and Italy.

The company also assumed full control of BIVV003 – formerly known as SAR445136 – indicated for the treatment of sickle cell disease. The asset tucks into SGMO’s wholly-owned pipeline. SGMO is completing the Phase I/II PRECIZN-1 trial to this effect, and results are promising. Data showed that 75% of patients dosed with previous manufacturing process continued to be free of vaso-occlusive crises. Investors can expect further readouts of the Phase 1/2 trials before end of H2 FY22.

In addition, the STEADFAST study made in-roads last quarter. The trial is investigating the safety and efficacy of SGMO’s chimeric antigen receptor-engineered regulatory T cells (“CAR-Treggs”) candidate, named TX200. The hypothesis is interesting here. The study is investigating TX200 in the “… prevention of immune mediated rejection in HLA-A2 mismatch kidney transplantation,” specifically from in vivo. It had successfully dosed its first patient with engineered CAR-Treggs in March, and over the 4 months to date, no adverse treatment effects are noted. The company believes it “to be a historic first” from the earnings call. Manufacturing for the second patient in the STEADFAST study also received a kidney transplant in Q2 FY22, and dosage is expected by end of FY22.

Furthermore, the EU commission granted TX200 orphan medicinal product designation. This stemmed from the opine of the European Medicines Agency Committee for Orphan Medicinal Products. One criteria for this designation is that no alternative/substitute treatment must exist and thus TX200 looks to potentially be positioned to create a remedial breakthrough in various complex disease segments. This regulatory momentum pushes SGMO one more notch up the quality spectrum of reducing the likelihood of organ transplant rejection.

SGMO Wholly-owned and partnered programs pipeline

Data: SGMO Q2 Earnings presentation

One final talking point is SGMO’s beta zinc-finger based editor and epigenetic zinc finger regulators. The base editor adds another layer into the company’s arsenal for platforms that increase/decrease the expression of genes in a tunable way. Regarding the editor, Chief Scientific Officer Jason Fontenot:

“A notable aspect of our beta editor is its compact architecture [size], allowing packaging into a single [Adeno Associated Virus] AAV vector. This is a critical requirement for the efficient use in many therapeutic applications, particularly in vivo. The epigenetic zinc finger regulators can be used for multiplex engineering of many cell types, including CAR T cells and CAR-Tregs, and has the potential to be deployed for both ex vivo and in vivo applications.”

Importantly, on the size front, SGMO reckons this is a differentiating factor because it can be deployed in a variety of delivery vehicles, and not just AAV gene delivery alone. The goal is therefore to address a spread of conditions with respect to engineering. That’s something to think about, given the future of infectious disease management.

Valuation

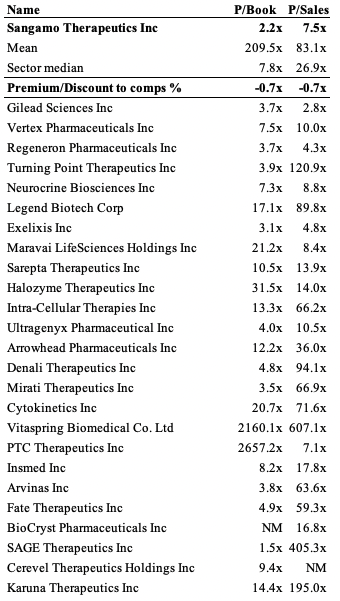

There’s no real validity in estimating the future cash flows of SGMO in our opinion. First, SGMO’s investment case is different, and we’d be looking to it as a stabilizer in equity portfolios. Second, we aren’t confident on the predictability of these and it with a series of forecasted operating losses to remain, there’s little flesh to put on the skeleton anyway. We do, however, forecast $30 million in SBC for this year, stretching up to $33 million in FY23 and $44 million in FY24, as a point of reference. Shares trade at an average ~70% discount to the GICS Industry peer median, however this is more than justified considering the juggernauts within the list.

Exhibit 5. Multiples and comps

Data: HB Insights;

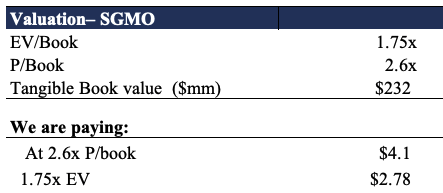

We are also paying 2.6x tangible book value (“TBV”), which also equates to 1.75x enterprise value (“EV”) to TBV. As seen below, this does present some opportunity at the value level. At this 1.75x multiple, we’d theoretically be paying $2.78 per share, a 47% discount to the current market price. With this adjustment, we price SGMO at $7.73. However, with no recordable price to cash flow (net cash loss of $112 million) the question of value is less authentic.

Exhibit 6.

Data: HB Insights Estimates

In short

There are better opportunities than SGMO to capture the rotation back into healthcare and risk-assets in general. We are searching for selective opportunities within the space that display a high affinity to factors like profitability, high ROIC, free-cash positive, and earnings momentum. SGMO displays none of these, but does offer investors exposure to a raft of clinical trial plays, which opens up the longer-term opportunity by estimation.

There is also some potential upside in the valuation sense when comparing SGMO’s market cap and EV to its tangible book value, however, in the absence of additional supportive factors, this could just be what the stock is worth. However, we are a little more optimistic, and feel the share is worth around $7. Despite this, we rate SGMO neutral.

Be the first to comment