jetcityimage

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on July 24th, 2022.

Conagra Brands (NYSE:CAG) is a household name. That is, even if you don’t know that CAG owns a particular brand. It might be a side effect of being an investor, but I’m constantly checking what brand is owned by who in the grocery store. For the average household in America, the list below will be brands they have in their freezers or cupboards right now.

In a high inflationary environment, it’s good to have strong brand recognition for passing higher costs onto customers and consumers. CAG was able to pass on higher expenses due to inflation. However, inflation came in hotter than they even anticipated.

Cost of goods inflation was expected at 9% from management, which came in at 16%, per the investor presentation. That was part of what they saw and believe will continue to impact them into their next fiscal year. Their fiscal year ends in May, interestingly enough. We had noted high inflation was a risk to the stock where they could struggle, and we continue to see this playout. They aren’t the only company having to maneuver through this environment, though.

Conagra Brands Earnings Review And Outlook

They announced a mixed quarter with guidance below what analysts were expecting. EPS beat but revenue missed expectations – even as it rose 6.2% year-over-year.

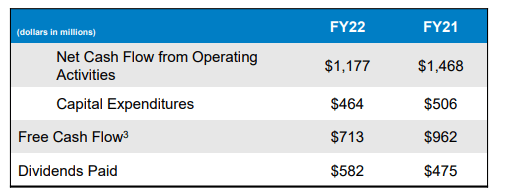

Full-year adjusted EPS year-over-year fell 10.6% to $2.36 from $2.64. Free cash flow fell year-over-year based on a significant drop in net cash flow from operating activities. Free cash flow here still covers the dividend, even the newly raised dividend.

CAG Cash Flow (Conagra)

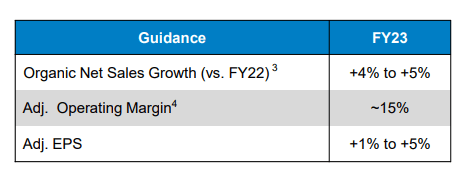

The outlook for the fiscal year 2023 has organic net sales growth of 4 to 5%. Adjusted diluted EPS growth is expected to be 1 to 5%.

CAG Guidance (Conagra)

With this dampened outlook, it spooked investors. We saw the shares fall after posting the results. They also guided below analysts’ expectations last year, too, for fiscal 2022. Unfortunately, they had guided for an adjusted EPS of $2.50. We know now that they came in short of this guidance.

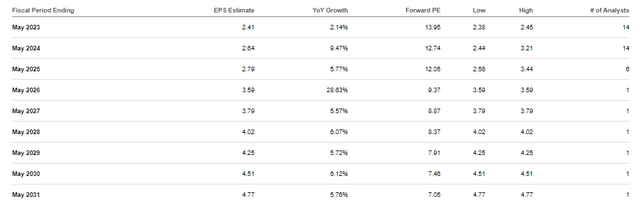

Analysts still believe that over the next few years, CAG should be able to deliver around 5.8% EPS growth.

CAG EPS Outlook (Seeking Alpha)

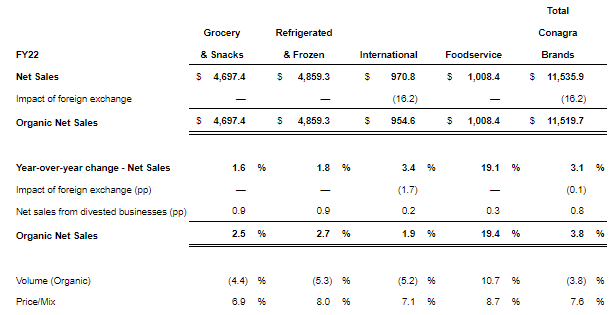

For fiscal 2022, the foodservice segment saw the highest increase in net sales. While that is encouraging, it is a minor segment relative to their grocery and snacks categories and the largest segment of refrigerated and frozen foods.

CAG Earnings (Conagra)

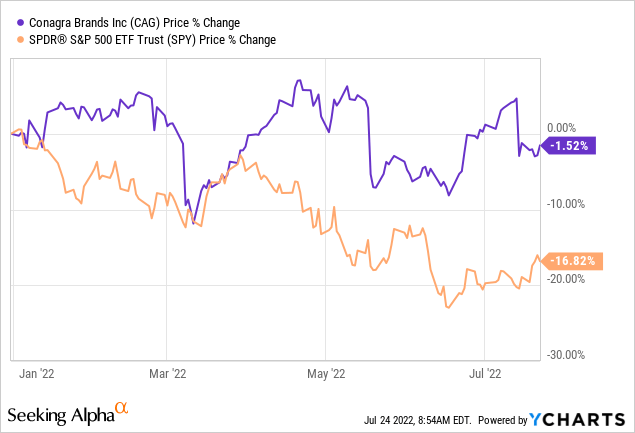

Despite this latest drop in share price, shares of CAG are holding up significantly better than the broader market on a YTD basis. While I’m invested in it for the dividend ultimately, I believe we are seeing the defensiveness of a packaged food stock play out here.

No matter what the current economic environment, a person has got to eat. At some point, food becomes even more important than a cell phone. (Yes, a reference to T mentioning that the payment cycles they were experiencing were becoming elongated as customers choose between basic necessities and a cell phone.)

Ycharts

Conagra’s Dividend Looking Attractive

Despite the current challenges, investors still received the good news that the dividend would be raised. The raise wasn’t as strong as it was in some prior years, but that’s probably a good thing. Leaving more cash for them can strengthen the balance sheet now to see them through this period and come out better on the other side.

A 5.6% increase from a quarterly $0.3125 to $0.33 isn’t anything to scoff at anyway. Inflation is high now, but chances are it won’t last into perpetuity. At some point, inflation will become much milder as the Fed continues to raise rates and slow down the economy.

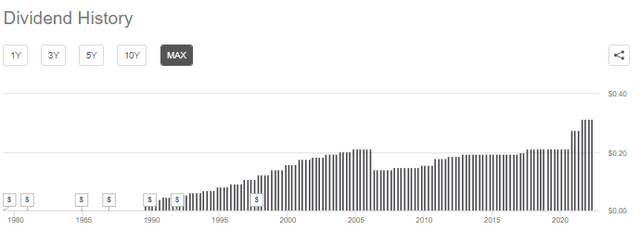

With that raise and the latest slide in the stock price, the dividend yield comes to nearly 4% now. Their dividend history is one that has generally been growing. They cut 2006, but it has been trending higher since. They don’t regularly raise every single year, as shown below. With this latest raise, it makes me believe that they are a bit more committed to a more regular and steady annual raise.

CAG Dividend History (Seeking Alpha)

As we know now, they missed their EPS guidance for the year based on higher inflation challenges. The dividend payout ratio with their new dividend based on the 2022 EPS puts the payout ratio at 56%. If they come in below guidance once again (which they did this year, so it is a very real risk), we could see the payout ratio rise.

They raised the dividend higher than anticipated EPS growth, even on the high end of their guidance range. That would mean that future dividend growth will either be slower or earnings growth will have to pick up. I’m long the shares, so I’m hoping it is the latter here. Given that I don’t believe inflation will last forever, I think that growth can pick up in the next couple of years.

CAG Stock – Trading Down Or Trading In

This is an important topic to discuss in a food company such as CAG. Trading down is when a consumer, instead of buying a name brand, opts for the generic brand. Nothing wrong with this at all; the average household will have tons of food in their house at this moment that are off-brand products.

There are reports that this is happening in the grocery stores. As inflation eats away at the purchasing power of people everywhere, they need to stretch their dollars further. In some cases, it isn’t even stretching the dollar further but just trading down to an off-brand as the name brand becomes too expensive.

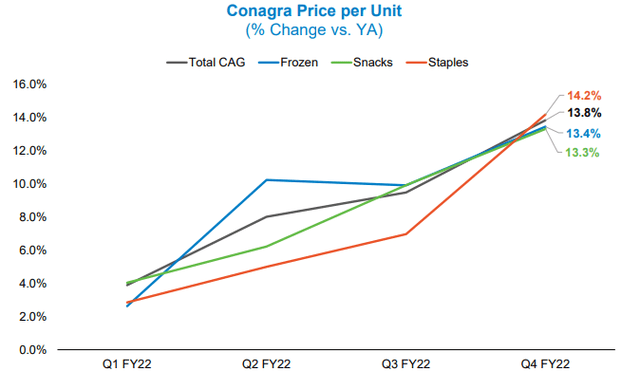

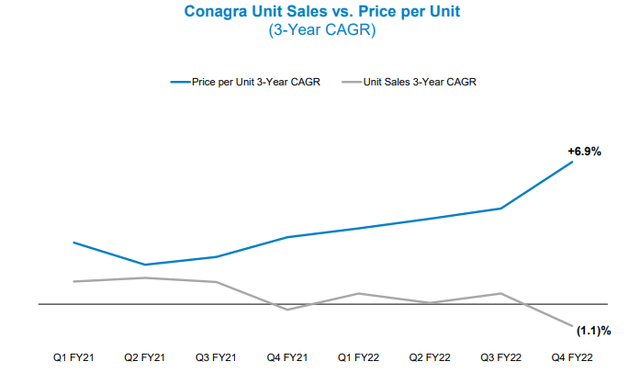

Still, CAG has shown that they’ve been resilient to this by being able to raise prices without sacrificing unit sales substantially.

We see above the price per unit change. They’ve put through around 13 to 14% price increases. At the same time, the unit sales have only begun to fall just recently.

One of the offsetting factors they have referred to is the benefits of “trading in.” That would be consumers choosing to buy groceries rather than go out and eat. It accomplishes the same thing as trading down, as going out to eat is generally more expensive. The more that a shopper is in the grocery store and out of restaurants, the greater chance that they will pick up a CAG-branded product.

The below was in reference to a question from an analyst on their conference call regarding trading in and elasticity.

It’s pretty clear as we look at the data we are experiencing trading in that others referenced and the demand for our products remains quite strong. So as you saw in the slide brand health is in a very good place and I would say no to the question of are we experiencing something unique in elasticity? Based on what we are seeing right now the answer to that is inequitably no.

Conclusion

The latest earnings saw shares of CAG fall and become attractive once again. I had recently picked up shares of CAG via selling cash-secured puts. The strike price was at $32 and collected $0.55 in premium. That knocked the breakeven down to $31.45.

That was after a previous trade saw the written puts expire worthless and locked in a $0.40 premium. That trade itself was a follow-up trade in late 2021, where $0.44 in premium was collected. All in all, I’ve been quite happy with the success of trading CAG. Now being long the shares, I’m quite content.

I left some room to add even more shares when appropriate. In this volatile market, there is no sense going all in at once. I also suspect the higher inflation and challenging economic period will persist. Meaning we don’t have to rush into any trades. However, I suspect that in the next year or two, we will still look back and view 2022 as a good buying opportunity.

Be the first to comment