Eoneren/E+ via Getty Images

Many investors have panicked this year due to the onset of a bear market. The sell-off of the broad market has been caused by the surge of inflation to a 40-year high and fears that the resultant interest rate hikes of the Fed may cause a recession. While the short-term outlook for the economy is negative, investors with a long-term perspective should view the bear market as a great opportunity to purchase stocks with solid business fundamentals at attractive prices. American Assets Trust (NYSE:AAT) certainly fits this description. The REIT is offering a nearly 10-year high dividend yield and is trading at a 10-year low price-to-FFO ratio due to its 22% decline this year.

Business overview

American Assets Trust is a REIT formed only in 2011 but its predecessor, American Assets, was founded in 1967. As a result, the REIT has great experience in office, retail and residential properties in Southern California, Northern California, Washington, Oregon and Hawaii. The trust has an office portfolio of nearly 4.0 million square feet, a retail portfolio of approximately 3.1 million square feet and 2,112 multifamily units.

American Assets Trust enjoys two key competitive advantages, namely its multi-decade expertise in its markets and the location of its properties. Most of its properties are in in-fill locations, in which zoning regulations restrict the development of new properties to a great extent. In addition, most of its submarkets are premier coastal markets with high population density and high barriers to entry. These characteristics offer American Assets Trust a strong negotiating position with its tenants and enable the trust to implement meaningful rent hikes every year.

American Assets Trust was hurt by the coronavirus crisis in 2020, as many of its tenants in its office and retail properties came under pressure. Nevertheless, the REIT posted just a 14% decrease in its funds from operations (FFO) per unit, from $2.20 in 2019 to $1.89 in 2020.

Even better, thanks to the massive distribution of vaccines, the trust partly recovered last year and has accelerated business momentum this year. In the first quarter, its same-store net operating income and its FFO per unit grew 18% and 50%, respectively, over the prior year’s quarter, primarily thanks to increased tourism in Hawaii. Moreover, thanks to an improved business outlook, management raised its guidance for the annual FFO per unit from $2.09-$2.17 to $2.13-$2.21. At the mid-point, this guidance implies 8.5% growth.

A unique challenge for numerous companies is the surge of inflation to a 40-year high this year. High inflation greatly increases the cost base of most companies, and thus, it exerts great pressure on their profit margins. However, American Assets Trust raises its rents meaningfully every year thanks to its strong negotiating position in its markets. Therefore, it is shielded from high inflation to a great extent. Analysts seem to agree on this view, as they expect the REIT to grow its FFO per unit by 10% this year and by another 5% next year.

Valuation

The only meaningful effect of inflation on American Assets Trust is its negative effect on the valuation of the stock. High inflation reduces the present value of future cash flows significantly, and thus it results in lower price-to-FFO ratios.

However, the correction of American Assets Trust seems to be overdone. The stock is now trading at a forward price-to-FFO ratio of only 13.3, which is a 10-year low level and much lower than the 10-year average of 20.0 of the stock. The current valuation of the REIT is too cheap, especially given its strong performance record and its competitive advantages in the markets in which it is present. American Assets Trust has grown its FFO per unit by 6.6% per year on average over the last decade, with remarkable consistency. Its bottom line decreased only in one year, in 2020, due to the extraordinary downturn caused by the pandemic.

It is also important to realize that the 40-year high inflation has resulted primarily from the unprecedented fiscal stimulus packages offered by the government in response to the pandemic. As the effect of these packages is likely to fade and the Fed is currently doing its best to lead inflation towards its long-term target of 2%, inflation is likely to revert towards its normal levels in the upcoming years. When that happens, American Assets Trust is likely to revert towards its historical valuation level. It thus has the potential to offer excessive capital gains to its unitholders merely thanks to a mean-reversion of its valuation.

If the price-to-FFO ratio of the stock expands from the current level of 13.3 to the historical average of 20.0, the stock will enjoy a 50% rally. Even better, the trust is expected to grow its FFO per unit and hence it can offer a double gift to its unitholders; higher FFO per unit and a higher price-to-FFO ratio.

Dividend

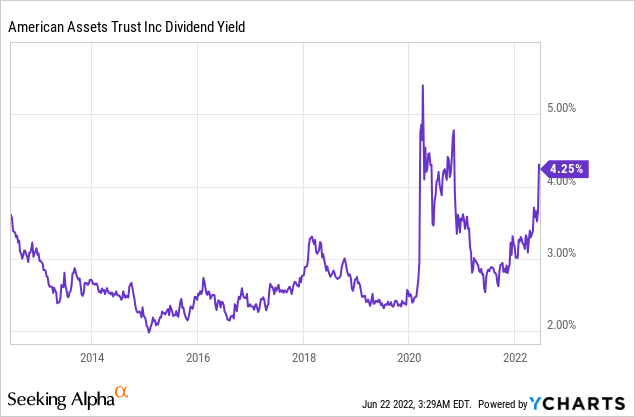

Due to the 22% decline of its stock price this year, American Assets Trust is currently offering a nearly 10-year high dividend yield of 4.3%.

As shown in the above chart, the stock offered a higher yield only for a few days in the unprecedented sell-off of the broad market in early 2020 due to the onset of the pandemic.

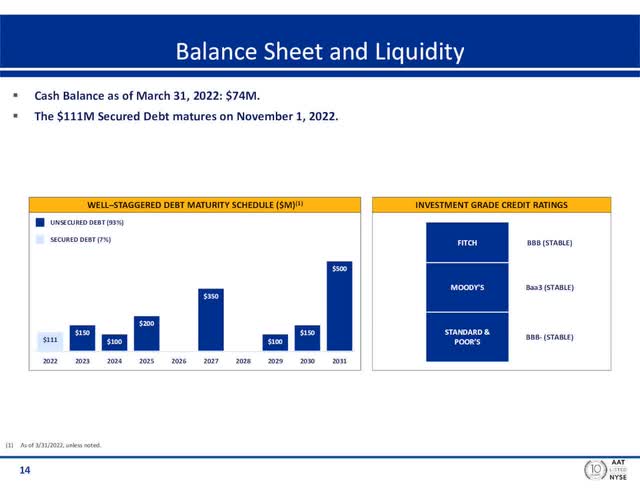

Thanks to its healthy payout ratio of 57%, American Assets Trust is covering its dividend with a wide margin of safety. The only caveat is the somewhat high debt load of the REIT. Its interest expense consumes 55% of its operating income, thus rendering the trust somewhat vulnerable to severe downturns. However, its net debt (as per Buffett, net debt = total liabilities – cash – receivables) stands at $1.6 billion, which is only 70% of the market capitalization of the stock and approximately 10 times the annual FFO. This helps explain the investment-grade credit rating the REIT has received from the three major credit rating firms.

In addition, American Assets Trust has well-laddered debt maturities.

AAT debt maturities schedule (Investor Presentation)

Given also its resilient business model and its reliable growth trajectory, the REIT can cover its dividend with a wide margin of safety.

Final thoughts

Just like many other REITs, American Assets Trust is resilient to high inflation, as it can raise its rents considerably to offset the effect of inflation on its results. Due to the broad market sell-off, the stock has become cheaply valued and is currently offering a nearly 10-year high dividend yield of 4.3%, with the dividend covered with a wide margin of safety. Nevertheless, due to the markedly steep decline of the stock and the broad market as well as the negative market sentiment prevailing right now, the pressure on the stock price of the REIT is likely to persist in the short run. Therefore, I recommend purchasing the stock near the technical support around $21-$23. At that level, the stock will be offering a 5.8% dividend yield (at the mid-point), while it will also have the potential to offer excessive capital gains over the next few years.

Be the first to comment