Aranga87/iStock via Getty Images

Air Products and Chemicals (NYSE:APD), a traditional supplier of industrial gases, has gained new markets and investor audiences with its expertise, particularly for hydrogen. It is typical that large industrial gas providers have sizable tolling contracts and take-or-pay contracts that ensure stable revenues, for example, for healthcare oxygen.

However, the company’s foray into hydrogen has become riskier. Methane (natural gas) for gray and blue hydrogen become much more expensive. Wind/solar energy for green hydrogen is also more expensive, as has energy for all industrial operations in Europe.

Potential investors should be aware that the company has an unusual fiscal calendar: its second quarter ended March 31 and its third quarter ended June 30. Air Products’ 2022 fiscal year will end September 30, 2022.

In a change from my earlier analysis, I recommend selling (or not buying) Air Products.

Macro

Air Products is being affected by macroeconomic events in at least three ways:

*inflation in all costs, which it must try to pass through,

*the proposed Inflation Reduction Act in the US, which, as described below, could be favorable to Air Products,

*and far higher costs for natural gas worldwide (and electricity in Europe), which is likely to constrain the profitability of making hydrogen, whether gray, blue or green. Natural gas costs are also described below.

Inflation Reduction Act

The Inflation Reduction Act has been proposed as a reconciliation bill (needing only 50 senators’ votes plus the vice president’s) that would front-load about $500 billion in spending ($385 billion for climate change and energy) with revenue recovery to pay for the spending back-loaded. According to a University of Pennsylvania analysis, the bill would do little to reduce inflation and even increase it through 2024.

Air Products’ Quarter Ending March 31, 2022 (fiscal 2Q) Results and Guidance

For the company’s second fiscal quarter of 2022-the quarter ending March 31, 2022-Air Products reported net income up 13% compared to the same quarter a year earlier: $537 million or $2.38/share. Adjusted EPS was also $2.38/share while adjusted EBITDA was $1.02 billion, up nine percent.

The company’s four geographic segments are: Americas, Asia, Europe, and the Middle East. For total sales of $2.95 billion in the quarter ending March 31, 2022, this divided:

Americas: 40.3%,

Asia: 25.5%,

Europe: 25.1%,

Middle East: 1.0%,

Corporate & other: 8.1%.

Third quarter (April 1-June 30, 2022) adjusted EPS guidance is $2.55-$2.65/share. For fiscal year 2022 (October 1, 2021-September 30, 2022), Air Products guides to adjusted EPS of $10.20-$10.40/share, up 13-15% over the prior fiscal year.

The company expects capital expenditures of $4.5 to $5.0 billion during fiscal-year 2022.

Operations and Hydrogen

Air Products and Chemicals produces 1) atmospheric gases including oxygen, nitrogen, and argon; 2) process gases, such as hydrogen, helium, carbon dioxide, carbon monoxide, syngas; and 3) equipment for gas production or processing for customers in refining, chemicals, gasification, metals, manufacturing, food and beverage, electronics, and magnetic resonance imaging.

Hydrogen continues to attract investor attention as an alternative to carbon-containing fuels.

Air Products makes “gray,” “blue,” and “green” hydrogen. Gray hydrogen is made from hydrocarbons (mainly methane, or natural gas). Blue hydrogen is also made from hydrocarbons but includes carbon capture and sequestration. Green hydrogen is made using wind and solar electricity to split water into oxygen and hydrogen.

From an engineering and consumer marketing standpoint, investors should be aware hydrogen has an extremely wide explosive range in both air and oxygen. This makes it very difficult to use on anything other than large industrial, top-safety-measure applications, and rockets.

Quoting from Explosive Lessons in Hydrogen Safety by NASA scientist Russell Rhodes (with emphasis added),

Hydrogen has a very broad flammability range-a 4 percent to 74 percent concentration in air and 4 percent to 94 percent in oxygen; therefore, keeping air or oxygen from mixing with hydrogen inside confined spaces is very important. Also, it requires only 0.02 millijoules of energy to ignite the hydrogen-air mixture, which is less than 7 percent of the energy needed to ignite natural gas.

Projects

Air Products has several big new projects underway. For each, the project capital is the total, not APD’s share.

*a $12 billion air separation/gasification/power join venture with Aramco in Saudi Arabia;

*a $1.3 billion net-zero hydrogen energy complex in Alberta, Canada;

*a $2.0 billion hydrogen project for World Energy in California;

*a $7.0 billion carbon-free hydrogen project for NEOM in Saudi Arabia;

*a $4.5 billion clean energy (blue hydrogen) complex in Louisiana.

Natural Gas Supplies and Costs

Natural gas has experienced a step-change in cost and demand. Due to the Russian invasion of Ukraine and consequent US and European sanctions, Russia has cut back (to 20% of Nord Stream’s capacity) the natural gas it exports to Europe. Before the cutbacks, Russia supplied 40% of Europe’s natural gas.

The EU has not been able to quickly replace the Russian cuts. This has led to emergency measures in Europe, including a requested voluntary reduction in natural gas use of 15% as countries try to stockpile natural gas for winter.

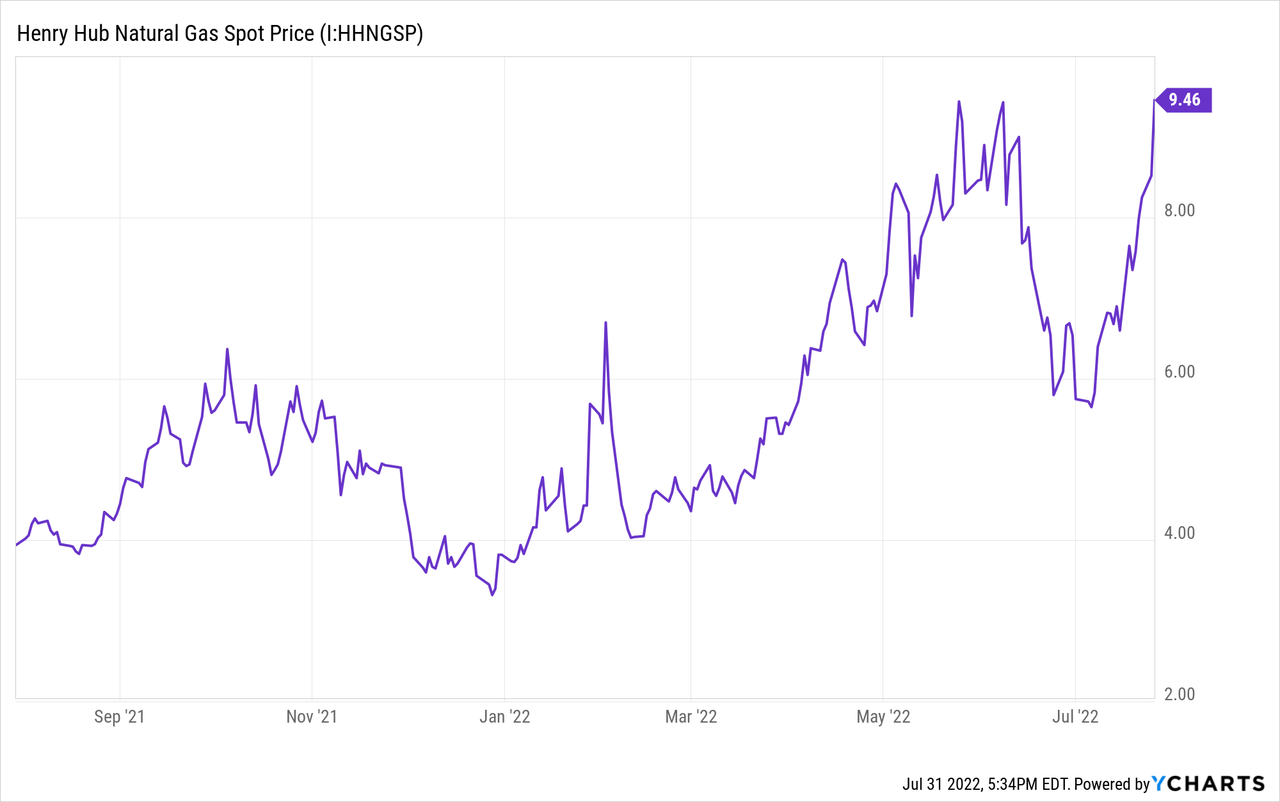

To illustrate, the Henry Hub, Louisiana natural gas price for September 2022 delivery closed at $8.23/MMBTU on July 29, 2022. (This is already seasonally higher than normal due both to EU draws on LNG exports and very hot US summer weather.)

However, the Dutch Title Transfer Facility (TTF) liquefied natural gas price for September closed at $57.29/MMBTU. Not only is this seven times the US spot price, but on a heat-equivalent basis, this equates to $344/barrel for oil.)

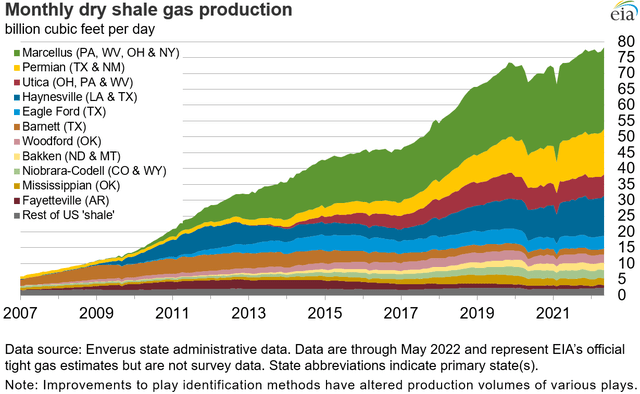

US dry gas production is 96.7 BCF/D. The graph below shows US shale gas production, so does not include conventional production. Haynesville production (dark blue) is near Air Products planned new blue hydrogen facility.

Energy Information Administration

However, as noted, in European (and some Asian) buyers are competing for the same natural gas in the form of LNG exports and are willing to pay higher prices. This situation is likely to continue for as many months or years as Russia exerts its clout over the EU by cutting Russian gas exports. The end result is natural gas is less affordable as feedstock for blue and gray hydrogen.

Competitors

Air Products and Chemicals is headquartered in Allentown, Pennsylvania.

Product competitors include Air Liquide, Linde, and privately held Messer Americas.

For gray and blue hydrogen whose feedstock is natural gas, both the cost of natural gas and other gas demand competitors should be considered. In both the US and Europe, natural gas (methane) is used not just to make chemicals like methanol and to fire boilers to generate electricity, but also used directly for heating. The particularly dire need for natural gas (and so high cost) in Europe to replace Russian imports means production of blue and gray hydrogen in the EU is likely to be a non-starter.

In the case of green hydrogen production (from wind and solar), it is likely that providing basic electricity for residential, commercial, and essential manufacturing use-again, particularly in Europe-will come ahead of using (wind and solar-generated) electricity to make no-carbon hydrogen fuel.

Governance

Institutional Shareholder Services (ISS) ranks Air Products’ overall governance on July 1, 2022, as a 5, with sub-scores of audit (5), board (6), shareholder rights (7), and compensation (3). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

Air Products and Chemicals’ ESG ratings from Sustainalytics at May 2022 were “low” with a total risk score of 11 (2nd percentile). Component parts are environmental risk 5.9, social 1.3, and governance 3.6. Controversy level is 1 (or “low”) on a scale of 0-5, with 5 as the worst.

Shorts were 0.9% of floated shares at July 15, 2022.

A small percentage of shares (0.3%) is held by insiders.

Beta is 0.84: the stock moves directionally with the overall market but less steeply.

At March 31, 2022, the four largest institutional holders, some of which represent index fund investments that match the overall market, were Vanguard (9.0%), Blackrock (6.6%), State Farm Mutual Auto Insurance Company (5.8%), and State Street (4.75%).

Financial and Stock Highlights

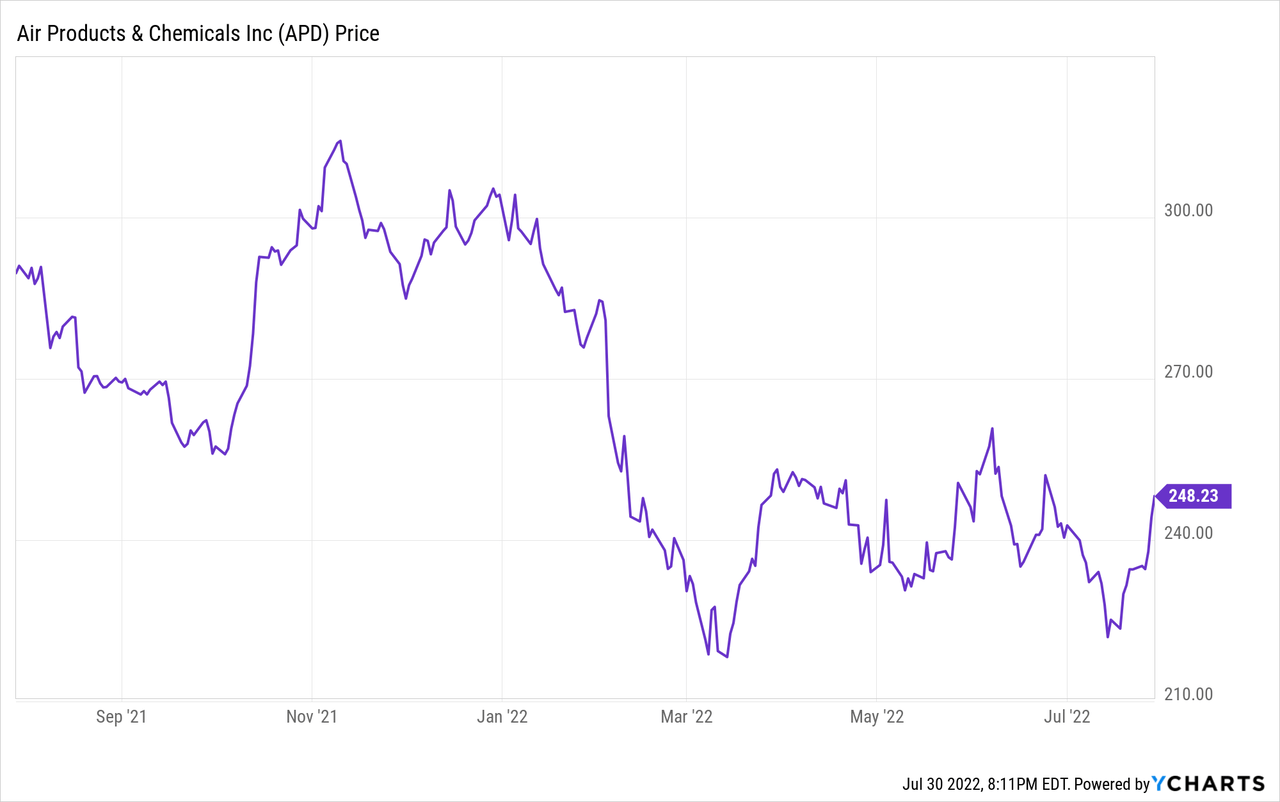

Market capitalization is $55.1 billion at a July 29, 2022, stock closing price of $248.23.

The 52-week price range is $216.24-$316.39 per share, so the closing price is 78% of the 52-week high and 88% of the one-year target of $282.71 per share.

Trailing twelve-months’ EPS is $9.77. The average of analysts’ estimates for 2023 EPS (for year ending 9/30/2022) is $11.53. This gives a current price/earnings ratio of 25.4 and a forward price/earnings ratio of 21.5.

Trailing twelve-month (April 1, 2021-March 31, 2022) return on assets is 5.5% and return on equity is 15.8%.

Trailing twelve months’ operating cash flow is $3.06 billion and leveraged free cash flow is negative at -$14.8 million.

At March 31, 2022, the company had $12.9 billion in liabilities and $27.4 billion in assets, giving Air Products a liability-to-asset ratio of 47%.

Of the liabilities, $3.2 billion is current liabilities and $6.5 billion is long-term debt.

Book value per share of $62.92 is a fraction of the market price, implying extremely positive investor sentiment.

The company’s ratio of enterprise value to trailing twelve months’ EBITDA is 15.9, higher (less attractive) than the preferred ratio of less than 10.

A dividend of $6.48/share provides a small 2.6% yield.

Mean analyst ranking is a 2.2, close to “buy,” leaning slightly toward “hold,” from twenty analysts.

The company will report quarterly results (for the third fiscal quarter ending June 30, 2022) on August 4, 2022.

Positive and Negative Risks

Air Products and Chemicals faces higher operations, labor, and financing costs due to inflation, which it may not necessarily be able to recover with higher prices. Moreover, current high supply chain and energy costs may slow transition-to-hydrogen plans in the US and Europe.

As with anything political, it is possible the Inflation Reduction Act may not pass.

Indeed, despite the company’s expertise, the high price of natural gas (and electricity in Europe, as well) which is expected to continue for a while-and the material handling challenges for hydrogen-especially its explosiveness across a wide range of condition-make it dubious that hydrogen manufacture for no-carbon fueling can be a substantial contributor to the company’s profitability any time soon.

Recommendations for APD stock

Air Products may be attractive to some dividend investors at its current 2.6% yield.

However, I am downranking it from “buy” to “sell,” based on the higher feedstock costs it faces–and will face for at least many months–for natural gas around the globe as well as for all energy in Europe. While some customers may be willing to pay up for hydrogen, these higher costs can be expected to halt or at least slow the transition to no-carbon fuels and infrastructure.

More generally, it is also unclear that Air Products will be able to completely pass through energy costs that are 4-5x higher in Europe–a major market–in the form of higher prices across its entire product line.

ESG-focused investors like the three of the company’s four largest equity holders (Vanguard, Blackrock, and State Street) may continue to find the company of interest for its new technologies and projects, particularly for producing green hydrogen.

Air Products

Be the first to comment