Stephen Lam

We are hold-rated on Salesforce, Inc. (NYSE:CRM). Salesforce is one of the leading customer relationship management companies, with around 24% market share in 2021. Salesforce remains a favorite at Tech Stock Pros, but we are bearish on the stock as we expect the company to face near-term pressure from macroeconomic headwinds affecting customer spending CRM budgets.

Salesforce offers cloud-based software that gives companies tools to identify more prospects, close more deals, and give their clients better services. Hence, the company’s business is highly reliant on the spending budgets of its customers, and we believe it is hard to forecast demand or how much budget will be allocated from customers towards their CRMs under current financial stresses.

Financial stress spilling into businesses and enterprises’ CRM spending

Salesforce beat expectations for fiscal Q2 2023 but came up short on guidance for Q3 2023 and FY23. We expect Salesforce will face pressure in the short term as customers figure out their spending expectations under current macroeconomic headwinds. We expect fewer companies to embark on new projects or expand their CRM spending budget under current inflationary pressures.

Macroeconomic headwinds, including inflation, foreign exchange headwinds, and rising interest rates, are taking a toll on enterprise spending. Our bearish sentiment is based on our belief that Salesforce is not immune to weakening spending. Salesforce CFO Amy Weaver stated in the 2Q23 conference call that the company is:

“started to see more measured buying behavior from [their] customers, which began in the last months of the quarter. This resulted in stretched sales cycles, additional deal approval layers, and deal compression.”

We believe Salesforce’s lowered guidance for FY23 is a significant indicator of potential headwinds from weakened enterprise spending. We recommend investors wait on the sidelines until the risks have played out.

Salesforce is still a clear market leader

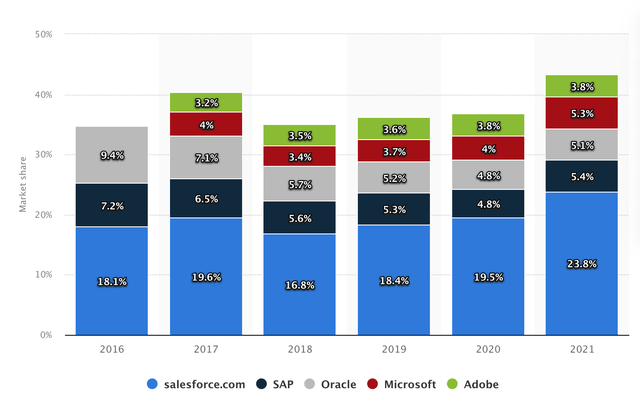

Salesforce is considered the leading vendor in customer relationship management, beating the competition by a mile with a market share of 23.8% as of 2021. Salesforce is a popular CRM tool for support, sales, and marketing teams worldwide. The company’s services allow businesses to use cloud technology to better connect with partners, customers, and potential customers. We’re excited about Salesforce’s market share but expect the company to face increased churn from the competition as the global CRM market expands.

We believe Salesforce needs to bring its A-game to maintain its position in the market as giant tech companies like Microsoft Corp. (MSFT) and Oracle (ORCL) enter the cloud-based CRM market. Oracle has strengthened its cloud position, and Microsoft has also added various key companies to its portfolio to improve its Dynamic CRM platform. We expect that since Microsoft offers special pricing for its Dynamics CRM Online service, it can potentially snatch Salesforce’s customers.

The following graph outlines the market revenue share of the global customer relationship management (CRM) applications market from 2016 to 2021.

We believe that acquisitions have been one of Salesforce’s key growth strategies, strengthening its position even more. In 2021, the company acquired Slack, positioning it as a leader in the enterprise team collaboration solution industry and allowing it to better compete with Microsoft’s Teams product. We also believe that buyouts of Tableau, ClickSoftware, and Datorama, among others, have been immensely positive for Salesforce.

Our bearish sentiment is based on our expectation that there is more downside risk from the current macroeconomic environment that has yet to play out. In the longer term, we expect Salesforce to continue to dominate the CRM market.

Global digitalization of businesses is a long-term growth catalyst

We believe that Salesforce benefits from a robust demand environment as companies undergo a major digital transformation. The rapid adoption of its cloud-based solutions is driving demand for its products. Salesforce’s 2Q23 revenue achieved $7.72B, beating expectations of $7.69B. Salesforce revenue rose 22% Y/Y in 2Q23.

The following image shows results for 2Q23.

The global CRM market size is projected to reach $145.79B in 2029, at a CAGR of 12.5% between 2022-2029. We believe Salesforce will ride this trend and grow even more over the next fiscal years.

Stock Performance

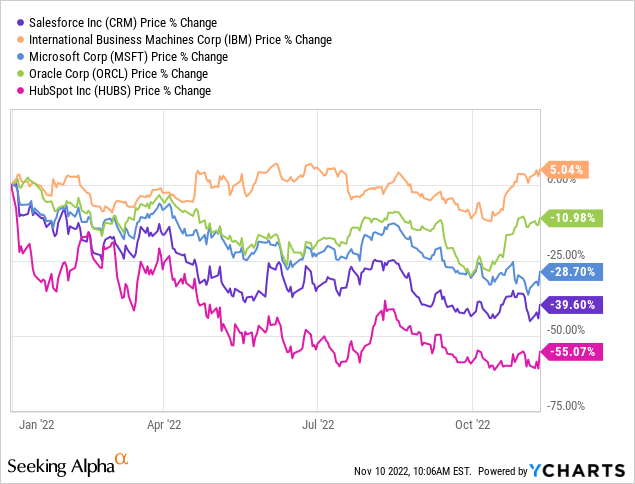

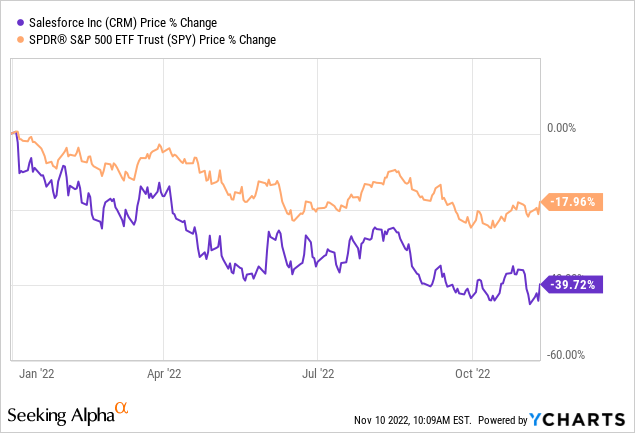

Salesforce is down around 39% YTD. The competition outperforms the company; IBM (IBM) is up around 5%, Microsoft is down around 29%, Oracle is down about 11%, and HubSpot (HUBS) is down about 55%. Salesforce is also underperforming the S&P index, down around 18% YTD.

The following graphs show Salesforce’s performance among competitors and the index YTD.

TechStockPros TechStockPros

Valuation

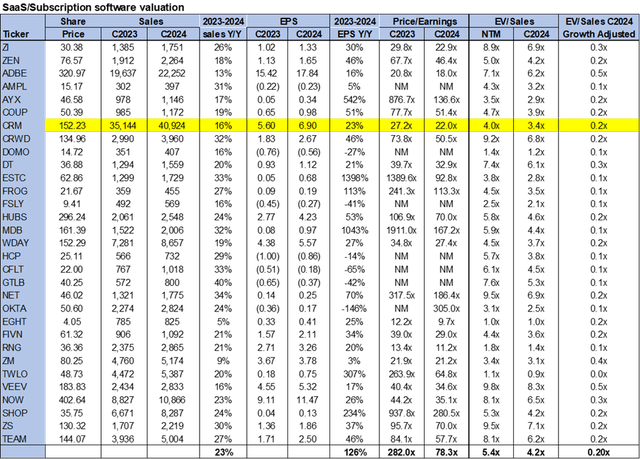

We believe Salesforce is relatively cheap compared to the large-cap peer group. On a P/E basis, Salesforce is currently trading at 22.0x C2024 EPS $6.90 compared to the average peer group of 78.3x. On an EV/Sales, Salesforce is trading at 3.4x C2024 sales versus the peer group average of 4.2x. We recommend investors wait until FY24 to see how the spending expectations pan out.

The following chart illustrates Salesforce’s valuation relative to its peer group.

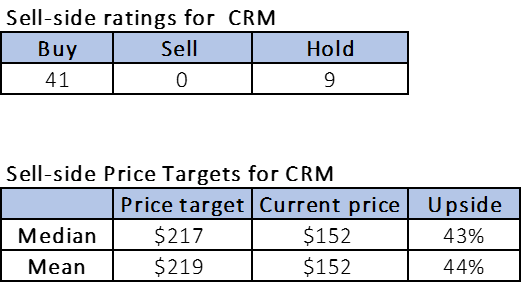

Word on Wall Street

Despite guidance cuts, Wall Street is overwhelmingly bullish on the stock. Of the 50 analysts covering the stock, 41 are buy-rated, and the remaining are hold-rated. Wall Street is looking beyond near-term headwinds and is optimistic about Salesforce delivering revenue growth despite economic uncertainties. Salesforce is currently trading at around $152. The median price target is $217, and the mean price target is $219, with a potential upside of 43-44%. The following chart indicates the sell-side ratings and price targets.

TechStockPros

What to do with the stock

We are hold-rated on the stock as we believe current economic uncertainties will take a toll on Salesforce. We are bullish in the long term as we expect the company to remain the CRM market leader. However, we recommend investors wait for market volatility to ease and for a better entry point on Salesforce, Inc. stock.

Be the first to comment