CHUNYIP WONG/iStock via Getty Images

The recent downturn in REITs have created a number of bargain-priced securities. It’s important, however, to separate the wheat from the chaff and be choosy in picking up high quality gems that can stand the test of time. This includes high quality names such as Alexandria Real Estate Equities (ARE), which I covered here in a recent piece.

This brings me to the high quality name, Safehold (NYSE:SAFE), which has come far back down to earth since hitting its 52-week high of $95 last year. It appears that this downward trend is moderating, as the stock has seen steady support over the past month. In this article, I highlight what makes SAFE a quality buy at current prices, so let’s get started.

Why SAFE?

Safehold is a modern ground lease REIT that’s externally advised by iStar (STAR), which is also Safehold’s largest shareholder. SAFE seeks to help real estate owners unlock the underlying value beneath their land.

As described on SAFE’s company website, with its unique capital solution, building owners targeting a 15% return on equity are no longer saddled with owning the underlying land at a 5% ROE. In return, SAFE gets a very stable and long-weighted revenue stream from tenants that are unlikely to default on their ground lease, in which case they could lose their rights to the whole building.

SAFE’s ground leases are primarily tied to office (48% of gross book value), multifamily (34%), hotels (14%) and life sciences (4%). It also enjoys the longest lease terms among publicly traded REIT peers, with a weighted average remaining lease term with extension of 92 years.

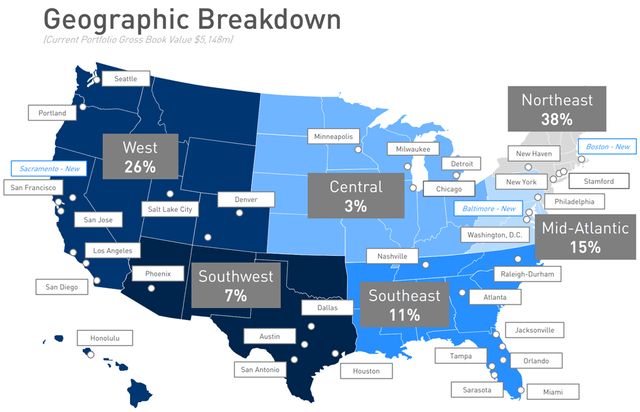

SAFE is also well-diversified by GEO, with presence in many major metropolitan areas. As shown below, it’s primarily exposed to the high income regions of the Northeast, West, and growing Southeastern region of the U.S.

SAFE Geo Mix (Investor Presentation)

SAFE continues to demonstrate impressive growth, with revenue increasing by 39% YoY, and importantly EPS growing by 35% YoY in the first quarter. The portfolio is also generating a healthy annualized in-place cash rent to $164 million, equating to an annualized yield of 5.1%.

Its leases also contain protections from inflation, with fixed rent bumps of approximately 2% per year, and has period upward rent adjustments in the form of CPI lookbacks when inflation stays above 2% for an extended period of time. This helps to mitigate duration risk on SAFE’s ultra long term leases. This also helps to dispel the general market perception that SAFE is merely a “bond-proxy”, as highlighted by management during the recent conference call:

As long-term inflation expectations have moved higher, we think that it’s important for all parties to understand the full value of the contractual inflation capture that is embedded in our portfolio. We have inflation capture in 96% of our portfolio. So with inflation moving higher it is a critical component in understanding our value.

Assuming the market’s current long-term inflation expectation of 2.49%, our portfolio generates a yield of 5.7%, which primarily includes the value captured by the CPI lookbacks and our Safehold ground leases.

So if we apply the 2.49% inflation breakeven to our cash flow stream, our portfolio will generate a 5.7% yield. Utilizing today’s benchmark century bond discount rate results in a significant increase in our cash flow value per share versus what the market seems to be assuming of no inflation capture in our portfolio. The takeaway here is that inflation is rising and discount rates move upwards so will our contractual cash flows as we are not just a simple fixed rate bond proxy.

Looking forward, SAFE is well-positioned to continue growing, as it has $1.15 billion in liquidity, comprised of cash on hand and availability on its revolving credit facility. It also maintains strong Baa1 and BBB+ credit ratings from Moody’s (MCO) and Fitch, and has a strong balance sheet with a 1.6x debt to equity ratio and 1.1x debt to equity market capitalization.

While the 1.7% dividend yield is on the low side, it comes with a safe 46% payout ratio and I see potential for stronger dividend growth as SAFE continues to consolidate the fragmented ground lease sector and ramp up its platform. Risks to the theses, however, include market volatility and lower equity valuations for SAFE, which raises its cost of equity and its ability to grow.

Admittedly, SAFE still isn’t cheap at the current price of $41.19 with a forward P/FFO of 22.5. However, the market sees the growth potential of this REIT, considering that it was willing to pay nearly 2.5x the current price just 12 months ago, and 2x the price just earlier this year. Sell side analysts have a consensus Buy rating on the stock, with an average price target of $70.50. This translates to a potential 73% total return from the current price.

Investor Takeaway

SAFE is a high quality, diversified REIT with a differentiated business model, ultra long leases, and impressive growth prospects. It also comes with a strong balance sheet with plenty of liquidity and pays a well-covered dividend. I believe the market has overreacted to the downside on this stock on fears of inflation, making the stock attractive for potentially strong long-term returns.

Be the first to comment