frender/iStock via Getty Images

We have stayed on the correct side of the Safehold Inc. (NYSE:SAFE) & iStar Inc. (NYSE:STAR) drama. While recognizing that STAR was undervalued relative to SAFE, we repeatedly emphasized that SAFE was one of the largest bubbles in the equity markets on the way to implosion. The last article summed this up.

Intel Corp. (INTC) had an A credit rating in 2000 and the stock fell 80% in the next two years. Imagine how silly it would look if someone equated the credit rating with INTC going up over the next few years. SAFE’s bubble has done just the first round of deflating. We maintain our neutral rating on SAFE and would look to get short in the $50-$55 range, looking for a sub $30 price ultimately.

Source: Just A Manic Merger Thursday

Unfortunately SAFE did not give us a “safe” short entry and rolled over at $47, back to $36.00. We are telling you why we are downgrading our price target on this to $16-$17 from the $25-$30 range we had previously suggested as the neutral zone.

1) Enormous Pressure From Risk-Free Rates

While 2020 was littered with “cash is thrash” articles, 2022 is more about actual coming to grips with reality. All growth stories that levitated to the sky, are now getting reacquainted with gravity. Cash now offers close to 3% for shorter term treasury bills. A lot of investors had rushed into risky assets as cash offered extremely poor returns. That has changed, and no stock is more vulnerable to this changed mentality than SAFE, a REIT, still yielding under 2%. Just on this metric, we would expect SAFE to yield at least 4%, implying a 50% price drop.

2) Bond & Equity Markets Closed Off

While SAFE did issue debt early in 2022 and the method and rates were relatively attractive, things have definitely taken a turn for the nurse. On the equity side, SAFE is now at a 20X earnings multiple. This is a massive contraction from the peak insanity days of $93 per share when SAFE traded at over 70X earnings. While we think earnings yield presents an unwarranted and optimistic view of the company value (cash flow is what matters), even using this metric, things look real bad. Most ground leases won’t work well at those levels, if at all, after taking into transaction costs and administration fees. That is of course half the problem.

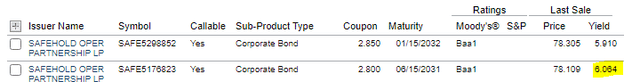

The debt markets are closed off as well. Despite the STAR merger and the potential for a credit upgrade, SAFE’s 9 year out debt is yielding 6%.

SAFE needs to issue far longer term to balance its 100-year leases and when the 9-year debt is screaming over 6%, you really cannot expect SAFE to grow buying 3.5% cash yields on ground leases. We estimate a realistic debt equity mix to weigh in at over 5.75% yield and that makes ground leases even at GAAP earnings as non-accretive.

3) Earnings About To Contract

The Federal Reserve’s rate hikes, which have even exceeded our pessimistic forecasts are about to make investors realize just how much debt SAFE is carrying. Even the tiny portion of the overall debt, which is made up of floating rates, will move the numbers.

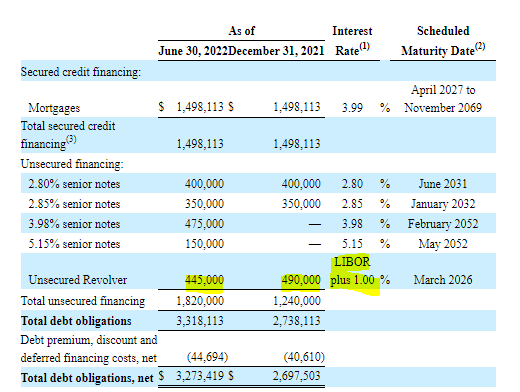

SAFE 10-Q

On $490,000 million SAFE was paying at a $4.9 million run rate in interest in 2021. At a 4% LIBOR rate, which looks very likely (over 90% probability based on Fed Funds Futures) by end of the year, 2023 would cost SAFE over $22.5 million interest on this portion alone.

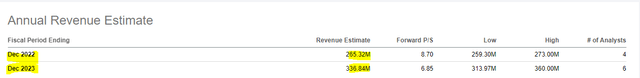

Analysts have still not refreshed their spreadsheets unfortunately and the numbers are so outdated that it is not funny. The revenue numbers are set for a 20% bump, and with the equity and debt markets closed off, that is not going to happen in this Universe.

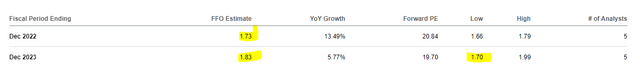

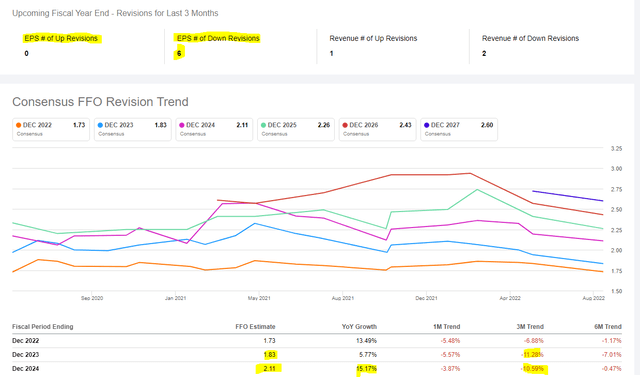

SAFE is still doing deals with cash raised earlier but we are now down to trickle levels. Just backing off the revenue growth and adjusting for the increased interest expenses, would give us a sub $1.60 per share number in earnings. This is even after accounting for some merger related savings, and extra revenue from managing STAR’s spinoff assets. But we still have $1.83 as consensus, with only one brave soul actually saying “hey, this looks like it is going to go in the other direction”.

Verdict

While this process is slow, and denial runs deep, they are awakening from their slumber. 6 out of 6 downgraded the EPS estimates for 2023 and 2024 as they factor in this change.

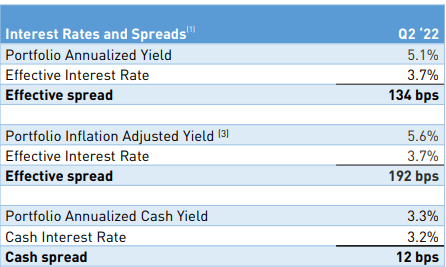

But our point still stands that the numbers are very far detached from reality. 2023 will contract hard, and we could see as much as a 10% drop from 2022 levels. That should wake all those who extrapolated a bubble equity-based growth story all the way to 2099. SAFE’s cash spread yield, which already looks like a rounding error at 12 basis points, will contract sharply as well.

SAFE Presentation

Sure, there may be some that will hang on to the minutest amount of Caret Units being sold to a third party. We don’t ascribe any realistic value to those. We are now looking for a price based on 10X EPS numbers for 2023 or about $16-$17. Stay out, you have 50% more to go.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints

Be the first to comment