bedo

The S&P 500/SPX (SP500) hit a low of around 3,640 in mid-June, roughly a 25% drop from the top. Then, we saw a significant counter-trend rally into mid-August. However, despite the late summer stock market optimism, it’s doubtful that the bear market is over. Recent inflation numbers illustrate that the economic climate remains highly challenging, and the Fed needs to do more. Unfortunately, interest rates are moving higher, and stocks will probably continue dropping.

Moreover, we haven’t seen many of the hallmark signs of a long-term bottom. There should be more blood in the streets, and the ultimate bear market bottom could arrive at around 3,000 in the S&P 500 in a base case outcome. I’m capitalizing on the volatility by hedging and buying high-quality stocks on big dips.

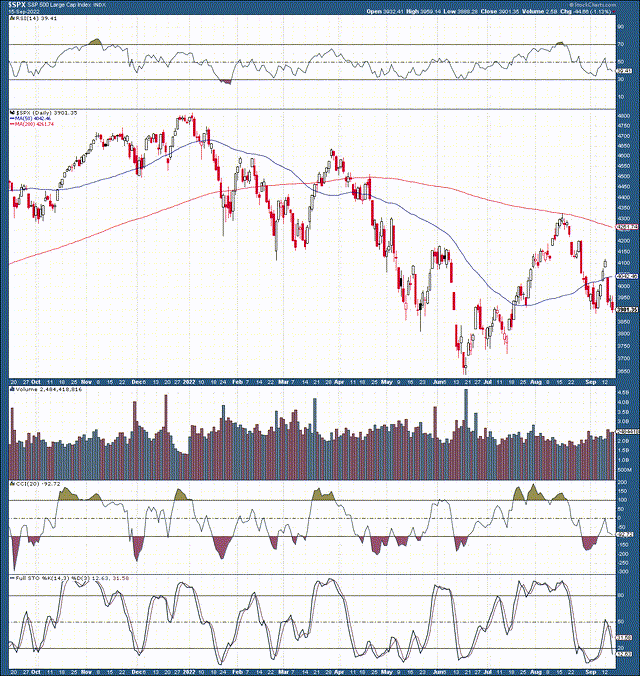

The Technical Image – Very Bearish Now

SPX 1-Year Chart

The S&P 500’s bear market began right around the start of 2022. Since the bearish trend began, we’ve seen a series of lower highs and lower lows. The most recent high occurred in mid-August when I put out a near-term top alert. Now, things are becoming more bearish. After the recent high, the market attempted to rebound but got smacked down by Jerome Powell’s Jackson Hole remarks. More recently, the market tried to muster another rally, but the higher-than-anticipated inflation numbers brought a quick end to that attempt.

Now, we’re looking at an increasingly bearish technical image as the SPX is putting in a pessimistic head and shoulders pattern and is on the verge of busting through critical 3,900 support. Once below this level, the S&P 500 should at least retest the prior low around 3,700-3,600. However, a likelier scenario is that the S&P will make a lower low, dropping the SPX down into the 3,400-3,000 range next.

What Do Jackson Hole And Inflation Have In Common?

At Jackson Hole, we learned just how intent the Fed is on battling inflation and how bearish this phenomenon is for the stock market. I wrote about the Fed’s bearish symposium several weeks ago. The key takeaway from Chair Powell’s speech is that inflation is much more persistent and challenging to deal with than previously expected. The Fed must do much more to lower inflation. The dynamic of high-interest rates, slower growth, and a worsening labor market will bring substantial pain to households and businesses.

Now, Let’s Look At Inflation

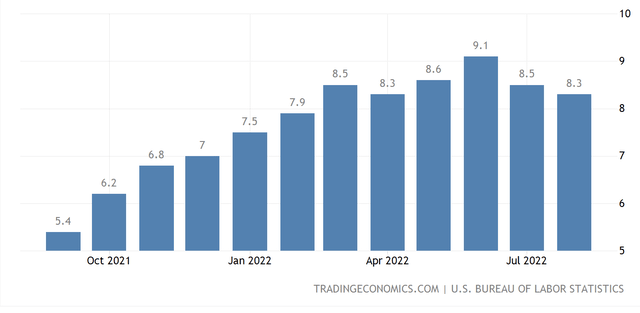

CPI Inflation

CPI inflation (TradingEconomics.com )

While inflation has decreased from the 9.1% reading, it remains remarkably high. Inflation is running hotter than we’ve seen in about 40 years now. The primary issue is that the Fed has been raising interest rates and implementing other tightening measures like QT, but we’re seeing a minimal effect on inflation. Therefore, the Fed needs to do more. However, more tightening will further constrict economic growth and decrease consumer confidence. Additionally, higher inflation, lower growth, and worsening spending negatively impact corporate profits and should lead to more pain as we advance.

Don’t Fight The Fed

Wise people have told me, “you don’t fight the Fed.” You don’t want to fight the Fed when the central bank is easing. We saw ultra-loose monetary policy since the 2008 financial crisis, and stocks did great for much of that time. However, we are in a completely different economic environment now. As the Fed pulls liquidity out of markets, the cost of borrowing increases, growth slows, sentiment worsens, and risk assets deflate. Furthermore, we’ve underestimated the severity of the inflation problem and the Fed’s commitment to making it “go away.”

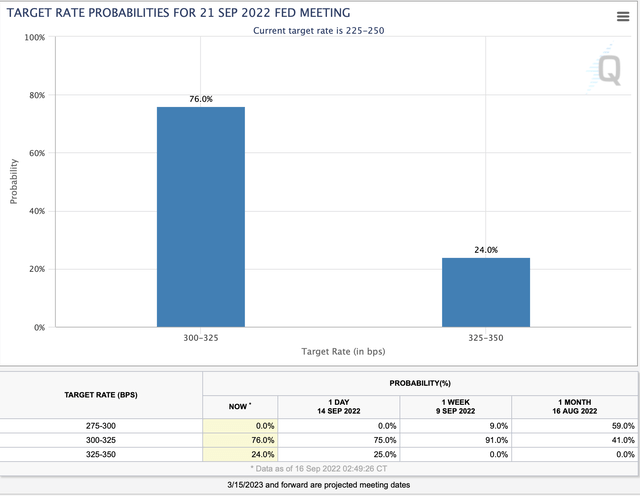

Rate Probabilities

Just one month ago, the market expected a 50 basis point hike at the upcoming Fed meeting. There is about a 25% probability that we may see a 100 basis point move. Whether we see a 75 basis point hike or a full 1% increase next week is not that relevant. The fact is that the Fed is intent on increasing interest rates until inflation is under control. Unfortunately, the benchmark will be above 3% after next week’s meeting. With rates at such elevated levels, economic growth will weaken further, and there is no telling when the inflation problem may end.

Uncertainty Ahead For Stocks

There is increased uncertainty surrounding inflation, growth, Fed tightening, the consumer, recession, corporate earnings, and much more. Typically, I would say that the stock market will climb the wall of worry, but this wall of worry may be too high to climb.

One of the most troubling factors is that we don’t know how deep the downturn will cut into corporate results. We already see declining revenues, worsening margins, and fewer profits at major corporations. However, these declines could continue, and future downward earnings revisions could persist. Additionally, valuations remain relatively high, and this dynamic could mean lower stock prices before this bear market gets sorted out.

The Valuation Dynamic

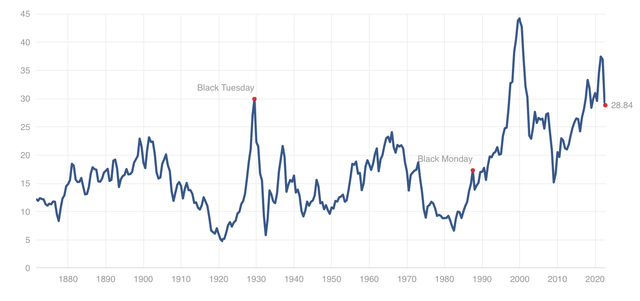

The Shiller P/E Ratio

Shiller P/E ratio (multpl.com)

We see the Shiller P/E coming down lately, but the drop has just begun. We can see that once the Shiller P/E drops, it rarely stops until a relatively low has been achieved. We should see the CAPE P/E ratio decline as the economy weakens, earnings decrease, and valuations come down. A reasonably conservative target could be a Shiller P/E ratio of approximately 20. While the historical mean is only 17, the market has become accustomed to higher P/E ratio valuations in recent years. Therefore, we may see increased buy interest around the 20 level, if the SPX doesn’t overshoot to the downside. A decline to a 20 Shiller P/E ratio would equate to an approximately 28% drop from current levels, roughly coinciding with the 2,800 level in the S&P 500. Therefore, my ultimate bottom in the S&P 500 target remains at 3,000. However, the market may overshoot lower into the 2,800-2,400 range in a bearish case outcome.

Be the first to comment