Alexander Lyakhovskiy/iStock via Getty Images

Today I’m taking another look at Ryder System (NYSE:R), a logistics company, for which I had written an article about one year ago. For a detailed breakdown of the company’s segments, you can check it out here. In this article, I will outline three reasons why I believe that this company is worth your attention in this difficult economic environment.

Reason #1: Business model

To those unfamiliar with the company, Ryder System provides logistics outsourcing services for its clients. This means that its customers are able to remove the fuss of vehicle management, maintenance, repairs etc. from their in – house operations, for a fee, in exchange for more effective services. In my opinion, this business model has some very important advantages.

First of all, logistics outsourcing is an ongoing trend, among supply chain professionals, which is expected to gain more traction in the next few years. In a recent survey conducted by Gartner, 66% of the responders said that they increased their budget in the area of logistics outsourcing in 2021 and nearly 75% said that they will definitely do it in the next two years.

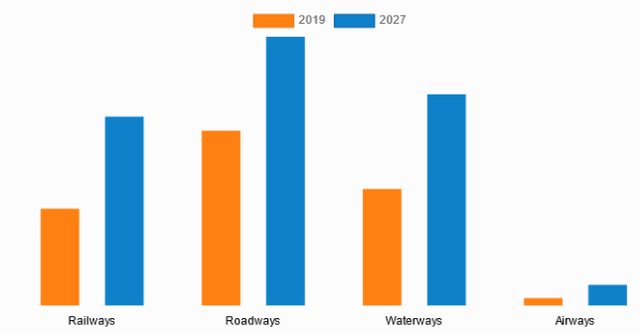

3rd party logistics market share projection (Allied Market Research)

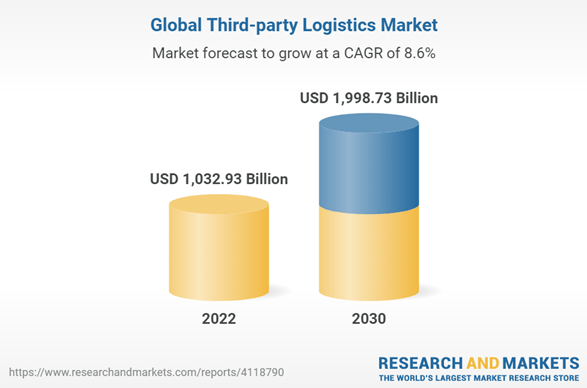

In addition, this trend is also confirmed by another research, as we can see in the graph listed above. It seems that roadway third party logistics providers will continue to own the market’s lion’s share, in relation with other market segments. In fact, global third-party logistics market is expected to show a CAGR of 8.6% until 2030.

Global Third Party Logistics Market (Research and Markets)

Moving again into the Gartner report, the main reason behind this trend was the need to improve or update technology. In an era of rapid technology improvements and advances, one can easily imagine the fuss associated with fleet modernization and optimization. This is something that can be done by third-party logistics companies, extremely increasing corporate effectiveness, as two-thirds of the respondents support.

Reason #2: High inflation means higher brokerage revenues

Things started to show since the company’s latest earnings announcement. More specifically, Ryder System reported that in the first quarter of 2022, revenues from brokerage services of tractors and trucks were up by 146% and 109% respectively, as compared to Q1 2021. This reflects a generalized trend, where inflation and uncertainty regarding economic conditions, together with market disruptions, increase market prices of vehicles. In other words, the increase in FMS related revenues was not attributed to the sale of more used vehicles. In fact, the company has been selling continuously fewer vehicles since the first quarter of 2021. This is a counter force to the used vehicle price increase I mentioned above. It seems, however, that the net outcome is deeply positive for the company, from a revenue standpoint and as such, I expect it to remain this way for the next quarters.

Reason #3: Strong Q1 2022 results point to an even more tempting valuation

Last April, the company reported some strong Q1 2022 results, including an increase in their quarterly revenues by 22%, compared to Q1 2021, and a more than threefold increase in their quarterly earnings per share. More specifically, Q1 2022 EPS figure reached $3.59, leading the company to update its FY 2022 EPS guidance to $13.40 – $14.40, up by 3% from the original guidance figures. The last traded price for Ryder’s shares was $71.14, so using a median guidance price of $13.90, we get a P/E forward multiple of 5.1x, which is very conservative. Even if we assume FY 2022 EPS of $13.40, we have a forward P/E multiple of 5.3x.

In addition, the company recently got a letter of buyout intent from HG Vora, at a rate of $86 per share. In other words, HG Vora wanted to pay just 6.2 times the company’s forward earnings to take over Ryder System. Firstly, from a purely valuation related standpoint, this multiple is still quite low, taking into consideration the general prospects of the 3PL industry in the near future. Secondly, from a more qualitative standpoint, the fact Ryder’s management rejected the offer, shows that they believe that their company is worth much more than that, which is in line with the earnings multiples I wrote about earlier.

Finally, the company also looks undervalued compared to its peers. I created a peer group, consisting of Schneider National (SNDR), Werner Enterprises (WERN) and Knight-Swift Transportation Holdings (KNX). All these companies have almost double earnings multiples than Ryder System and all of them have also significantly worse ROE figures.

Final word

Ryder System seems like a company that has a lot of value to give to its shareholders. It is probably a company caught in the global economic storm and generalized market instability. However, in this mess, it is a pure value play and given the last buyout offer, it has more than 20% upside potential from current share price levels. On top of that, the company also pays a dividend of $0.58 per share per quarter, which represents a 3.26% dividend yield. While not spectacular, as I said before, this is a value opportunity for investors, coupled with an additional 3% return to make it look even better. The dividend is pretty safe, with payout ratio being just south of 20%. Is there really anything more to ask for?

Be the first to comment