T_A_P/iStock via Getty Images

The Spinoff Paid Off, But Now It’s Done

Exelon Corporation (NASDAQ:EXC) took a bold step to unlock value for shareholders with the spinoff of Constellation Energy (CEG) on 2/1/2022. This move created a generator and marketer in Constellation and a pure transmission and distribution utility in the remaining Exelon. The idea is that some investors will appreciate the stability and predictability of a fully regulated, T&D utility, while others would appreciate the upside of a generation and marketing company with more exposure to power pricing.

This worked out as planned, as Exelon’s P/E approached that of its peer utilities instead of running at the low end as it did before the spinoff. Constellation has also been an outstanding stock to own since the spinoff, as power prices have increased. Also, the “Inflation Reduction Act” now under consideration in Congress provides considerable subsidies for nuclear power generation.

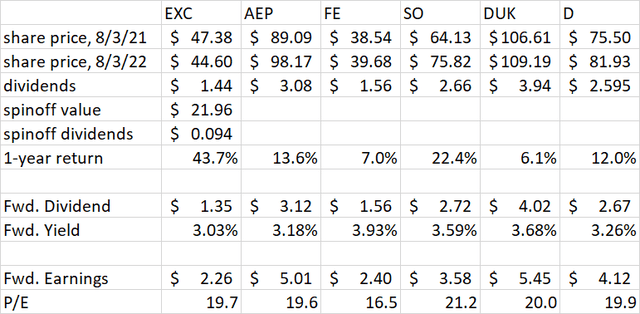

Shareholders who owned Exelon one year ago and held it along with the 1/3 share of Constellation received in the spinoff strongly outperformed shareholders of peer utilities. The EXC + 1/3 CEG package returned 43.7% in the past year, far more than peers and certainly more than the S&P 500 index fund (SPY) which returned around -5%.

Note: Please be careful using online historical data on companies that have done spinoffs. Sometimes the price is adjusted for the value of the spinoff and other times it is not. The price shown here is the actual price EXC closed at on 8/3/21 so it is appropriate to include the 1/3 CEG share as part of the 1-year total return.

While the past year has been profitable for shareholders, the current valuation is not compelling. Considering the low growth, low dividend yield, and dilution from upcoming equity issuance, Exelon is not attractive here.

Low Growth And Dilution

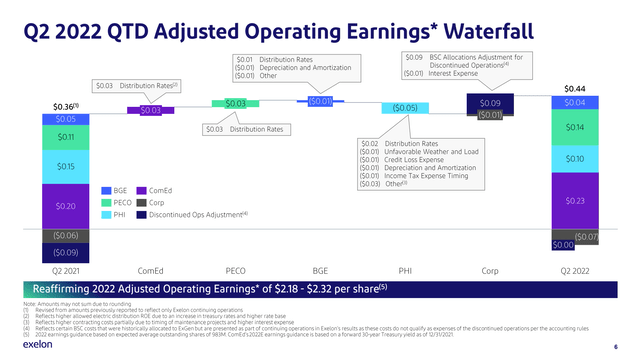

Exelon reported what looks like a nice increase in non-GAAP earnings from $0.36 in 2Q 2021 to $0.44 in 2Q 2022. However, all of this “growth” is caused by accounting rules around the spinoff. Exelon has a Business Services Company, or BSC, that provides support to its subsidiaries including Generation before the spinoff. GAAP rules allowed operations with the actual Generation subsidiary to be included in discontinued operations so that they can be easily backed out of year-on-year comparisons. The accounting rules do not allow Generation’s share of BSC costs to be included in discontinued operations, however. These BSC costs amounted to $0.09 per share in 2Q 2021 and zero in 2022 since the spinoff was completed. Companies can define non-GAAP results any way they like, so it feels a bit misleading that they chose to leave the BSC impact in non-GAAP, but that’s what they did. Outside of the BSC change, Exelon did see benefits from higher rates in all the subsidiaries, but these were offset by higher depreciation and other costs, especially at Pepco. As a result, the real growth over the past year has been zero.

Exelon 2Q 2022 Earnings Slides

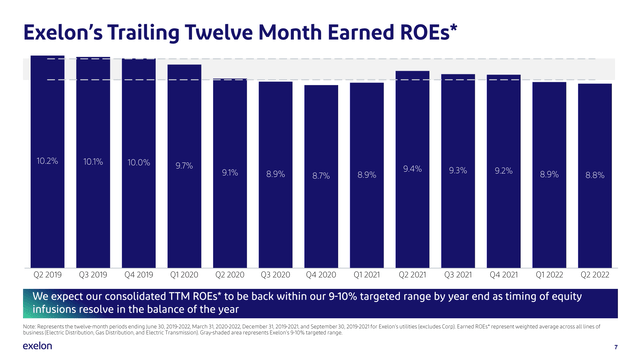

Looking forward, Exelon says they are still committed to the 6%-8% EPS and dividend growth they announced to analysts at the time of the spinoff. This seems like a stretch however, considering Exelon’s return on equity has been declining below its targeted range. In fact, the latest rate case for ComEd represents only a 7.85% ROE. ComEd rates have also been less predictable as they are indexed to Treasury rates. However, when interest rates go up, it takes some time to incorporate that into the formula, true-up the utility rate, and collect the extra revenue. Additionally, ComEd plans to move away from Treasury-indexed rates in 2024, which could be giving up an advantage if interest rates keep increasing.

Exelon also plans to issue $1 billion worth of new equity by 2025 including $500 million this year. Given Exelon’s current market cap around $44 billion, this would dilute current shareholders by around 2.2%.

In line with previously announced plans, Exelon anticipates issuing up to $1.0 billion of registered shares of common stock through 2025. Exelon plans to establish a $1.0 billion at-the-market (ATM) program and anticipates issuing $500 million in 2022 through the ATM, a one-time common equity offering, or a combination of these methods.

Source: Exelon 2Q 2022 Earnings Release

An additional risk was mentioned at the start of the earnings call. While the Inflation Reduction Act would be a great benefit to Constellation, the 15% minimum corporate tax provision in the bill would be detrimental to Exelon, which currently has a low cash tax rate. The added taxes could impact Exelon by around $200 million per year or about $0.20 per share if the current legislation is not modified before passing.

Valuation

As seen on the peer comparison table above, Exelon is valued right in the middle of its peer group at 19.7 times 2022 earnings. It is no longer the bargain it was pre-spinoff. At barely 3%, the dividend yield is at the bottom end of its peer group. With limited growth, an income investor might as well invest in US Treasuries yielding a similar rate.

Conclusion

Exelon was a great stock to own into the Constellation spinoff, which truly did create shareholder value based on the combined return over the past year. Looking forward however, Exelon stock is not as attractive with its average P/E and low dividend. Low growth, dilution from new equity issuance, and changing tax laws are also risks. I do not recommend buying Exelon and would be looking to sell on any bounce from the latest post-earnings decline.

Be the first to comment