Vasilii Binzari

Investment Thesis

DocuSign (NASDAQ:DOCU) delivers middle-of-the-road revenue guidance for the next quarter. Also, looking out to next year, its guidance points to 9% y/y growth rates, in the best case.

That’s the most superficial way to look at this result. But when we dig further, we can see that there’s a lot to be positive about.

In the first case, I believe that having a new CEO at the helm will mean some changes will come. It’s early days to know if the changes will be successful, but changes are coming.

Furthermore, where I believe DocuSign is truly making its mark is on its rapidly improving bottom-line profitability.

The stock is priced at 15x next year’s non-GAAP operating profits. I believe this is cheap enough to entice new investors to this name.

Revenue Growth Rates Slow Down, But

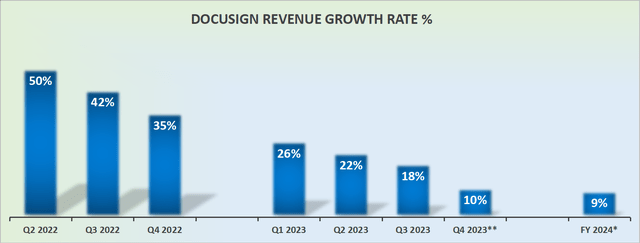

DOCU revenue growth rates

Here’s the thing. DocuSign’s growth rates are slowing down. And down. And down. But, think of the overall context too.

DocuSign came out of the pandemic at a time when companies of all shapes and sizes were being led to believe that they must quickly transition to a digital-first world. There was a run for IT service solutions and productivity tools. There was money aplenty for IT.

Whereas right now, it’s essentially the opposite of that in nearly every one of these elements. Companies are resolutely cutting back on spending. And anything that is being invested to improve IT, or to improve productivity, is going through multiple lines of executives for approval.

And then, to confound matters further, the macro environment was extremely favorable last year, which would have been challenging to compare against at the best of times.

But this year, again, it’s diametrically the opposite. Companies are being forced to truly think if they need an e-signature offering, or can a traditional alternative solution be used ”for now”.

Along these lines, this is what Allan Thygesen, DocuSign’s recently appointed CEO said on the earnings call,

[…] I believe it’s important to acknowledge where we have not executed as well. It’s clear we did not pivot quickly enough and we were slow to make changes.

As we experienced tremendous growth during the pandemic, we did not scale the team properly. We lost some innovation velocity.

Thygesen used DocuSign’s earnings call to highlight to investors that DocuSign is moving beyond its core offering to broaden out its solutions to contract lifecycle management (”CLM”).

To be fair, a lot of this push had already been initiated under the previous management team. Hence, I can’t exactly state that Thygesen has come out with a brand new vision.

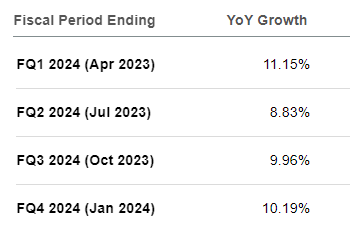

Furthermore, Q4 billings are expected to be approximately 6% at the midpoint. That means that DocuSign’s future growth rates are likely to remain around 8% to 9% next year and no higher.

DOCU’s analysts’ estimates

Indeed, this is what was said on the call about DocuSign’s next fiscal year’s growth rates,

For total revenue, we would expect high single-digit growth during fiscal ’24. For billings, we would expect low single-digit growth for next year.

Put another way, DocuSign’s management team wanted to get ahead of the Street’s expectations and to bring down their consensus revenue expectations.

Accordingly, the best that one can now hope for, is that Thygesen will look to satisfy investors’ craving for strong, sustainable, and high earnings, which is what we’ll next discuss.

Profitability Profile Guidance Points to Improvement

This quarter’s non-GAAP operating margins improved by 100 basis points from last year to 23%. Meanwhile, DocuSign’s GAAP figures went from negative 1% in last year’s quarter to negative 4% in the current quarter.

However, we should keep in mind that this quarter did see a restructuring charge of $28 million, which would have impacted DocuSign’s GAAP operating margin by approximately 5%.

So, it could be said that DocuSign could possibly have been very close to GAAP breakeven, had it not been for this restructuring charge.

Now, as we look ahead to fiscal Q4 2023, in the best case, non-GAAP operating margins point to 22%. So, right off the bat, there does not appear to be an improvement from Q3 2023.

That being said, when we compare with the same period a year ago when DocuSign’s non-GAAP operating margins were 18%, Q4 2023 non-GAAP operating margins appear to be close to 400 basis improvement from last year.

On the other hand, DocuSign’s management team sought to once again get ahead of analysts’ expectations and openly declare that DocuSign next year will operate at the ”lower end of our long-term target operating margin range of 20% to 25% in fiscal 2024.”

Next, we’ll discuss DocuSign’s capital allocation.

Capital Allocation, Share Buybacks

Most companies have no idea how to repurchase shares. They repurchase shares at highs and stop when the shares move lower.

DocuSign repurchased $38 million worth of shares at approximately $51.35. During the earnings call, DocuSign stated that it still had more cash to deploy towards buying back more shares.

DOCU Stock Valuation — 15x Fiscal 2024 non-GAAP Operating Income

If we look out to fiscal 2024 and assume that DocuSign’s growth rates next year improve by 9% from fiscal 2023, this would put DocuSign’s consolidated revenues at $2.7 billion.

And if we presume that DocuSign’s non-GAAP operating margin is around 22% next year, this would translate into $600 million of non-GAAP operating income.

Accordingly, DocuSign is left priced at approximately 15x next year’s non-GAAP operating income.

The Bottom Line

In a nutshell, this is the setup. I’ve taken this quote from DocuSign’s CFO Cynthia Gaylor’s comments from the Q&A part of the call,

…[S]o we’re certainly seeing kind of a more challenging macro environment and some softening trends materialize, right? And I talked about kind of smaller deal sizes, smaller expansions and expansions at a slower rate.

DocuSign’s high growth rates are done and dusted. The only question now, is whether the stock is cheap enough to entice value investors to pay 15x non-GAAP operating earnings?

I suppose the real question here is having enough shareholders sold out from the stock and given up hope so that 15x non-GAAP operating earnings will entice new investors to get interested in a maturing ”post-pandemic” e-signature company?

Be the first to comment