Boarding1Now/iStock Editorial via Getty Images

Since my last report on Ryanair (NASDAQ:RYAAY), shares of the Irish low-cost carrier have lost nearly 12% of their value. Something that is relatively hard to rhyme with the release of pent-up demand to the market, but also somewhat understandable if we look at the current macro environment. I have had a look at the results and listened to the earnings call and found the earnings call to be lacking an action plan to tackle the current pressures that are being faced. Maybe that is because the problems for Ryanair are not as big as they are for other airlines. I flew twice on Ryanair in the past two weeks and both flights had a delayed departure. So, from my own experience Ryanair is also suffering delays for various reasons but it is not nearly as bad as we are seeing with some other carriers where cancellations and hours of waiting in line for security seem to be more rule than exception.

Ryanair Indicators Surge On All Levels

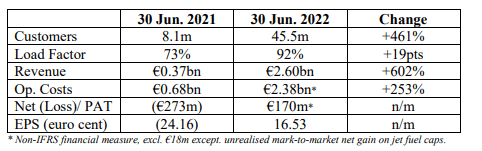

Ryanair key results (Ryanair )

Normally, I like to show fancy slides from earnings presentations. However, the simple table that Ryanair provides in its report basically tells all that you need to know. The number of customers surged by 461% and the growth in revenues was even higher due to strong unit revenue improvement. Across the industry we are also seeing elevated load factors and Ryanair was no exception with a 19 points improvement in the load factor. At the same time, the €2.23 billion in revenue growth was partially offset by $1.7 billion in higher costs. This was driven by a combination of higher flight activity and higher unit fuel prices. The result is a swing from €273 million loss to a €170 million profit. It’s something, but these are not the kind of margins you would like to see and that is some reason for concern as staffing challenges remain. Maybe not so much for Ryanair, but for airport handling and ATC services which could affect the growth profile if these issues do not dissolve. Furthermore, weakening in pricing if not offset by falling oil prices would easily put any airline back in a loss position. So, the profit is good but it is an extremely fragile one.

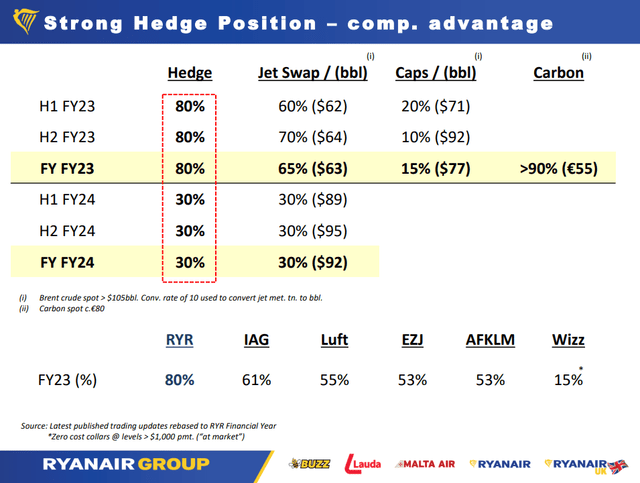

Ryanair fuel hedge portfolio (Ryanair )

One thing I do like about Ryanair is their strong hedging portfolio. The fuel hedging obviously is an informed gamble, but the company has now 80% of its fuel consumption hedged at an average price of $63 per barrel. That might be a good thing, but also seems to be pointing at Ryanair expecting higher fuel prices for the foreseeable future and that could become problematic if demand for air travel cools.

The strong bookings were not used by Ryanair to meaningfully reduced gross debt. The company had €5.1 billion of debt in the quarter ending March and reduced this debt to €5.0 billion in the quarter ending June. Net debt on the other hand reduced €1.1 billion basically telling us that strong bookings led to a strong cash balance but it wasn’t used reduce gross debt.

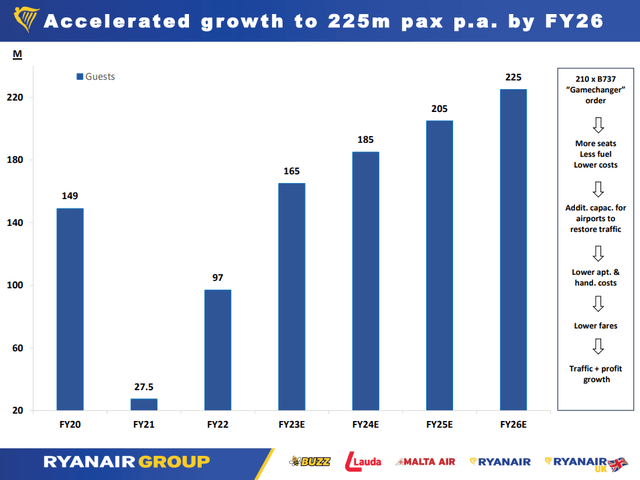

Long-Term Ryanair Targets Remain

Ryanair at this stage is unable to provide an outlook for 2023, but its passenger target of 225 million passengers by FY26 has not changed and neither did the trajectory. To support that, obviously demand needs to remain robust and the aircraft need to be there. In order to get there, Ryanair has renewed leases on its Airbus fleet. The company also is extremely upbeat about their Boeing 737 MAX 200 aircraft, yet when asked by an analyst O’Leary about the MAX 10 which O’Leary is interested in the Ryanair Group CEO couldn’t stop himself from once again pointing out that Boeing lost recent sales campaigns without regard for the campaigns that the jet maker did win.

More concerning are the current delays on the Boeing 737 MAX 200 deliveries. Boeing has hinted that there might be delays on 21 jets that were due to be delivered between September and December. Up until June 2022, Boeing delivered 73 MAX 200 jets to Ryanair two short of the initial target that at some point was lowered to just 60 units. So, while pressure is certainly present Boeing previously came closer to the target than what Ryanair suggested. While pressure on timely deliveries is most certainly there and deliveries have largely been disappointing, this also seems to be a Ryanair strategy to keep Boeing on the edge for deliveries of the Boeing 737 MAX and the sales prospects of the MAX 10.

Conclusion

Ryanair’s results did not contain big surprises. I remain bullish on the longer term execution of the company. The company is facing some pressures when it comes to timely deliveries for its MAX 200 jets and they are not getting the deal they want on the MAX 10. Over the longer term, not getting the aircraft they want and need might become a problem. However, currently I think that Ryanair is executing quite well and staffing related issues seem to be more a problem of airport handling and air traffic control services. The only worrisome element is that Ryanair barely generated a profit with the high demand environment we see right now and weakening in the demand profile could easily put the company in a loss position again. With 80% of the fuel consumption being hedged, it also seems that Ryanair wouldn’t be able to benefit optimally from a fall in fuel prices and that gives the impression that high fuel prices remain for a couple of quarters and to me it is a big question whether the pricing environment will remain strong as long. So, I like the execution but the macro environment could put significant pressure on Ryanair’s results.

Be the first to comment