Ceri Breeze

Published on the Value Lab 23/7/22

Veolia Environnement (OTCPK:VEOEY) is a company we’ve been following for a while now. We always maintained that it was undervalued relative to US waste management peers in particular, but with its positive exposures to the durable elements on inflation as well as substantial downside protection as a regulated utility, we think the 4.5% yield is a bit too hard to pass up. The need to possibly dispose some assets also constitutes an opportunity to realize a very good price on private markets, which are substantially higher valued than public markets right now, making the CMA concerns relatively moot for public investors. Overall, this is a buy on dividend and multiple.

Q1 Update

The merger with Suez is progressing and most of the regulatory hurdles have been cleared except with the UK regarding its Suez waste management and its own water treatment businesses. We’ll discuss this later.

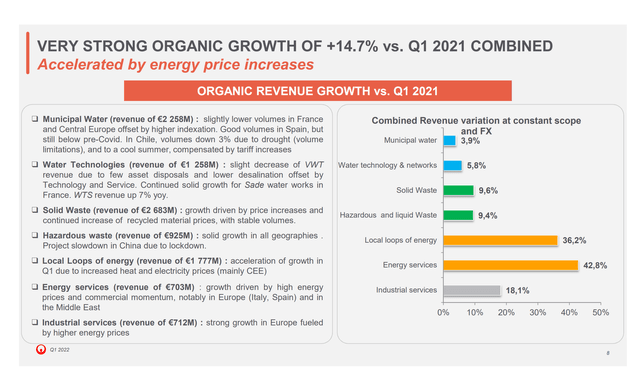

The current quarter shows the benefits from a still elevated commodity environment on revenues.

Segment Breakdown (Q1 2022 Pres)

- Municipal water (20%) had the smallest delta, which is no surprise because this is a regulated utility. Volume declines drove some disappointment in this segment which otherwise grew thanks to indexation to inflation as a regulated utility. While not fully indexed, there’s enough to be happy with the segment given that remuneration occurs on a government scheme and is highly predictable. Overall, we are overweight regulated utilities in the current environment, which helps our view on Veolia thanks to this business.

- The water technology business (12%) includes the water treatment businesses, and this continues to generate greater revenues on higher engagement. This also might be the business that gets sold if issues with the British CMA continues and the antitrust situation has to be resolved with disposals.

- Solid waste (26%) and Hazardous Waste (9%) are being driven by increases in recycled product prices and volume growth respectively, the latter subject to slowdown risks due to China. The former again is constituted by businesses that might have to be sold in the UK due to antitrust issues around the Suez merger. Those assets are likely to sell wonderfully on private markets.

- The last 3 segments (30%) are all exposed to commercial momentum from high energy prices, as well as being directly exposed positively to high energy prices. With this inflation being durable and geopolitical, that’s 30% of Veolia’s businesses that will continue to benefit from the energy environment.

On the cost side, most of the inputs required for the regulated utility services in particular have already been acquired, and those input prices have otherwise been hedged, allowing from pretty strong EBITDA growth of 13% compared to the combined EBITDA of Suez and Veolia YoY. 2% of this growth is attributed to synergies and the rest is mostly from efficiency gains from operations and procurement. One thing to be aware of is that the pricing benefits from recycled product prices may reverse as a consequence of the rate hikes, while other energy prices might not. Moreover, recycling facilities depend on gas supply, although they can be supported by other LPGs too. Nonetheless, this is the only segment where there is risk of disruption, while on the cost side the main impacts are likely to hit the regulated utilities businesses but those still avail from highly stable remuneration and partial indexation to inflation which will continue to be driven by energy.

Final Remarks

The CMA is worried about antitrust issues around Veolia’s solid waste businesses in the UK, now including Suez’s, as well as the water treatment business which also got duplicated in the merger. The current state of capital markets is that there is still a lot of dry powder, but the public markets offer worse valuations than transactions in the private markets. Therefore, a situation where Veolia now combined with Suez has to dispose of assets that are perfect for private equity (recession resistant, recurring revenue etc.) in order to complete an already accretive low-multiple merger with actual synergies possible, one that was long opposed by Suez’s board we might add, is actually good for capital appreciation. There is likely to be an attractive realization of value on those assets, especially water treatment which has already been an area targeted by PE in the UK.

Besides the possibility for shareholder value creation there, we point out the 4.5% dividend which is really quite safe. Regulated utilities are limited from substantial declines. Moreover, a major portion of the business benefits from the higher energy prices at least in the building of commercial momentum for their construction and other industrial services. While the EBITDA impact is more neutral from these rising energy prices, the net effect continues to be positive thanks to the overpowering growth on the revenue side. On top of efficiency gains that are still in the early stages as the integration progresses, 50% of the business appears safe to us. The hazardous and solid waste businesses are more vulnerable. Hazardous waste will suffer because of China and solid waste will likely suffer as recycled product prices decline. Nonetheless, some of those assets might be sold at premiums, and they are otherwise attractive for the long-term. With a 4.5% dividend fairly covered by an albeit lumpy FCF, we think the economics support continued shareholder payouts and that the disposals may actually create a lot of shareholder value, even though it would be nice to keep those assets. At 5.5x EV/EBITDA it strikes us as a buy relative to what its assets would get on private markets these days.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment