peshkov/iStock via Getty Images

This article is part of a series that provides an ongoing analysis of the changes made to Ruane, Cunniff & Goldfarb’s 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 5/13/2022. Please visit our Tracking Ruane, Cunniff, & Goldfarb’s Portfolio article for an idea on their investment philosophy and our previous update for the moves during Q4 2021.

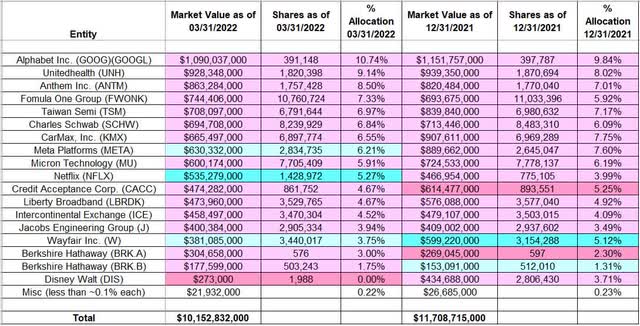

This quarter Ruane, Cunniff, & Goldfarb’s 13F portfolio value decreased from $11.71B to $10.15B. The number of holdings remained steady at 34. 18 of those stakes are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The top three positions are at ~28% while the top five are at ~43% of the 13F assets: Alphabet, UnitedHealth, Anthem, Formula One, and Taiwan Semi.

The firm is best known as the investment advisor of the Sequoia Fund (MUTF:SEQUX) which has a venerable ~51-year track record (July 15, 1970 inception, 13.62% annualized return compared to 11.34% for the S&P 500 index). After new management took over in Q1 2016, the portfolio has seen a significant shift to information & services businesses from asset-intensive manufacturing & retail. Also, the cash allocation which had averaged ~20% since inception is now ~4.3%. The following significant stakes in Sequoia’s portfolio are not in the 13F report as they are not 13F securities: Constellation Software (OTCPK:CNSWF), Eurofins Scientific SE (OTCPK:ERFSF), Rolls-Royce Holdings plc (OTCPK:RYCEY), and Universal Music Group (OTCPK:UMGNF). Bill Ruane was a Benjamin Graham pupil. To learn about Benjamin Graham’s teachings, check out the classics The Intelligent Investor and Security Analysis.

Stake Increases:

Meta Platforms (META), previously Facebook: The META position saw a whopping ~600% stake increase in Q1 2018 at prices between $152 and $193. The next two quarters had seen another ~27% increase at prices between $155 and $218. Q1 2019 saw an about turn: ~23% reduction at prices between $124 and $173. Q1 2021 saw a ~13% stake increase at prices between ~$246 and ~$299. The stock currently trades at ~$164 and it is now at 6.21% of the portfolio. There was a ~10% stake increase in Q3 2021 and a ~7% increase this quarter.

Netflix, Inc. (NFLX): NFLX is a 5.27% of the portfolio position purchased in Q4 2020 at prices between ~$471 and ~$554. There was a ~15% stake increase in Q2 2021 at prices between ~$485 and ~$555. That was followed with a ~85% stake increase this quarter at prices between ~$331 and ~$597. The stock currently trades well below their purchase price ranges at ~$168.

Note: the Netflix investment thesis is based around the idea that as the global trend toward subscription-based streaming video consumption accelerates, the leaders will be more profitable than the leaders of the cable era.

Wayfair Inc. (W): W is a 3.75% of the 13F portfolio stake purchased in Q3 2019 at prices between $106 and $152. Next quarter saw a ~40% stake increase at prices between $80 and $118. That was followed with another ~30% increase in Q1 2020 at prices between ~$24 and ~$110. The four quarters through Q1 2021 saw a ~75% reduction at prices between ~$47 and ~$346. Q3 2021 saw a ~80% stake increase at prices between ~$239 and ~$317. That was followed with a one-third increase last quarter at prices between ~$190 and ~$280. The stock currently trades at $47.14. This quarter also saw a ~9% stake increase.

Note: Wayfair has seen a previous roundtrip. It was a very small 0.76% of the portfolio position purchased in Q1 2019 at prices between $85 and $172 and disposed next quarter at prices between $138 and $164.

Stake Decreases:

Alphabet Inc. (GOOG) (GOOGL): GOOG is the largest 13F stake at 10.74% of the portfolio. It was first purchased in 2008 and that original stake was almost sold out the following year. In 2010, a much larger position was built in the mid-200s price-range. Recent activity follows: Q2 2019 saw a one-third reduction at prices between $1036 and $1288. That was followed with a ~60% reduction over the six quarters through Q4 2020 at prices between ~$1057 and ~$2138. The stock currently trades at ~$2134. Last five quarters have also seen minor trimming.

UnitedHealth (UNH): The large (top three) ~9% UNH position was established in Q4 2019 at prices between $215 and $296 and increased by ~300% next quarter at prices between ~$195 and ~$305. Q3 2020 saw a ~30% stake increase at prices between ~$291 and ~$324. The stock currently trades at ~$462. Last six quarters have seen only minor adjustments.

Micron Technology (MU) and Anthem, Inc. (ANTM): MU is a 5.91% of the portfolio position built over the two quarters through Q3 2021 at prices between ~$74 and ~$96 and the stock currently trades well below that range at $58.70. There was minor trimming in the last two quarters. The large (top three) 8.50% ANTM stake was established in H1 2021 at prices between ~$288 and ~$402 and it is now at ~$460. There was minor trimming in the last two quarters.

Formula One Group (FWONA) (FWONK): Sequoia’s Q4 2016 letter disclosed a new stake in Liberty Media Formula One. They participated in Liberty’s acquisition of Formula One and acquired the shares at a discounted price of $25. There was a 24% stake increase in Q2 2017 at prices between $30.50 and $37. The six quarters thru Q3 2019 had seen a ~18% selling at prices between $28.50 and $43 and that was followed with similar selling next quarter at prices between $40 and $46. Last nine quarters have seen only minor adjustments. FWONA is now at $53.33, and the stake is at 7.33% of the portfolio.

Note: their ownership stake in Formula One Group is ~5%.

Taiwan Semi (TSM): The top-five ~7% of the portfolio TSM stake was purchased in Q4 2019 at prices between $46.50 and $59. There was a ~130% stake increase in Q2 2020 at around the same price range. The stock currently trades at $87.19. Q1 2021 saw a ~12% selling while in Q3 2021 there was a ~20% stake increase. There was minor trimming in the last two quarters.

Note: their investment thesis is based on the following: fabs are capital intensive (~$10B per facility) and the leader naturally has a strong moat thereby yielding big profit margins. Debatably, they produce the most important manufactured component in the modern economy. It is essentially a monopoly, and the main concern is geopolitical risks.

Charles Schwab (SCHW): SCHW is a 6.84% portfolio stake purchased in Q2 2016 at a cost-basis of ~$29. Q1 2020 saw a ~40% stake increase at prices between $28.50 and $49. There was a ~17% selling in Q2 2020 at prices between $32.50 and $43. Last seven quarters also saw minor trimming. The stock is now at $61.11.

CarMax, Inc. (KMX): KMX is currently at 6.55% of the 13F portfolio. It was purchased in Q2 2016 at prices between $46 and $56 and increased by ~70% in Q4 2016 at prices between $48.50 and $66. Q4 2017 saw a ~30% selling at prices between $64 and $77 while next quarter there was a ~80% increase at prices between $59 and $72. The eleven quarters through Q4 2020 had seen a ~45% selling at prices between ~$44 and ~$109. The stock is now at $89.79. Last few quarters have seen only minor adjustments.

Credit Acceptance Corp. (CACC): CACC is a 4.67% stake established in Q1 2017 at prices between $185 and $221. There was a ~25% stake increase in Q4 2020 at prices between $288 and $356. Q3 2021 saw a ~18% selling at prices between ~$438 and ~$670. That was followed with a one-third reduction last quarter at prices between ~$582 and ~$696. The stock is now at ~$506. This quarter also saw a minor ~4% trimming.

Note: They have a ~6% ownership stake in Credit Acceptance Corp.

Berkshire Hathaway (BRK.A) (BRK.B): Berkshire stake is now at 4.75% of the portfolio. It is a very long-term position that was the largest stake in their first 13F filing in 1999. Recent activity follows: Q1 2018 saw a one-third selling at prices between ~$191 and ~$217. Last nine quarters have seen the large stake sold down at prices between ~$169 and ~$359. The stock is now at ~$278.

Liberty Broadband (LBRDK): LBRDK is a 4.67% of the portfolio position purchased in Q1 2018 at prices between $86 and $97 and increased by ~20% next quarter at prices between $69 and $85. Q1 2020 saw a ~18% reduction at prices between ~$91 and ~$139. There was a ~23% stake increase in Q1 2021 at prices between ~$143 and ~$157. The stock currently trades at ~$114. Last four quarters saw minor trimming.

Intercontinental Exchange (ICE): The 4.52% ICE stake was purchased in Q3 2020 at prices between ~$92 and ~$107. The stock currently trades near the bottom of that range at ~$94. Last few quarters have seen only minor adjustments.

Jacobs Engineering Group (J): J is a 3.94% long-term stake first purchased in 2012. Recent activity follows: Q2 2018 saw a ~20% increase at prices between $56.50 and $67 while the next six quarters saw minor trimming. There was a ~25% selling in Q1 2020 at prices between ~$63 and ~$104. That was followed with a similar reduction in Q2 2021 at prices between ~$129 and ~$143. The stock currently trades at ~$124. Last three quarters also saw minor trimming.

Walt Disney (DIS): DIS was a fairly large 3.71% of the portfolio position established in Q2 2020 at prices between $94 and $127. The position was sold down to a minutely small stake this quarter at prices between ~$129 and ~$158. The stock currently trades at $94.22.

The spreadsheet below highlights changes to Ruane, Cunniff, & Goldfarb’s 13F stock holdings in Q1 2022:

William J. Ruane – Ruane, Cunniff, & Goldfarb’s Q1 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment