felixmizioznikov/iStock Editorial via Getty Images

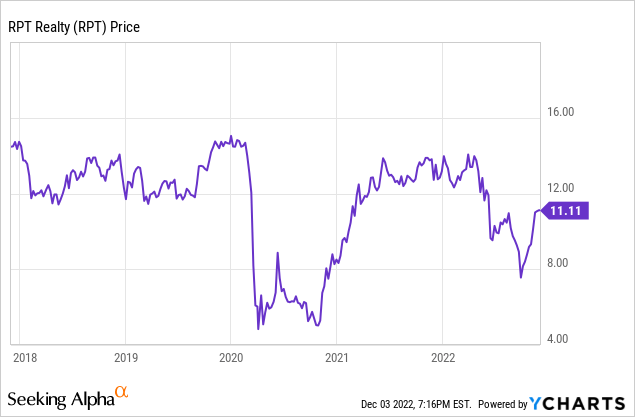

The market has many depressed REITs and preferred shares that should be grabbed onto with both hands. I present one such opportunity that is currently earning its place in any income investor’s portfolio as both the common and preferred are attractive at current prices.

Background

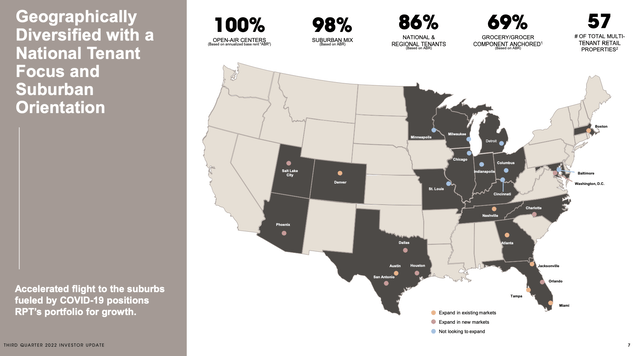

RPT Realty (NYSE:RPT) is a REIT that owns a national portfolio of open-air shopping destinations located in fast growing markets. At present, the company’s portfolio consists of 57 multi-tenant properties. Since the start of 2021, RPT has acquired about $840 Million shopping centers through its wholly-owned and grocery anchored investment platforms. With these acquisitions, over 50% of RPT’s value is now derived from Boston, Atlanta, Nashville, and Florida. 69% of total properties are anchored by major grocery tenants but 96% of properties in Boston, Atlanta, Nashville and Florida are grocery-anchored, which provides hedging against the retail-elements of their portfolio.

Q3 2022 Investor Presentation (RPT Realty) Q3 2022 Investor Presentation (RPT Realty)

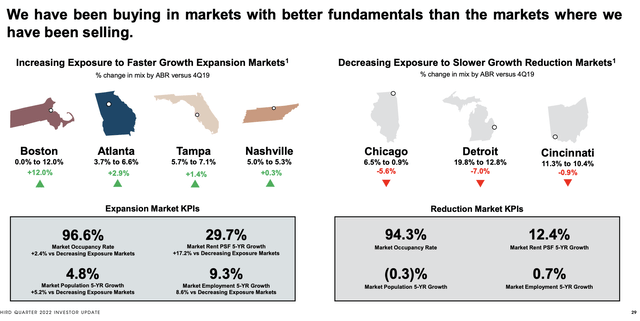

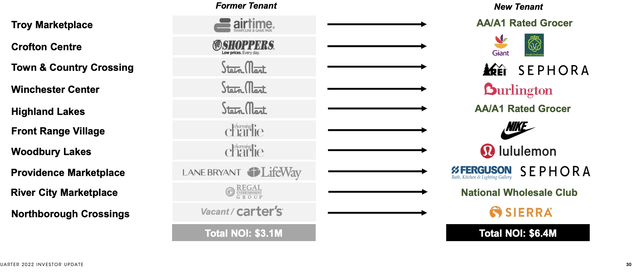

Since 2019, RPT has sold lower IRR properties in slower growth markets and used the proceeds to acquire higher quality assets in stronger growth markets, transforming the quality of their cashflows towards higher ABR/sf and higher income markets with greater grocer exposure. RPT has replaced lower quality tenants with national grocers and retailers and upgraded their tenants to investment grade quality which has increased total rents over 100%. Grocery-anchored centers typically trade at cap rate premiums to non-grocery-anchored centers which will increase Net Asset Value on a go-forward basis.

Q3 2022 Investor Presentation (RPT Realty)

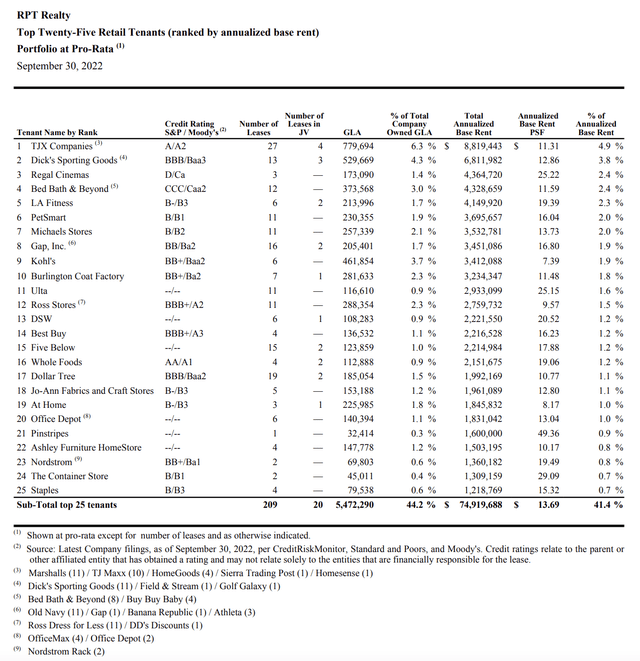

Among their top retail tenants are The TJX Companies, Inc (TJX), DICK’S Sporting Goods, Inc (DKS), and Bed Bath & Beyond Inc. (BBBY) but their top 20 tenants only account for 41% of the portfolio base rent. Their portfolio is still a way off from being considered investment grade with less than 20% of tenants being considered as such.

Q3 Supplemental Reporting Information (RPT Realty)

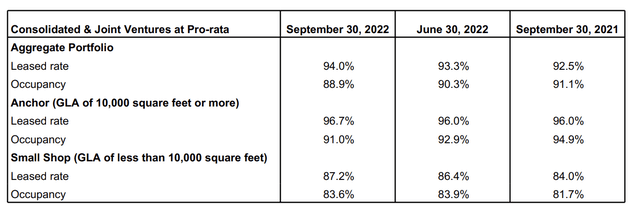

The slight downward trends in occupancy may scare off many prospective investors but some extra digging actually leads to a different conclusion than one might think.

Q3 Supplemental Reporting Information (RPT Realty)

The decreases in aggregate portfolio occupancy have been due to the recapture of two anchor spaces that have been re-leased to top tier tenants and are reflected in the aggregate portfolio leased rate which as you can see is very much positively trending being up 70 bps QoQ.

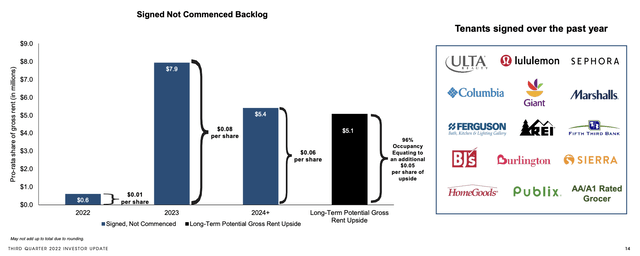

There was $14.0 Million in signed but not commenced backlog of rent and recovery income as of September 30, 2022, an increase of $5.2 Million or 60% QoQ. This was driven primarily by the addition of leases with Sierra Trading Post, Burlington (BURL) and BJ’s Wholesale Club (BJ). This will add $0.15/share incrementally to FFO by 2025.

Source: Q3 2022 Supplement

Q3 2022 Investor Presentation (RPT Realty)

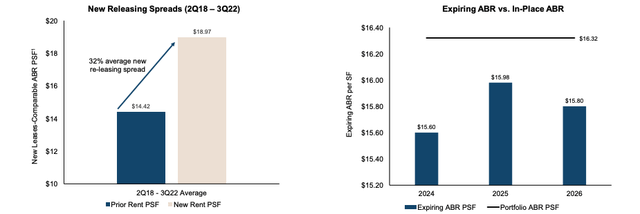

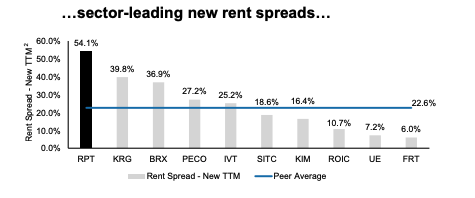

Those who have said traditional brick and mortar retail is “dead” due to the likes of Amazon (AMZN) and other major online retailers will be shocked to see the rental spreads RPT has captured in recent years. Comparable re-leasing spreads have averaged 32% since 2018 which works out to ~8% annually well above its peer group and more importantly the rate of inflation. New leases-comparable rent per square foot has averaged about $19 since mid-2018 which is significantly above the current portfolio average rent per square foot of ~$16, so as leases expire, we should expect higher renewal rates.

Q3 2022 Investor Presentation (RPT Realty) Q3 2022 Investor Presentation (RPT Realty)

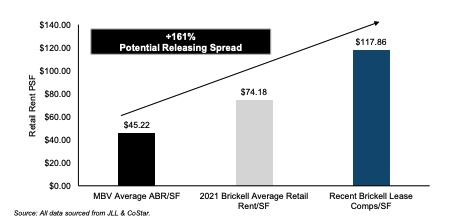

During Q3 2022, RPT acquired Mary Brickell Village (MBV) for a contract price of $216 Million or $111 Million through its grocery-anchored joint venture platform.

MBV is a generational three-story, 200,000 square foot, grocery-anchored center that sits on 5.2 acres in the heart of Miami’s Brickell neighbourhood. It is located at the epicenter of Miami’s premier retail and dining destination, with over 6.7 Million annual visitors, it has quickly become one of the most sought-after office, residential and hospitality markets in the U.S. Tenant sales average over $1,100 per square foot with low occupancy costs. The property is currently 80.5% occupied and 94.4% leased, with attractive contractual rent growth providing visible near-term earnings upside. In addition, MBV provides for compelling value-creation opportunities as the site’s zoning allows for the potential to develop up to 80 stories or 4.1 Million square feet, which could consist of residential, office and hospitality.

Source: Q3 2022 Supplement

The area has caught the attention of prominent hedge funds, PE firms, tech companies, and banks such as Citadel, D1 Capital Partners, Apollo (APO), and Microsoft (MSFT). Each of these entities has either begun leasing office space or are in the process of doing so. Recent retail lease comparables in Brickell have averaged nearly $118/sft including Sexy Fish Miami, Negroni, and Chipotle (CMG) which is well above RPT’s weighted average portfolio base rent of $16/sf.

Q3 2022 Investor Presentation (RPT Realty) Q3 2022 Investor Presentation (RPT Realty)

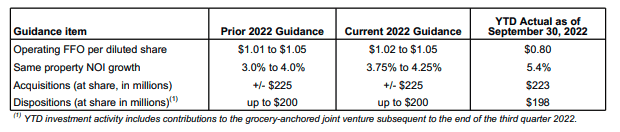

As a result of realizing on higher lease spreads and the MBV acquisition, management has increased guidance slightly from earlier this year for fiscal 2022. This is always a positive.

What this means is that the higher end of previous guidance is more likely. Given that the conversion price of the preferred shares is 30% above the common share price FFO per diluted share is really not as meaningful as basic which would actually put FFO/share at 1.14/share for fiscal 2022 and imply a cheap valuation of ~9.6x.

Q3 Supplemental Reporting Information (RPT Realty)

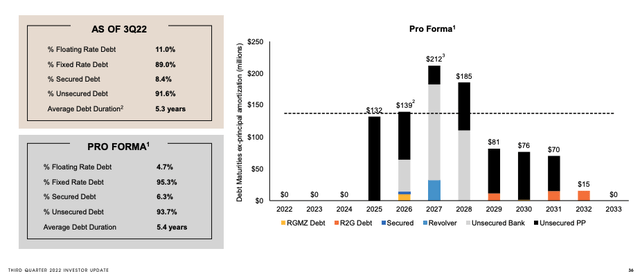

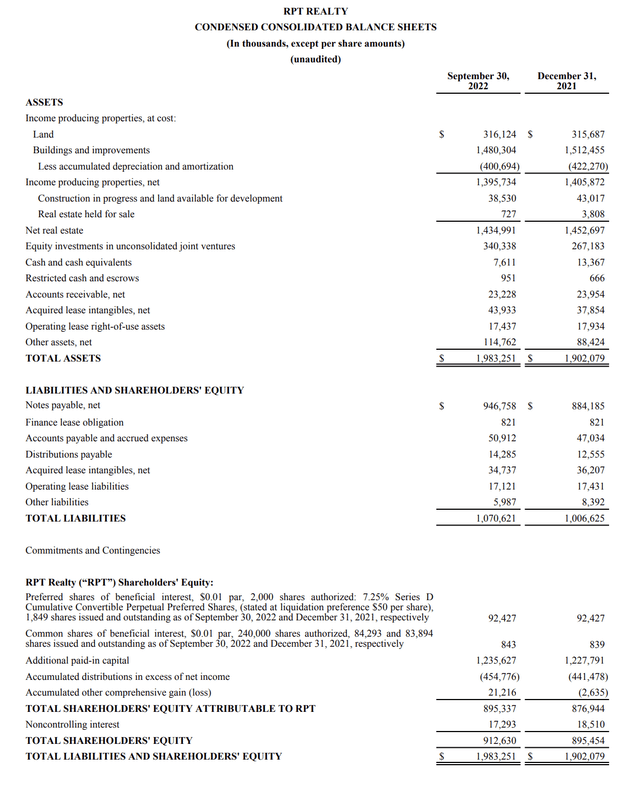

One of the largest risks for REITs is rising interest rates as they will be forced to refinance upcoming maturities into higher rates and is precisely the case for many REITs today. RPT’s debt profile is about as ideal as it can get in this current environment with no maturities until 2025 and only 11% of debt is floating rate anyway. The weighted average interest rate is only 3.57% as well which is well below current mortgage rates of 5-6%. Leverage is not overly high with Net Debt to annualized EBITDA at ~6x.

Q3 2022 Investor Presentation (RPT Realty)

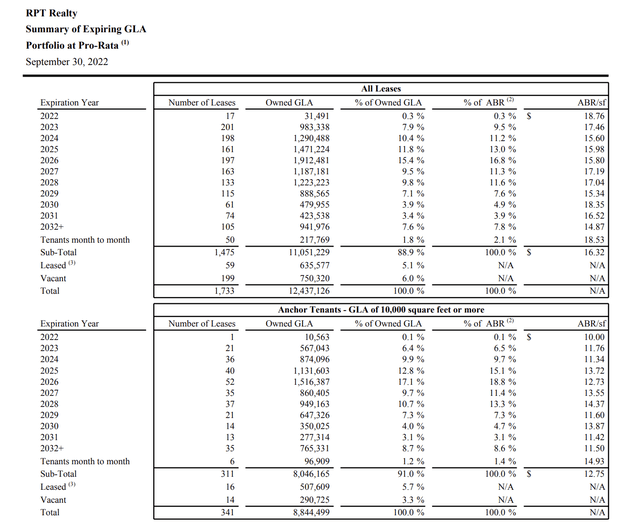

The ideal debt maturity profile is combined with a strong lease maturity profile with only ~21% of tenant leases (16% of anchor tenants) expiring before 2025. Embedded rent escalators have averaged 1.7% since 2018.

Q3 Supplemental Reporting Information (RPT Realty)

Valuation

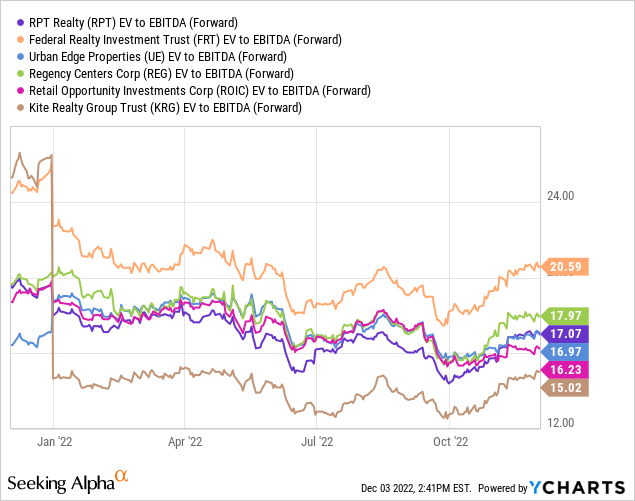

When compared to its retail peer group, the stock is by no means expensive but does not trade at any meaningful discount either, which doesn’t exactly catch your eye. The market is clearly not taking into account its ability to capture on higher leasing spreads than its peer group as I would argue it could even trade at a premium.

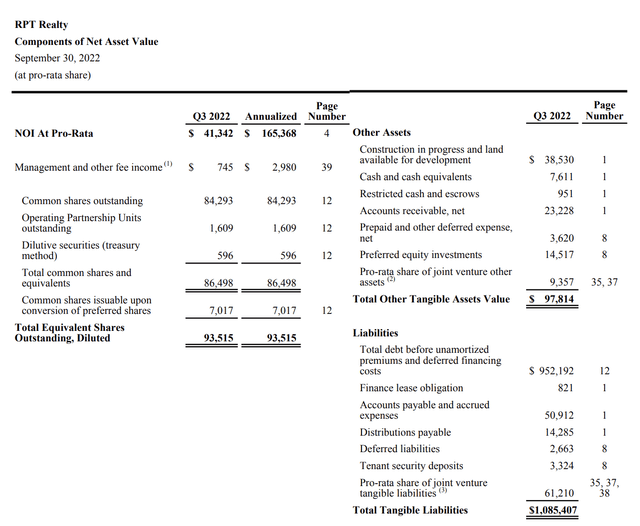

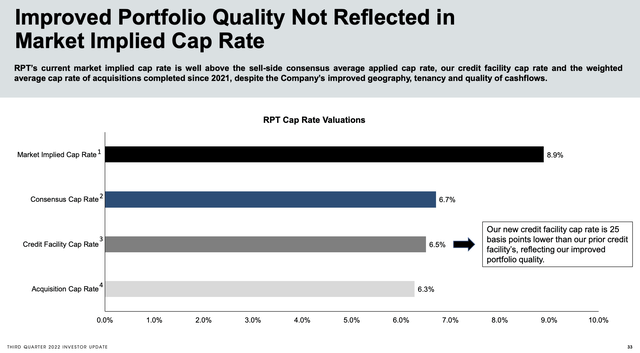

To calculate NAV, I use annualized Q3 pro-rata NOI, reallocate preferred equity to debt, and use the sell-side consensus average applied cap rate for their properties of 6.7%. This would imply a ~$15.40/share NAV which is 40% above the current market price. This is conservative as this does not account for the MBV acquisition, or other future acquisitions for that matter, nor does it account for expiring lease activity which will likely be renewed at rates up to 18% higher.

Q3 Supplemental Reporting Information (RPT Realty) Q3 2022 Investor Presentation (RPT Realty)

RPT Realty 7.25% Series D Cumulative Convertible Preferred (NYSE:RPT.PD)

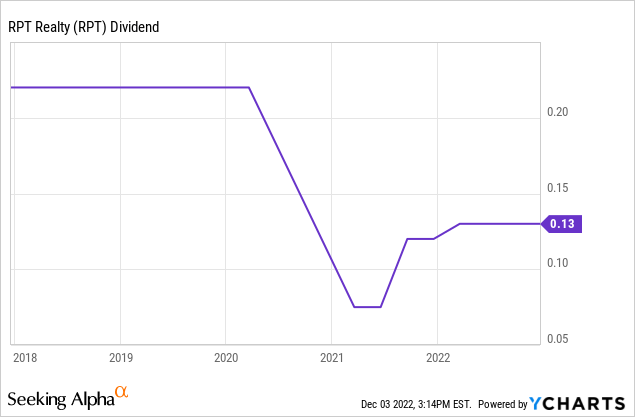

The $0.13/share quarterly dividend which works out to a 4.7% yield is nothing to scoff at and the payout ratio as a percentage of operating FFO is only 49% so there is plenty of room for increasing the dividend. There is even room to increase it to pre-COVID levels at $0.22/share but has happened painfully slow since that cut.

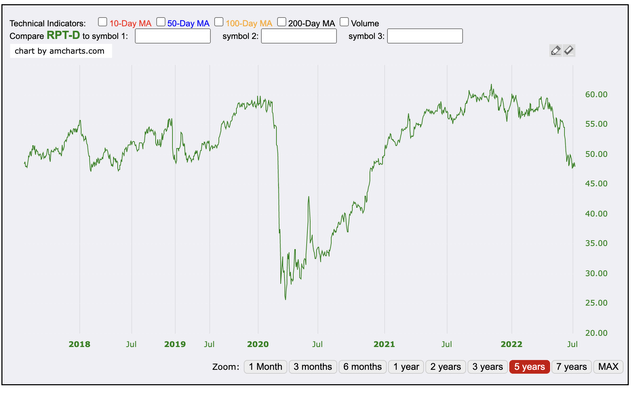

For the income-oriented investors, there is a better option to pick up an additional 240 basis points in yield, which is also safer.

The option is the 7.25% Series D Cumulative Convertible Preferred shares, which may not exactly be liquid with only 1,849 outstanding. However, it is cumulative meaning the $0.90625/share quarterly dividend cannot be cut unless the common dividend is as well and preferred shareholders must be paid all missed payments before common shareholder distributions can resume.

As an added sweetener the preferred shares are not callable but are redeemable by the preferred shareholder. Each Series D Preferred Share has a liquidation preference of $50.00 per share and is convertible, meaning the holder has the option to convert at any time into 3.4699 of common shares (equal to a conversion price of ~$14.69 per share at the current share price). The conversion price is still ~32% above the current market price so it doesn’t make sense to convert, but given that NAV is at least equal to the conversion price, we could see the market price exceed the conversion price in the next few years. This could be accelerated if management implements a share repurchase program. The market price has tested that boundary before as well.

Looking at the Q3 2022 Balance Sheet below, preferred equity only accounts for 10% of total equity and even less in relation to NAV (liquidation value). With a 48% payout ratio on operating FFO which already deducts preferred share dividends, the chances of a preferred dividend cut seem extremely low.

Q3 Supplemental Reporting Information (RPT Realty)

The preferred share price is at $51/share which is slightly above par but has not traded this low since December 2020 and has dropped 20% since its highs at $60/share in mid-2021 which is perplexing as RPT’s debt has maintained an investment grade credit rating of BBB through that time. A 345 bps premium for the preferred shares over the debt makes it seem as though the preferred shares are much riskier which is not the case, even with mortgage rates being 5-6% currently. A more reasonable 200 bps spread would imply a fair price of $65/share for 27% upside.

RPT Realty 7.25% Series D Cumulative Convertible Preferred Stock Price (Stock Market MBA)

Conclusion

The common and preferred shares appear to have tremendous upside at current share prices. I personally gravitate towards the preferred shares given the relative safety and higher yield. There is still a good chance you can participate at some point in the upside associated with the common shares by buying the preferred shares with NAV being at least 5% above the current conversion price as well. I am more confident the preferred shares offer a lower risk way to achieve double digit returns and you will be hard pressed to find an investment grade rated company with preferred shares trading at ~7%.

Be the first to comment