Domagoj

Honda Motor (NYSE:HMC) is definitely a car company with some serious brand equity. With that comes a certain degree of price discovery. Positive effects that were protecting Honda from weaker deliveries are reversing. While pent-up demand is something that lends itself to confidence in automotive sales, it’s still a consumer durable in a pretty uncertain environment. Most importantly, it’s a company that gets dominated by others in terms of valuation and margin of safety. It’s not bad, but we’re not interested.

Q2 Breakdown

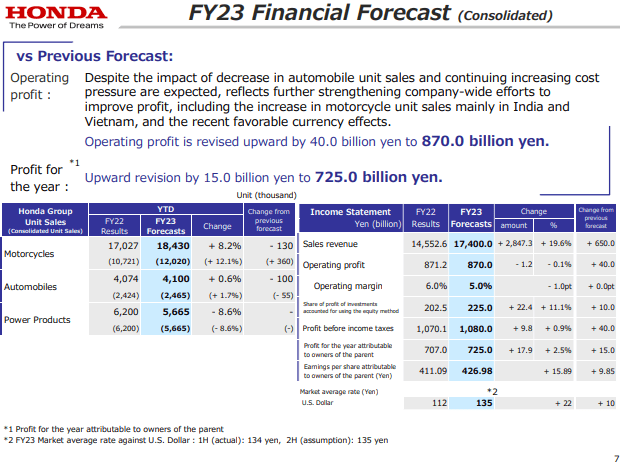

There’s a fair bit to learn from Honda’s call. Of course, semiconductor shortages and supply chain issues in general were a pain for the company, and deliveries of cars fell while motorbikes grew in the mix as they are less material intensive. Motorbikes becoming more prominent supported margins, as they sell more profitably than cars.

Volumes (Q2 Pres)

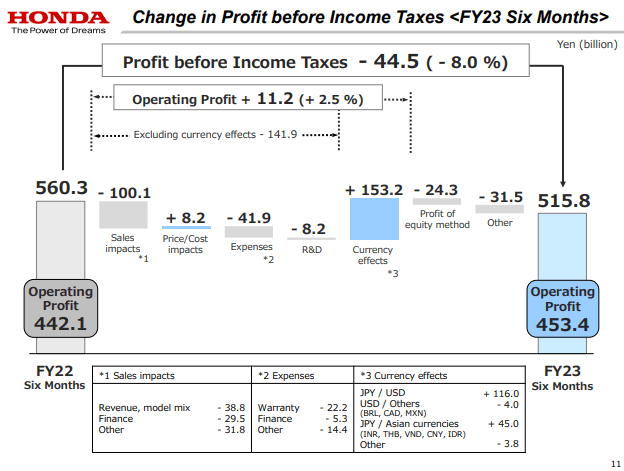

FX effects have been a key issue for most Japanese companies, and a precipitous declines in the Yen, which got as bad as being down 20% from highs relative to the dollar, was in Honda’s case a very positive effect. Quite a lot of the electronic inputs to the Honda models are Japanese, and therefore relative to the largely foreign market for the final product, Honda has been making spread on the Yen-denominated inputs getting cheaper relative to the cars on FX effects. The ratio of mix to FX effects was about 1:3.

Profit Waterfall (Q2 Pres)

These effects were enough to growth the operating profit despite overall declines in deliveries. They will of course reverse to the detriment of the profits. The Yen has already retraced meaningfully back from its 20% low relative to the dollar by about one third. With semiconductor shortages becoming less of a problem, volumes should also resume and grow cars in the mix again.

Bottom Line

Easing supply chain issues is of course not a negative thing. While there will be negative mix effects, volume effects are going to overtake. These volume effects can be relied upon quite well; there is evidence of pent-up demand for cars which are continuing to sell well in Europe despite being a durable and despite the recession in Europe being meaningful. There will be a balance between volume and perhaps some pressure on pricing as demand concerns see an end to car inflation. The severity of this depends on your soft-landing assumptions. We think a soft landing is very likely at this point, but only in America which accounts for 46% of Honda’s revenues. The jobs report shows no growth in risk of a unemployment-consumption spiral, which would have doomed the economy if it started. Employment keeps getting better. CPI is seeing a peak from cost-push contributions as logistics, a major marker, sees calm. Honda will perform decently, but it’s not a total breeze.

The main problem we have with Honda is on valuation. In Japan you can find car stocks whose values are covered meaningfully by non-operating assets, like Mazda (OTCPK:MZDAY). PEs are also much lower. We’d take a company like that over Honda at the 66% discount factor. Honda just doesn’t impress us on the valuation front.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment