baona

One specialized company in the health care administration space that we have traded several times is HealthEquity (NASDAQ:NASDAQ:HQY). The stock has ebbed and flowed, making it ideal for trading. Right now, the stock has rallied to a higher point that we think you need to let the market walk this back, and then do some buying. Generally speaking the stock is a buy in the $40s and $50s, a hold in the 60s, and a sell in the $70s and $80s. That is our current take. With the stock in the high $60s, we think upside is capped to at best 10-15% in the near-term, but is more likely to fall back. This is just how this stock operates. Readers, please understand, that it really is a trading name. Most investors have seen little gain in 5 years. But if you bought and sold anywhere close to the above ranges a few times, you would be far outpacing investors and the market. Sure, timing is hard, and sometimes you will sell to soon, but you certainly won’t let gains dissipate.

We like this company generally as it is connecting consumers to care, but it’s a niche play. You see in healthcare savings in the US, many companies/plans allow its members to use products such as health savings accounts, or HSAs, health reimbursement accounts, or HRAs, and Flexible Spending Accounts, or FSAs, to pay for routine healthcare expenses, while also using a high deductible insurance plan to mitigate catastrophic medical expenses.

These high deductible insurance policies are typically lower in cost, and the user pays medical claims out of a pre-tax pre-funded spending account, often with a debit card provided by a bank or insurance plan. In many cases, users can rollover and invest any unused balances for future use.

You see, with this type of model there is some advantage. They can provide people more flexibility and control when paying for medical expenses and can offer an alternative, or even a supplement, to traditional health insurance plans.

As a supplement, HSAs can augment a traditional health insurance plan by providing savings for non-covered medical expenses. Consumers using these plans are also more cost-sensitive and request only the treatment they need, as well as having a higher adherence to treatment regimes.

This lowers costs for everyone, long-term. That is a good thing.

Most consumer HSA and HRA insurance plans are offered by traditional health insurance providers. Most of the monetization of these plans comes from the custodial assets.

The HSA market is currently around $100 billion in custodial assets spread across nearly over 34 million accounts. However, this market is estimated to grow to more than $500 billion over the next few decades. So HealthEquity should have a runway for growth, if they can keep a competitive moat.

That said, the stock ebbs and flows because it seems performance ebbs and flows. Perhaps it is the nature of the industry, and of course, COVID-19 was a bit of a bottleneck for a few quarters, but things have normalized. Inflation is rampant, but the economy and job market remains strong, which means those employed can purchase or open certain types of health plans, like health savings accounts.

Yet, HealthEquity saw a quarter that was mixed when it just reported earnings. On the surface, we saw a revenue beat versus consensus estimates, along with earnings that were in line. Not too shabby. But, as we dig deeper there are some concerns when we look at the performance relative to the valuation.

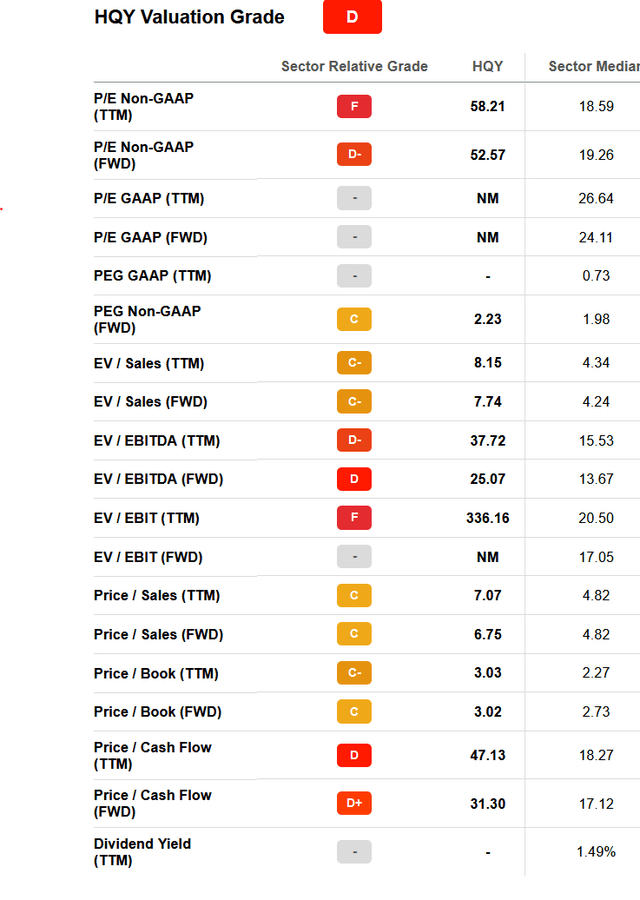

Performance (i.e., growth) suggests the valuation here is stretched and justifies our hold rating. We outright are sellers in the $70s and especially if it hits $80. It could even be a short at that level for traders. For now, it is a hold. But we are talking about lofty valuations:

So, it is extremely expensive. Does the performance justify this? We do not believe so, since the quarter saw some contraction in key metrics.

The top line revenue showed growth, but was not very strong. At $206.1 million, this was an increase of 9% compared to $189.1 million last year. There are 3 segments of operations. The company reported service revenue of $103.0 million, custodial revenue of $65.6 million, and interchange revenue of $37.5 million. But when we factor in the expenses, the company saw a net loss of $10.7 million, or $0.13 per share. Ouch. But making adjustments, we saw net income of $28.1 million, or $0.33 per share. Earnings are down folks. Last year there was a GAAP net loss of $3.8 million, or $0.05 per share, and on an adjusted basis, net income was $33.4 million, or $0.40 per share. So we are seeing contraction. Now there are more shares in the float versus last year, but operating expenses were up as well, eating into profit.

There was small growth in adjusted EBITDA. Adjusted EBITDA was $67.0 million, an increase of 2% from last year.

This comes despite many more new accounts being sold and more assets under management. There were 196,000 new HSAs, a larger increase in accounts sold vs. the 180,000 sold last year. HSAs in total were 7.5 million, an increase of 26% year-over-year. Total accounts were 14.5 million, including 7.0 million other consumer-directed benefits. In terms of assets, the company has $20.5 billion of HSA assets. This is an increase of 33% year-over-year.

So why then, with all of this growth in assets, is the company not earning more? At the end of the day, earnings matter, especially long-term. The growth has been impressive. The company is seeing high operating expenses and has been rather inefficient with its returns on invested capital. The acquisitions over the years are driving revenues higher. Earnings growth is a bit slower. But guidance was strong.

The outlook was an increase for the fiscal year, but the company is still losing money on a GAAP basis. As noted in the press release:

management expects revenues of $834 million to $844 million. Its outlook for net loss is between $43 million and $36 million, resulting in net loss of $0.51 to $0.43 per diluted share. Its outlook for non-GAAP net income, calculated using the method described below, is between $103 million and $111 million, resulting in non-GAAP net income per diluted share of $1.23 to $1.32 (based on an estimated 84 million diluted weighted-average shares outstanding). Management expects Adjusted EBITDA of $252 million to $262 million.

If EPS comes in at the midpoint of $1.27, would be down from $1.33 in fiscal 2022, and down from $1.69 in fiscal 2022. Folks, this is moving in the wrong direction.

As a result, at 53X FWD EPS, shares are too expensive for the lack of per share growth. While we like the growth in accounts, there is also debt. At the end of Q2 HealthEquity had $177 million of cash and cash equivalents but $928 million of debt outstanding. This includes $346 million of variable rate debt, and this is why interest expenses were up heavily, which weighed on earnings.

Take home

The stock is a hold here, but a sell if the market takes this higher toward $80. We are buyers in the $45-$55 range.

Be the first to comment