Photobuay/iStock via Getty Images

The RPAR Risk Parity ETF (NYSEARCA:RPAR) is a diversified multi-asset class ETF, with exposure to treasuries, treasury inflation-protected securities, commodities, and stocks. RPAR’s strategy and holdings are meant to preserve shareholder capital during downturns and recessions and outperform during periods of heightened inflation. The fund and its underlying holdings / strategy had performed as expected during prior downturns, but the fund has underperformed YTD. As the fund has underperformed expectations, I thought to write an article explaining just why that has been the case.

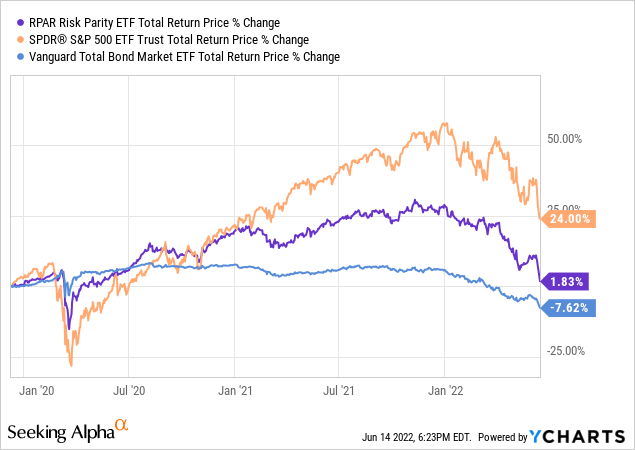

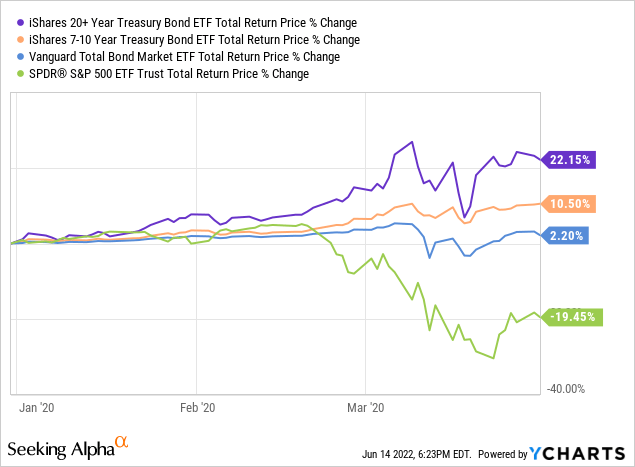

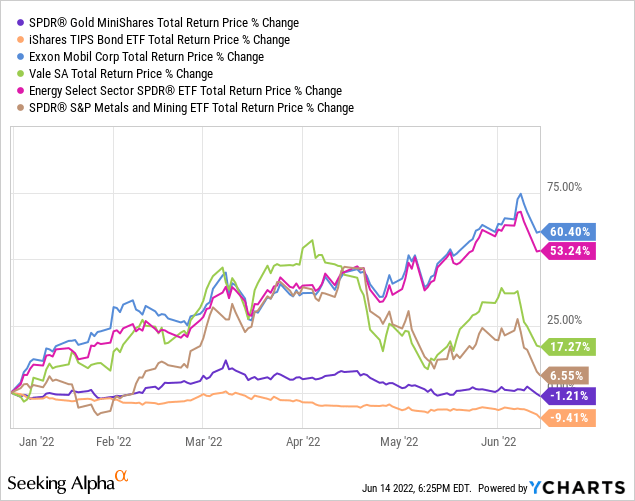

RPAR’s capital preservation strategy rests on the fund’s significant long-term treasury holdings. These securities tend to see skyrocketing prices during downturns and recessions, due to a flight-to-quality effect, and due to Federal Reserve policies. These same securities have significantly underperformed YTD, due to rising rates and increasing inflation. RPAR’s performance during periods of rapid inflation is driven by the fund’s gold, commodity equities, and treasury inflation-protected securities, or TIPs, holdings. Gold has not performed all that well YTD, unlike most other commodities. TIPs have also not performed all that well YTD, due to rising rates, and due to investor expectations of normalizing inflation. Commodity equity producers have mostly performed as expected.

In general terms, as most asset classes are down YTD, there is little the thing could have done to significantly reduce losses without jeopardizing diversification and / or long-term returns. The fund’s strategy is not working, but very little is working right now. In my opinion, the fund remains a reasonable long-term investment opportunity, but recent underperformance does make me less bullish about the fund.

Quick Risk Parity Overview

A quick overview on risk parity, the portfolio strategy underpinning RPAR’s strategy and holdings. I have a more in-depth analysis of said strategy here, for those who wish to read more about the subject.

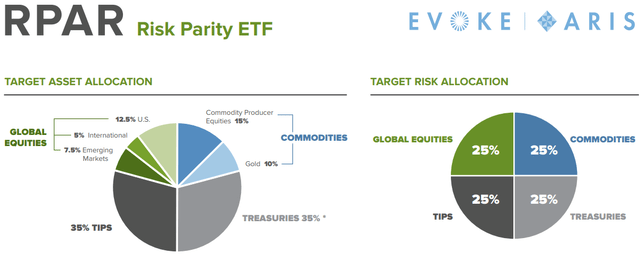

Risk parity is an asset allocation strategy used to create diversified portfolios. RPAR itself invests in treasuries, TIPs, global equities, gold, and commodity producers.

Risk parity portfolios target equal risk between different asset classes which means, in practice, overweighting relatively safe asset classes like treasuries.

Risk parity portfolios also tend to use modest amount of leverage, to boost returns. RPAR itself sports a 1.35x leverage ratio, roughly comparable to that of a CEF. Leverage also increases risks, but the effect tends to be relatively muted due to being overweight safe asset classes. A modestly leveraged portfolio focusing on safe securities, like treasuries, should be about as risky as an unleveraged portfolio focusing on risky securities, like equities.

The end result should be a portfolio with strong long-term returns, due to some allocation to risky securities and leverage, but relatively low level of risk, due to diversification. In theory at least.

RPAR Strategy and Holdings Analysis

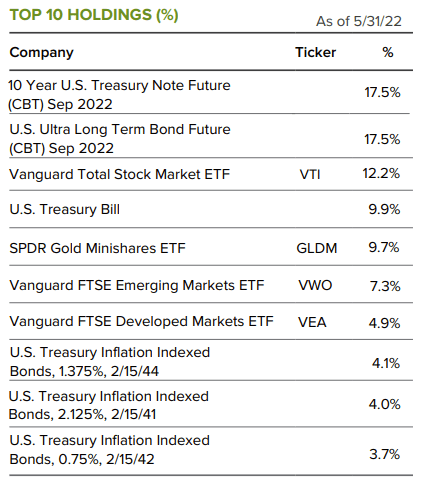

RPAR itself is an ETF following a risk parity approach to portfolio construction, through investments in ETFs, equities, and bonds. RPAR’s holdings, asset, and risk allocations, are as follows.

RPAR Factsheet

RPAR Factsheet

RPAR’s long-term returns are driven by the fund’s equity investments, with these accounting for around 30-35% of its net asset value. Equities have the strongest long-term returns out of all / most relevant asset classes, so their inclusion boosts returns. Other asset classes do have positive expected returns, but much lower than equities. RPAR’s equity exposure includes U.S. and international equities, as well as commodity equity producers like Exxon (XOM) and Vale (VALE).

RPAR’s realized returns have been somewhat lower than expected, in part due to underperforming YTD.

RPAR’s capital preservation is driven by the fund’s long-term treasury holdings. As mentioned previously, these securities tend to see skyrocketing prices during downturns and recessions, due to a flight-to-quality effect, and due to Federal Reserve policies. Long-term treasuries perform exceedingly well during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic.

Some other of the fund’s holdings perform reasonably well during downturns and recessions too, including the fund’s treasury bills and TIPs. On a more negative note, the fund’s equity and gold holdings post significant losses during the same.

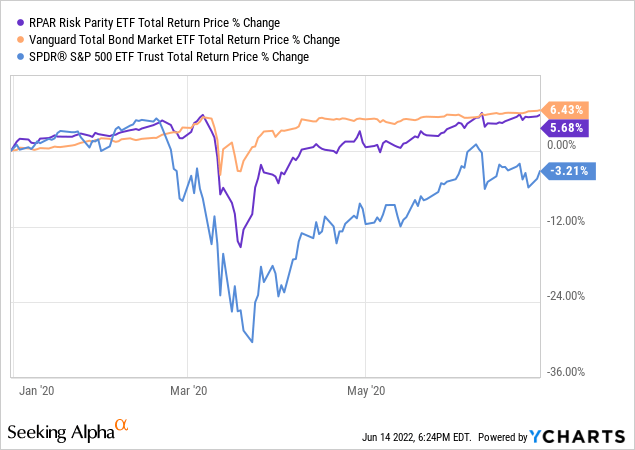

Fund asset class weights are chosen so as to ensure treasury gains neutralize equity losses, leading to capital preservation during downturns and recessions. The strategy mostly worked during prior downturns, with the fund suffering relatively little in losses during early 2020 and having fully recovered from these by mid-2020.

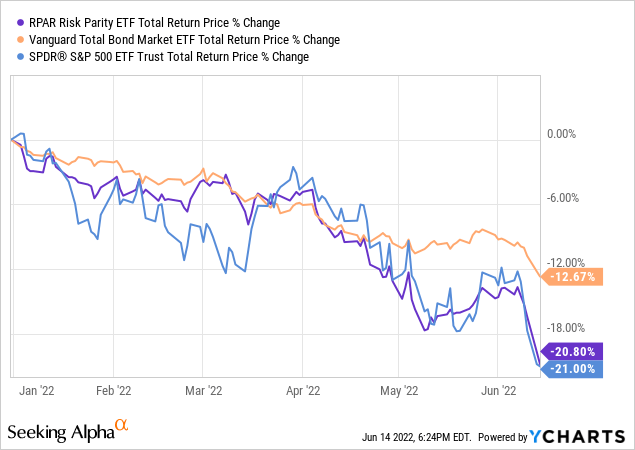

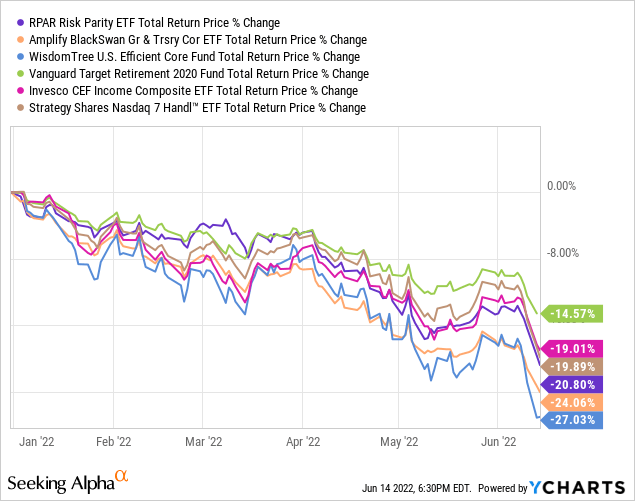

On a more negative note, and as previously mentioned, the fund has not performed all that well YTD, being down 20.8%. Losses have been effectively equal to those of the S&P 500, and quite a bit higher than that of bonds. Although one could argue that the current environment does not technically constitute a downturn or recession as the economy remains strong, we are definitely in a bear market, as equities are down by almost 20% these past few months. RPAR is meant to preserve shareholder capital, and it has definitely not done so YTD, even as equities tumble.

Finally, the fund’s gold, TIPs, and commodity equity producers are meant to perform reasonably well during periods of increased inflation. That has been somewhat the case, with most of these investments being up YTD, but several are down instead, including gold and TIPs. Results have been about average, at best, but expectations were much higher.

As should be clear from the above, RPAR’s underperformance YTD has been somewhat unexpected, contrary to its (expected) investment thesis, and a significant negative for the fund and its shareholders. RPAR is supposed to perform well during downturns, recessions, and inflationary environments, but it has clearly not done so these past few months.

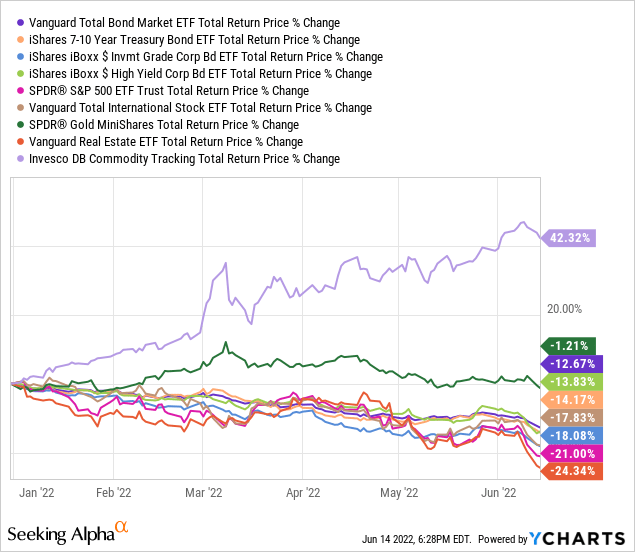

RPAR’s underperformance is the result of the fund’s strategy, holdings, and broader market conditions. RPAR is a diversified, multi-asset class fund, and most asset classes have underperformed YTD. Bonds are down, including treasuries, investment-grade bonds, junk bonds, and TIPs. Equities are down, including local and international stocks. Real estate is down, as is gold and silver. Only commodity indexes and energy are up, and that is simply not enough to make up for losses in other asset classes.

Diversification simply does not work when most asset classes are down, hence RPAR’s losses. Importantly, basically all diversified multi-asset class ETFs are down too, not just RPAR. I’ve covered several of these in the past, and all are down. RPAR’s diversification and strategy were ineffectual in reducing shareholder losses YTD, but the same is true for most funds.

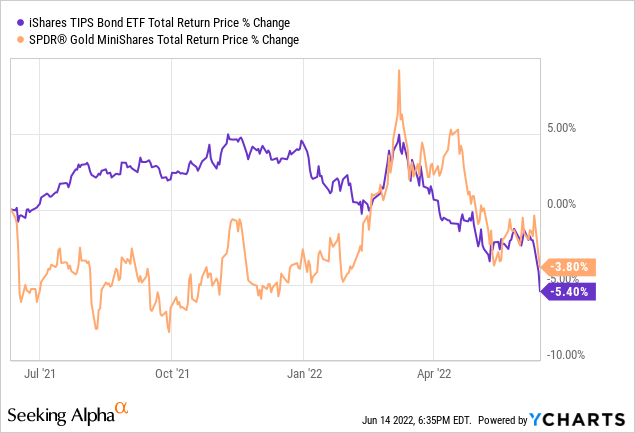

Besides the above, lackluster gold and TIPs performance also explains the fund’s underperformance. These two asset classes are meant to perform well when inflation is high but have not performed all that well YTD.

TIPs have not performed all that well due to investor expectations of normalizing inflation. It is not clear to me why gold has underperformed, but lack of interest from younger investors is at least partly to blame. Gold is, or was, an effective inflation hedge partly because investors thought it was, and so bought gold during inflationary periods, leading to higher gold prices. Gold is not a popular asset class for younger investors, so there is less demand for gold when inflation increases, blunting the asset’s effectiveness as an inflation hedge.

RPAR would have seen stronger results YTD if it had exclusively focused on commodity equity producers for its inflation exposure, but doing so would have significantly reduced diversification, and was not obviously the right call earlier in the year.

Conclusion

RPAR is a diversified multi-asset class ETF. The fund has underperformed YTD, as most asset classes are down. RPAR remains a reasonably good long-term investment but has definitely underperformed expectations.

Be the first to comment