AndreyPopov/iStock via Getty Images

Co-produced with Treading Softly

I used to love my annual pay increase from my employer. When I was young, I’d count down the days to my annual review to find out how much more I would get paid.

Think of all that extra money!

Getting even a few dollars more an hour felt like I was rapidly becoming a rich man. Better watch out for Uncle Pennybags coming to a store near you!

Turns out, I was as uninformed as I was excited. Many don’t realize that annual pay increases often only keep you in lockstep with inflation. Your wage might grow, but in a real-world contrast to inflation, you don’t experience real wage growth unless the growth rate outpaces inflation. The target wage increase of 2-3% by most employers is meeting the Federal Reserve’s target inflation rate.

When inflation is above this level and employers are not hiking wages enough to meet it, you might get a bigger paycheck but end up with less real-world income. We’re seeing that all over the globe currently. You’re making more but able to buy less.

So when it comes to investing, I am determined to make my own wage increases. To do this, we have two readily available paths:

- Dividend growth investments – we can’t control how much they grow it, but growth is growth.

- Dividend reinvestment – we can control how much we reinvest to see income growth. Want your income to grow faster? Reinvest more.

Today, I want to look at two investment opportunities that you can reinvest in and see your income grow, and are also growing their dividends on their own – win-win!

Let’s dive in.

Pick #1: BRSP – Yield 9.7%

BrightSpire Capital (BRSP) has hiked its dividend from $0.10/quarter to $0.20/quarter through several raises since reinstating it in March 2021.

We don’t want to be greedy, we’re perfectly happy collecting the current 9.7% yield the market is gifting us. Yet the stars are aligned in BRSP’s favor for even more hikes in the future. BRSP is in the commercial mortgage business. They invest in floating rate loans with a first lien mortgage on a commercial property.

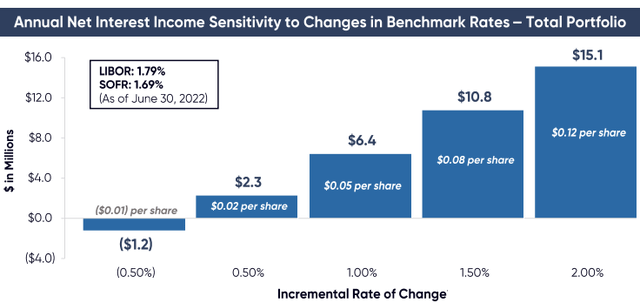

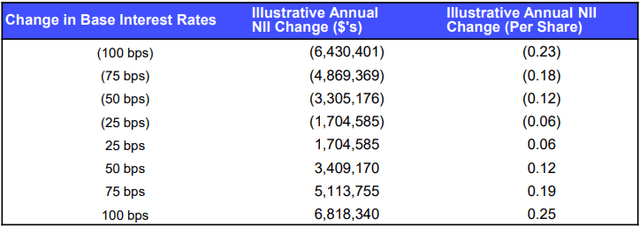

Unless you have been floating around the world on your yacht for the past year, you know that interest rates are going up. Rising rates are great when you own floating rate loans. How great? BRSP quantifies it for us. (Source: Supplemental Q2 2022)

As of this writing, the one-month LIBOR is 2.99%, up 120 bps from the June 30 chart above. This implies that BRSP is making an additional $0.05-$0.06 in annualized net income today. The Fed is widely expected to hike the target rate to 3-3.25% on September 21st. If that happens, that implies LIBOR will be over 150 bps above June levels, and BRSP will be making an additional $0.08/year.

Not that BRSP needed to make more money to hike the dividend. BRSP covered the current dividend by 120% last quarter.

Supplemental Q2 2022

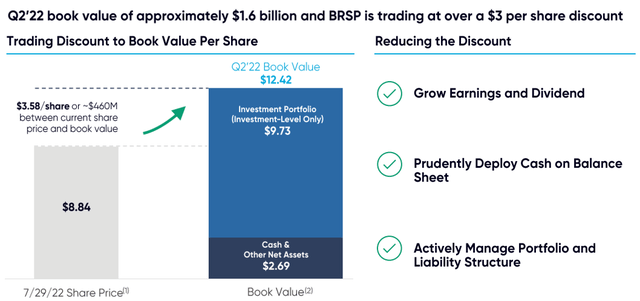

BRSP is trading at a huge discount to book value, with a significant amount of cash on its balance sheet to deploy. Credit spreads have widened over the summer, meaning that any capital BRSP deployed benefited from a wider initial spread in addition to rising rates. (Source: Q2 Investor Presentation)

BRSP’s strategy to get shares trading closer to book value is to deploy capital, grow earnings, and raise the dividend, it’s a great strategy.

So let’s review:

- BRSP’s earnings are going up due to rising interest rates.

- Interest rates are expected to rise even more.

- BRSP had additional cash on hand to deploy, even as credit spreads widened over the summer.

- Management has stated an intention to grow earnings through deploying cash and, in turn, raise the dividend.

- BRSP had ample dividend coverage in Q2, with earnings exceeding the dividend by 120% in a sector where dividend coverage is typically close to 100%.

So no, we cannot guarantee when BRSP will hike its dividend. But, we feel very comfortable saying that dividend hikes are likely in the future. We’re happy to buy BRSP even if they go ultra-conservative and maintain the current dividend. If BRSP’s dividend keeps rising with rising rates, that is just a cherry on top!

Pick #2: CSWC – Yield 11.1%

Too many investors look at investing as a race. If it is a race, let me clue you in on a secret: The tortoise wins. I’m sure you are familiar with the story of the tortoise and the hare. The hare challenges the tortoise to a race, convinced he can win because he can run faster. Yet ultimately, the rabbit tires himself out and can’t make it to the finish line while the tortoise plods on relentlessly at a pace that can be maintained indefinitely. Slow and steady wins the race.

Well, I’m not going to place any bets on a real tortoise in a race against a real hare at the local racetrack. However, the lesson behind the story is absolutely true when it comes to investing.

Capital Southwest Corporation (CSWC) announced a dividend hike along with a strong earnings report for Q2. Investors raced to buy it in the following weeks. A month later, the share price has come back down.

This is why we don’t try to predict the share price next week or next month. Or try placing big bets on what share prices will do over short periods. At HDO, we take a “slow and steady” approach. We receive dividends, and we reinvest a portion of them. Since we are receiving dividends multiple times per month, every month, the next dividend is rarely more than a week away. When the dividends come in, we buy a few shares of whatever looks attractive, furthers our income goals, and fits our allocation targets. We wanted to buy CSWC last month, but we want to buy it today too. There is little doubt in my mind that it will also be a company I want to own next month.

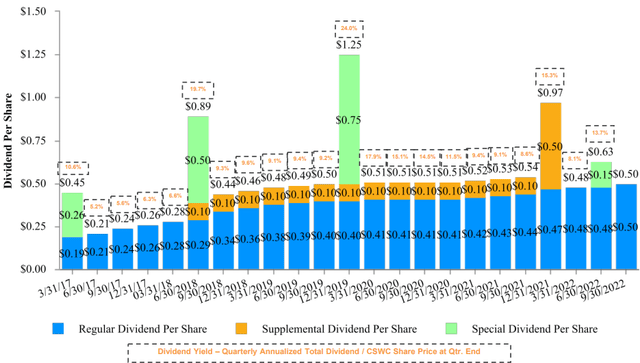

If you missed out on CSWC’s last dividend, don’t worry. There will be another one. And given CSWC’s track record, dividends will be even higher in the future. (Source: Q1 2023 Earnings Presentation)

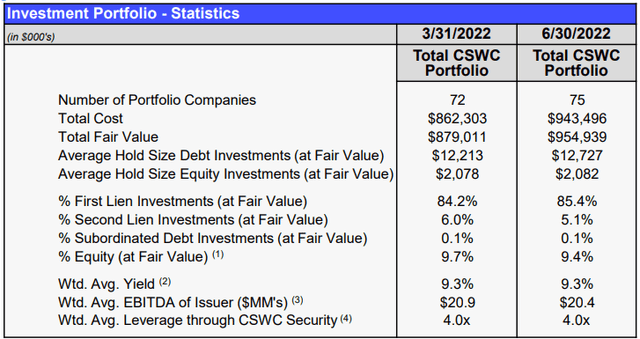

CSWC is a BDC (Business Development Corporation) which invests in small businesses. CSWC’s customers have an average EBITDA of $20 million, compare to peers like Ares Capital (ARCC), which invests in companies with an average annual EBITDA of $180 million. CSWC truly invests in “small” businesses.

CSWC fills a need in the market as bank loans can be extremely difficult for smaller businesses to obtain at reasonable interest rates. CSWC can be more flexible than a bank by simultaneously taking on an equity position. These equity positions can produce extreme upside when the borrower grows or is acquired by a larger peer.

CSWC’s portfolio consists primarily of first lien loans, with about 5% in second lien loans and 9.5% in equity. The loans provide recurring interest which covers the “regular” dividend, while the equity positions provide upside when there is a liquidity event. Those gains are typically distributed through a “supplemental” or “special” dividend.

One of the greatest strengths of BDCs right now is that they lend using floating-rate loans while they use fixed-rate debt for their own leverage. This means that rising interest rates add directly to their bottom line.

Here is how much a change in 3-month LIBOR would impact CSWCs net investment income:

3-month LIBOR is already up 115 bps since this slide was created, and will likely go higher if the Fed hikes 75 bps as most expect later this month. CSWC will see a very hefty increase in NII, and historically, CSWC has been very generous with passing along these gains to shareholders.

So we will just keep plodding along, buying up a few more shares of CSWC here and there as our dividends come in and all those hares in the market sell it, letting us invest at a higher yield.

Shutterstock

Conclusion

With CSWC and BRSP, we can enjoy great high yields immediately, allowing us plenty of room to allocate some to reinvestment. At the same time, both have been increasing their dividends regularly.

I recommend investors in retirement reinvest at least 25% of their dividends, this helps to ensure your income is growing over time and gives your future a larger runway to explore new opportunities. Need less income? It means you can reinvest even more to see your overall income grow more rapidly.

This 25% reinvestment is a target level to achieve. If you can’t do that now, reinvest what you can, and whatever growth you see in your income – reinvest it all to work towards 25% reinvestment over time. You will find that your income grows regardless of whether the market is up, down, or sideways.

Income in retirement is a must. You have to have income from somewhere to meet expenses. I’d rather not sell what I own to pay what I must. I want to receive income from what I own in an abundance over what my life costs to live. That is the key to being financially secure and financially independent. That is the heart of income investing and our Income Method. I believe in you, you can do it, and we’re happy to help!

Be the first to comment