z1b

We are in a bear market.

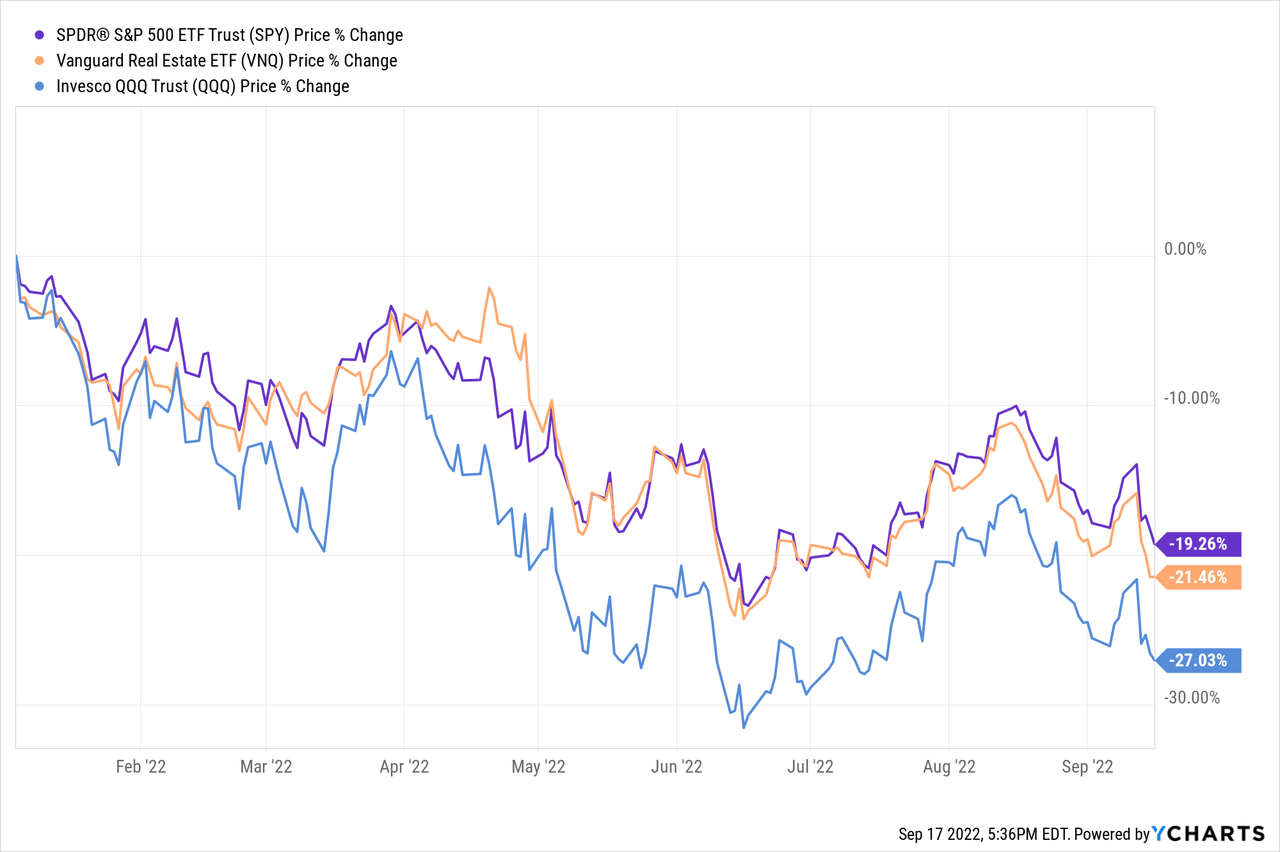

Major indexes (SPY; QQQ; VNQ) are down 20% or more and increasingly many investors are selling their positions, fearing that things will get even worse.

I am doing the exact opposite. I recognize that it is impossible to time the market, but I also recognize that those who keep accumulating larger positions during bear markets have always earned the greatest rewards in the recovery.

Today, it may seem as if “this time is different” and that the market has only one way possible, and it is down.

But in reality, today’s uncertainty is nothing out of the ordinary. Sure, inflation is high, interest rates are rising rapidly, and we are likely headed into a recession.

But so what?

It is not as if we have never experienced such things before. And yet, the market always eventually recovers and richly rewards those who have the courage to buy the dips.

“In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.” Warren Buffett

Could prices head even lower before they recover? Possibly. But that’s impossible to know. Today’s valuations are already exceptionally low in some sectors of the market and as Buffett likes to say:

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” Warren Buffett

In other words, it is absolutely impossible to predict how the market will perform in the month, quarter, or even year.

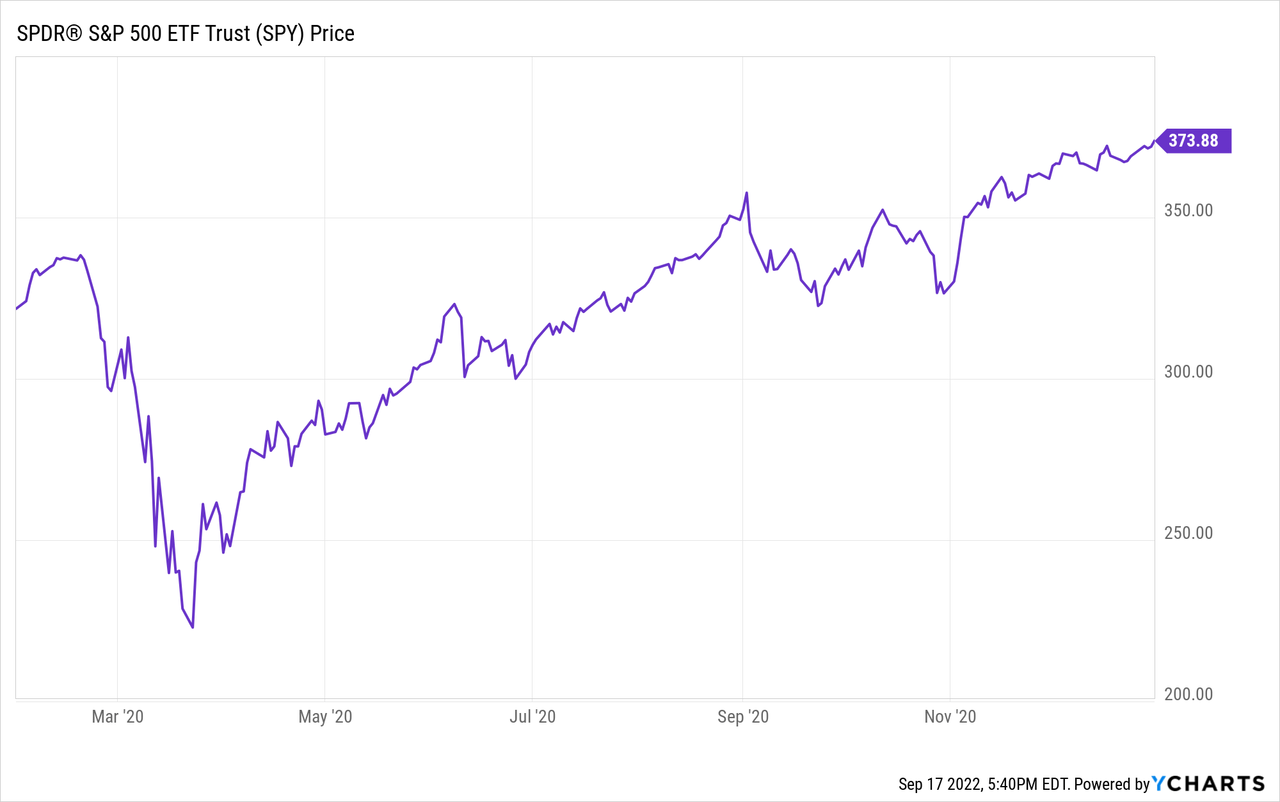

To prove my point, consider the following: how many people correctly predicted that within a year from the pandemic sell-off, the market would have fully recovered and then some? That’s despite having gone through the worst economic contraction in history and suffering severe supply chain issues all over the world.

The answer is no one.

What happened is that after a brief period of panic, the market regained its senses and realizes that 1-2 years of poor results has little impact on the fair market value of businesses. Stocks often sell off because investors are overly focused on short-term results, but if you are a long-term-oriented investor, you can keep an eye on the bigger picture and take advantage of the excesses of the market. No matter how bad the crisis, it shouldn’t materially change the value of a business as long as it is temporary. Yet, because the market is so short-sighted, it is not uncommon for stocks to drop by 20, 30, 40, or even 50% due to temporary fears that surely won’t last for long.

This year, a few sectors have dropped particularly heavily and become highly opportunistic for long-term-oriented investors.

Those are REITs, asset managers, and some specific sub-sectors of the tech market.

Personally, I am mainly investing in REITs and other real estate-heavy businesses because they offer the best risk-to-reward in my opinion. As I have explained in previous articles, these stocks are today priced at historic lows, despite offering superior inflation protection and not being so heavily affected by rising rates and recessions.

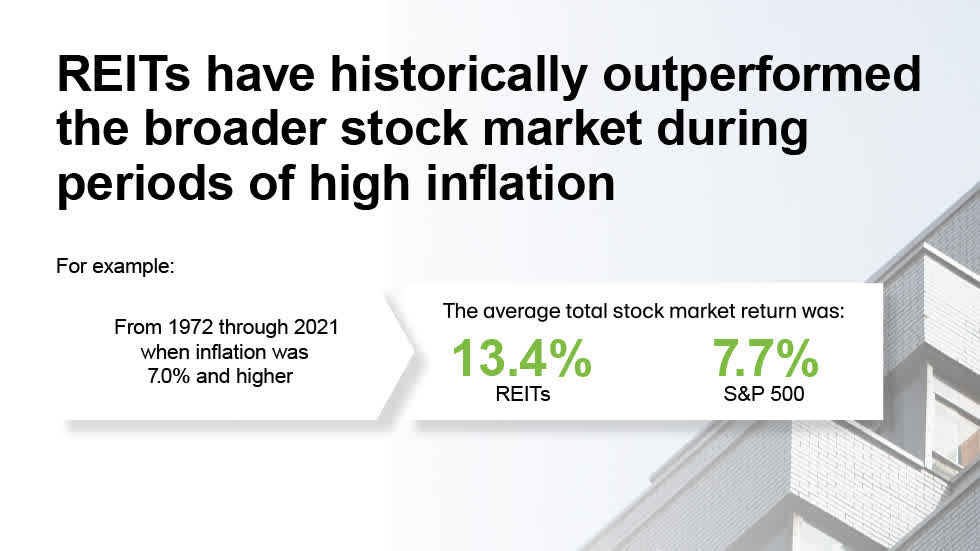

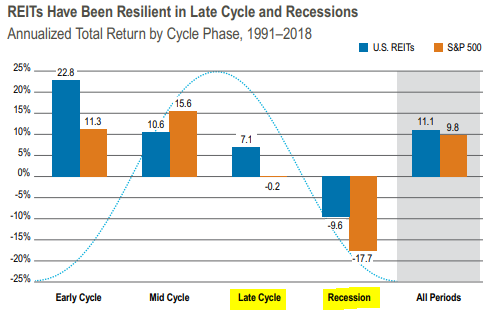

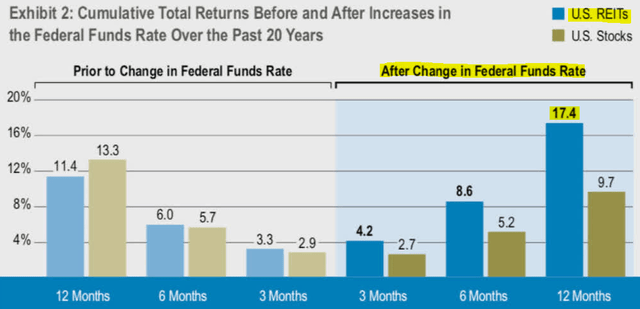

Below you can see that REITs typically outperform during all three scenarios:

- Rising interest rates

- High inflation

- Recessions

NAREIT

Cohen & Steers

This also makes logical sense.

- These companies don’t use much debt and the debt is long-term fixed rate. Therefore, the impact of rate hikes is not significant in most cases.

- Moreover, they benefit from the inflation as it grows the value of their real assets and allows them to pass larger rent hikes, even as it also deflates the real value of their debt.

- Finally, rents don’t typically change materially in a recession. Real estate is typically essential to the tenant and landlords earn steady income from long-term leases.

Despite that, these companies have dropped particularly heavily and now offer a once-in-a-decade opportunity to accumulate real estate at bargain valuations.

Below, I highly 2 REITs that we are accumulating at High Yield Landlord for our Core Portfolio:

BSR REIT

Real estate is all about location, location, location…

If you own a good property in a rapidly growing market, you can enjoy large returns as your rents grow and the property appreciates in value.

This has been the case for many Texan cities over the past few years.

Cities like Austin, Dallas, and to a lesser extent, Houston, have been great markets for real estate investing as increasingly many companies decided to move there to lower their taxes and improve their profitability.

There is a long list of companies that have made the move in recent years. This includes Tesla (TSLA), Hewlett Packard (HPE), and Oracle (ORCL).

As companies moved there, they bring jobs and people with them. Most people are also happy to move there as it allows them to reduce their taxes and increase their disposable income.

This has resulted in rapid population growth and rising demand for real estate, which has not been met with enough new supply, partly due to all the construction delays caused by the pandemic.

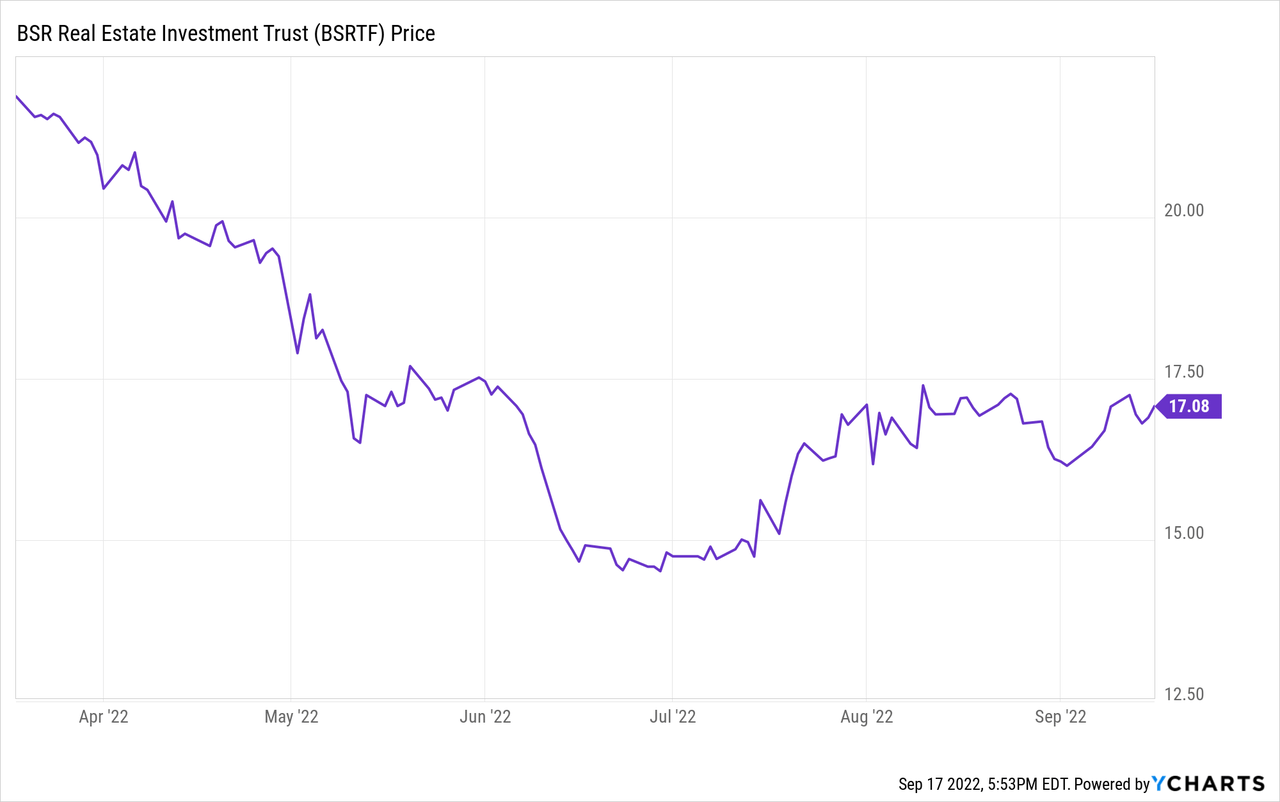

As a result, rents and property values have exploded to the upside and BSR REIT (OTCPK:BSRTF / HOM.U) is one of the biggest beneficiaries.

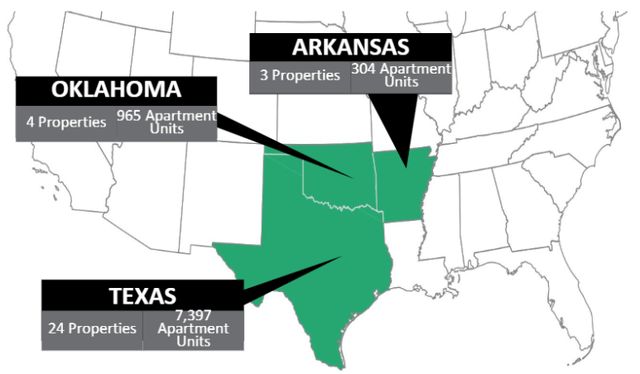

Unlike most other apartment REITs like Camden (CPT) and Mid-America (MAA), BSR has decided to follow a concentrated strategy, and today the majority of its portfolio is invested in Texas.

And wow, has it paid off for them!

Their net asset value per share is up 150% year-over-year. It grew from $14.77 to $22.35 at the end of the last quarter.

And the growth is not over.

In Q2, same-community NOI increased 16.7% YoY, while blended rent growth came in at 12.6%. Meanwhile, AFFO per share surged 26.7%.

Despite that, BSR recently sold off heavily, and as a result, it now trades at just $17 per share, representing a 25% discount to the value of its properties, net of debt.

How often do you get the chance to buy highly desirable real estate that’s growing rents so rapidly at just 75 cents on the dollar? You get diversification, liquidity, and professional management for free on top of it.

The rising interest rates only make housing less affordable, forcing more people to rent. The inflation benefits BSR by allowing it to hike rents further. And a recession is unlikely to materially impact BSR since it focuses on Class B affordable communities.

We expect 40% upside and while we wait for the recovery, we earn a monthly 3% dividend yield. If the market fails to reprice BSR at a higher level, I would expect a company like Blackstone (BX) to buy it out. They have been buying residential REITs left and right and they recently made the following statement:

“The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.” Jon Gray, COO of Blackstone

Clipper Realty

Clipper Realty (CLPR) is similar to BSR in that it also invests in affordable Class B apartment communities and enjoys rapid rent growth, but the main differences are that it focuses on NYC instead of Texas.

Clipper Realty

NYC was more heavily affected by the pandemic and it caused CLPR’s market sentiment to suffer. But COVID-19 is definitively now in the rearview mirror, illustrated by the 97.3% rent collection rate in the second quarter (virtually the same as its pre-pandemic level).

On the back of 7.6% residential revenue growth, CLPR’s AFFO per share of $0.12 increased 20% from last year’s $0.10 in Q2. None of the REIT’s secured debt matures until 2027, and it has plenty of liquidity ($44 million in cash) available as a cushion as well as for investment purposes.

Despite that, CLPR still trades at a massive 45% discount to NAV, which makes little sense given how fast its rents are growing, and the many catalysts ahead.

It was recently reported that CLPR has put up its biggest asset for sale and we are currently trying to organize an interview of the management for members of High Yield Landlord.

We think that CLPR could sell it at a price that would imply a much greater valuation than what’s implied by its current share price. It could use some of the proceeds to buy back shares and/or sell the rest of the company as well to finally close the discount.

The management is heavily invested, approaching retirement, and might be looking for a way to cash out.

We estimate that CLPR trades at just around half of its NAV, which means that it offers up to 100% upside potential in the best-case scenario, and while we wait for this value to be unlocked, we earn a near 5% dividend yield.

Bottom Line

The vast majority of crises are only temporary.

We have gone through world wars, pandemics, times of even greater inflation, cold wars, and plenty of other crises. Despite that, the market has always eventually recovered, and this time won’t be any different.

This is why the best time to invest is when prices are heavily discounted and that’s the case today in the real estate segment of the stock market.

Following the 2008-2009 crash, REITs nearly tripled in the following two years.

Following the 2020 pandemic crash, REITs nearly doubled in the following year.

How will REITs perform following the 2022 sell-off?

While I cannot predict short-term results, I expect to be richly rewarded in the coming years, and this is why I am aggressively accumulating these names ahead of the recovery.

Be the first to comment