JHVEPhoto

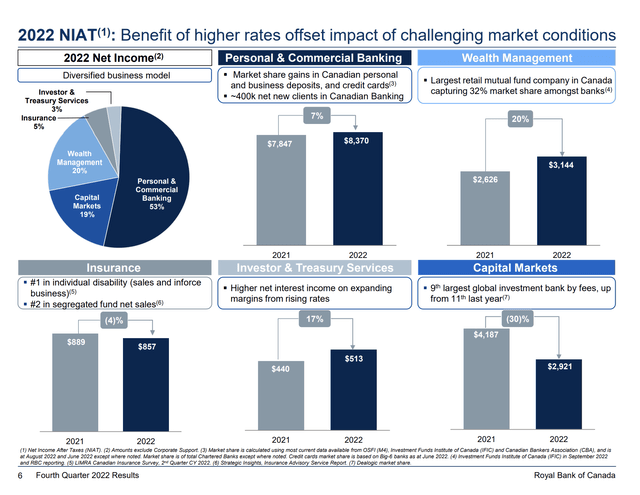

Royal Bank of Canada (NYSE:RY, TSX:RY:CA) defied analysts’ predictions that economic headwinds would cause revenues to drop in its fourth quarter. Canada’s largest bank by market capitalization posted revenues of C$12.57 billion (~$9.30 billion), representing an increase of 1.5% from last year’s fourth quarter. The figure exceeded the consensus analysts’ forecast by C$250 million (~$185 million), as higher net interest income more than made up for lower revenue from capital markets.

Net income in Q4 2022 fell slightly, by 0.3% from the year-ago quarter, to C$3.88 billion (~$2.87 billion), as higher provisions were booked for loan losses on the worsening macroeconomic outlook. But due to the lower share count, following buybacks during the year, diluted EPS was higher than a year ago, at C$2.74 (~$2.05) – an increase of 2% from C$2.68 (~$1.98) in Q4 2021. This also compared favorably to the consensus EPS estimate of C$2.66 (~$1.97), with a positive surprise of C$0.08 (~$0.06).

“While market conditions continue to be tough, our 2022 results reflect a resilient bank that is well-positioned to pursue strategic growth and deliver long-term shareholder value. Our premium businesses, strong balance sheet, prudent risk management and diversified business model mean we can deliver advice and services that help our clients navigate all cycles.”

Chief Executive Officer Dave McKay, RBC Q4 2022 Earnings Release.

Interest Rate Tailwinds

Royal Bank of Canada Q4 2022 Earnings Presentation

The bank got a big boost from interest rate hikes, as net interest income rose 24.1% compared to last year, to C$6.28 billion (~$4.63 billion) in Q4 2022. NII was also 6.7% higher than Q3 2022, primarily reflecting margin expansion as benchmark rates rise.

Net interest margin in Q4 2022 was up 4 basis points on a sequential quarterly basis, to 1.56% – and 13 basis points higher than the year-ago quarter.

Royal Bank of Canada Q4 2022 Earnings Presentation

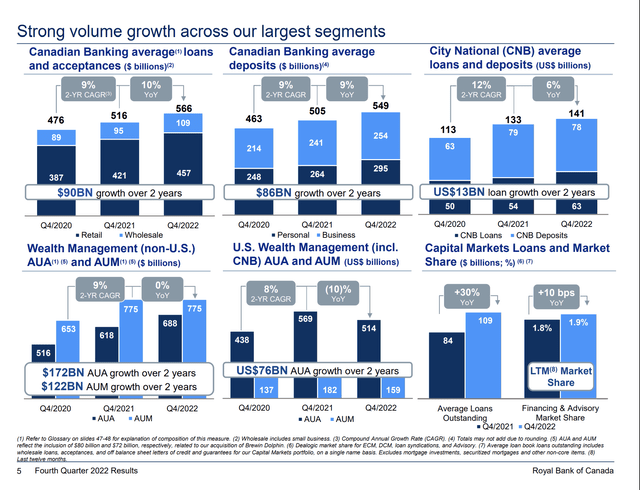

Like The Bank of Nova Scotia (NYSE:BNS, TSX:BNS:CA), which I have written about before and which reported earnings a day earlier, RBC continued to deliver resilient loan growth in spite of the more challenging macro backdrop. Total loans were 14.1% higher than a year ago, and 3.4% higher than three months ago, with particularly strong demand for borrowing from wealth management customers and large corporate clients.

On the downside, this was partly offset by weakness in investment banking, owed to the slowdown of dealmaking activity from recent choppy markets, and lower fees from wealth management due to lower asset valuations.

HSBC Canada Acquisition

A day earlier, RBC announced that it had agreed to acquire HSBC Bank Canada from HSBC Holdings plc (HSBC) for C$13.5 billion (~$10.1 billion), in a deal which would add C$134 billion (~$99 billion) in assets and bolster its commercial banking and international product capabilities.

The higher-than-expected valuation represents a 2.5x multiple on its tangible book value and a 9.4x multiple on HSBC Canada’s estimated 2024 adjusted earnings of C$1.4 billion (~$1.0 billion), assuming fully realized expense synergies. In October, analysts had valued the unit to be worth just C$8-10 billion (~$5.9-7.4 billion).

RBC expects to achieve annual cost synergies worth around C$740 million (~$546 million), by eliminating 55% of HSBC Canada’s estimated 2024 non-interest expense base. It set a high bar, but should nonetheless be achievable, given significant overlaps in footprint and operations. A substantial majority of the expected cost synergies are expected to come from the elimination of HSBC’s duplicated back office functions and IT investment. RBC expects to spend around C$1 billion (~$740 million) in acquisition and integration costs.

On these assumptions, the transaction would be 6% accretive to RBC’s expected 2024 EPS, on a 14% internal rate of return. If all goes to plan, the deal is expected to close by late 2023.

Regulatory Concerns

Besides the accretion to EPS, and despite the pricey valuation, the deal looks attractive given that it would extend RBC’s market share lead in Canada, further strengthening the wide economic moat that it enjoys in its home market.

The downside is that RBC could face trouble in getting regulatory approval for the merger. Canada’s government has lately been vocal about its opposition to industry consolidation, and has tasked its Competition Bureau to encourage more competition. This could pose problems as Canada’s banking market is highly concentrated – the six largest banks control about 80% of total assets, with RBC already the largest player.

The proposed acquisition must get approval from both the Competition Bureau, Canada’s antitrust agency, and the Office of the Superintendent of Financial Institutions (OSFI), Canada’s banking regulator. Finally, it will face a political hurdle, as the federal Minister of Finance gets a final say on whether the deal can go ahead.

What’s more, merger clearance may only be given on the condition that RBC offers structural remedies, such as divestments to allay competitive concerns. Given how much the rationale of the merger is dependent on expected cost synergies and the higher-than-expected valuation of HSBC Canada, a divestment of even a modest portion of the target could undermine the investment case for the transaction.

Nevertheless, RBC’s management is confident that the bank would get approval for the merger without any remedies. “We are not aware of any areas where the [Competition] Bureau is likely to have concerns,” CEO Dave McKay said yesterday when asked about possible market concentration concerns that regulators may have.

Still Strong Credit Quality

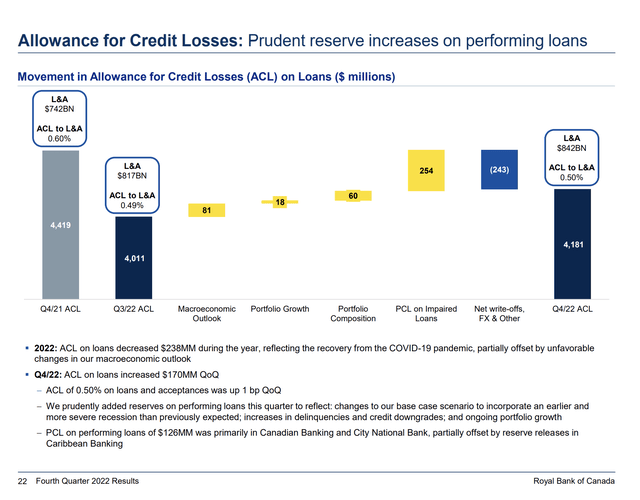

Despite growing macro risks, including slowing GDP growth, rising inflation and a housing correction, credit quality at RBC has held up relatively well. Provision for credit losses in Q4 2022 rose to C$381 million (~$282 million), compared to a net release of C$227 million (~$168 million) last year, following a return to positive performing reserve build. Compared to Q3 2022, PCL rose more slowly, by just C$41 million (~$30 billion). The PCL on loans ratio was 18 bps – up just 1 basis point from the previous quarter, and still well below pre-pandemic levels.

This reflects still low credit delinquency rates, although signs of credit normalization are beginning to become more visible – particularly in the small business category, where delinquency rates are once again above pre-pandemic levels. Gross impaired loans to Canadian small businesses rose 18 basis points over the year to 109 basis points in Q4 2022, compared to a fall of 6 basis points to 18 basis points for the Canadian Banking average.

Royal Bank of Canada Q4 2022 Earnings Presentation

Final Thoughts

Although credit normalization looks set to eat into RBC’s medium-term earnings, higher provisions will likely remain manageable as improving net interest margins and resilient loan growth largely offset this headwind. Against a less than favorable macro backdrop, Royal Bank of Canada’s latest financial results demonstrate its resilient earnings profile and strong credit quality.

Be the first to comment