Rob Kim/Getty Images Entertainment

“Accept what life offers you and try to drink from every cup. All wines should be tasted; some should only be sipped, but with others, drink the whole bottle.” – Paulo Coelho

Today, we take our first look at The Duckhorn Portfolio (NYSE:NAPA). I have enjoyed the wine from this Napa Valley producer but have never done research into the company. An analysis follows below.

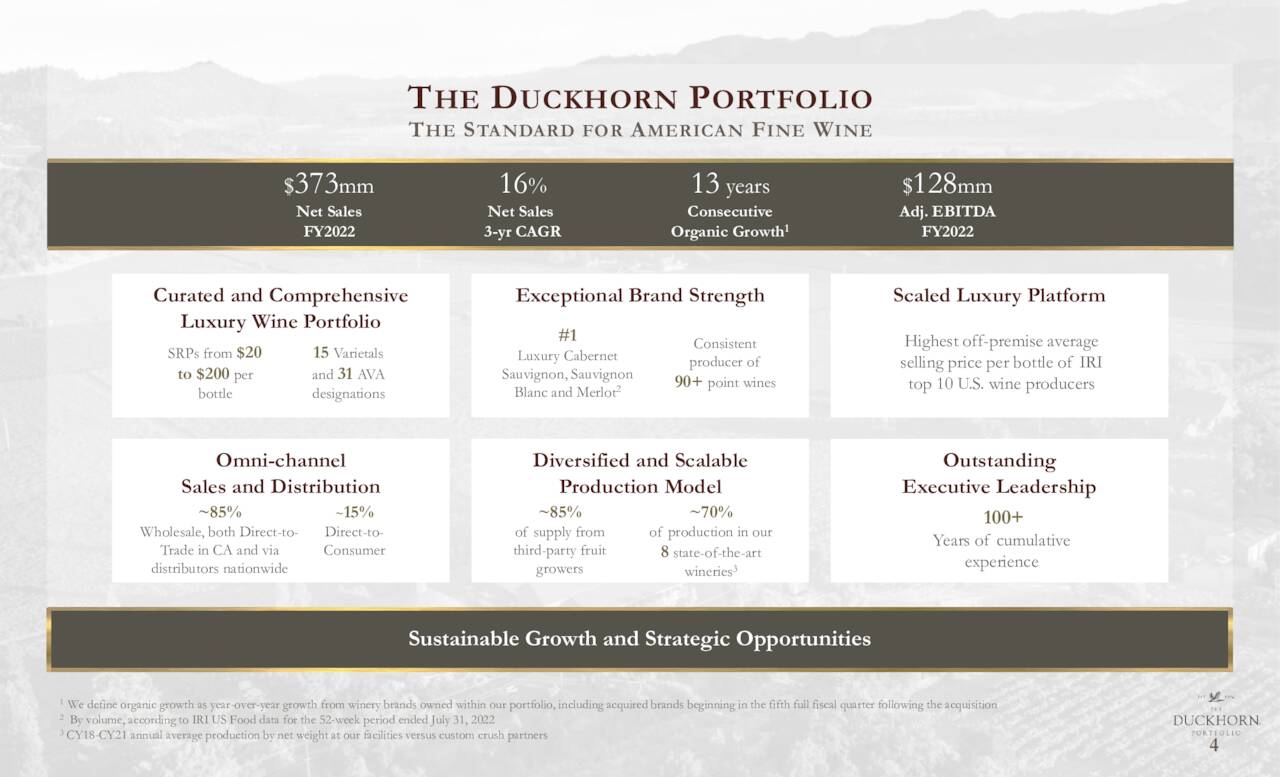

Company Overview:

The Duckhorn Portfolio is headquartered just outside of Santa Rosa, CA. The company produces and offers wines under a portfolio of brands, including Duckhorn Vineyards, Decoy, Goldeneye, Paraduxx, Migration, Canvasback, Calera, Kosta Browne, Greenwing, and Postmark directly to distributors, and directly to retail accounts and consumers. The price point of these wines is roughly $15 to $200 a bottle as the company is focused on the luxury segment of the wine industry.

September Company Presentation

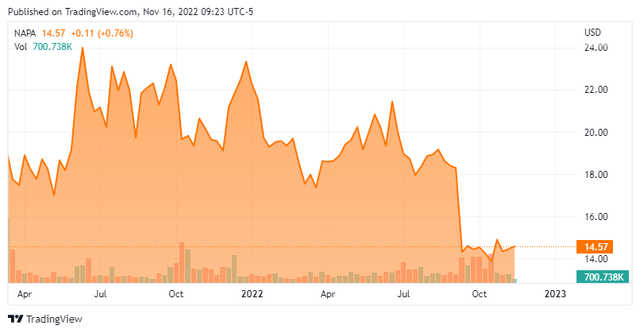

The stock currently trades around $14.50 a share and sports an approximate market capitalization of $1.7 billion. The firm operates on a fiscal year that ends on June 30.

September Company Presentation

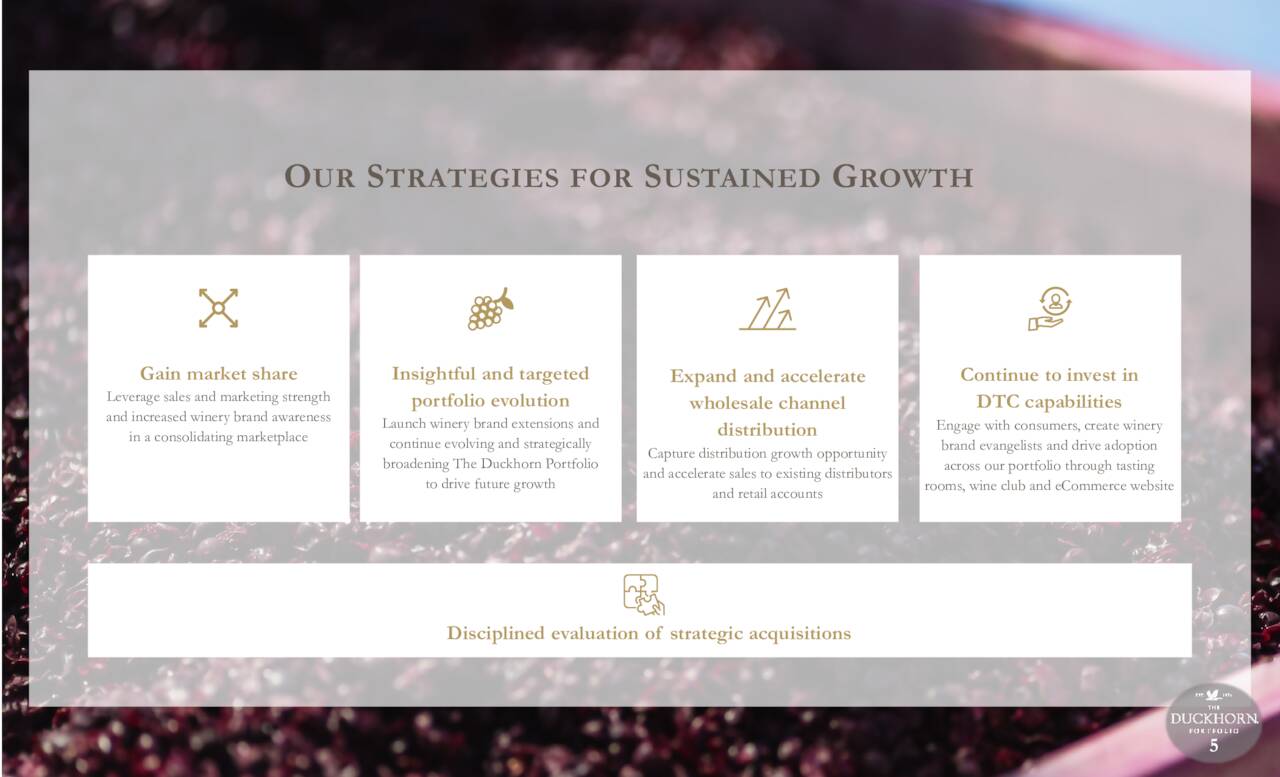

The company plans to grow its top line by gaining market share, increasing its direct-to-consumer or DTC sales, and expand its existing wholesale channel distribution. As well as to continue to expand their wine offerings.

September Company Presentation

Fourth Quarter Results:

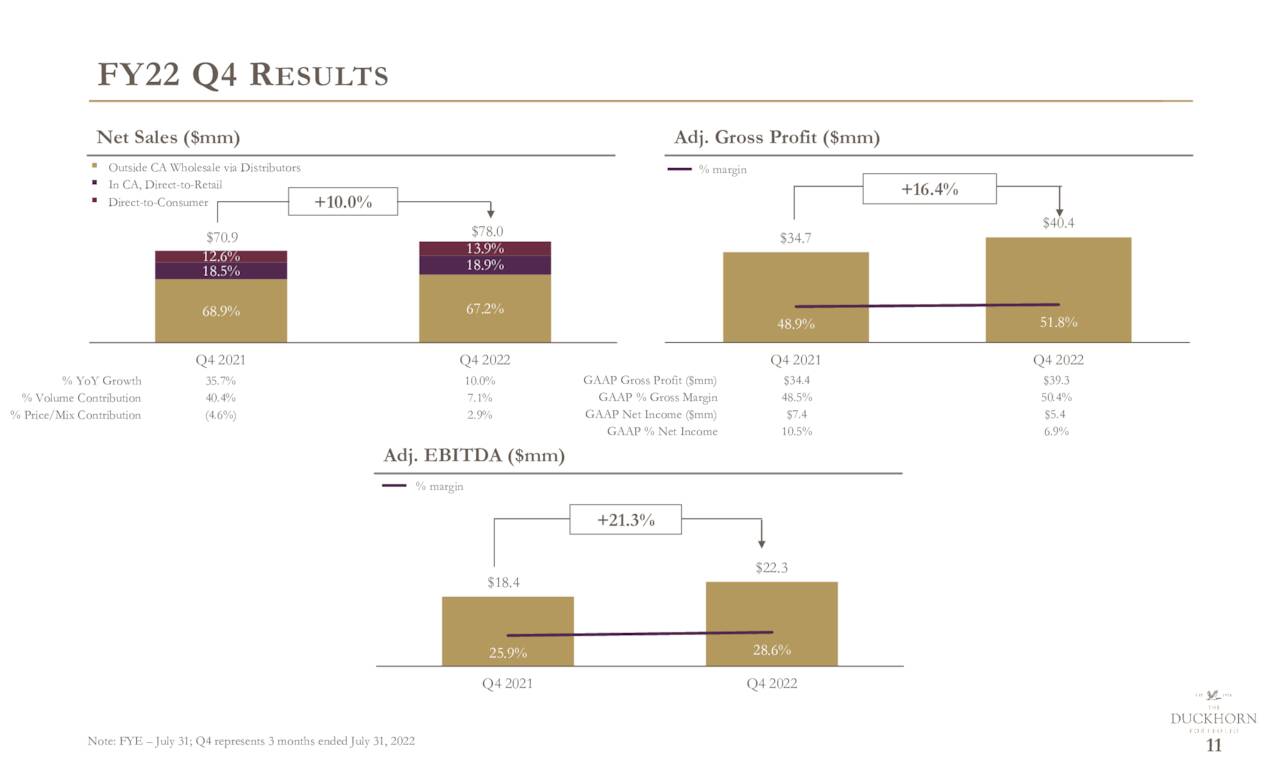

The company posted fourth quarter numbers on Sept. 28. The Duckhorn Portfolio posted a GAAP profit of a nickel a share, four cents below expectations. Net income was $5.4 million for the quarter, compared to $7.4 million in the year-ago period. Revenues rose 10% from the same period a year ago to $78 million, largely in line with the consensus. Sales were powered by 7.1% volume growth and an average 2.9% price increase.

September Company Presentation

Both adjusted gross profit and EBITDA grew at a nice clip during the quarter as well. Adjusted EBITDA for the quarter increased just over 21% to $22.3 million compared to 4Q2021. For the 52-week period as of July 31, the luxury wine segment in this country grew at 3.5% compared with a negative 4.5% for overall wine sales. The company’s product portfolio was the fastest-growing supplier of the top 15 luxury wine suppliers on both the dollar and volume growth basis during the quarter.

September Company Presentation

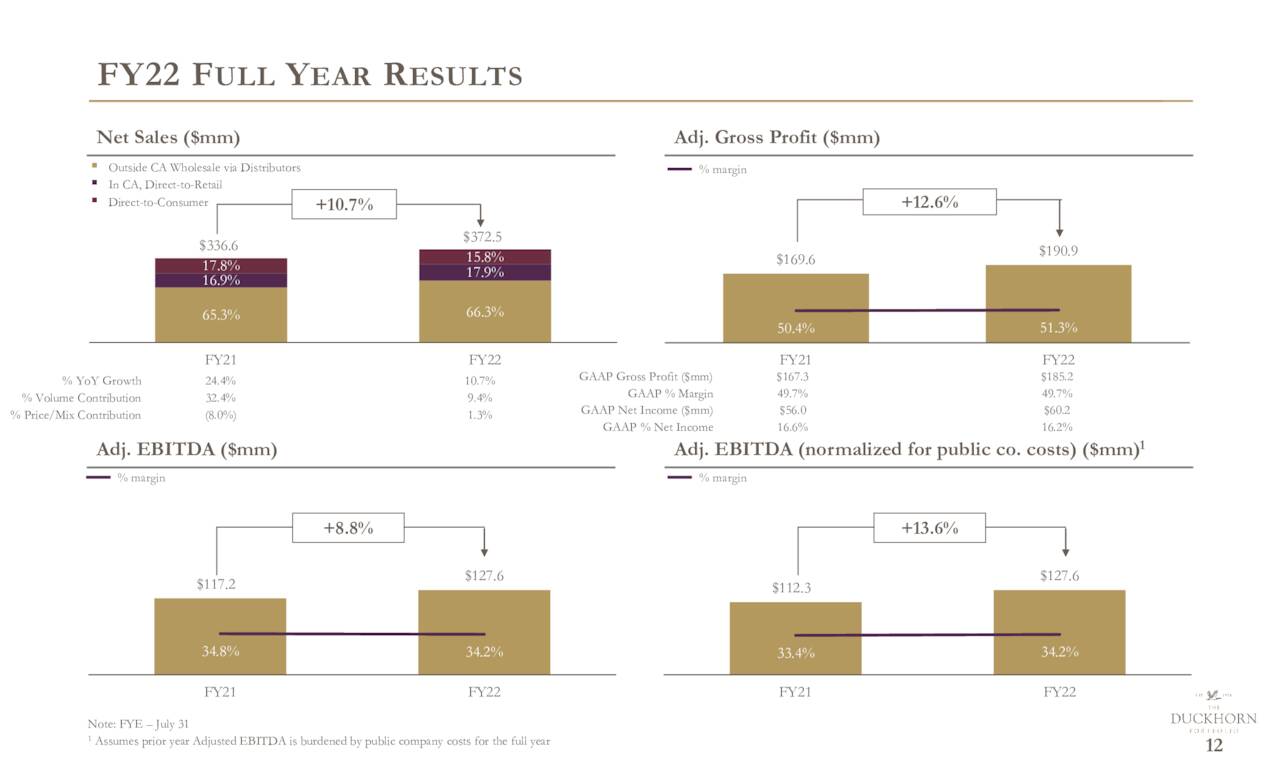

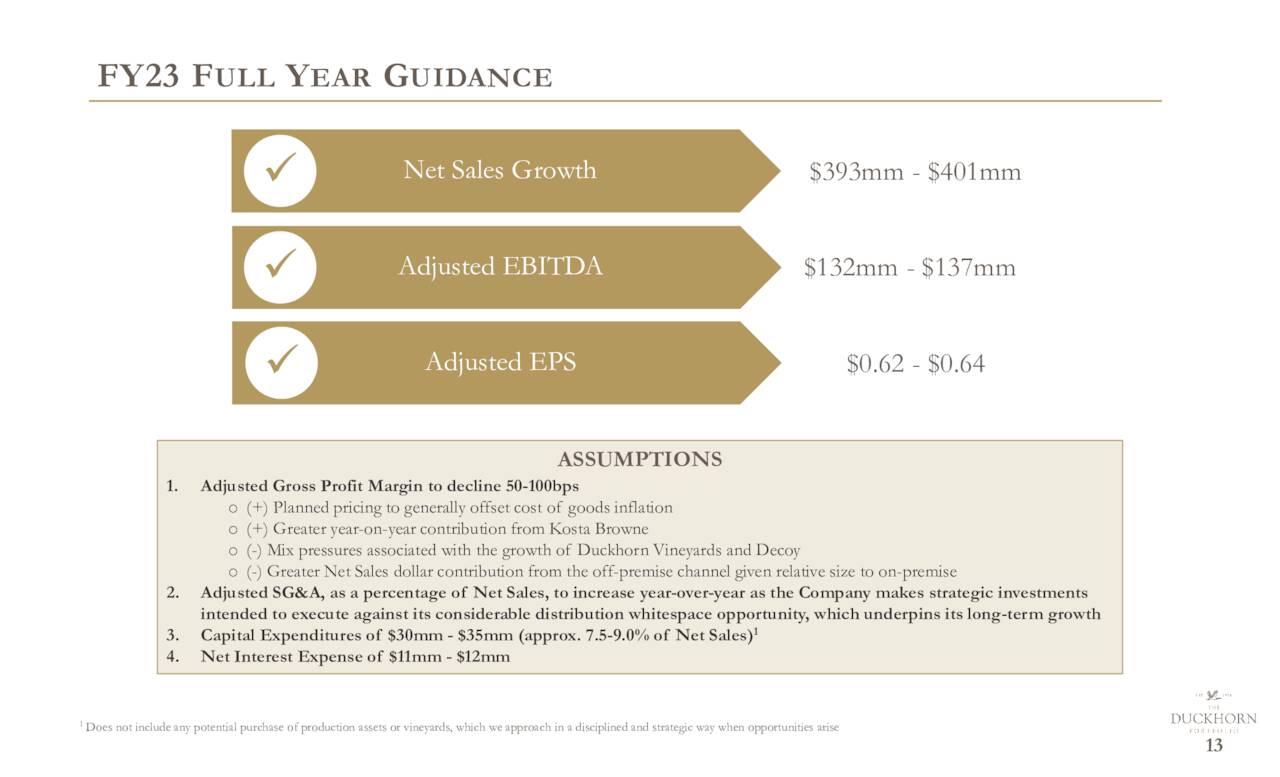

For the full year 2022, revenues rose nearly 11% to just over $372 million. The company booked 62 cents a share of profit in FY2022. Management sees slightly slower sales growth in FY2023 and projects earnings will be flat or have a modest gain.

September Company Presentation

Analyst Commentary and Balance Sheet:

Since fourth quarter results were posted, five analyst firms including Jefferies and Wedbush have reissued or initiated Buy ratings on NAPA. Two of these contain slight downward price target revisions. Price targets proffered range from $18 to $23 a share. Both JPMorgan ($18 price target) and Barclays ($17 price target) have maintained Hold/Neutral ratings on the stock.

Approximately five percent of the outstanding float of this stock is currently held short. Insiders were frequent sellers of the stock this spring, disposing of approximately $4 million in aggregate between April and the first day of July. A beneficial owner dumped five million shares at $19.25 a piece on July 11 as well. The company ended FY2022 with just over $3 million in cash and marketable securities against just over $210 million worth of long-term debt. This gave the company a leverage ratio of 1.8x net debt.

Verdict:

The current analyst firm consensus has the company earning 62 cents a share in FY2023 as revenues improve nearly 7% to just under $400 million. EPS would be flat with FY2022 in this projection. For FY2024, they see earnings rising 10% while sales increase in the high-single digits.

It’s hard to get to a buy recommendation on NAPA at these trading levels. The stock goes for north of 20 times forward earnings even as analysts see flat earnings growth this year on mid-single-digit sales growth. The company also has a decent amount of debt, and there was a good slug of insider sales during the spring and early summer.

In addition, consumers will continue to cut back and trade down in 2023, hardly a conducive environment for a high-end wine purveyor. They have little choice given the personal savings rate has sunk to 3.7%, the lowest level since 2008. The average consumer also has lost nearly 6% of their buying power to inflation since the start of 2021 and average real wages have fallen for 18 straight months now.

In conclusion, an investor might be better off picking up one of the company’s bottles of wine than buying its shares at the current stock price.

“I cook with wine, sometimes I even add it to the food.” – W.C. Fields

Be the first to comment