Darren415/iStock via Getty Images

With Q1/22 complete, we highlight four key trends for US cannabis from the quarter that we believe investors should be focused on. Overall, we remain bullish on the market in both the short and long term and continue to believe US cannabis stocks are too cheap and will offer significant upsized returns for investors in time.

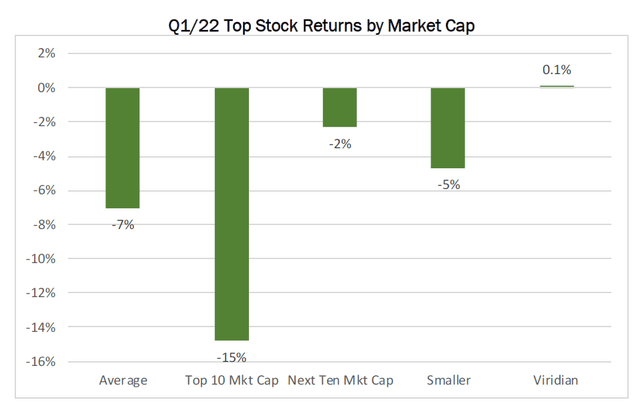

The Q1/22 trends highlighted are: earnings weakness and concerns over the more challenging macro environment, on-going industry consolidation particularly amongst public operators, our pessimistic outlook for federal legislation passage and the outperformance in stock returns for smaller and medium sized operators. Regarding the final point, Q1/21 marked a significant change from prior periods whereby stock returns have traditionally always favored the largest MSOs in contrast to traditional investing fundamentals. While stock returns were down overall in Q1, the stocks of smaller and medium sized operators outperformed significantly on a relative basis highlighting the fact that investors are beginning to better understand the favorable positions and discounted relative valuations for stocks in these categories and that M&A is a factor that must be considered.

With our coverage, we have to-date focused on underappreciated smaller and medium sized operators and for Q1/22 investment in a portfolio of Viridian covered stocks would had driven a modest positive return (equating to a >7% outperformance to the average of the broader group and ~15% versus the ten biggest MSOs).

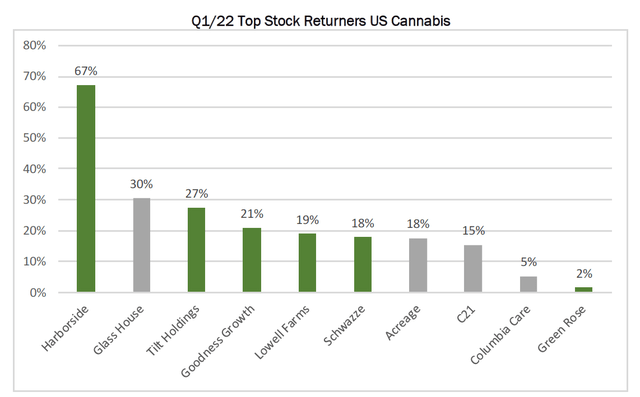

We expect the outperformance in returns for smaller and medium sized operators to continue on further investor awareness, the execution of more focused expansion initiatives and as these companies remain the targets of consolidation. Finally, we highlight our top five picks for near term investment. Amongst our coverage the top picks are: Harborside (OTCQX:HBORF), Jushi (OTCQX:JUSHF), Lowell Farms (OTCQX:LOWLF), Planet 13 (OTCQX:PLNHF) and Schwazze (OTCQX:SHWZ) while outside our coverage we most favor: Ascend, Glasshouse and Unrivaled. We believe each can offer meaningful upside at a time when positive returns may remain elusive.

Short-Term Weakness Should Not Overshadow Favorable Long Term

Opportunity COVID driven tailwinds inclusive of a more attentive customer base and stimulus checks which boosted results in 2020 and early ’21 have largely subsided making operations for US cannabis companies more challenging in recent months. Q4 earnings reports reflected this as results for most underperformed expectations while for this year companies guided to a substantially weaker than anticipated 2022. Q4 underperformance stemmed from wholesale pricing pressure across key markets (with Massachusetts in particular becoming a new challenge for operators), slowed Y/Y growth in demand in the absence of new state openings and in many cases growing pains with the integration of acquired assets and expansion. By most accounts, pricing pressure and slower than anticipated demand (albeit still up) continued in Q1/22 while results for many for the remainder of this year will also be impacted by delayed market openings and expansions (particularly Illinois, New Jersey and New York on the rec side and Virginia for medical).

We believe concerns over the near-term headwinds are overblown and should be outweighed by the truly positive long-term outlook for the space and companies within it. In most states recent slowed growth rates stem from more challenging comparisons on COVID inflated results and new state openings in comparative periods. We are confident that growth will again accelerate as comps normalize beginning in the current quarter. This along with execution by companies with expanded grows and production capacity will also ease some of the current pricing pressure that has challenged recent results.

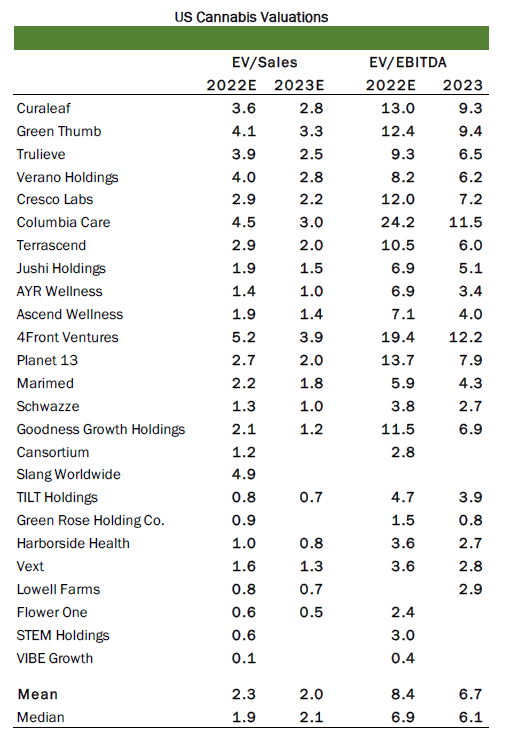

Beyond the immediate term, there are still many meaningful catalysts ahead to drive strong growth in 2023 and beyond including the launch of new rec markets in major populated states. Meanwhile we believe execution on major expansion initiatives will come for companies within existing markets as time progresses. Execution will result in scaled revenues, enhanced profitability and significant cash generation for operators. We are confident that scaled operations will be the catalyst to bring greater investor interest and raise valuations in time. At some point soon, whether legislation occurs or not, US cannabis companies will be just too big (and profitable) to ignore by investors.

Consolidation is Happening and Can Drive Outperforming Investor Returns

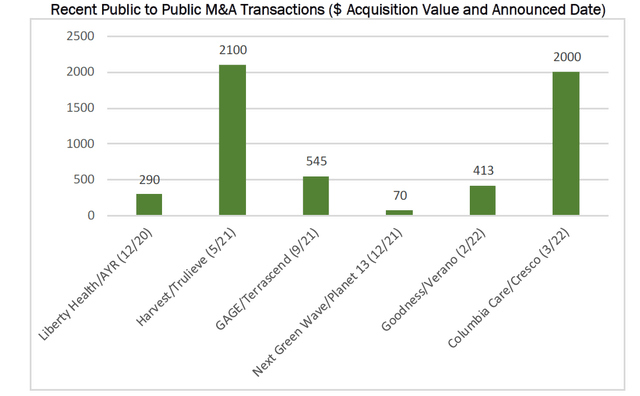

Q1/22 brought more large-scale M&A deals in US cannabis with the recent $2B Cresco acquisition of Columbia Care and the Verano takeout of Goodness Growth (valued at $413M) highlighting the trend of large scale public to public M&A in the space. Including previously closed deals like the Harvest sale to Trulieve and Liberty Health’s acquisition by AYR, a meaningful portion of the legitimate US cannabis names from late 2020 have now been acquired. Outside of the public world, meaningful consolidation amongst important and established operators has also occurred with Pharmacann’s recent acquisition of LivWell and Riv Capital’s $250M acquisition of Etain Health (and its vertically integrated New York license) representing two of the most important recent transactions. Importantly in addition to announced deals, GAGE’s takeout by TerrAscend (OTCQX:TRSSF) and Next Green Wave’s (OTCQX:NXGWF) acquisition by Planet 13 were completed and in a relatively timely manner proving that regulators will be accepting of consolidation.

Each of the recent large public transactions was fully funded with equity with the seller taking their operational risk and execution burden off the table while maintaining the long-term upside that the market presents given cheap valuations for all. As we have previously mentioned, it helps with the M&A trend that most companies are run by former investors and bankers so the investment way of thinking is intrinsically understood and the concept of taking execution burden off table through sell-out is welcomed. We expect the consolidation trend amongst public companies will continue and even accelerate in the near term particularly as pessimism regarding the passage of SAFE banking grows. A passage of SAFE is assumed to provide all in the space with an immediate catalyst for upsized stock valuations.

As we have previously mentioned, we believe all but the biggest names in US cannabis are very much in play to be acquired.

For buyers, we believe the motivation for transactions is scale and an interest in being positioned at the top of any comparative listing of operators (whether that be the number of states exposed to, market cap, revenue or reported EBITDA) in order to drive greater institutional investment in the near term (amongst those that can and will invest in the space) or to be best positioned for a post legislation world whenever that comes. The recent Cresco/Columbia Care transaction announcement exemplifies this trend. The two took an absolute conservative approach to valuation in the deal and in fact made Cresco out to pay an inflated multiple in the transaction in our view for the purpose of announcing that post deal the combination will be the largest operator in the space by market cap.

With the expectation that consolidation will continue, we continue to favor small and medium sized operators in US cannabis that have solid businesses on their own which can provide long term growth, cash generation and profits but are also viable takeout candidates. For us, the most likely takeout candidates are operators with a leading position with in a specific state (or few states) that can be complimentary to the acquiring company’s existing operations. Importantly, as proven with the Cresco and Columbia transaction, state exposure redundancies do not rule out consolidation even when those redundancies are in capped states. In fact, the redundancies (whether licenses or operations) can actually prove to be beneficial as providing additional capital through sale in the future and in essence reduce the stated price.

In terms of next companies to be acquired, we believe 4Front, Ascend, Ayr, Jushi and Terrascend could be in play amongst traditional second tier sized MSOs given their size and attractive positions in a few specific markets which would be a nice compliment to larger operators. We also foresee a possible merger of equals amongst these operators or the meaningful acquisition by any of a smaller player in order to scale operations and remain in the class of biggest operators in the space. Amongst more limited state operators, we continue to expect Planet 13 is a likely takeout given the fact that the company’s Las Vegas Superstore would be as attractive as any asset an acquiring could find in the space while expansion state opportunities are still in development and thus may not be worth it for management. Additionally, within our coverage amongst smaller operators, we believe Cansortium (OTCQX:CNTMF), Greenrose (OTC:GNRS), Schwazze and Vext (OTCQX:VEXTF) could be targets given their discounted valuations and leading positions in Florida, Connecticut, Colorado (and New Mexico) and Arizona, respectively.

Finally, we continue to believe California represents the ultimate untapped market for consolidation and expect M&A in the state to come in the near term. No longer should MSOs avoid California as the legislative environment appears to be on a path toward becoming more accommodating while pricing pressures are easing somewhat on simple attrition following such a challenging 2021 for smaller underfunded operators in the state. Meanwhile, at some point the potential TAM is just too big to ignore.

Given scaled positions and cheap valuations, any potential California takeout is likely to include: Glass House (OTC:GLASF), Harborside, Lowell Farms, the Parent Company, Unrivaled (OTCQX:UNRV) or Vibe (OTCPK:VIBEF). Of current California exposed companies, we note that we also expect 4Front (OTCQX:FFNTF), Glass House, Harborside and Planet 13 will also themselves be acquirers of some of the smaller operators in the space.

Viridian Cannabis Deal Tracker, Company Reports

Federal Legislation Unlikely this Year, and That’s Ok

There were many headlines out of Washington in Q1 regarding federal legislation and that continued on Friday (4/1) with reports that the MORE Act had once again passed in Congress. As has been the case with other legislative measures that have recently passed the House, the MORE Act will likely again stall in the Senate if it is heard at all this year.

We anticipate further news will come in the coming weeks as Chuck Schumer puts out his long awaited full federal legislation proposal later this month. As has been the case for the last few years, with each meaningful news item, cannabis stocks pop on optimism that permitted institutional investment will come with legislation and ultimately will drive upside in the stocks.

Unfortunately, we believe the buzz and optimism is misguided and remain pessimistic that anything gets done this year in terms of legislation at the federal level. As we have previously stated, in our view the most likely path to legislation this year is for Mr. Schumer to put out his wide-ranging proposal later this month, make the rounds with that knowing full-well that a passage will not occur before ultimately championing piece-meal legislative progress in the form of banking either on its own or through the attachment onto another measure. Regarding full legislation passage, Mr. Schumer does not have the requisite 10 Republican votes to ensure passage particularly if there are any social equity components attached which is a pre-requisite to garnering progressive Democrat support. While the scenario described remains possible even in a mid-term year like 2022 however we believe the on-going conflict in Russia and the associated impact on the economy is likely to make that even more challenging and ultimately too difficult to get done. Specifically, we expect the attachment of cannabis banking language to a 2023 Defense Spending Bill, which could permit passage, becomes significantly more difficult politically given defense related concerns and we also expect that Congress and the Senate may have greater concerns which carry a lot of debate and would prove to be a distraction to cannabis legislation passage as we get later in the year such as potential stimulus measures to ease gas price challenges.

While a lack of federal legislation would be a huge disappointment for the industry, particularly as the timing outlook for passage becomes more uncertain if the Republican party takes over the House and/or the Senate in the Mid-terms, however we caution that not all is lost. While it will be an unlikely priority in the immediate days of a party change, we do not rule out Republicans pushing and passing a paled down banking specific measure in 2023 or 2024 (similarly to Rep Mace’s proposal from last year) as a way of stealing the Democrats thunder ahead of the 2024 cycle. A paled-down banking measure without social equity components could allow for a more stream lined integration/implementation and still would drive the institutional investment that investors are longing for. Meanwhile, as previously noted, we continue to believe that with execution and a scaling of results institutional investors will find a way into the space with or without legislation. At some point the scale, coupled with cheap valuations will be too big to ignore.

Small and Medium Plays on the Space are Outperforming

In US cannabis, the biggest MSOs garner the most attention and generate the top stock returns. We have and continue to highlight our belief that this performance correlation to market cap is misguided as many smaller well-positioned operators had more attractive fundamentals and future growth opportunities but never-the-less had discounted valuations. The fact that US cannabis remains a state by state business makes the valuation discount for smaller operators more appealing as it should not matter how wide spread any company’s operations are across the country if they are not a leader in specific states. Scale does not necessarily equate to winning (whether that be through profitability or cash generation). Furthermore, we believe that improved capital access for all over the past year has levelled the playing field while on-going consolidation should also benefit smaller and medium sized stocks as these companies are more likely to be acquired.

The historical return trend did not occur in Q1 with medium and smaller sized operators outperforming significantly during the period. This likely stemmed from greater awareness amongst investors, outperforming execution by some small and medium sized operators and the perception of stocks becoming acquisition targets. Based on average stock returns, the overall US cannabis market declined by 7% in Q1 with the stocks of the ten largest MSOs declining by 15%. Meanwhile stocks for the next ten largest operators declined by 2%. The stocks of the remaining smaller names declined by 5%. Viridian equity research coverage has to-date focused on overlooked/under-followed stocks in the space that we felt deserved greater consideration from investors based on the quality of operations and growth opportunity ahead. Today, the coverage consists of fourteen covered that fall mainly in the second tier and smaller market cap categories. A portfolio of covered names for Q1/22 would have generated a positive 0.14% return.

We continue to favor these small and medium sized operators for the same reasons listed above and expect this outperformance trend to continue as the year progresses.

*Green Denotes Covered Company (Viridian Cannabis Deal Tracker, Factset) *Green Denotes Covered Company (Viridian Cannabis Deal Tracker, Factset)

Top Picks for Near-Term Investment

As previously stated, we do not expect legislation to provide a catalyst for enhanced stock returns in the near term and while we are confident that gains for the space can come as companies execute and return to high growth mode later this year, we believe the pressured returns of Q1/22 will continue in the coming months. With that in mind, our top picks for near term investment are stocks of companies that can take share in the coming periods, that can be the beneficiaries of looming legislation news and/or that are in play to be acquired. Within our coverage this line of thinking makes Harborside, Jushi, Lowell Farms, Planet 13 and Schwazze our top picks for near term investment while beyond our coverage, we favor Ascend, Glasshouse and Unrivaled. Ascend (OTCQX:AAWH) was one of the worst performing stocks in Q1/22 on the impact of the MedMen (OTCQB:MMNFF) litigation news. We believe that reaction was overblown particularly as we ultimately believe on-going litigation will end in favor of the company. Even without that, we expect favorable opportunities in other markets (namely Massachusetts and New Jersey) will drive outperforming results in the near term. Meanwhile we believe both Glasshouse and Unrivaled are underappreciated California operators that will garner greater credit in the near term as market conditions improve and as outside operators take a greater interest in the state in the near term.

We believe stocks for each of these companies can be meaningful outperformers in Q2.

We note that beyond the near term, Ayr (OTCQX:AYRWF) remains one of our top picks as we expect execution on outstanding expansion initiatives positions the company as well as any other operator while the relative discount in valuation presents the opportunity for disproportionate upside in the stock. We also expect additional expansion initiatives are forthcoming and believe Ayr is a likely prime candidate to eventually acquire Columbia Care’s redundant New York license which would provide a top incremental growth opportunity for the company.

Top near-term picks amongst covered names:

Harborside:

Harborside was Q1/22’s top returning stock and we expect further outperformance to come as investors gain greater awareness for the company’s scaled position in California and improving competitive market conditions in the state. We expect Harborside’s expansion initiatives will translate to strong growth on both the top and bottom lines while ultimately, we believe Harborside is in play to be acquired as bigger operators look to finally enter the California market at scale. Harborside is the largest public operator in California today and any acquiring company looking to enter the state at scale would have to consider it for acquisition particularly given Harborside’s still cheap valuation. In fact, we believe that position is at least in part what has motivated some of the company’s recent M&A initiatives which added both retail and cultivation assets.

Jushi

As we have previously stated, we believe Jushi is an underappreciated MSO despite having one of the top growth profiles in the space. We believe near term catalysts for greater awareness could come with news of legislative progress in either Pennsylvania or Virginia (for medical market expansion) where Jushi is as well positioned as any other operator. Furthermore, we expect additional meaningful state expansion for Jushi to come through acquisitions in the near term given the company’s background and capital position. In particular, we believe Jushi could look to acquire some of the redundant Cresco/Columbia Care assets particularly in Massachusetts or Florida. Finally, given its size and attractive position within several key markets, we believe Jushi itself is in play to be acquired by one of the larger operators given the on-going arms race in the industry. The company’s position in Pennsylvania and Virginia would be a nice compliment to any larger MSO without a meaningful presence in those states.

Lowell Farms

Lowell has a leading brand in California that has a following in additional states and garnered early returns through a licensing agreement with Ascend in Illinois and Massachusetts. Due to continued pricing pressure in California, the company remains unprofitable (management is targeting a profitable adjusted EBITDA run rate within Q2) and Lowell is now in a perilous capital position with an estimated cash balance in the mid-single digit range. In short, Lowell needs additional capital in order to continue and while we believe it is available given the company’s solid investor base, we expect the more likely scenario is a sale to another operator for a premium to current levels. In fact, we believe Lowell is the most likely company in the space to be acquired in the near term. For an acquiring company, Lowell would provide a leading brand to leverage in whatever markets it operates while also offering a hedge on California market conditions improving and/or eventual interstate sales at a low cost (and with a path to near term profitability in the state).

Planet 13

Planet 13 has been disproportionately impacted by COVID-19 and reduced tourism levels to Las Vegas and Orange County, CA. We believe the company is now positioned to discriminately benefit from a return to more normal tourism levels in the coming months and we forecast strong growth from that and a return to higher margins at the company’s Superstore. Additionally, we expect an upcoming lounge launch in Las Vegas will permit Planet 13 to further showcase its brand building capabilities and provide a new margin expansion catalyst. Meanwhile, we believe expansion initiatives in California and Florida can bear fruit in the near term and provide long awaited secondary growth drivers for the company outside of Nevada. In particular, we expect Florida will be a major contributor to the business in 2023 if the company goes through with expansion initiatives. This is a factor that to date has largely been overlooked by investors. We also view Planet 13 as a likely takeout in the near term as we expect any large MSO would like to add the Superstore asset and its consistent >$100M annual revenue capabilities at a time when scale of results is so important. Furthermore, the Planet 13 brand name would likely add value for any dispensary asset in a company’s portfolio while the company’s on-going state expansion initiatives could be complimentary to existing operations for a would-be acquirer. For Planet 13, the motivation for a sale would likely be an interest in taking the expansion risk off the table while maintaining long-term upside on gains in the space.

Schwazze

We believe Schwazze is a rare execution story in US cannabis from 2021 as the company has quickly become one of the top (if not the top) operators in Colorado and New Mexico. We are confident that the company’s on-going roll-up initiatives in Colorado will translate to strong top line growth and leading profitability and we believe the company’s early presence in New Mexico will drive strong results in the coming quarters during the initial days of rec. We expect the scaling of results will garner greater investor awareness and result in a reduction of the company’s legacy discounted valuation in the near term.

Viridian Capital Estimates, Priced Intraday 4/1/2022

Analyst Certification

The research analyst responsible for the content of this research report, in whole or in part, certifies that with respect to each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers and were prepared in an independent manner, including with respect to Bradley Woods & Co. Ltd.; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in this report.

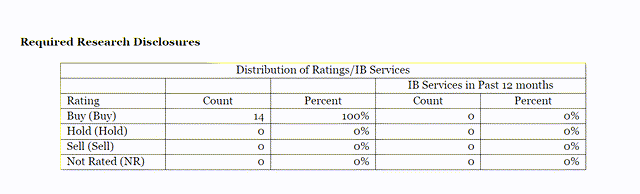

Meaning of Ratings

Bradley Woods & Co. Ltd.’s rating system of Buy, Hold, Sell, Not Rated reflects the analyst’s best judgment of risk- adjusted assessment of a security’s 24-month performance.

Buy: A Buy recommendation is assigned to stocks with low risk and approximately 10% expected return or stocks with high risk and approximately 25% expected return. The analyst recommends investors add to their position.

Hold: A Hold recommendation is assigned to stocks with low risk and less than 10% upside or less than 15% downside or to stock with high risk and less than 25% upside or less than 15% downside.

Sell: A Sell recommendation is assigned to stocks with an expected negative return of approximately 15%. The analyst recommends investors reduce their position.

Not Rated: A Not Rated recommendation makes no specific Buy, Hold or Sell recommendation.

Compensation or Securities Ownership

The analyst(s) responsible for covering the securities in this report receives compensation based upon, among other factors, the overall profitability of Bradley Woods & Co. Ltd. including profits derived from investment banking revenue and securities trading and market making revenue. Unless noted in the Company Specific Disclosures section above, the analyst(s) that prepared the research report did not receive any compensation from the Company or any other companies mentioned in this report in the previous 12 months, or in connection with the preparation of this report. Unless noted in the Company Specific Disclosures section above, neither the analyst(s) responsible for covering the securities in this report, nor members of the analyst(s’) household, has a financial interest in the Company, but in the future may from time to time engage in transactions with respect to the Company or other companies mentioned in the report.

For compendium reports (a research report covering six or more subject companies) please see the latest published research to view company specific disclosures.

Other Important Disclosures

This report is provided for informational purposes only. It is not to be construed as an offer to buy or sell a solicitation of an offer to buy or sell any financial instruments or to particular trading strategy in any jurisdiction. The information and opinions in this report were prepared by registered employees of Bradley Woods & Co. Ltd. The information herein is believed by Bradley Woods & Co. Ltd. to be reliable and has been obtained from public sources believed to be reliable, but Bradley Woods & Co. Ltd. makes no representation as to the accuracy or completeness of such information.

Bradley Woods & Co. Ltd. is regulated by the United States Securities and Exchange Commission, FINRA, and various other self-regulatory organizations. This report has been prepared in accordance with the laws and regulations governing United States broker-dealers.

Opinions, estimates, and projections in this report constitute the current judgment of the author as of the date of this report. They do not necessarily reflect the opinions of Bradley Woods & Co. Ltd. and are subject to change without notice. In addition, opinions, estimates and projections in this report may differ from or be contrary to those expressed by other business areas or group of Bradley Woods & Co. Ltd. and its affiliates. Bradley Woods & Co. Ltd. has no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Bradley Woods & Co. Ltd. does not provide individually tailored investment advice in research reports. This report has been prepared without regard to the particular investments and circumstances of the recipient. The securities discussed in this report may not suitable for all investors and investors must make their own investment decisions using their own independent advisors as they believe necessary and based upon their specific financial situations and investment objectives. Estimates of future performance are based on assumptions that may not be realized. Furthermore, past performance is not necessarily indicative of future performance. Investment involves risk. You are advised to exercise caution in relation to the research report. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Bradley Woods & Co. Ltd. salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed in this research. Bradley Woods & Co. Ltd. may seek to offer investment banking services to all companies under research coverage. Bradley Woods & Co. Ltd. and/or its affiliates expect to receive or intend to seek investment-banking related compensation from the company or companies mentioned in this report within the next three months.

This research report (the “Report”) is investment research, which has been prepared on an independent basis by Bradley Woods & Co. Ltd., a member of FINRA and SIPC, with offices at 805 Third Avenue, 18th Floor, New York, NY USA, 10022. Electronic research is simultaneously available to all clients. This research report is provided to Bradley Woods & Co. Ltd. clients and may not be redistributed, retransmitted, disclosed, copied, photocopied, or duplicated, in whole or in part, or in any form or manner, without the express written consent of Bradley Woods & Co. Ltd. Receipt and review of this research report constituted your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion or information contained in this report (including any investment recommendations, estimates, or target prices) without first obtaining express permission from Bradley Woods & Co. Ltd. In the event that this research report is sent to you by a party other than Bradley Woods & Co. Ltd., please note that the contents may have been altered from the original, or comments may have been added, which may not be the opinions of Bradley Woods & Co. Ltd. In such case, neither Bradley Woods & Co. Ltd., nor its affiliates or associated persons, are responsible for the altered research report.

This report and any recommendation contained herein speak only as of the date of this report and are subject to change without notice. Bradley Woods & Co. Ltd. and its affiliated companies and employees shall have no obligation to update or amend any information or opinion contained in this report, and the frequency of subsequent reports, if any, remain in the discretion of the author and Bradley Woods & Co. Ltd.

Bradley Woods & Co. Ltd. may effect transactions in the securities of companies discussed in this research report on a riskless principal or agency basis. Bradley Woods & Co. Ltd.’s affiliated entities may, at any time, hold a trading position (long or short) in the securities of the companies discussed in this report. Bradley Woods & Co. Ltd. and its affiliates may engage in such trading in a manner inconsistent with this research report. All intellectual property rights in the research report belong to Bradley Woods & Co. Ltd. Any and all matters related to this research report shall be governed by and construed in accordance with the laws of the State of New York.

This report is not directed at, or intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject Bradley Woods & Co. Ltd. and its affiliates to any registration or licensing requirements within such jurisdictions.

The Bradley Woods Form CRS, Client Relationship Summary, can be accessed here.

Be the first to comment