freemixer/E+ via Getty Images

The general impression we got from going over Rover’s (NASDAQ:ROVR) Q3 results is that the business is maturing. There are positives and negatives related to that, but overall we see it as a good thing. The growth rates are coming down, but on the positive side margins are improving, revenue retention is high, and the business is becoming more international.

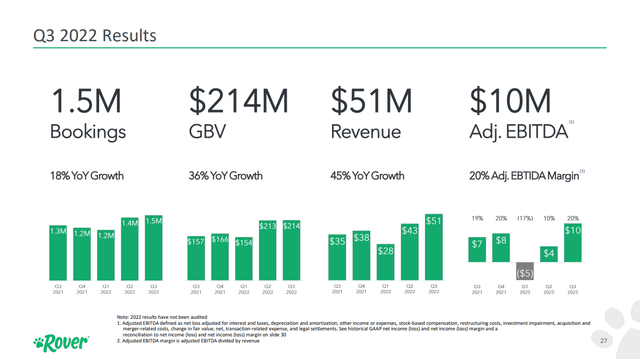

Q3 revenue and adjusted EBITDA were up a decent amount year over year. Revenue of $50.9 million was up 45% while Gross booking value of $213.7 million was up 36%. Adjusted EBITDA was $10.2 million or a 20% margin, up from $6.6 million the prior year. The international business continued its impressive growth trajectory despite economic uncertainty in Europe, with GBV increasing approximately 100% over Q3 2021 levels.

Guidance given last quarter for the just reported quarter had been disappointing, and one of the reasons the company was relatively pessimistic was that cancellations were elevated. It was therefore great to hear that the elevated cancellation trajectory in June and July has moderated.

Q3 2022 Results

Revenue in the third quarter was $51 million, while third quarter GBV was $214 million. The increase in revenue was driven both by growth in bookings and an increase in average booking values. Third quarter ABV was $142, up 15% y/y. Total bookings were 1.5 million, a growth rate of 18% y/y.

Adjusted EBITDA was $10.2 million or a margin of 20%, up from the adjusted EBITDA of $6.6 million or a margin of 19% in Q3 last year. The improvement in adjusted EBITDA resulted from strong revenue and moderated marketing expense. Importantly, the company is getting closer to its long-term target of ~30% adjusted EBITDA margin.

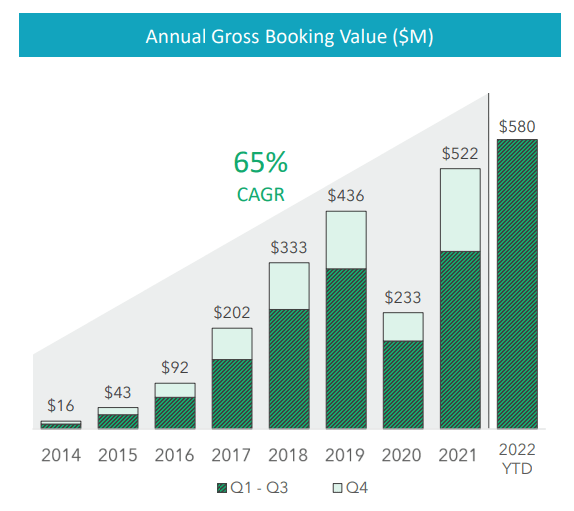

Rover Investor Presentation

Growth

The most important metric in our opinion is GBV, which represents the size of the economic activity taking place in the company’s platform. The historical growth rate for GBV of 65% has now moderated to 36% in the most recent quarter, signaling the hyper-growth phase is over. Revenue grew faster than GBV this quarter, which means the company’s “take rate” went up. There is a limit, however, as to how high the company’s take rate can go before service providers start leaving the platform. We therefore believe revenue growth and GBV growth will start to converge in the future.

Rover Investor Presentation

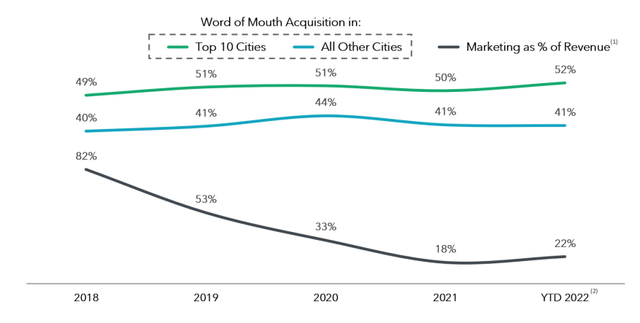

Marketing

One of the positives shared by the company this quarter is that it now expects a substantial portion of incremental revenue to fall to the bottom-line. One of the reasons this has become possible is that the company no longer needs to spend exceedingly high percentages of its revenue in marketing activities. At one point in the company’s history marketing as a percentage of revenue was ~82%, this has come down nicely. In Q3 2022 non-GAAP marketing expense was 16% of revenue, down from 18% in Q3 2021, and 24% in Q2 2022.

Rover Investor Presentation

Cancellation Rates

One topic that got a lot of discussion the previous quarter was the increase in cancellations the company was seeing. That was one of the reasons the company gave disappointing guidance last quarter.

It was therefore good to hear that cancellation rates have come down, even if they remain “stubbornly elevated”, as the company described, from pre-Covid levels. It seems cancellation rates peaked at ~15% in July and went down to 13.8% in September, but have yet to reach the pre-Covid levels of 8-10% that used to be the norm. During the earnings call CFO Charlie Wickers answered a question related to cancellation rates explaining why the company believes they remain so high:

Pre-pandemic, the cancellation rate norms were in the 8% to 10% range and that fluctuated based on seasonality. Since COVID impacted the world and started to impact Rover, we have just remained at an elevated level and the words that I chose are accurate, it is stubbornly elevated. With regards to longer-term, there is a couple of dynamics that we are looking at. One, COVID, as we know, has impacted cancellation rates negatively and kept them elevated.

As the pandemic itself has lessened from a direct impact, the other thing that we are seeing is just sickness generally has been trending up. I think, RSV is the latest viral dynamic that is starting to have some elevated dynamics. And the reality for our platform is that we think that we are more susceptible to sickness because of the dynamic of our marketplace having both a provider and a pet owner susceptible to illness.

So on a go forward basis, our baseline assumption is that the cancellation rates will remain elevated for some period of time. But we do hope and have not yet incorporated any tick down in those cancellations rates for the first foreseeable future.

Balance Sheet

Rover continues to have a balance sheet filled with cash. At the end of the quarter it had cash and short-term investments of $266 million, down slightly from $288 million in Q2. This is very significant, given that it represents about a third of its market cap, and the company has basically no long-term debt.

Outlook

For the fourth quarter Rover expects $49 million to $51 million in revenue and $6 million to $8 million in adjusted EBITDA, or a 12% to 16% margin.

For the full year 2022, the company updated prior guidance and now expects revenue of $171 million to $173 million, which at the midpoint would be a 57% increase in revenue over 2021. It expects adjusted EBITDA of $16 million to $18 million, up from $12.4 million of adjusted EBITDA in 2021.

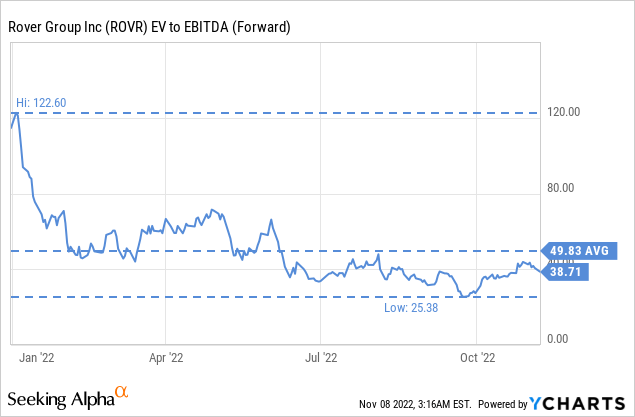

Valuation

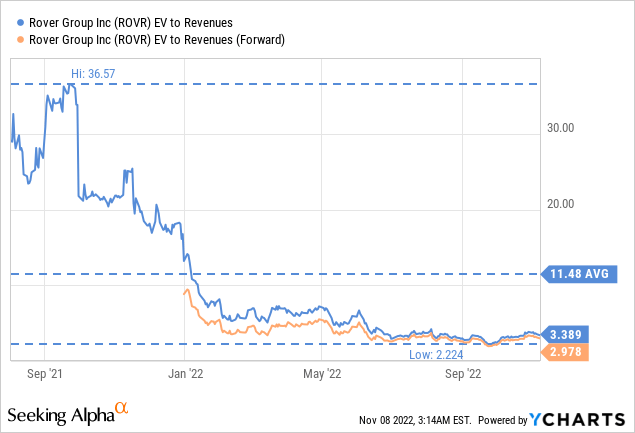

Rover currently has an enterprise value of ~$500 million. That means that based on the mid-point of its expected adjusted EBITDA for 2022 of $17 million, it is trading at an EV/Adj. EBITDA multiple of ~30x. Given the expectation that revenue growth will still be higher than 20-25% for a few more years, and that the company could reach a ~30% adjusted EBITDA margin in the future, we view the valuation as reasonable.

Using EV/Revenues, the company is trading with a 3.3x trailing twelve months multiple, and a 2.9x forward multiple. This is a lot more reasonable than the multiples at which the company was trading last year. While we continue to believe shares are attractively priced at current prices, we are changing our rating to ‘Buy’ from ‘Strong Buy’ given that we expect growth rates will continue to moderate.

Risks

Rover’s business is highly correlated with travel, therefore another Covid wave could significantly reduce demand for the services offered on the company’s platform. Fortunately, Rover has the advantage of an extremely solid balance sheet with significant cash and short-term investments and basically no long-term debt.

Conclusion

Overall we view Rover’s Q3 results as positive, with cancellation rates coming down, improved guidance, and the company sounding more optimistic. The business appears to be maturing, which means margins are improving and the company is becoming more profitable, but at the same time growth rates are decelerating. We believe shares are currently reasonably priced, even though we are a little bit less enthusiastic as growth rates come down. Still, we believe this can become a nice profitable business, growing at a healthy rate for at least a few more years.

Be the first to comment