jetcityimage/iStock Editorial via Getty Images

Dear readers/followers,

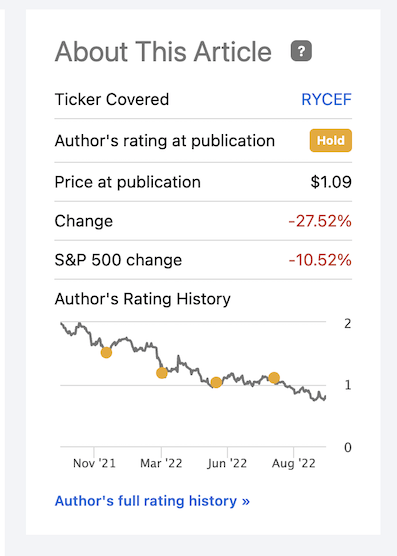

The “right price” is a big thing when it comes to an investment like Rolls-Royce (OTCPK:RYCEF). I’ve been following the “right price” for months at this point. Since my first article on this list, we’ve seen a massive price drop. However, as you can see, I’ve never switched my overall stance on this company.

Rolls Royce Article (Seeking Alpha)

That is, I’ve never switched my stance up until now.

Because now it’s time to go “BUY” on Rolls Royce.

As usual, it has a lot to do with the company’s overall valuation.

Rolls-Royce – An Update

But in this case, it also has a lot to do with what the company has managed to achieve in the last few quarters. While it’s too early to say that the company’s turnaround is complete, and RYCEF will now be a solid company to really invest in, I believe it’s time to say that what is asked for the company is way less than what it is actually worth – even in a conservative thesis.

The market is treating RYCEF as though it’s literal trash with zero profit.

That is a case made on a fairly “strong stomach” for what is a company with a £50B backlog, underlying operating profit of over £400M, and an R&D that’s slowly coming under control.

As I’ve mentioned in earlier articles, RYCEF is a company that only recently turned EBIT-positive again. It’s also successfully moving through its ongoing restructuring, and no matter what metric you look at, these transitions are going extremely well. Operating costs have seen a 35% reduction, the footprint has gone down 27% through 13 plants closed, consolidated, or sold, and investments have seen a 46% reduction across the entire company.

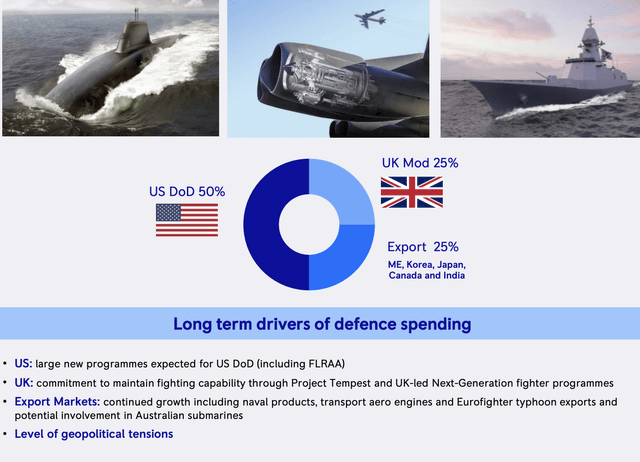

RYCEF is Aerospace, and Aerospace is, to some degree, RYCEF. How it goes in jets and the military aerospace segments have a high correlation to overall company results, and this is quite unlikely to significantly change as we move forward into 2H22.

Still, these industries have seen some significant improvements over the past few quarters, leading to highlights such as these.

Rolls-Royce is seeking to return to an overall investor appeal. The way for the company to do this is, in part, by investment-grade credit rating, which has been off the table for some time. However, things are changing.

Combine over £7B in liquidity, of which £2.8B is cash, net debt of around twice that including company leases (around half without leases), and nearly £2B worth of disposal proceeds that have gone to pay down company debt. Beyond this, the company does not have any maturities until 2024 worth mentioning.

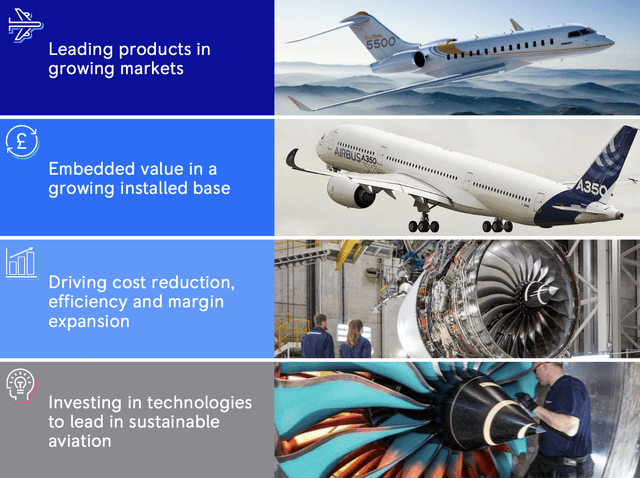

The core segment is at a market-leading (or among) position, with a very strong R&D department.

Market recovery alone in aerospace will drive earnings here, and the company has space to improve margins through assembly efficiencies, procurements, and productivity changes. The company’s pearl engine ramp-up is also moving forward, and the next company investment cycle is set to be somewhat less cost-intensive than the previous, with a capital-light approach and higher utilization of JVs and partnerships.

Defense meanwhile, is another pearl to look at here. The clients are attractive, and the market for these sorts of spending trends is very, very good at this point.

We’re talking about the company’s investment in a total of 7 new aerospace engines, with industrial production ramp-up (similar to Airbus (OTCPK:EADSY)). COVID-19 did impact things, but the company expects the 2022-2024 period to be characterized by things like margin expansion, FCF generation, and focus on the five value drivers.

Rolls-Royce has a 58% market share on the current large aerospace engine programs, and its recent contract wins confirm its positives here. It’s already delivered more than £1.3B in cost reduction, and 7/9 Trent 1000 fixes are currently being implemented. Furthermore, the company has an 88% market-leading share of large-cabin long-range business aviation.

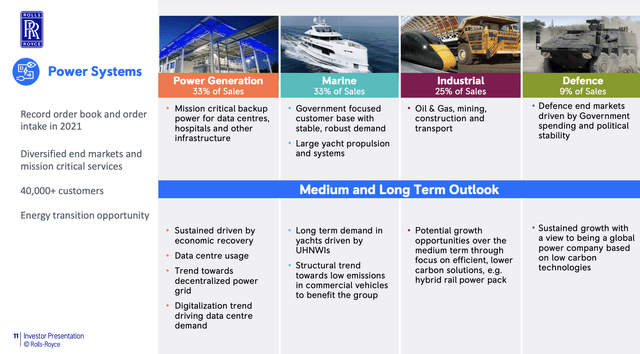

That’s not even going into the appealing power systems segment, which I personally believe to become a major tailwind for the business going into the next few years given the current situation. What was previously a smaller growth segment is going to become one of the primary drivers for profit.

Rolls Royce IR (Rolls Royce IR)

We can also mention the electrical aviation propulsion as well as the small modular reactors, set to decarbonize global power. All of this means that Rolls-Royce is incredibly well-positioned for the future, and the implications are that things will grow in the company’s favor, with 2H22 set to see positive FCF and margin improvements on a broad basis. The company is investing heavily in low-carbon tech, including a new generation aero engine that’s far more fuel-efficient, sustainable fuels that are already tested well in lab settings, and hybrid power generators for yacht propulsion and the like. All of these ambitions go toward enabling the company’s net-zero goals.

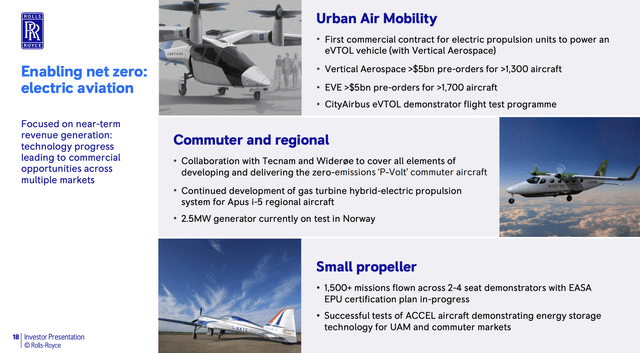

Then we also have more “out-there” projects like urban air mobility and small propeller planes, where the company tries to work out working and commercially viable electric aviation.

Rolls Royce IR (Rolls Royce IR)

So, all in all, Rolls-Royce is a very competent group of segments bundled into a potentially very profitable business with real future RoR, if things go well. Combine appealing legacy like Civil Aero, Power Systems, Defence, and Electrical with SMR and you get a very good sales mix. If the company was a dividend-paying stock that hadn’t gone through the doldrums the past decade or so, I would expect this industrial/aerospace to fly very high even now.

That’s not where we are though.

RYCEF is exposed highly to the absolutely weakest market segment. The company’s history of burning cash is well-established, and recovery here could take far longer than we might expect – though the current signs which have been ongoing now for a year soon, are starting to justify a more positive stance on the company.

It’s all about what you pay, after all.

Rolls-Royce Valuation

The combined headwinds of a decade of what we can call “mismanagement” as well as the current no-dividend status make RR a hard company to get seriously into. I’ve been following the business for several years at this point and started to write about it about a year back or so.

The issues with DCF valuation or other methods of valuation remain. This is especially true for the current, specific market.

The company, despite good expectations, hasn’t been able to perform for some time. To forecast mid or long-term growth here is a problematic venture because of this. Even assuming low sales growth, it remains a question of what exactly the company can do or perform here, or how the share price will react in the short term.

It’s very easy to claim that Rolls-Royce is undervalued – because most indicators do point this way. Even heavily discounted, there is a 10-30% upside to the company’s current valuation.

The company is still negative on a 1-year basis, down around 10% for the time being. However, the main difference when looking at Rolls-Royce here is that some analysts are actually considering the company undervalued at this point. Trading at under a pound per share, or £0.72/share (under $1) currently, average targets from 15 analysts put the company’s PT at £0.94/share, implying an upside of close to 30%.

However, despite this price target and the generous margin of safety, the majority of analysts still retain a “HOLD” or equivalent rating – not a “SELL”, but a “HOLD”. Only 3 analysts out of 15 consider the company a “BUY” here, from a price target range starting at £0.6 and going up to £1.5 on the high end.

The message I view from this is that it’s extremely uncertain when the company will revert to any sort of normalized upside. The key of course isn’t to invest then but before then. We want the company cheap, but as close to as cheap as it will get to lock in a superb potential future RoR.

I believe a good time to lock in such an upside is now.

As I mentioned – once this company does turn around, the turnaround will be massive. There’s plenty to like about a “good” Rolls-Royce. But when a company has failed to consistently deliver for so long, we can’t simply “go in” here without considering past performance (despite the old adage about performance).

I’ve previously said that the only time I would be willing to actually start establishing a position in RR is at a massive discount to every perspective you might look at. The company is still undervalued to my previous PT of £0.8/share ($0.97). I previously cut it to below/around £0.7/share ($0.85).

Because the valuation has now reached these levels, I’m now starting to be more positive about RR – and I believe the time has come for a shift.

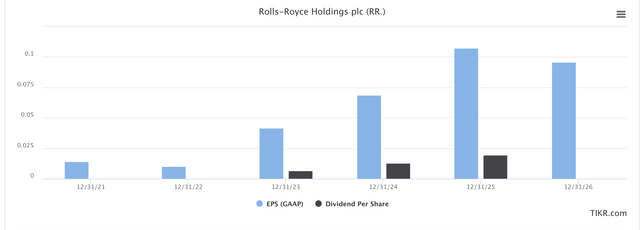

Here are the current expectations for what the company will deliver in terms of profit. There’s even the expectation that a dividend will come back for 2023E, but until then the upside is primarily related to capital appreciation from an undervalued business.

RR EPS/Dividend forecasts (RR EPS/Dividend forecasts)

The combination of expected debt reductions, fundamental upside, appealing legacy combined with new assets, and improving margins which are set to expand 200-300 bps in the next few years on the gross basis, and EBIT that’s set to grow at around 22.4% CAGR, I would now start viewing the company as a “BUY”.

Can it go lower? It always can. But at this valuation, I’m okay with the risk/reward ratio for the stock.

I’m changing my thesis. It’s now a “BUY”, and I say that a £0.7-£0.72 price range is an acceptable entry for the business.

Thesis

For now, this is my Rolls-Royce thesis.

- Great business, great exposures, great duopoly player with some really nice fundamentals – but with the pressures we’re seeing, and the Ukraine war, things aren’t looking better except for the defense sector.

- No yield and low visibility make this a no-go at all but pennies on the dollar. Specifically, I’d want to pay no more than 0.5X-0.6X to NAV with a normalized EBIT as a base, which comes to around $0.85/share for the ADR. At that point, you could buy it and really be buying quality for pennies on the dollar.

- Because of that, I’m now on a “BUY”

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment