Md Saiful Islam Khan/iStock via Getty Images

Ardelyx (NASDAQ:ARDX) is a small biopharmaceutical with a market cap around $210 million. The company is repurposing its first commercial product, IBSRELA (tenapanor), indicated for the treatment of Irritable Bowel Syndrome with Constipation (IBS-C) in the U.S. and Canada, as a novel product candidate to control serum phosphorus in adult patients with chronic kidney disease (or CKD) Stage 5 (receiving hemodialysis). If approved, it will be sold under the brand XPHOZAH. But first, the committee will be asked to comment on whether tenapanor’s treatment effect on serum phosphorus seen from three successful Phase 3 trials is clinically meaningful, and whether its benefits outweigh its risks. If the Committee votes to recommend XPHOZAH, another 30-day countdown begins, giving traders several opportunities to play these momentous catalysts.

Background (readers may skip this section)

The National Kidney Foundation Kidney Disease Outcomes Quality Initiative (NKF KDOQI) Guideline 5 recommends that patients with stage 5 CKD aim for normal serum phosphate levels from 3.5 to 5.5 mg/dL, and in patients who remain hyperphosphatemic despite the use of either of calcium-based phosphate-binding agents or other nonaluminum -, nonmagnesium-containing phosphate binders, a combination of both should be used. The Kidney Disease: Improving Global Outcomes (KDIGO) 2017 Guideline Update agreed with lowering elevated phosphate levels towards the normal range, and further suggested maintaining serum calcium in the age-appropriate normal range by restricting the dose of calcium-based binders. KDIGO also noted that in the COSMOS trial, the best patient survival was observed with phosphate close to 4.4 mg/dL. In general, there is a U-shaped relationship between phosphate levels and mortality in dialysis patients, meaning higher chances of death with either abnormally high or low phosphate.

A high proportion of dialysis patients are simply unable to consistently achieve and maintain healthy serum phosphate levels. Based on latest available data from the Dialysis Outcomes and Practice Patterns Study (DOPPS) among U.S. patients, more than 80% are prescribed phosphate binders. Calcium-based binders are the least expensive, followed by generic sevelamer and lanthanum. Iron-based binders Velphoro (sucroferric oxyhydroxide) from Fresenius Medical Care (FMS) and Auryxia (ferric citrate) from Akebia Therapeutics (AKBA) were approved in 2013 and 2014, respectively, and have no generic competition. No other drug classes have been approved for phosphate management since. And yet, current pharmacological and dietary best practices are insufficient, as evidenced by 43% (highest ever recorded by DOPPS) of patients having serum phosphate levels >5.5 mg/dL and 71% having >4.5 mg/dL as of the most recent month.

In 2014, Ardelyx completed a double blind, placebo controlled, parallel arms dose finding study with a 4 weeks randomized treatment period (or RTP) of tenapanor in end-stage renal disease (ESRD) patients with hyperphosphatemia (>5.5 mg/dL). At screening, patients had to be on a stable daily dose of phosphate binder (defined as ≥800 mg sevelamer, ≥250 mg calcium carbonate/acetate, or ≥500 mg lanthanum). After the 1- to 3-week washout of the phosphate binders, the 162 eligible participants had phosphate levels between 6.0 to 10 mg/dl and showed an increase of at least 1.5 mg/dl from screening. The primary efficacy end point (or PEP) was change in serum phosphate levels from the end of wash out (pre-randomization value) to end of RTP. Tenapanor treatment resulted in dose-dependent reductions which were significant in the tenapanor 10- and 30-mg bid (twice daily) dosing groups (-1.70 mg/dl and -1.98 mg/dl, respectively) compared to placebo (-0.54 mg/dl, P<0.05), but not to pre-phosphate-binder washout levels. More patients on these doses also achieved the normal phosphate goal of <5.5 mg/dl than those on placebo.

In December 2015, Ardelyx commenced a second, longer Phase 2b trial, TEN-02-201. After this study began, the U.S. Food and Drug Administration (FDA) informed Ardelyx that the previous 4-week study was sufficient for dose range finding and so TEN-02-201 was upgraded to a Phase 3. At the end of the originally planned 8-week RTP, patients were rerandomized 1:1 to either remain on their previously assigned dose of tenapanor or to receive matching placebo and entered a 4-week randomized withdrawal period (RWP). Accordingly, the PEP was amended to change the evaluation period as the end of the RTP to the end of the RWP. Around this time, the company identified a total addressable market (or TAM) of 735,000 ESRD patients with hyperphosphatemia in the United States, Europe, and Japan.

In TEN-02-201’s RTP, reductions of -1.07 and -1.09 mg/dl were achieved in the tenapanor 10- and 30-mg bid groups. In the RWP, serum phosphate in the placebo group increased by a mean of 0.85 mg/dl versus only 0.02 with the pooled (all doses combined) tenapanor group, so the least squares mean difference of −0.72 mg/dl was significant (P=0.003).

The FDA also requested a responder analysis, which was performed on patients who experienced at least a 1.2-mg/dl decrease in serum phosphate during the RTP. Eighty of the 164 patients who completed the RTP were deemed responders. Among responders in the RWP, the phosphate change difference between placebo and pooled tenapanor was again significant: +1.38 mg/dl versus +0.56 with the pooled tenapanor group, LS mean difference of −0.82 mg/dl, P=0.01.

Some limitations of this trial were that it was short, and that the design precluded a titration of tenapanor dose to either match tenapanor dose to those requiring the highest amount of phosphate binder at baseline or to reach a particular phosphate target. Ardelyx attempted to address these issues with two more Phase 3’s that were completed in 2019. TEN-02-202 (AMPLIFY) employed tenapanor in combination with phosphate binders, while the longer TEN-02-301 (PHREEDOM) allowed the titration of tenapanor dose based on patient response.

Tenapanor is a small molecule that acts locally in the gastrointestinal tract to inhibit the sodium/hydrogen exchanger 3 (NHE3) and reduce dietary phosphorus absorption from the gut. In AMPLIFY, randomized 236 subjects who were taking phosphate binder medication at least three times per day and still had serum phosphorus levels ≥5.5 and ≤10.0 mg/dL at screening and at the end of a 2- to 4-week run-in period (baseline visit), during which their existing binder dose was maintained. Tenapanor plus phosphate binders (“dual-mechanism” group) achieved a greater decrease in serum phosphate concentrations from baseline to Week 4 (the PEP) compared with those treated with placebo and just phosphate binders (mean of -0.84 vs. -0.19 mg/dl, P<0.001). Additionally, a significantly larger proportion of the dual-mechanism group achieved the 5.5 mg/dl level at Week 4 compared with placebo + binders (37.1% vs 21.8%, P=0.01). These results in a population of high-mortality-risk patients with no other options is normally compelling data that clinches FDA approval.

PHREEDOM was comprised of a 26-week, open label RTP, then a 12-week, placebo-controlled RWP, followed by an open label 14-week safety extension (52-week total treatment period). Patients who had 4.0-8.0 mg/dl serum phosphate at screening, and which increased by ≥1.5 mg/dl to ≥6.0 mg/dl and <10.0 mg/dl at the end of the washout period, were randomly assigned to receive either tenapanor for the RTP, or Renvela (sevelamer carbonate) for the entire 52 weeks. For the RTP, serum phosphate decreased by a mean (standard deviation) of -1.4 (±1.8) mg/dl from 7.4 mg/dl at baseline to 5.9 mg/dl at Week 26 in the ITT analysis set. There was also a responder analysis. Among the 407-subject ITT set, 131 achieved a reduction of ≥1.2 mg/dl in serum phosphate from baseline at week 26; in this subset, phosphate decreased by a mean (±standard deviation) of 2.5 (±1.2) mg/dl from 7.7 mg/dl to 5.2 mg/dl.

Although the trial design did not allow for an “official” direct comparison of phosphate lowering efficacy between tenapanor and the active-control Renvela group, “a post-hoc analysis demonstrated that the distribution of change in serum phosphate at the end of the randomized treatment period was nearly identical between participants in the ITT analysis set who received tenapanor for the entire 52-week study (n=88) and those who received sevelamer (n=108).” An accompanying distribution graph served as proof and icing on the cake.

The PEP was the difference in the change in serum phosphate from baseline to the end of the RWP. Subjects who completed the RTP were rerandomized (1:1) to tenapanor at the same dose or switch to placebo for the RWP. The least squares mean change in serum phosphate from baseline to the end of the RWP was +1.8 mg/dl for the placebo group and +0.4 mg/dl for tenapanor, for a LS mean difference of −1.4 mg/dl (P<0.001). The clinical utility of this end point is unknown, but was determined with input from the FDA.

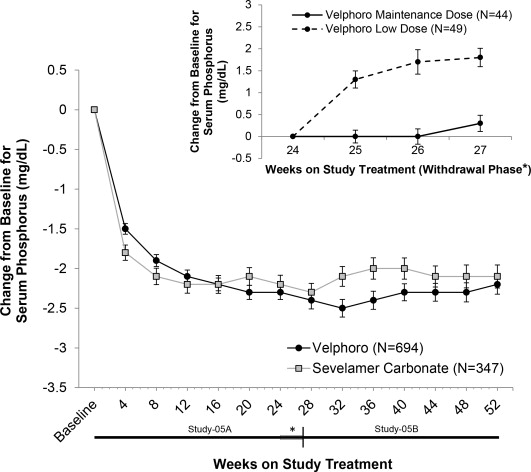

For comparison, Velphoro was approved on the strength of ONE Phase 3 study, where the lowering effect in the effective dose was compared with the known “non-effective” low dose control (Figure 1) during a 4-week RWP. Apparently, this PEP vs a low dose didn’t reveal much, which led to the FDA to suggest placebo control in later trials, such as Auryxia’s second pivotal Phase 3. In that one, at the end of the 4-week placebo-control RWP, the mean phosphorus levels fell in the Auryxia group (-0.58 mg/dl) but rose in placebo group by 2.09 mg/dl, with an adjusted mean treatment difference of −2.2 mg/dl (P<0.001).

Figure 1. Mean serum phosphorus change over time from baseline in Velphoro pivotal trial

Fresenius

The FDA accepted the XPHOZAH NDA on September 15, 2020 with a Prescription Drug User Fee Act (PDUFA) goal date of April 29, 2021, which was extended by 3 months when the agency then requested further analyses. In accordance with PDUFA, it is the FDA’s Center for Drug Evaluation and Research (CDER) that reviews and acts on NDAs. Director Patrizia Cavazzoni had led the Center since May 2020 and was appointed permanently on April 12, 2021. Dr. Cavazzoni was also a former head of Global Pharmacovigilance and Epidemiology at Sanofi (SNY), the maker of sevelamer brands Renagel and Renvela, which as of last year were marketed in more than 85 countries, as well as a generic which launched in the U.S. in 2019.

Nonetheless, the FDA responded on July 28, 2021 with a Complete Response Letter (or CRL), in which they characterized magnitude of tenapanor’s treatment effect as “small and of unclear clinical significance.” Presumably, this was in comparison to Auryxia and not to any equivalent performance with Renvela. The CRL wanted Ardelyx “to conduct an additional adequate and well-controlled trial demonstrating a clinically relevant treatment effect on serum phosphorus or an effect on the clinical outcome thought to be caused by hyperphosphatemia in CKD patients on dialysis.”

Ardelyx submitted a Formal Dispute Resolution Request (or FDRR) to the FDA’s Office of Cardiology, Hematology, Endocrinology and Nephrology (OCHEN) but received an Appeal Denied Letter (or ADL) in February. The ADL cited additional paths forward without conducting an additional trial, including new analyses; benefits vs risks assessments; and alternate label proposals. The company then filed an appeal of the ADL to CDER’s Office of New Drugs (or OND), which garnered them the AdComm. Committee members include expert clinicians who could clarify the clinical meaningfulness of XPHOZAH’s phosphate lowering effect. After the vote, the OND will render its response to the Company’s appeal within thirty days after the meeting.

Financials

As of June 30, Ardelyx had cash and equivalents of $81 million. Q3 revenues from IBSRELA product sales and collaborations with HealthCare Royalty Partners and Kyowa Kirin will probably come under $5 million inclusive, unless the $10 million in royalties paid in June are recognized next quarter. Research and development expenses of around $10 million and selling, general and administrative expenses around $20 million will probably mean a burn of around $25 million, leaving around $65 million in cash by end of September. Recent Ardelyx’s Q3 earnings calls fell on November 12, 2021 and November 5, 2020, so 2022’s will likely come before AdComm and by itself have little bearing on share prices unless IBSRELA has breakout sales of at least $5 million.

Risks and Takeaways

-

The briefing documents could have leading questions that are phrased in a way that suggests the FDA favors a particular outcome. Because the agency determines the Committee lineup and it is generally thought to be an honor to serve on AdComm, invited members might be influenced to toe the party line, so to speak, to be picked again. It would be also be bad but likely that the FDA directs the members to only consider the data in the NDA and not information from other trials since last year, things such as the potential reduction of pill burden, a significant benefit given the max daily pill counts of Auryxia (12), lanthanum (9), sevelamer (16), and Velphoro (6).

-

AdComm could vote negatively, which would uphold the NDA rejection. However, it seems inconceivable that more than half the Committee wouldn’t see the advantages brought by XPHOZAH’s unique mechanism to dialysis patients. While not demonstrative of a causal relationship between hyperphosphatemia and mortality, a meta-analysis of dialysis studies showed an incremental 18% chance of death associated with each 1 mg/dl increase in serum phosphate concentration. This tidbit is well known and will likely be cited by the experts. There were also no safety or non-clinical (e.g., manufacturing) issues brought up before, so it is unlikely that any will come out now.

Either could cause shares to tank by 10-30%, and the latter could easily sink prices below $1 for an extended period of several months.

3. AdComm could have a positive recommendation, but because AdComm votes are non-binding, the OND could choose to ignore it.

4. The OND agrees with a positive AdComm and Ardelyx is allowed to resubmit the XPHOZAH NDA. The review will take at least 2 months after resubmission.

Buyers can expect a runup through November and sell a few days before the 16th with minimal risk. Alternatively, they may hold through the vote, which is more likely than not to be in favor of XPHOZAH. Traders can gamble on the November 18 options for the possible AdComm outcomes, although only the $2.50 call is realistic and all available puts are in the money. The January 20, 2023, options offer straddles that are true hedges, since it is unlikely that the stock will remain around the $1.50 strike price immediately after the AdComm and OND decisions, but this date might be too soon for the potential NDA approval.

Be the first to comment